Featured Research

Macroeconomic Insights: UK CPI — Assessing the Renters’ Rights Act 2025

Executive Summary The Renters' Rights Act received Royal Assent on 27 October 2025. Council investigatory powers commenced on 27 December 2025, and the main rent-setting provisions take effect from 1 May 2026. Official rent measures largely reflect the stock of...

Macroeconomic Insights: UK CPI — Assessing the Renters’ Rights Act 2025

Executive Summary

The Renters’ Rights Act received Royal Assent on 27 October 2025. Council investigatory powers commenced on 27 December 2025, and the main rent-setting provisions take effect from 1 May 2026.

Official rent measures largely reflect the stock of tenancies, so policy-related changes feed through with a lag as contracts renew. The near-term signal is therefore more likely to appear first in advertised and new-tenancy rents from May 2026, while the CPI rent component responds later as those changes propagate through the renewal cycle.

Over the next 12 months, we expect only a modest effect on headline CPI. Rent inflation has already rolled over from its 2024 peak and is easing into early 2026, and our base case is that this cooling continues through 2026 given subdued housing churn and still restrictive borrowing costs. The most plausible near-term effect of the Act is therefore not a sharp rise in measured rent inflation, but a slowing in the pace of rent disinflation from mid 2026 onward. Because official rent measures are stock-and-renewal based, any shift in pricing conditions after May is more likely to enter the CPI rent component with a lag, becoming clearer later in 2026 and into early 2027 if the post-May change proves persistent.

We evaluate this within the CPI model using the official rental price index and the CPI component for actual rentals for housing, interpreted alongside the housing and financing inputs already used by the model, including house prices, turnover, construction activity, interest rates, mortgage rate proxies, credit flows, and housing and property services surveys.

Transmission to CPI

Official rent series primarily reflect the stock of tenancies, so re-pricing occurs with a lag. The practical consequence is that the rent impulse is measured in two stages. The first stage is a change in short-horizon momentum. The second stage is a sustained move in year-on-year inflation.

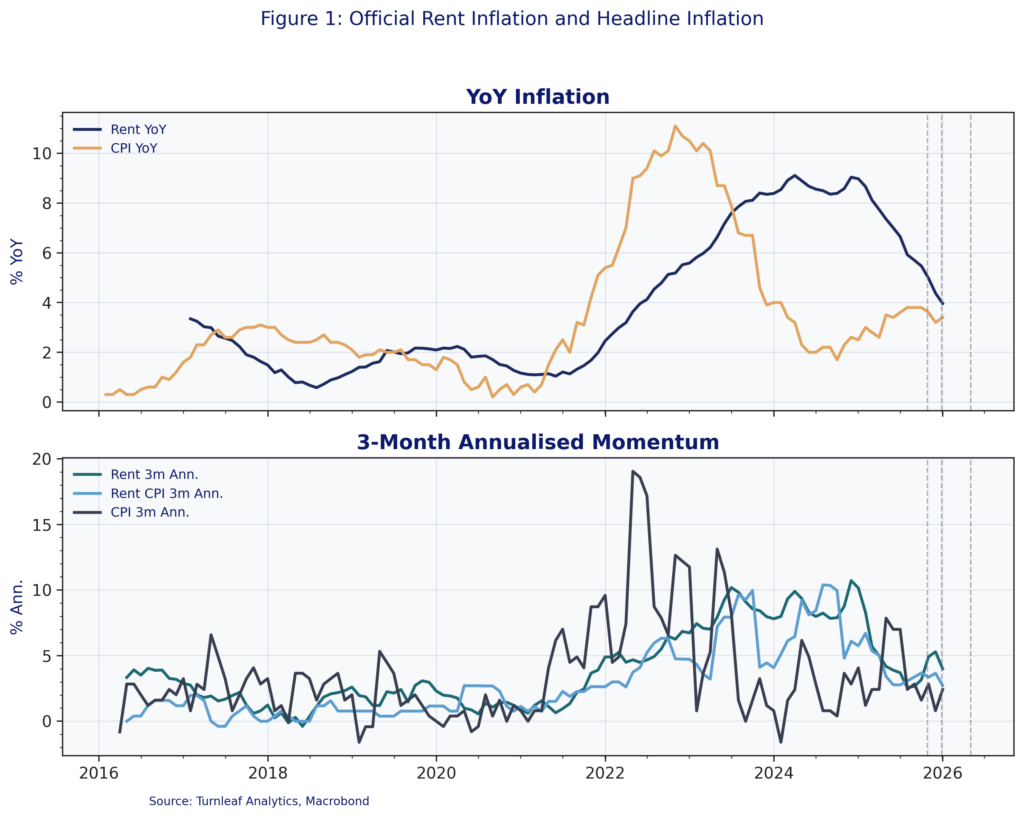

Figure 1 shows that rent inflation lagged the post-pandemic CPI surge and remained firm after headline inflation fell back. Rent inflation then rolled over from its 2024 peak, but it remains well above the levels seen in the late 2010s. The current read serves as a pre-implementation baseline and sets the starting point for the post-May monitoring window.

