Featured Research

Macroeconomic Insights: Gold’s New Inflation Playbook

Gold has stopped trading as a clean derivative of US real yields and now reflects a broader external pricing regime. Since 2022, the real-yield anchor has weakened, gold has lined up more consistently with broad-dollar moves, and episodes of dollar tightening have...

Macroeconomic Insights: Gold’s New Inflation Playbook

Gold has stopped trading as a clean derivative of US real yields and now reflects a broader external pricing regime. Since 2022, the real-yield anchor has weakened, gold has lined up more consistently with broad-dollar moves, and episodes of dollar tightening have coincided with more synchronized depreciation within a basket of emerging-market currencies. Inflation outcomes also show episodic fragmentation. Dispersion widens sharply during the 2021–22 shock, compresses through 2023–24, and then widens around 2025. The figures below trace this rotation in drivers and show how it propagates into inflation through exchange rates, tradables pricing, and country-specific pass-through.

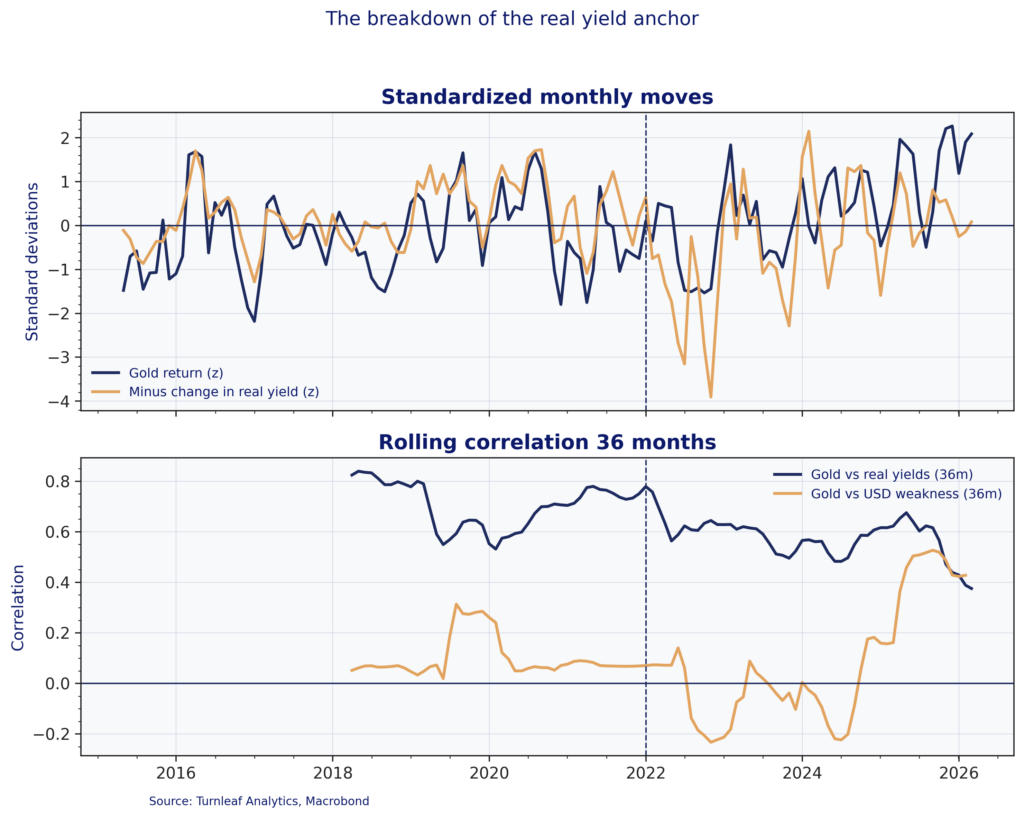

The breakdown of the real yield anchor

For much of the past decade, real yields offered a reliable framework for thinking about gold. When inflation-adjusted returns on safe assets fell, gold typically benefited. Since 2022, that relationship has weakened. US 10-year real yields rose sharply to post-GFC highs, yet gold remained resilient and went on to set successive record highs through 2025. Figure 1 captures the shift. The rolling correlation between gold and real yields trends lower after 2022, while the correlation between gold and broad-dollar weakness rises into 2025, which is consistent with gold rotating from a rate-dominated signal toward a more FX-sensitive regime.

Emerging-market central banks have helped drive this decoupling by diversifying reserves away from dollar assets. Their buying changes the marginal source of demand and shifts the transmission mechanism. Gold increasingly responds through exchange rates and import-price dynamics via the cost of dollars and local-currency purchasing power, rather than primarily through the domestic real-rate channel.

