Using ML techniques to create trading rules for ETFs

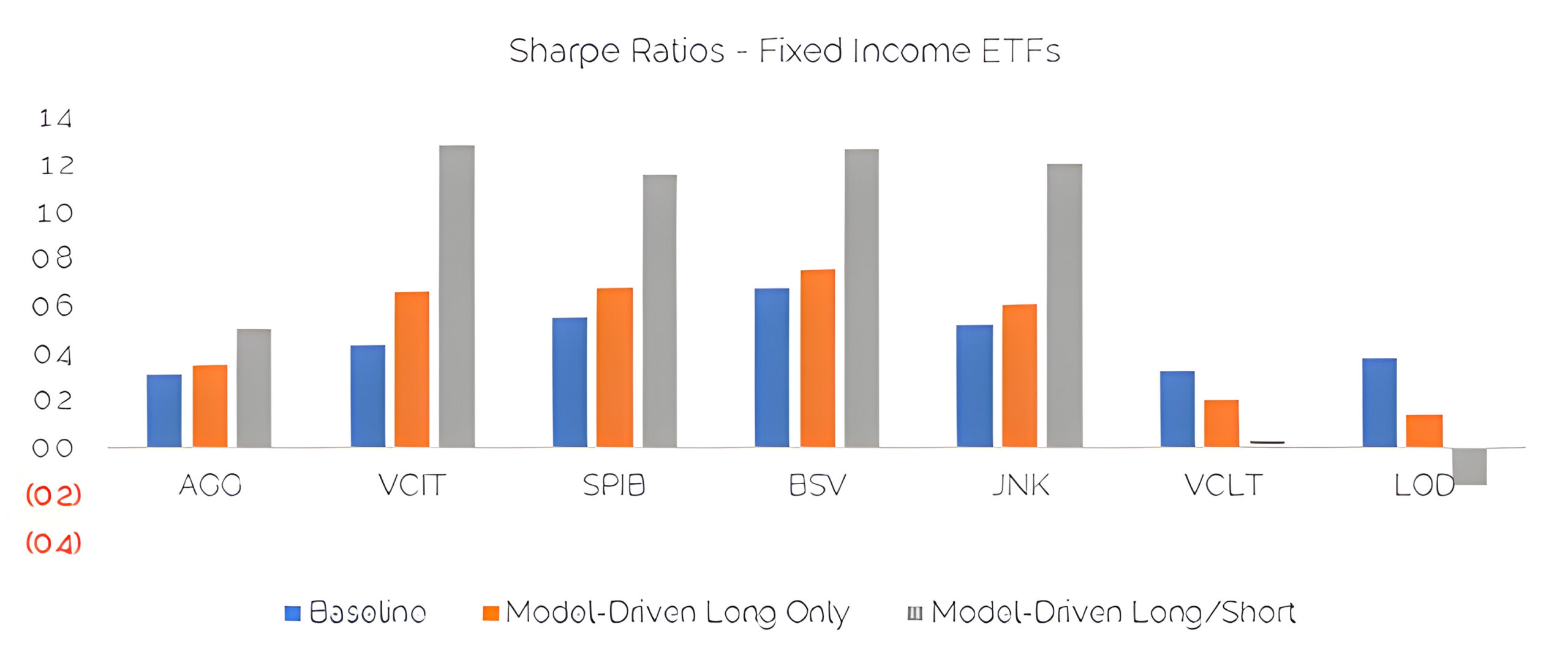

In this piece, we examine the question, “Can a combination of Inflation (CPI), and 2 proxies for GDP be used to inform future allocation decisions?”. The proxies are ISM PMI and ISM NMI, which correspond to ISM Purchasing Manager’s Index and ISM Non-Manufacturing Index respectively. In addition to the officially published values, we look at Turnleaf Analytics forecasts of each of the above series to see if accurate forecasts can assist in forward-looking asset allocation decisions. Within our framework of using an active trading rule-based inflation/ISM forecast data, debt-based ETFs outperform versus passive long only historically. However, we note that we do not see outperformance in other ETFs such as equities and commodities within the same framework, although we have created historical profitable trading rules for commodities before using other forecast based approaches (see Turnleaf Analytics: The Loco-modties 19 Jan 2024).