There’s just something about being in Geneva that makes you want to reduce tariffs on all Chinese goods from 145% to 30%. Recently, the U.S. and China reached an agreement to cut tariffs on each other’s goods for the next 90 days. Trump followed up by confirming that...

On April 28, 2025, at approximately noon, I couldn’t send a message to a colleague. I thought there must have been a problem with my WIFI, until I realized that none of the lights were working either. Within an hour, thousands of confused employees walked out of their...

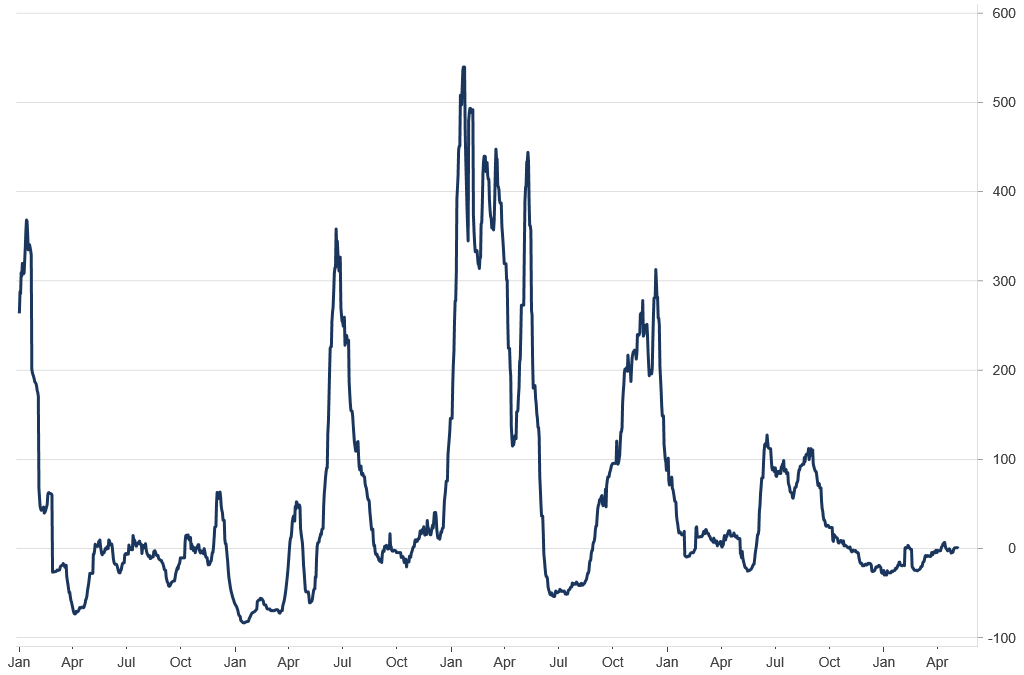

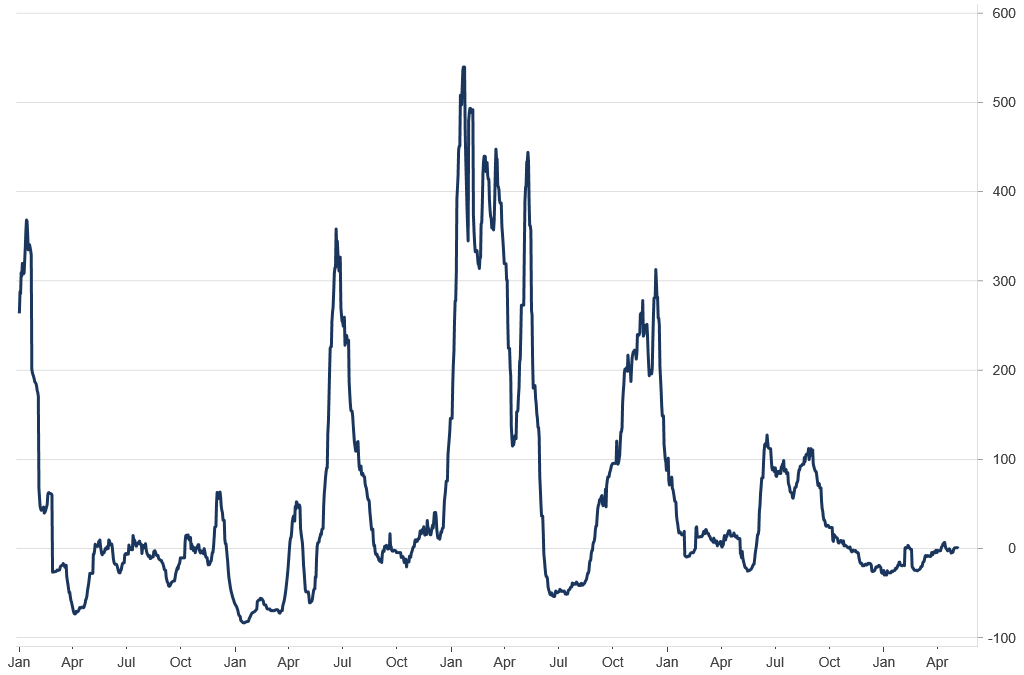

Based on recent weekly forecasts, Turnleaf is projecting deflation of -0.09%YoY in April 2025 as export growth is expected to contract and China begins to reorganize its economy to avoid the brunt of U.S. tariffs. Turnleaf’s China inflation 12-month inflation horizon...

On March 17, 2025, Prime Minister Viktor Orbán’s government introduced a profit-margin cap across thirty essential goods, beefing up oversight to prevent cross-pricing strategies (for example, offsetting a cut on fish by hiking detergent prices). Previous rounds of...

In our April 2025 inflation preview, we project headline CPI will undershoot consensus, underpinned by subdued Brent‐crude volatility, cheaper USD imports due to dollar weakness, and softer inflation expectations. However, April’s seasonal dynamics—especially firmer...

Just as Turnleaf has been applying alternative data to forecast inflation amid trade policy uncertainty, understanding Argentine inflation requires moving beyond conventional structural models. Inflation dynamics in Argentina are shaped less by traditional monetary...

Based on recent weekly forecasts, Turnleaf is projecting deflation of -0.09%YoY in April 2025 as export growth is expected to contract and China begins to reorganize its economy to avoid the brunt of U.S. tariffs. Turnleaf’s China inflation 12-month inflation horizon...

On March 17, 2025, Prime Minister Viktor Orbán’s government introduced a profit-margin cap across thirty essential goods, beefing up oversight to prevent cross-pricing strategies (for example, offsetting a cut on fish by hiking detergent prices). Previous rounds of...

In our April 2025 inflation preview, we project headline CPI will undershoot consensus, underpinned by subdued Brent‐crude volatility, cheaper USD imports due to dollar weakness, and softer inflation expectations. However, April’s seasonal dynamics—especially firmer...

Just as Turnleaf has been applying alternative data to forecast inflation amid trade policy uncertainty, understanding Argentine inflation requires moving beyond conventional structural models. Inflation dynamics in Argentina are shaped less by traditional monetary...