Featured Research

Macroeconomic Insights: UK CPI — Assessing the Renters’ Rights Act 2025

Executive Summary The Renters' Rights Act received Royal Assent on 27 October 2025. Council investigatory powers commenced on 27 December 2025, and the main rent-setting provisions take effect from 1 May 2026. Official rent measures largely reflect the stock of...

Macroeconomic Insights: UK CPI — Assessing the Renters’ Rights Act 2025

Executive Summary

The Renters’ Rights Act received Royal Assent on 27 October 2025. Council investigatory powers commenced on 27 December 2025, and the main rent-setting provisions take effect from 1 May 2026.

Official rent measures largely reflect the stock of tenancies, so policy-related changes feed through with a lag as contracts renew. The near-term signal is therefore more likely to appear first in advertised and new-tenancy rents from May 2026, while the CPI rent component responds later as those changes propagate through the renewal cycle.

Over the next 12 months, we expect only a modest effect on headline CPI. Rent inflation has already rolled over from its 2024 peak and is easing into early 2026, and our base case is that this cooling continues through 2026 given subdued housing churn and still restrictive borrowing costs. The most plausible near-term effect of the Act is therefore not a sharp rise in measured rent inflation, but a slowing in the pace of rent disinflation from mid 2026 onward. Because official rent measures are stock-and-renewal based, any shift in pricing conditions after May is more likely to enter the CPI rent component with a lag, becoming clearer later in 2026 and into early 2027 if the post-May change proves persistent.

We evaluate this within the CPI model using the official rental price index and the CPI component for actual rentals for housing, interpreted alongside the housing and financing inputs already used by the model, including house prices, turnover, construction activity, interest rates, mortgage rate proxies, credit flows, and housing and property services surveys.

Transmission to CPI

Official rent series primarily reflect the stock of tenancies, so re-pricing occurs with a lag. The practical consequence is that the rent impulse is measured in two stages. The first stage is a change in short-horizon momentum. The second stage is a sustained move in year-on-year inflation.

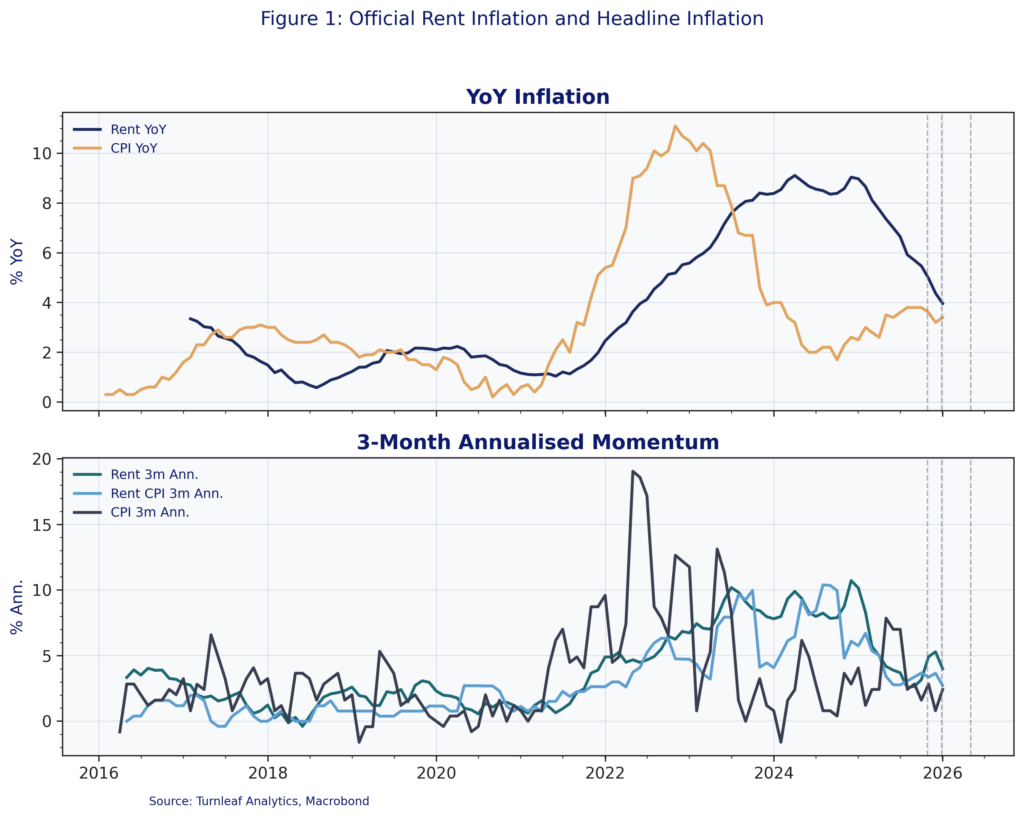

Figure 1 shows that rent inflation lagged the post-pandemic CPI surge and remained firm after headline inflation fell back. Rent inflation then rolled over from its 2024 peak, but it remains well above the levels seen in the late 2010s. The current read serves as a pre-implementation baseline and sets the starting point for the post-May monitoring window.

