Featured Research

Macroeconomic Insights: Eurozone CPI — “Sweater Weather” Is Repricing Energy Risk

Energy markets have moved back to the foreground as a near-term driver of Eurozone headline inflation. Colder January temperatures lifted heating and power demand into a winter that began with below-normal gas storage, pushing TTF higher and increasing the system’s...

Macroeconomic Insights: Eurozone CPI — “Sweater Weather” Is Repricing Energy Risk

Energy markets have moved back to the foreground as a near-term driver of Eurozone headline inflation. Colder January temperatures lifted heating and power demand into a winter that began with below-normal gas storage, pushing TTF higher and increasing the system’s sensitivity to incremental shocks.

At the same time, Europe’s post-2022 reliance on US LNG supply has strengthened the link between domestic weather outcomes and global LNG clearing prices, reinforcing the transmission from gas into electricity in gas-marginal markets. While CPI pass-through remains uneven across countries and is partly damped by regulated and tax-heavy retail price structures, Turnleaf expects a modest upwards shift in its Eurozone baseline inflation forecast over the next 12 months (Figure 1 – see our latest Substack post here).

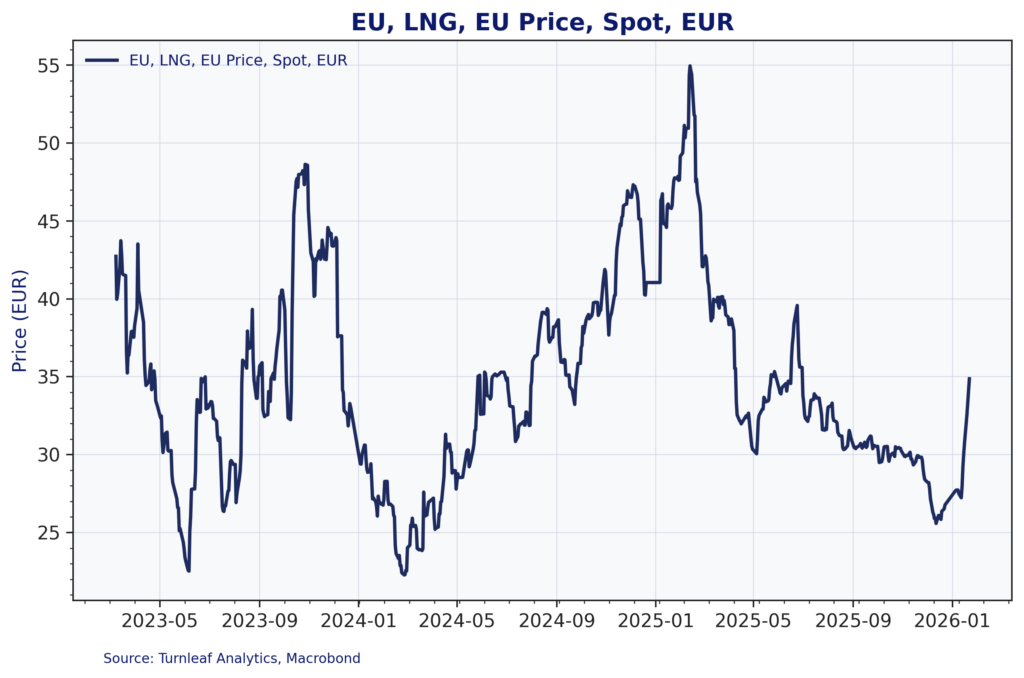

European gas prices (Dutch TTF) rose sharply in January as colder temperatures tightened the heating and power balance against an already constrained storage position (Figure 2). EU storage has fallen to roughly 50% full versus a seasonal five-year average near 65%, which increases sensitivity to additional weather shocks and accelerates the need for spot procurement.

