Featured Research

Macroeconomic Insights: UK CPI — Assessing the Renters’ Rights Act 2025

Executive Summary The Renters' Rights Act received Royal Assent on 27 October 2025. Council investigatory powers commenced on 27 December 2025, and the main rent-setting provisions take effect from 1 May 2026. Official rent measures largely reflect the stock of...

Macroeconomic Insights: UK CPI — Assessing the Renters’ Rights Act 2025

Executive Summary

The Renters’ Rights Act received Royal Assent on 27 October 2025. Council investigatory powers commenced on 27 December 2025, and the main rent-setting provisions take effect from 1 May 2026.

Official rent measures largely reflect the stock of tenancies, so policy-related changes feed through with a lag as contracts renew. The near-term signal is therefore more likely to appear first in advertised and new-tenancy rents from May 2026, while the CPI rent component responds later as those changes propagate through the renewal cycle.

Over the next 12 months, we expect only a modest effect on headline CPI. Rent inflation has already rolled over from its 2024 peak and is easing into early 2026, and our base case is that this cooling continues through 2026 given subdued housing churn and still restrictive borrowing costs. The most plausible near-term effect of the Act is therefore not a sharp rise in measured rent inflation, but a slowing in the pace of rent disinflation from mid 2026 onward. Because official rent measures are stock-and-renewal based, any shift in pricing conditions after May is more likely to enter the CPI rent component with a lag, becoming clearer later in 2026 and into early 2027 if the post-May change proves persistent.

We evaluate this within the CPI model using the official rental price index and the CPI component for actual rentals for housing, interpreted alongside the housing and financing inputs already used by the model, including house prices, turnover, construction activity, interest rates, mortgage rate proxies, credit flows, and housing and property services surveys.

Transmission to CPI

Official rent series primarily reflect the stock of tenancies, so re-pricing occurs with a lag. The practical consequence is that the rent impulse is measured in two stages. The first stage is a change in short-horizon momentum. The second stage is a sustained move in year-on-year inflation.

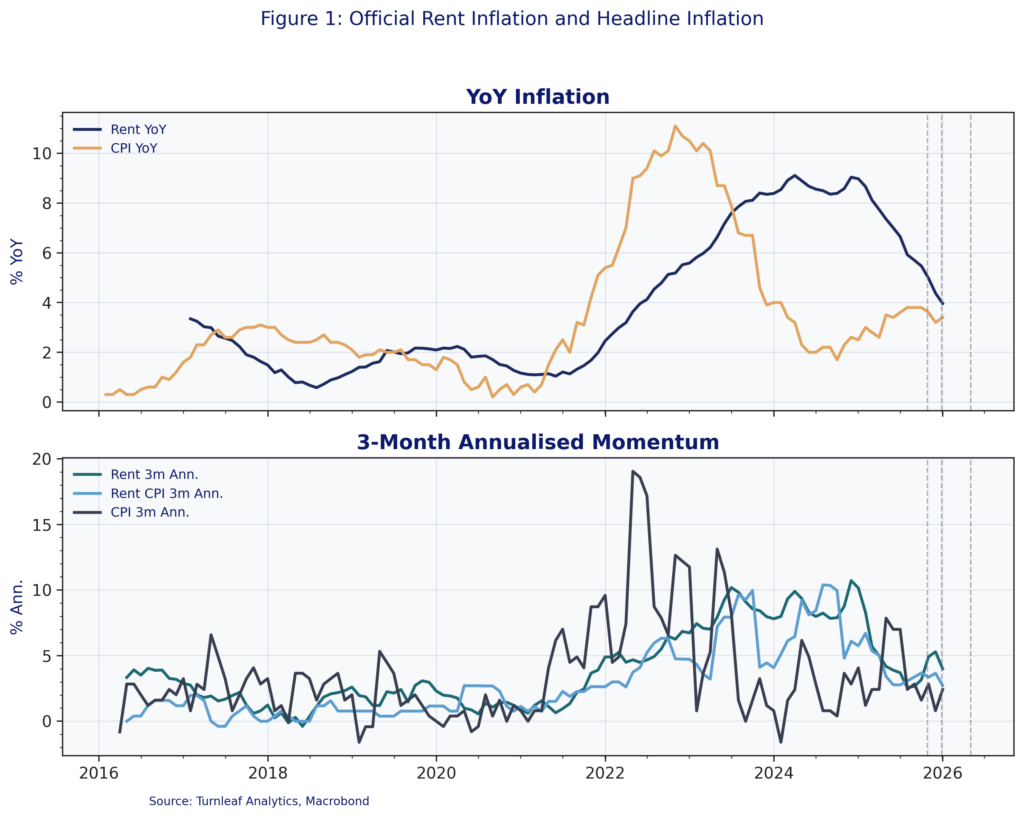

Figure 1 shows that rent inflation lagged the post-pandemic CPI surge and remained firm after headline inflation fell back. Rent inflation then rolled over from its 2024 peak, but it remains well above the levels seen in the late 2010s. The current read serves as a pre-implementation baseline and sets the starting point for the post-May monitoring window.