Rent inflation follows the same forces that drive the housing cycle, mainly borrowing costs, credit availability, and the amount of churn in the housing market. Our approach is to read the rent prints alongside those drivers and ask a simple question: does the rent path look like the housing cycle, or does it look like something rent-specific.

When rates and mortgage pricing are easing, secured lending is improving, turnover is recovering, and house prices are firming, a pickup in rent inflation is usually the normal follow-through from stronger demand and easier financing. In that setting, a stronger rent print is informative about the cycle, but it is not strong evidence of a policy impulse.

When rent inflation picks up while borrowing costs remain high, credit conditions are not improving at the margin (i.e., not accelerating), turnover stays weak, and the price data are flat, the rent move is harder to explain as a broad upswing. That is the configuration where a change in rent-setting or rental supply conditions becomes the leading explanation, and it is the one we watch most closely after May 2026.

When rent inflation cools even as rates ease and housing activity improves, the binding constraint is usually on the tenant side. The macro data equivalents are weakening credit conditions or signs that households are already stretched, which limits how far rents can be pushed even when the market environment is otherwise supportive.

To read the rest of the article, visit Turnleaf’s latest Substack post, here.

Research Archive

Macroeconomic Insights: U.S. Core CPI – Who’s Paying for the Tariffs?

In the first five months of 2025, the U.S. government collected $68.9 billion in tariffs and excise taxes, as the Yale Budget Lab reports the effective tariff rate surged from...

Macroeconomics Insights: Navigating Inflation and Deflation – China and Japan

As we approach the second half of 2025, the inflation trajectories of China and Japan reflect contrasting dynamics shaped by domestic economic conditions, external influences,...

Run to Research

Left foot forward, right foot forward, puncturing the mud, plodding along, the wind in winter, the sun in summer, in the trees’ shadows, patterns of light and dark along the...

Macroeconomic Insights: Ea-Nasir’s Fine Quality Copper Hit with 50% Tariffs in August

Since the inauguration of President Trump, uncertainty has significantly influenced inflation dynamics, primarily through unpredictable tariff policies. However, firms are now...

Macroeconomic Insights: United States CPI – Firms are Still Front-Loading

To date, uncertainty has been the defining feature of the inflation story. Volatile trade policy has deterred many firms from making strategic investments, slowing business...

Macroeconomic Insights: FX, Oil, Copper, and Tariff Risks in Emerging Markets

Across Colombia, Chile, Brazil, and China, inflation dynamics are currently shaped by common external themes: exchange rate movements, global commodity prices—particularly...

Twenty years in financial markets

Time is a curious thing. We say time passes, yet rather than simply pass, time tends to dissolve. Once gone, it dissolves leaving an imprint behind. At times, it's a clear...

Macroeconomic Insights: Czech Republic CPI – House Prices on the Rise

Recently, housing prices in the Czech Republic have increasingly exerted upward pressure on inflation. Our June 2025 Forecast Word Cloud highlights the primary drivers...

Macroeconomic Insights: Malaysia CPI – Electricity Tariff Reform from July 2025

Malaysia has changed its electricity tariff schedule, and allegedly, it should save the average consumer up to 19% on their bills. However, after an announcement in June 2025,...

Macroeconomic Insights: Hungary CPI – Food Prices on the Rise

At the end of May 2025, the Orban government decided to extend the profit margin cap on 30 essential food items through August 2025, in line with previous guidance stating the...

Macroeconomic Insights: Vegetable Prices Push India Inflation Downwards

In 2024, volatile vegetable prices repeatedly triggered in-market releases from India’s Price Stabilisation Fund (PSF). PSF, launched in 2014–15, was designed to curb extreme...

Macroeconomic Insights: Israel CPI – The Cost of War

Over the past 24 hours, Israel’s strike on Iran has markedly increased upside risks to inflation in the country. Just as tariffs introduce additional costs to consumers,...

Macroeconomic Insights: Spain CPI – Is it Time to Buy a House?

Since the start of the year, housing market indicators have increasingly correlated with rising inflation pressures. Interestingly, Spain classifies mortgages as financial...

Macroeconomic Insights: United States – A Bad Economy in a Good Economy

Our United States CPI YoY, NSA model continues to flag two quiet but disinflationary forces: a moderate rise in unemployment and trends in disability-program flows. To qualify...

Neudata New York conference 2025

When you're in New York, there are several things you have to have, a burger (preferably from Minetta Tavern), a cookie (preferably from Levain bakery on the Upper East Side) and...