Featured Research

Macroeconomic Insights: Colombia CPI: The Minimum Wage Shock

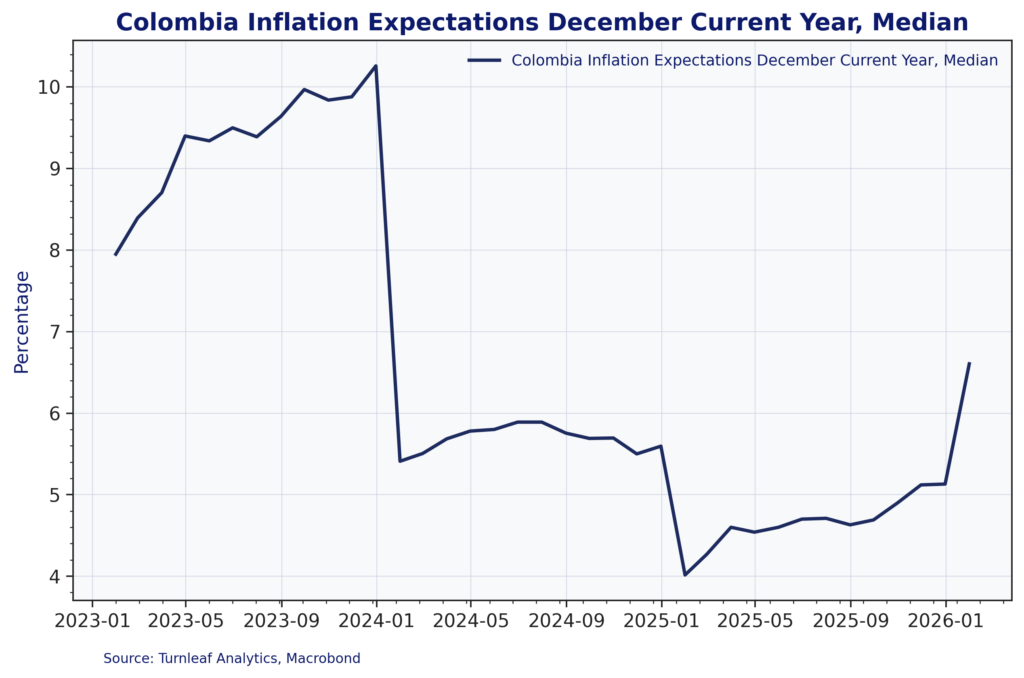

Colombia’s 12-month inflation outlook for 2026 has been revised higher. We now expect inflation to hit up to 6.7%YoY by the end of the year (Figure 1). This is a clear break from the lower path implied before the minimum wage decision. The shift follows the 23%...

Macroeconomic Insights: Colombia CPI: The Minimum Wage Shock

Colombia’s 12-month inflation outlook for 2026 has been revised higher. We now expect inflation to hit up to 6.7%YoY by the end of the year (Figure 1). This is a clear break from the lower path implied before the minimum wage decision. The shift follows the 23% minimum wage increase by government decree, which is expected to add substantial upward pressure to prices. To understand this trend shift, we need to understand the minimum wage’s role in indexation and cost pass-through, particularly in services and regulated or administrative prices.

Figure 1 – See Turnleaf’s latest Substack post, here.

The Indexation Mechanism

In Colombia, an estimated 27.9% of the CPI basket is affected by indexation linked to the minimum wage (BBVA Research). At the same time, indexation doesn’t happen all in January, but is distributed across the year as prices adjust based on contract renewal dates, regulatory calendars, and annual reset clauses for items such as:

- Education/tuition (often adjusted around the academic cycle)

- Public utilities and other regulated/administered prices (often adjusted on scheduled reviews, which can be quarterly or semi-annual depending on the item)

- Service contracts (adjusted at various points throughout the year at renewal/reset dates)

- Government fees and fines (often updated at the beginning of the year or when the relevant administrative unit is updated)

- For urban housing leases, increases are typically capped by the prior year’s CPI and applied at contract renewal. That said, higher minimum wages can still affect housing-related services and maintenance costs via pass-through.

The minimum wage increase decreed by President Gustavo Petro on December 29, 2025, raised the base minimum wage to COP 1,750,905 per month, with a transport subsidy bringing the total to COP 2,000,000. This is one of the largest annual increases in recent decades.

Inflation Expectations Surge

Besides the minimum wage increase mechanically increasing a portion of indexed prices, inflation expectations have adjusted sharply (Figure 2).

Figure 2

In the first central bank/bank-survey readings following the decree, economists raised their forecasts for end-2026 inflation to ~6.4% (Bloomberg reports ~6.37%, consistent with the central bank survey shift from ~4.6% to ~6.4%). Prior to the decree, Colombia’s central bank had projected ~3.6% inflation for end-2026.

