Featured Research

Macroeconomic Insights: Trump’s Tariff War – The Sequel

On Feb 20, 2026, the Supreme Court ruled 6–3 (Learning Resources, Inc. v. Trump) that the International Emergency Economic Powers Act (IEEPA) does not authorize the U.S. President to impose tariffs, a power the Constitution assigns to Congress. Between our Feb 20,...

Macroeconomic Insights: Trump’s Tariff War – The Sequel

On Feb 20, 2026, the Supreme Court ruled 6–3 (Learning Resources, Inc. v. Trump) that the International Emergency Economic Powers Act (IEEPA) does not authorize the U.S. President to impose tariffs, a power the Constitution assigns to Congress. Between our Feb 20, 2026 nowcast for the US and our Feb 23, 2026 nowcast, we see a moderate increase at the tail of the 12-month forecast curve (Figure 1).

Figure 1 – visit our Substack to see the latest forecast, here

Within hours of the ruling, Trump signed a proclamation invoking Section 122 of the Trade Act of 1974, a statute never previously used for tariffs, imposing a 10% global surcharge effective today, February 24, 2026. On February 21, Trump announced via Truth Social his intention to raise this to the statutory ceiling of 15%, though no formal proclamation had been issued as of the time of writing (White House Fact Sheet). Unlike IEEPA, Section 122 tariffs are capped at 15% and expire after 150 days (July 24, 2026) unless Congress votes to extend them. Markets are treating the 15% as the operative rate pending CBP enforcement guidance, and our table below reflects that assumption. Given the administration’s prior use of multiple statutory pathways, further action under Sections 232 or 301 remains a high-probability scenario once the 150-day window expires.

Refunds as Fiscal Offset

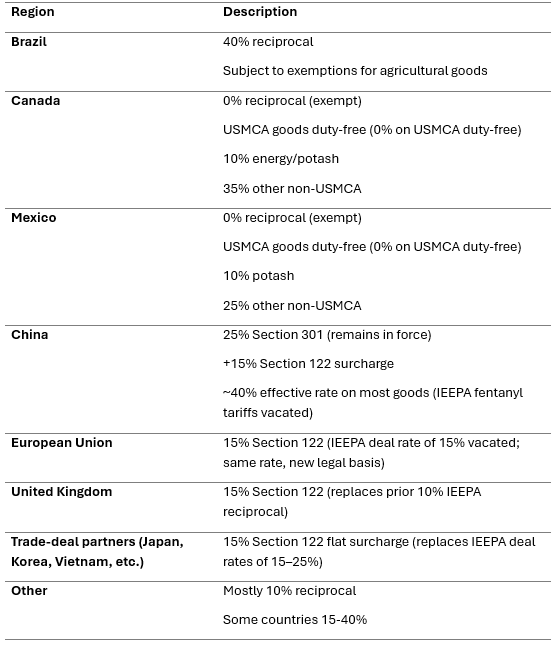

Other countries who have already made deals with Trump are likely to resist any global tariff that exceeds their established amounts. As the table below illustrates, several partners (EU, UK, trade-deal countries) now face a higher effective rate under the flat 15% Section 122 surcharge than under their prior IEEPA deals, while others (notably China) see a net reduction as the stacked IEEPA fentanyl tariffs are vacated. IEEPA refunds also pose a significant fiscal challenge (Figure 2).

Figure 2: Current Tariff Policy as of February 18, 2026 (Source: Yale Budget Lab; Global Trade Alert) – Broad Tariffs under IEEPA Authority (REPEALED)

U.S. Customs and Border Protection collected approximately $133–$142 billion in IEEPA duties through year-end 2025, with the Penn Wharton Budget Model projecting up to $175 billion in total refund liability. These refunds flow to importers rather than consumers, functioning as a form of backdoor fiscal stimulus that partially offsets the inflationary drag from remaining tariffs, though the timing is highly uncertain, with TD Securities estimating a 12–18 month disbursement window. On net, the Yale Budget Lab estimates a short-run consumer price increase of ~0.6% under full pass-through, roughly $600–$800 per household, approximately half the impact had IEEPA tariffs remained in force. This is consistent with our view that the inflation impulse from the tariff transition will be modest and gradual, concentrated in metals, electronics, and motor vehicles where Section 232 tariffs continue to bite.

Implications for Inflation and the Fed

The temporary and legally constrained nature of Section 122 tariffs reduces the risk of a sustained inflation shock, allowing monetary policy to remain focused on underlying disinflation trends. Chairman Powell’s last day is set to be May 15, 2026, when he is replaced by Kevin Warsh, a former Fed Governor (2006–2011) nominated by Trump on January 30, 2026, who is expected to cut interest rates at a faster pace than his predecessor. Though interest rates remain on hold for now, markets are pricing in 2–3 cuts in 2026 under the Warsh-led Fed, a trajectory that, if realized, would provide some offset to any tariff-driven cost pressures visible in H2 CPI prints.

