Turnleaf Analytics Papers

Our Research

We regularly publish trading strategies of how to use our data for trading profitably a variety of asset classes. Click on each paper to download.

There’s Currency In Inflation

Trading DMFX with Turnleaf Analytics inflation forecasts In this paper, we examine ways of trading DMFX using Turnleaf Analytics inflation forecasts. The intuition is that Inflation forecasts expectations are linked to monetary policy expectations given that central...

EM-bracing Inflation

Trading EMFX with Turnleaf Analytics inflation forecasts In this paper, we look at the relationship between Turnleaf Analytics inflation forecasts and EMFX. We find that typically falls in medium term expectations are beneficial for EMFX. Using this idea, we create an...

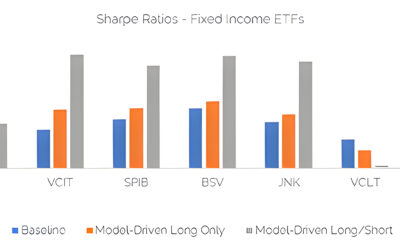

Systematic Trading of ETFs

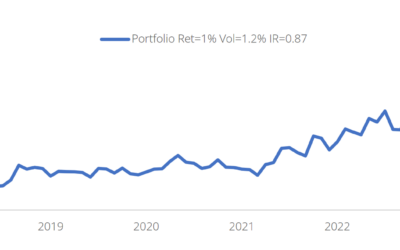

Using ML techniques to create trading rules for ETFs In this piece, we examine the question, “Can a combination of Inflation (CPI), and 2 proxies for GDP be used to inform future allocation decisions?”. The proxies are ISM PMI and ISM NMI, which correspond to ISM...

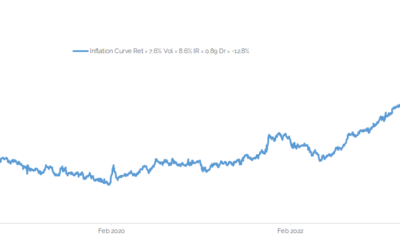

Floating above it all

Trading DM IRS with Turnleaf Analytics inflation forecasts In this paper, we examine the relationship between inflation forecasts and interest rate swaps in developed markets. We create trading rules based upon inflation forecasts both in terms of where inflation will...

The loco-modities

Turnleaf Analytics economic forecasts to trade commodities It seems intuitive that there is a relationship between commodities, inflation and growth. However, the key question is whether such a link can be monetised. In this paper, we explore how Turnleaf Analytics...

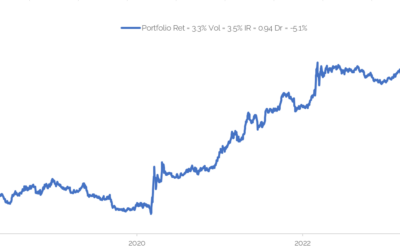

Surprise, it’s inflation

Trading macro assets over US CPI releases In recent years, the US CPI release has impacted a wide array of macro assets. In this paper, we discuss how we can trade a portfolio of macro assets around US CPI. We create short term trading rules over the days of US CPI...

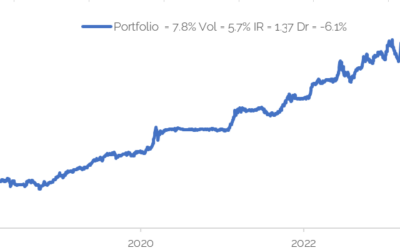

Bonding Over Inflation

Trading bond futures with Turnleaf Analytics inflation forecasts In this note, we discuss how Turnleaf Analytics inflation forecasts can be used to trade liquid bond futures using a systematic trading rule. The rationale is that inflation expectations impact monetary...