Decoupling Efforts

It’s no surprise that after a minimum wage hike of this magnitude, the government has also begun to discuss how the country can reduce automatic linkages between the minimum wage and certain prices to prevent additional price pressure. Petro has discussed “deindexing” some regulated/administered prices and administrative charges from the minimum wage and instead adjusting them based on annual inflation or other criteria.

Critically, public transport and other wage-intensive, regulated or administered services can face higher cost pressure after a large minimum wage increase, and those increases can ripple through the economy via logistics and distribution costs. A reversal toward a downward inflation trend is likely only in 2027, especially if further minimum wage increases are much lower than that of 2026.

Currency Appreciation vs. Price Pressures

Though Colombia benefited from peso appreciation versus the dollar in late 2025, uncertainty continues to strain the outlook (Figure 3).

Figure 3

The price shock of a minimum wage increase of this magnitude is likely to push prices higher across broad segments of the economy, particularly in labor-intensive service sectors. The combination of strong indexation pressures, staggered adjustment timing throughout the year, and elevated inflation expectations creates a challenging environment for monetary policy. Turnleaf will keep updating its inflation forecasts as new data comes in, including developments that could signal higher-for-longer interest rates.

The price shock of a minimum wage increase of this magnitude is likely to push prices higher across broad segments of the economy, particularly in labor-intensive service sectors. The combination of strong indexation pressures, staggered adjustment timing throughout the year, and elevated inflation expectations creates a challenging environment for monetary policy. Turnleaf will keep updating its inflation forecasts as new data comes in, including developments that could signal higher-for-longer interest rates.

Research Archive

Emerging Markets: January 2025 India CPI YoY Forecast Review

In our January 2025 YoY CPI forecast, we projected inflation at 4.57%, slightly above the realized 4.3%, yet outperforming consensus (4.71%)—even with our estimate released a...

Macroeconomic Insights: 2025 Eurozone Inflation Outlook – 4 Key Charts to Watch

Turnleaf is forecasting 2–2.5% headline inflation for the Eurozone in 2025, while core inflation is expected to decline through the end of the year towards 2% as momentum in wage...

DeepSeek, objectives and constraints

When a new burger joint opens up, there's often a buzz. Everyone (well, at least me) wants to try the new burger. Is it as good as it looks on Instagram? Or is it just style over...

Hundreds of quant papers from #QuantLinkADay in 2024

I tweet a lot (from @saeedamenfx and at BlueSky at @saeedamenfx.bsky.social)! In amongst, the tweets about burgers, I tweet out a quant paper or link every day under the hashtag...

What we’ve learnt from reading thousands of Fed communications

We recently had the last FOMC decision of 2024. Market l participants reacted to the hawkish tone including Powell’s comments that the Fed’s year-end inflation projection has...

Flash Inflation Outlook: The Cost of Stability, Poland’s Extended Energy Caps

The Polish government’s decision to extend the cap on electricity prices at 500 PLN/MWh is a critical measure to limit inflationary pressures on households. To understand its...

Macroeconomic Insights: A Pinch of Real Rates, a Dash of Slack: Turnleaf’s 2025 U.S. Inflation Recipe

At Turnleaf Analytics, leveraging our machine learning models, we project U.S. inflation to stabilize between 2–3% through 2025, shaped by the interplay of import inflation,...

Macroeconomic Insights: Rising Costs Hit Germany Where It Can’t Afford It—Manufacturing

Germany, long regarded as Europe’s economic powerhouse, owes much of its success to its export-driven industrial base. However, recent years have seen this foundation weaken...

Macroeconomic Insights: France’s Inflation Outlook Amid Fiscal and Economic Pressures

France’s inflation remains near the European Central Bank’s (ECB) 2% target despite significant fiscal spending during the pandemic and in response to the war in Ukraine....

Flash Inflation Outlook: South Korea Inflation Amid Political Instability

South Korea’s brief declaration and subsequent revocation of martial law by President Yoon has damaged investor confidence, further weakening the won and placing pressure on the...

November 2024 Global Inflation Call: Transcript

Global Inflation Amid Trade Uncertainties Good afternoon and welcome to Turnleaf’s global inflation call. For the past month, global inflation expectations have been shaped by...

Takeaways from QuantMinds 2024 in London

Over the past years, the quant industry has changed substantially. My first visit to Global Derivatives was just over a decade ago. At the time, perhaps unsurprisingly, the...

Macroeconomic Insights – Poland’s Fight with External and Domestic Demand

As Poland navigates a complex economic landscape, its rapid growth, fueled by competitive wages and strong manufacturing, faces challenges from both domestic and external...

Takeaways from Web Summit 2024

Think of Lisbon and no doubt it’ll conjure images of explorers setting sail in centuries past across the ocean, the hills that climb across the city, pastel de nata and salted...

Macroeconomic Insights: UK Autumn 2024 Budget and Global Trade Pressures Add to Inflation Challenges

The UK government's Autumn Budget for 2024, introduced on October 30, is designed to enhance public services through increased capital investments, funded by higher taxes along...