Trading bond futures with Turnleaf Analytics inflation forecasts

In this note, we discuss how Turnleaf Analytics inflation forecasts can be used to trade liquid bond futures using a systematic trading rule. The rationale is that inflation expectations impact monetary policy expectations, which then impact yields.

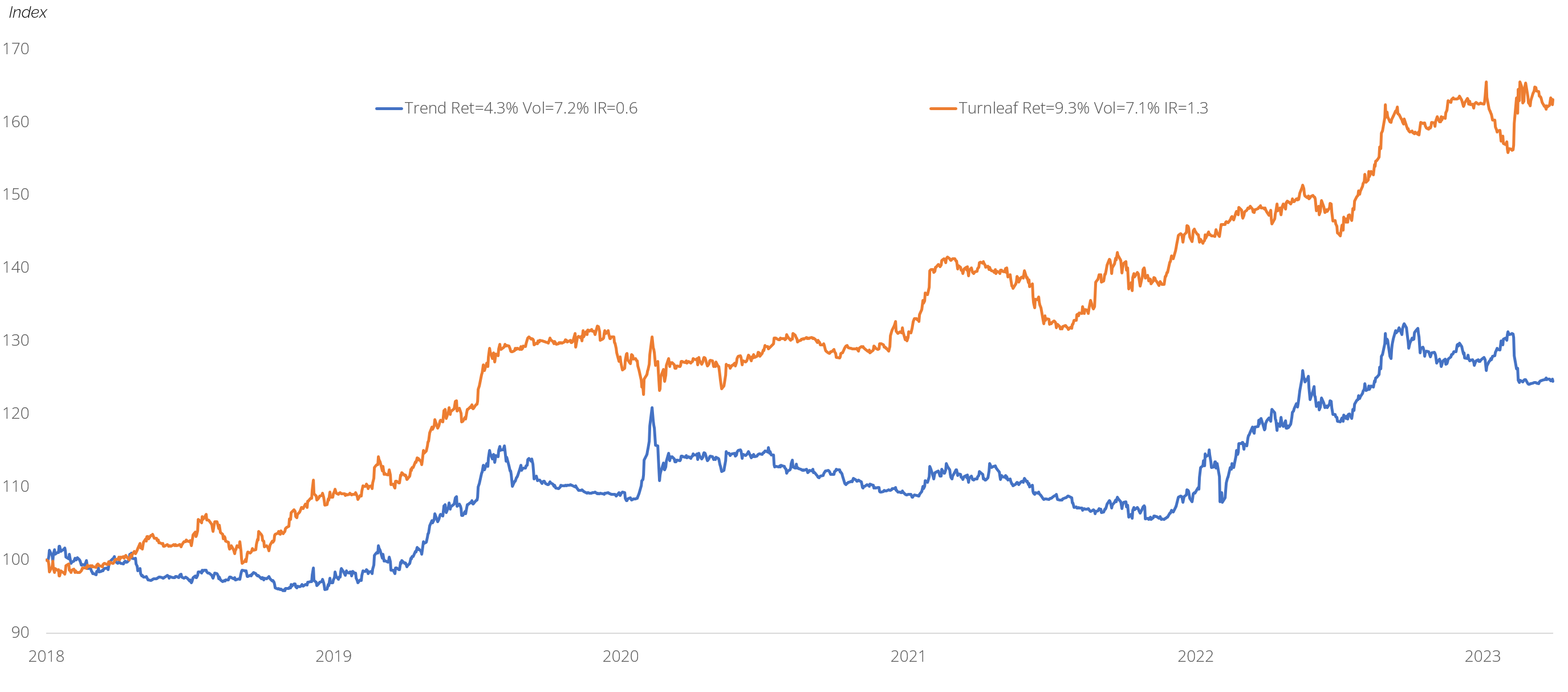

Our basket of liquid developed bond futures traded using our inflation forecasts has risk adjusted returns of 1.3 and returns of 9.3% since 2018. This outperforms a trend following strategy on bond futures, which has risk adjusted returns of 0.6 and returns of 4.3%.