Figure 1

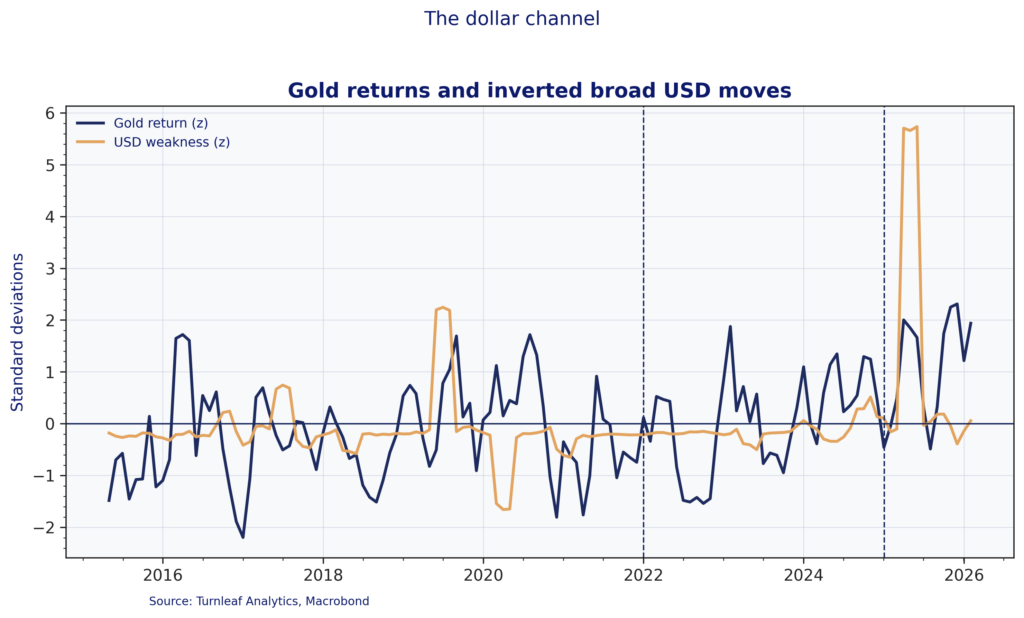

The dollar channel and EM currency clustering

In the current regime, gold strength often lines up with broad-dollar weakness because exchange-rate moves pass through quickly into traded goods and import prices. Figure 2 shows this by plotting gold returns against an inverted broad-dollar index return series. The relationship is episodic, but the co-movement becomes more visible in stress windows, including the large dollar move around the 2025 marker.