Figure 2

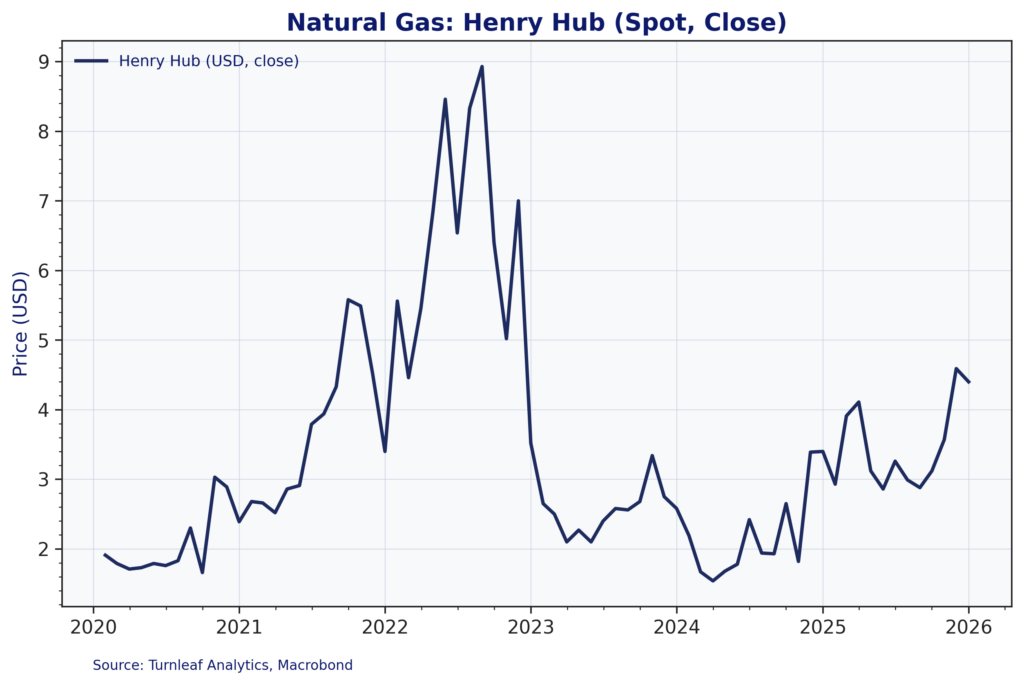

That tightening has been reinforced by global dynamics. U.S. gas prices also spiked as an Arctic blast boosted heating demand and raised concerns around operational disruptions, lifting Henry Hub and increasing marginal costs for LNG exporters (Figure 3). Colder conditions in Asia have added further competition for LNG cargoes.

Figure 3

Natural gas remains a key marginal fuel for electricity pricing across much of Europe, and the inflation relevance of this channel is being reinforced by structurally higher power demand tied to electrification. As peak-load conditions become more frequent, the system leans more often on dispatchable generation—precisely when gas is most likely to set the marginal price.

Since 2022, Europe’s pivot away from Russian pipeline gas has coincided with rapid growth in U.S. LNG shipments into the region. By Q3 2025, the United States supplied roughly 60% of EU LNG imports, materially increasing Europe’s exposure to global LNG market conditions. This winter’s weaker storage starting point has compounded that vulnerability, leaving TTF more responsive to cold snaps and to disruption risk in global LNG flows. Policy headlines have also contributed a short-lived risk premium at the margin. In mid-January, President Trump threatened tariffs on several European countries in connection with the Greenland takeover, before subsequently stepping back from an immediate tariff plan following talks in Davos.

CPI Pass-Through

In gas-marginal electricity markets (e.g., Italy), CPI pass-through is typically faster because wholesale power prices respond directly to moves in gas spot costs. This is one reason heating gas remains a key input in our Italy framework given its linkage to electricity pricing.

France, supported by a larger nuclear base, is relatively more insulated through the power channel, although gas still influences heating and parts of industry. We expect the brunt of the impact in February, when France resets regulated electricity tariffs, and our latest 12-month forecast curve has moved higher (Figure 4 – see our latest Substack post here).

In Germany, renewables represent a larger share of power generation, but gas still often sets electricity prices during periods of high demand and/or low renewable output. Ongoing plans for additional gas-fired capacity as backup generation reinforce the point that elevated gas prices can still feed through into German inflation via electricity.

Spain, with higher renewable penetration, typically experiences less direct pass-through under normal conditions, but can still see sharp power price spikes when gas plants set the marginal price, creating episodic inflation pressure through electricity costs and regulated tariff adjustments.

Limited Upside Pressure for Fuel

While higher fuel prices add some upward pressure to inflation, Turnleaf’s Eurozone model suggests near-term pass-through remains constrained. This largely reflects retail fuel price structures across the Euro Area, where taxes and regulated components make up a significant share of the final price and dampen short-term volatility. In France, these features tend to smooth and delay the impact of wholesale swings; in Italy, transmission can be quicker but remains limited by the high tax content of pump prices.

More broadly, the latest fuel-price gains appear driven by a mix of tighter natural-gas fundamentals and a temporary rise in geopolitical and supply-risk premia. Taken together, this points to an inflation impulse that is likely to be modest and short-lived, and we do not view recent fuel price movements as a material shift in the broader inflation outlook at this stage.

