Trading DM IRS with Turnleaf Analytics inflation forecasts

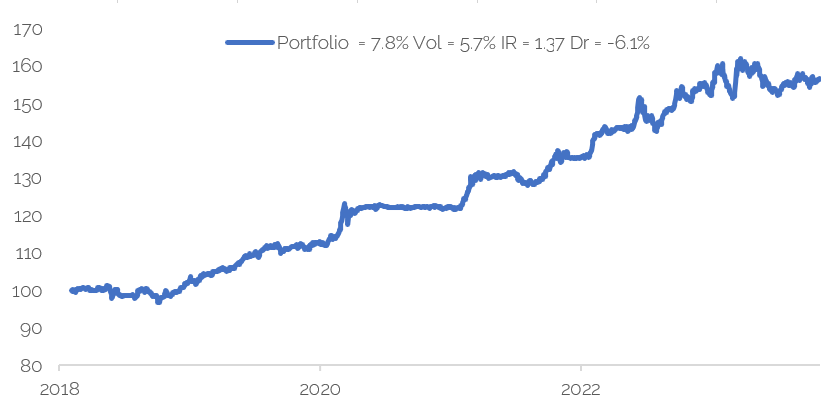

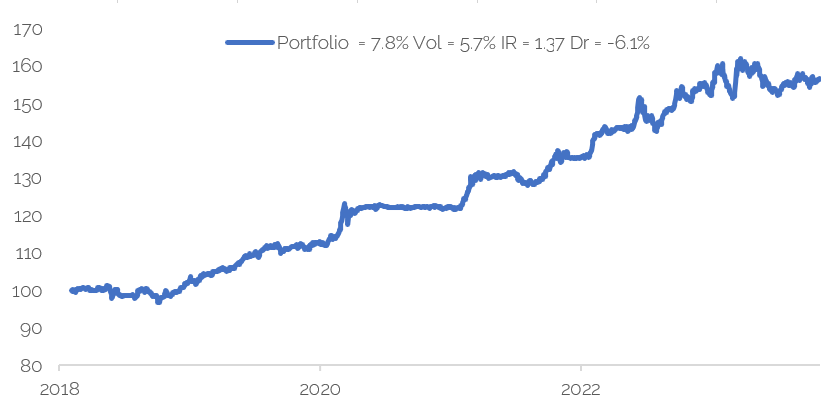

In this paper, we examine the relationship between inflation forecasts and interest rate swaps in developed markets. We create trading rules based upon inflation forecasts both in terms of where inflation will likely move compared to current levels and also by looking at the inflation forecast curve. We create systematic trading rules for developed market interest rate swaps using metrics based on our inflation forecasts. Our portfolio of various inflation forecast based trading rules for interest rate swaps has historical risk adjusted returns of 1.37 and annualised returns of 7.8% since 2018, which outperforms trend over the same period on the same assets.