Figure 2

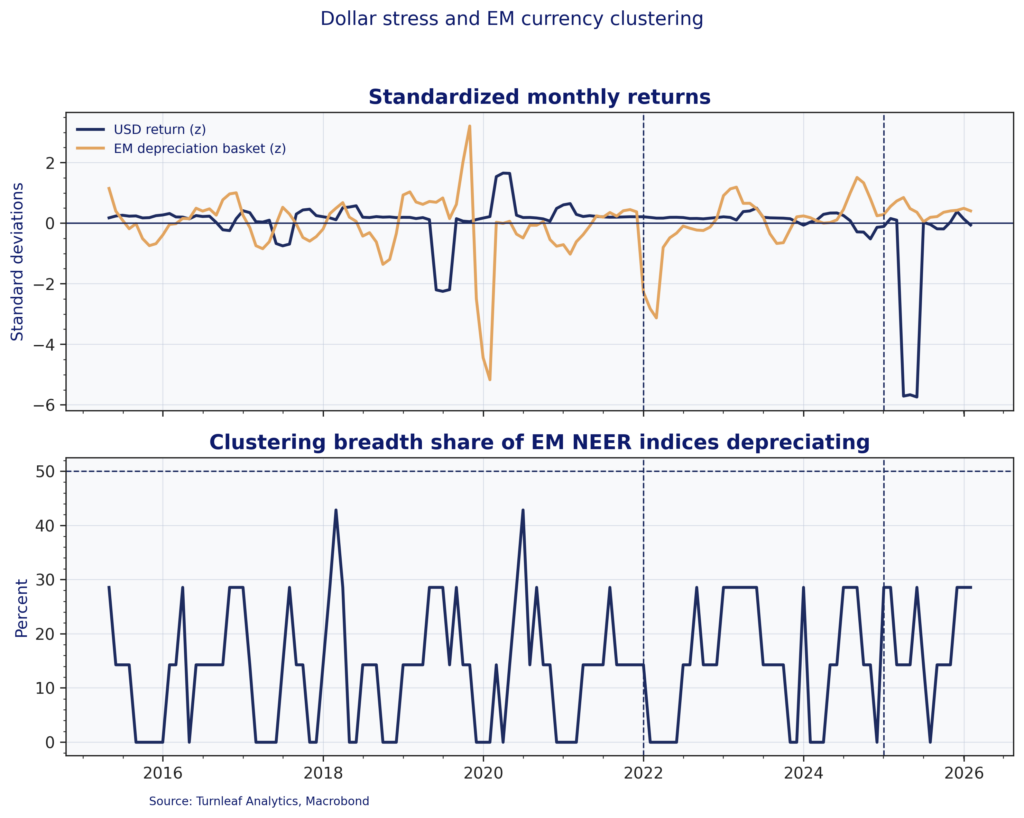

For emerging markets, the key issue is synchronicity within the basket rather than idiosyncratic single-country moves. Figure 3 pairs standardized broad-dollar index returns with an EM depreciation basket and a breadth measure that tracks how many currencies in this basket depreciate at the same time. Breadth stays low in most months but rises in stress episodes, which captures the clustering mechanism in practice: the distribution shifts toward shared drawdowns when the broad-dollar strengthens and funding conditions tighten.

Figure 3

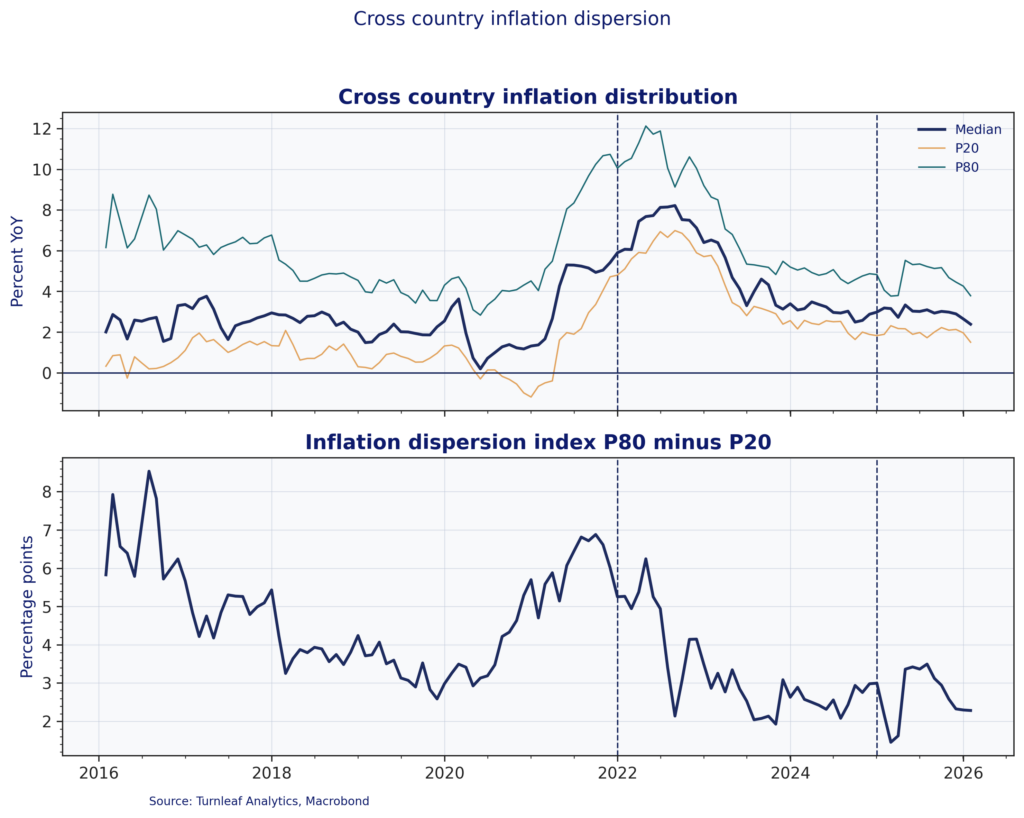

Figure 4 checks whether the shift in transmission shows up in realized outcomes by plotting the cross-sectional distribution of headline CPI inflation across the sample and a trimmed dispersion metric defined as the P80–P20 spread. The sample combines advanced economies and major emerging markets (United States, Eurozone, United Kingdom, Japan, Canada, China, India, Brazil, Mexico, Turkey, South Africa). Dispersion rises into the 2021–22 inflation shock as inflation outcomes fan out across countries, then compresses sharply through 2023 and 2024 as inflation re-converges. The modest widening around 2025 suggests renewed fragmentation, but at a far smaller scale than 2022.