What We Leverage in Turnleaf’s Eurozone Framework

Turnleaf’s Eurozone framework is built to translate energy-market shocks into inflation outcomes as they develop. We use high-frequency uncertainty indices to separate volatility driven by geopolitical and policy headlines from changes in underlying fundamentals. We incorporate high-frequency weather data (daily temperatures and precipitation) to quantify demand shocks that flow through heating and power load. We then track wholesale gas and electricity prices, which embed both marginal input costs and risk premia and are typically the first markets to reflect tightening conditions. Finally, where available, we anchor the signal using explicit supply-demand indicators like storage trajectories and LNG flow constraints which determine how quickly the market must clear through spot pricing when buffers are thin.

This structure allows us to capture the full chain from weather and risk sentiment to gas and power pricing, and ultimately to CPI pass-through in near real time. As new prints come in, we update the forecast path accordingly.

Research Archive

Berkshire Hathaway meeting 2025

Go to a fancy London steakhouse, and there will be a chance that you will get served steak from Nebraska. I’ve been to Nebraska many times over the years, and if there’s one...

Macroeconomic Insights: April 2025 Brings Lower Inflation in Hungary and Cheaper Chicken Wings

On March 17, 2025, Prime Minister Viktor Orbán’s government introduced a profit-margin cap across thirty essential goods, beefing up oversight to prevent cross-pricing strategies...

Macroeconomic Insights: Inflation Outlook Israel April 2025 – Key Drivers and Upside Risks

In our April 2025 inflation preview, we project headline CPI will undershoot consensus, underpinned by subdued Brent‐crude volatility, cheaper USD imports due to dollar weakness,...

Macroeconomic Insights: Measuring Inflation in Argentina Through Alternative Data

Just as Turnleaf has been applying alternative data to forecast inflation amid trade policy uncertainty, understanding Argentine inflation requires moving beyond conventional...

Macroeconomic Insights: Tariff Reprieves and Market Uncertainty — Implications for Inflation and Growth

Late last Friday, the U.S. administration announced exemptions for phones, computers, and chips from Trump's tariffs after imposing a 145% tariff against China – a large exporter...

The dollar, yields and inflation

Harold Wilson once said a week is a long time in politics. He might have had the foresight to be referring to Liberation Day and the subsequent fallout into markets. One...

Macroeconomic Insights: 90 More Days of Letting the Data Speak

Within hours of the large-scale tariffs taking effect, the Trump administration announced a 90-day pause, replacing the full tariff package with a baseline 10% rate. China—among...

Macroeconomic Insights: Tariffs Shock U.S. Inflation Expectations

The recent imposition of sweeping U.S. tariffs has triggered a sharp stock market selloff, erasing up to $2.5 trillion in market value. More importantly, this sell-off reflects...

Neudata 2025 London conference

I recently attended the Neudata conference on alternative data in London. I had last gone quite a few years ago, and I was pleasantly surprised about how much bigger the event...

Liberation Day Arrives – Market Prints Fall in Line with Turnleaf Expectations

Yesterday, President Trump announced a minimum 10% tariff on all imports into the United States, with higher rates targeted at countries running large trade surpluses with the...

Turnleaf Forecast Review: Recent Misses and Outcomes

This issue aims to clarify several of Turnleaf’s and the market’s forecast deviations over the past few months. Below, we outline key insights and performance drivers across a...

Macroeconomic Insights: India’s Inflation Paradox – Headline Drops, Core Rises

In recent forecasts, Turnleaf has observed an interesting trend in India’s inflation dynamics. While headline inflation has been trending downward, largely driven by a decrease...

Macroeconomic Insights: Polish Inflation – What Could Be, What Won’t Be in 2025

Recent retail sales in Poland have come in below expectations (-0.5%YoY in February 2025), with a significant decline driven by vehicle sales, followed by reduced consumption in...

Macroeconomic Insights: Mexico’s Inflation Path In Tariff Uncertainty Limbo

The tail of our inflation curve is currently driven by two key factors: U.S. tariffs set for April 2, 2025, and Plan Mexico, which aims to revitalize domestic manufacturing and...

Macroeconomic Insights: How Germany’s Fiscal Stimulus Could Reshape Its Inflation Outlook

Amid shifting geopolitical tensions and the need to revitalise its economy, Germany is preparing for a massive fiscal stimulus that will allocate up to $1 trillion in defence and...