The table above shows that the shift to a flat 15% Section 122 surcharge produces mixed outcomes across partners. The effective tariff rate rises to approximately 13.7% (Yale Budget Lab, Feb. 21, 2026, a moderate increase from the initial 10% rate but well below the pre-SCOTUS level of 16.0%. Firms largely absorbed import costs through 2025 pending legal clarity, delaying pass-through to consumer prices. Any residual price pressures are likely to emerge gradually over the next few months, with delays possible depending on how Congress acts at the 150-day mark. We will continue to monitor high-frequency port data, PMI import price subcomponents, and survey data to gauge upside risk on inflation.

What’s Next?

The tariff transition does not materially change the macro outlook. The SCOTUS ruling removes tail risk from an uncapped IEEPA regime, while the Section 122 replacement is time-limited, legally constrained, and partially offset by the fiscal stimulus of IEEPA refunds. The inflation impulse remains modest and manageable. The more consequential variable is whether Congress extends Section 122 past July 24 or the administration deploys Sections 232 and 301 at scale, either of which would warrant an upward revision to our CPI forecasts.

Research Archive

Macroeconomic Insights: Switzerland CPI – Escaping Deflation

Turnleaf expects Switzerland inflation to oscillate around 0% over the next 12 months with some indication of healthy price growth towards the tail-end of our forecast (Figure 1...

Macroeconomic Insights: Japan CPI – Nigiri Sushi Inflation

As of September 2025, Japan's inflation profile remains dominated by food price dynamics. The headline 2.9% YoY reading reflects a disproportionate rice contribution—despite...

U.S. Government Shutdown and the October 2025 CPI Print

The BLS released the September 2025 CPI print on October 24, nine days after its originally scheduled October 15 release date, following a partial recall of staff during the...

Quant Strats London 2025

Quant Strats has been a feature of the quant calendar for a number of years. I went to my first event recently after a couple of years. The event has evolved somewhat over time,...

Macroeconomic Insights: Brazil CPI — Food Costs, Currency Dynamics, and the Path to 4%

Brazilian inflation has proved particularly sticky, driven by persistent wage growth, global trade dynamics, and elevated food inflation from weather-related supply constraints....

Macroeconomic Insights: UK September 2025 CPI Analysis

UK CPI for September 2025 declined to 3.8% YoY, falling below market expectations of 4.0% (vs. Turnleaf estimate of 3.94%). The decline was primarily driven by sustained lower...

Macroeconomic Insights: Japan CPI – Subsidies Reset

Japan’s CPI over the next two months will be shaped by a mix of expiring and newly introduced subsidies. Over the past two years, national electricity and gas subsidies have...

Macroeconomic Insights: Australia CPI – Could Higher Unemployment Change Everything?

Turnleaf expects Australia's 12-month inflation forecast path to remain close to the Reserve Bank's upper bound 3% target range as stronger than expected demand continues to...

Macroeconomic Insights: China CPI — Will the Chinese New Year Be Enough?

China's headline CPI rose to -0.3% YoY in September 2025, still capped by food deflation and soft energy prices. Core CPI printed 1.0% YoY, above headline but still subdued as...

Macroeconomic Insights: United States CPI – Core CPI to Drive Inflation Trends

Core Goods and Core Services are steering U.S. inflation in the second half of 2025. According to Turnleaf’s U.S. inflation models, Core Goods will be driven by short-lived...

WBS Training Palermo Conference 2025

Italy is made up of twenty regions, each of which is very different from another, from Veneto to Lazio to Puglia. Two weeks ago I visited Sicily. Perhaps unsurprisingly for an...

Macroeconomic Insights: United Kingdom CPI Gets a Boost

Turnleaf’s Oct 9, 2025 nowcast for September 2025 prints slightly higher than the Oct 1, 2025 weekly, reflecting a mix of policy and pricing signals that point to firmer levels...

Macroeconomic Insights: France CPI– Consumers are Waiting for Something Bad to Happen

Consumers are waiting for something bad to happen. Industrial weakness and worries about the government dominate the story, and French households are preparing for the worst. As...

Macroeconomic Insights: Poland CPI – The 2025 ‘Cheap Energy’ Party Winds Down

Turnleaf expects Poland’s CPI to average around 3% YoY over the next 12 months. By 2026, the base effects from the 2024 energy surge will fade, leaving food and services as the...

Macroeconomic Insights: South Africa CPI – Got Milk?

Turnleaf’s Headline CPI YoY forecast for South Africa has been revised lower following the unexpected August 2025 print of 3.3% YoY. The shift downwards of the inflation curve is...