Figure 4

Country-level transmission

The shift from yield-driven to reserve-driven gold increases the scope for inflation dispersion based on structural archetypes.

China is a structural contributor. The PBoC has been an important contributor to the current regime through price-insensitive gold accumulation to reduce exposure to US Treasuries. While domestic inflation in China is muted by capital controls and managed exchange rates, reserve diversification affects the marginal demand for dollars and reshapes global pricing conditions for other economies.

Turkey illustrates regime-dependent pass-through. Turkey’s exchange rate is not a clean market price, because policy has often leaned on reserves, regulation, and administrative measures to smooth or delay depreciation. That does not remove pass-through, it changes its timing and its form.

To read the rest, consider subscribing to Turnleaf’s Substack, here.

Research Archive

Macroeconomic Insights: Japan CPI – Nigiri Sushi Inflation

As of September 2025, Japan's inflation profile remains dominated by food price dynamics. The headline 2.9% YoY reading reflects a disproportionate rice contribution—despite...

U.S. Government Shutdown and the October 2025 CPI Print

The BLS released the September 2025 CPI print on October 24, nine days after its originally scheduled October 15 release date, following a partial recall of staff during the...

Quant Strats London 2025

Quant Strats has been a feature of the quant calendar for a number of years. I went to my first event recently after a couple of years. The event has evolved somewhat over time,...

Macroeconomic Insights: Brazil CPI — Food Costs, Currency Dynamics, and the Path to 4%

Brazilian inflation has proved particularly sticky, driven by persistent wage growth, global trade dynamics, and elevated food inflation from weather-related supply constraints....

Macroeconomic Insights: UK September 2025 CPI Analysis

UK CPI for September 2025 declined to 3.8% YoY, falling below market expectations of 4.0% (vs. Turnleaf estimate of 3.94%). The decline was primarily driven by sustained lower...

Macroeconomic Insights: Japan CPI – Subsidies Reset

Japan’s CPI over the next two months will be shaped by a mix of expiring and newly introduced subsidies. Over the past two years, national electricity and gas subsidies have...

Macroeconomic Insights: Australia CPI – Could Higher Unemployment Change Everything?

Turnleaf expects Australia's 12-month inflation forecast path to remain close to the Reserve Bank's upper bound 3% target range as stronger than expected demand continues to...

Macroeconomic Insights: China CPI — Will the Chinese New Year Be Enough?

China's headline CPI rose to -0.3% YoY in September 2025, still capped by food deflation and soft energy prices. Core CPI printed 1.0% YoY, above headline but still subdued as...

Macroeconomic Insights: United States CPI – Core CPI to Drive Inflation Trends

Core Goods and Core Services are steering U.S. inflation in the second half of 2025. According to Turnleaf’s U.S. inflation models, Core Goods will be driven by short-lived...

WBS Training Palermo Conference 2025

Italy is made up of twenty regions, each of which is very different from another, from Veneto to Lazio to Puglia. Two weeks ago I visited Sicily. Perhaps unsurprisingly for an...

Macroeconomic Insights: United Kingdom CPI Gets a Boost

Turnleaf’s Oct 9, 2025 nowcast for September 2025 prints slightly higher than the Oct 1, 2025 weekly, reflecting a mix of policy and pricing signals that point to firmer levels...

Macroeconomic Insights: France CPI– Consumers are Waiting for Something Bad to Happen

Consumers are waiting for something bad to happen. Industrial weakness and worries about the government dominate the story, and French households are preparing for the worst. As...

Macroeconomic Insights: Poland CPI – The 2025 ‘Cheap Energy’ Party Winds Down

Turnleaf expects Poland’s CPI to average around 3% YoY over the next 12 months. By 2026, the base effects from the 2024 energy surge will fade, leaving food and services as the...

Macroeconomic Insights: South Africa CPI – Got Milk?

Turnleaf’s Headline CPI YoY forecast for South Africa has been revised lower following the unexpected August 2025 print of 3.3% YoY. The shift downwards of the inflation curve is...

Macroeconomic Insights: Hungary CPI Still Has a Long Way to Go

Turnleaf’s September 2025 headline inflation forecast for Hungary over the next 12 months points to an uptick toward 5% YoY by October 2025, followed by a steady decline into...