Rent inflation follows the same forces that drive the housing cycle, mainly borrowing costs, credit availability, and the amount of churn in the housing market. Our approach is to read the rent prints alongside those drivers and ask a simple question: does the rent path look like the housing cycle, or does it look like something rent-specific.

When rates and mortgage pricing are easing, secured lending is improving, turnover is recovering, and house prices are firming, a pickup in rent inflation is usually the normal follow-through from stronger demand and easier financing. In that setting, a stronger rent print is informative about the cycle, but it is not strong evidence of a policy impulse.

When rent inflation picks up while borrowing costs remain high, credit conditions are not improving at the margin (i.e., not accelerating), turnover stays weak, and the price data are flat, the rent move is harder to explain as a broad upswing. That is the configuration where a change in rent-setting or rental supply conditions becomes the leading explanation, and it is the one we watch most closely after May 2026.

When rent inflation cools even as rates ease and housing activity improves, the binding constraint is usually on the tenant side. The macro data equivalents are weakening credit conditions or signs that households are already stretched, which limits how far rents can be pushed even when the market environment is otherwise supportive.

To read the rest of the article, visit Turnleaf’s latest Substack post, here.

Research Archive

Neudata New York conference 2025

When you're in New York, there are several things you have to have, a burger (preferably from Minetta Tavern), a cookie (preferably from Levain bakery on the Upper East Side) and...

Macroeconomic Insights: Trump Announces a Trade Deal With China. Will U.S. Inflation Go Down Now?

There’s just something about being in Geneva that makes you want to reduce tariffs on all Chinese goods from 145% to 30%. Recently, the U.S. and China reached an agreement to...

Trip notes from USA

Over the past week and half I’ve been travelling in America, starting with Chicago, then Omaha and finally New York. I’ve met many clients and attended various financial events,...

Macroeconomics Insights: Eurozone Inflation and The Price of Fun

On April 28, 2025, at approximately noon, I couldn’t send a message to a colleague. I thought there must have been a problem with my WIFI, until I realized that none of the...

Macroeconomic Insights: China Inflation & The Uncertainty Pandemic

Based on recent weekly forecasts, Turnleaf is projecting deflation of -0.09%YoY in April 2025 as export growth is expected to contract and China begins to reorganize its economy...

Berkshire Hathaway meeting 2025

Go to a fancy London steakhouse, and there will be a chance that you will get served steak from Nebraska. I’ve been to Nebraska many times over the years, and if there’s one...

Macroeconomic Insights: April 2025 Brings Lower Inflation in Hungary and Cheaper Chicken Wings

On March 17, 2025, Prime Minister Viktor Orbán’s government introduced a profit-margin cap across thirty essential goods, beefing up oversight to prevent cross-pricing strategies...

Macroeconomic Insights: Inflation Outlook Israel April 2025 – Key Drivers and Upside Risks

In our April 2025 inflation preview, we project headline CPI will undershoot consensus, underpinned by subdued Brent‐crude volatility, cheaper USD imports due to dollar weakness,...

Macroeconomic Insights: Measuring Inflation in Argentina Through Alternative Data

Just as Turnleaf has been applying alternative data to forecast inflation amid trade policy uncertainty, understanding Argentine inflation requires moving beyond conventional...

Macroeconomic Insights: Tariff Reprieves and Market Uncertainty — Implications for Inflation and Growth

Late last Friday, the U.S. administration announced exemptions for phones, computers, and chips from Trump's tariffs after imposing a 145% tariff against China – a large exporter...

The dollar, yields and inflation

Harold Wilson once said a week is a long time in politics. He might have had the foresight to be referring to Liberation Day and the subsequent fallout into markets. One...

Macroeconomic Insights: 90 More Days of Letting the Data Speak

Within hours of the large-scale tariffs taking effect, the Trump administration announced a 90-day pause, replacing the full tariff package with a baseline 10% rate. China—among...

Macroeconomic Insights: Tariffs Shock U.S. Inflation Expectations

The recent imposition of sweeping U.S. tariffs has triggered a sharp stock market selloff, erasing up to $2.5 trillion in market value. More importantly, this sell-off reflects...

Neudata 2025 London conference

I recently attended the Neudata conference on alternative data in London. I had last gone quite a few years ago, and I was pleasantly surprised about how much bigger the event...

Liberation Day Arrives – Market Prints Fall in Line with Turnleaf Expectations

Yesterday, President Trump announced a minimum 10% tariff on all imports into the United States, with higher rates targeted at countries running large trade surpluses with the...