Trading inflation swaps with Turnleaf Analytics inflation forecasts

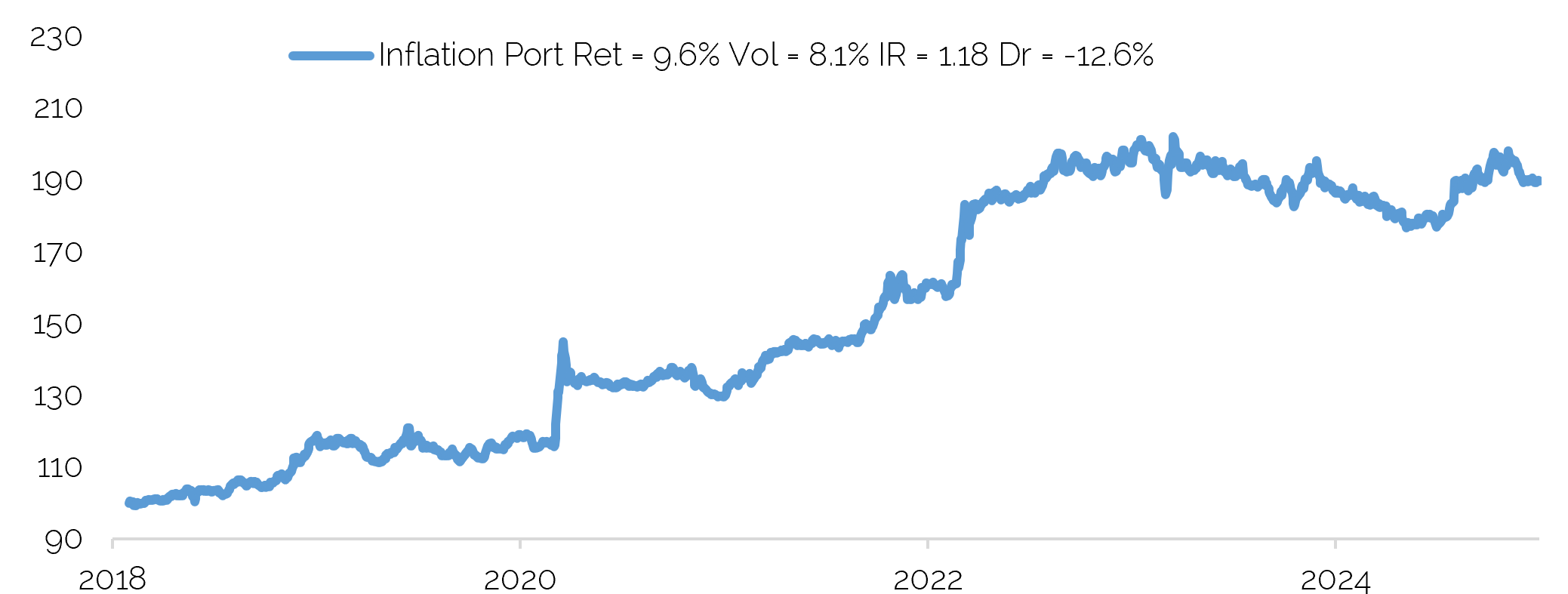

In this paper, we look at active trading strategies for longer dated US and Eurozone inflation swaps using a signal derived from Turnleaf Analytics inflation forecasts. We note that having foresight of inflation is beneficial when trading inflation swaps, as we might expect, which suggests that having accurate inflation forecasts are relevant for trading longer dated inflation swaps. We find that our approach of using Turnleaf Analytics inflation forecasts outperforms long only strategies.. Furthermore, during periods of more range bound price action our Turnleaf Analytics inflation forecast based signal also outperforms trend based strategies. Our final portfolio, which uses Turnleaf Analytics inflation forecasts to create trading signals, has risk adjusted returns of 1.18 and annualised returns of 9.6% in a historical sample since 2018.