Rent inflation follows the same forces that drive the housing cycle, mainly borrowing costs, credit availability, and the amount of churn in the housing market. Our approach is to read the rent prints alongside those drivers and ask a simple question: does the rent path look like the housing cycle, or does it look like something rent-specific.

When rates and mortgage pricing are easing, secured lending is improving, turnover is recovering, and house prices are firming, a pickup in rent inflation is usually the normal follow-through from stronger demand and easier financing. In that setting, a stronger rent print is informative about the cycle, but it is not strong evidence of a policy impulse.

When rent inflation picks up while borrowing costs remain high, credit conditions are not improving at the margin (i.e., not accelerating), turnover stays weak, and the price data are flat, the rent move is harder to explain as a broad upswing. That is the configuration where a change in rent-setting or rental supply conditions becomes the leading explanation, and it is the one we watch most closely after May 2026.

When rent inflation cools even as rates ease and housing activity improves, the binding constraint is usually on the tenant side. The macro data equivalents are weakening credit conditions or signs that households are already stretched, which limits how far rents can be pushed even when the market environment is otherwise supportive.

To read the rest of the article, visit Turnleaf’s latest Substack post, here.

Research Archive

Macroeconomic Insights: US CPI – Natural Gas Price Dynamics and Inflation Pass-Through

The recent spike in natural gas futures reflects market expectations of future supply constraints. Unlike past volatility driven by weather alone, this increase stems from...

Macroeconomic Insights: Switzerland CPI – Inflation Not Hot Not Cold

Last month Turnleaf argued that Switzerland was escaping deflation but still stuck near 0% inflation over the next year, with any firming coming mainly from tax changes and...

Macroeconomic Insights: Australia Inflation Sparks Concern

Reaching 3.8% YoY in October 2025, headline CPI is currently above both the RBA's 2–3% target band and the market consensus forecast of 3.6% (ABS CPI October 2025). Turnleaf's...

Macroeconomic Insights: India CPI – Structural Pressures Emerge

In the past month Turnleaf's 12-month inflation forecast for India has edged lower as the pace of food and energy price increases slowed. This moderation reflects seasonal...

QuantMinds London 2025

"Are you on mute?" is perhaps the most succinct catchphrase which most comprehensively describes the post-covid landscape of work. Yet, despite the plethora of video conferencing...

Macroeconomic Insights: Gilt Selloff, Autumn 2026 Budget

The Autumn 2025 Budget, scheduled for 26 November, is expected to deliver substantial fiscal tightening. Independent forecasts estimate a tax-raising package in the region of...

Macroeconomic Insights: US CPI — Shutdown Distortions Shift the Focus to November

The 43-day U.S. government shutdown has materially degraded the quality of October’s inflation data. With BLS field operations suspended for the duration of the collection...

What would you have said?

I recently went back to Imperial College. Whilst, I've been back many times since I graduated, this was the first time that I was returning to stand in front of an audience to...

Macroeconomic Insights: Norway CPI – Hey It’s Okay, Mistakes Happen

The Norway Statistical Institute recently revised the latest CPI print from 3.3% to 3.1%, correcting an error in electricity-price calculations that overstated inflation. Despite...

Macroeconomic Insights: Abu Dhabi GDP Forecast

Turnleaf expects Abu Dhabi GDP growth to slow to 2-3%YoY in the next two quarters before hitting 7%YoY in 2026Q1 and then falling back to a bit over 3%YoY by June 2026 (Figure...

Macroeconomic Insights: Switzerland CPI – Escaping Deflation

Turnleaf expects Switzerland inflation to oscillate around 0% over the next 12 months with some indication of healthy price growth towards the tail-end of our forecast (Figure 1...

Macroeconomic Insights: Japan CPI – Nigiri Sushi Inflation

As of September 2025, Japan's inflation profile remains dominated by food price dynamics. The headline 2.9% YoY reading reflects a disproportionate rice contribution—despite...

U.S. Government Shutdown and the October 2025 CPI Print

The BLS released the September 2025 CPI print on October 24, nine days after its originally scheduled October 15 release date, following a partial recall of staff during the...

Quant Strats London 2025

Quant Strats has been a feature of the quant calendar for a number of years. I went to my first event recently after a couple of years. The event has evolved somewhat over time,...

Macroeconomic Insights: Brazil CPI — Food Costs, Currency Dynamics, and the Path to 4%

Brazilian inflation has proved particularly sticky, driven by persistent wage growth, global trade dynamics, and elevated food inflation from weather-related supply constraints....