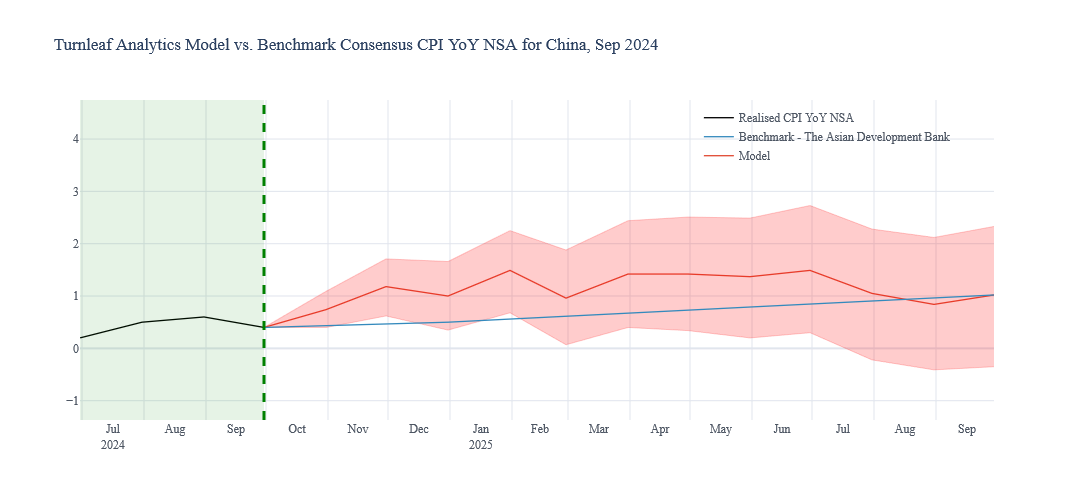

Turnleaf Analytics’ forecast for YoY NSA CPI published in October 2024 suggests an inflation trajectory expected to remain well below 2% over the coming 12 months. Specifically, our model projects a 0.74% YoY NSA CPI increase for October, underscoring persistent deflationary concerns and reflecting the impact of a slowing Chinese economy, increasingly burdened by waning consumer sentiment. In this forecast, we closely incorporate downside risks to inflation, stemming from ongoing corrections in the property market and a subdued consumer sentiment compounded by ongoing labor market challenges.

Aimed at incentivising demand and stabilising a weak property market, China announced a significant monetary policy package in late September. The package released $142 billion in new lending and included a 50-bps reduction in mortgage rates for existing loans, alongside a 15% reduction in minimum down payments. A new swap program was introduced alongside targeted liquidity operations to further ease liquidity. Additionally, the government announced a one-off financial transfer to low-income households ahead of National Day, though the exact amount remains undisclosed. On October 12, China announced a $282 billion fiscal stimulus package, financed through special sovereign debt issuance.The package targets consumption by providing subsidies for consumer durables, business equipment upgrades, and allowances for households with two or more children. A further ¥1 trillion has been pledged to address local government debt challenges, while incremental support for SMEs includes employment subsidies, tax and fee reductions, and additional capital injections into state-owned banks to bolster lending capacity. Policy specifics are expected following the upcoming National People’s Congress Standing Committee sessions in late October or early November 2024.

Despite the government’s stimulus efforts, we find that overall price pressures remain subdued, reflecting a lack of consumer confidence. Roughly 70% of household wealth is tied to real estate, which has seen a 3.36% decline in residential and non-residential prices over the past year. Weaker demand, driven in part by a 13.11% rise in YoY Youth Unemployment, has spilled over into other key sectors that traditionally fuel China’s growth. Slowing exports in major industries like energy and vehicles further signal a broader slowdown in manufacturing activity. Deflationary pressures are intensifying as global trade headwinds persist. Liquefied Petroleum Gas exports dropped close to 30% in the past month, as narrowing refinery margins point to weaker industrial demand. Steel and sheet metal inventories have fallen by 15.7% and 29.4% MoM, respectively, as manufacturers brace for lower future orders. Vehicle Exports also declined 27.3% MoM, following the European Union’s recent decision to impose tariffs on Chinese electric vehicles, adding another strain on the sector. Our models also identify some upward inflationary pressures, primarily due to seasonal factors tied to upcoming holidays, such as National Day (October 1) and Singles’ Day (November 11).

Together, these coordinated fiscal and monetary interventions aim to boost aggregate demand and mitigate deflationary risks, without imposing structural adjustments that could destabilize the manufacturing sector. Historically, China has favored investment-led growth, underpinned by preferential tax treatment (20% on capital gains vs. 45% personal income tax). The current stimulus measures are designed to sustain growth momentum and support the government’s 5% GDP growth target for year-end. While Beijing’s stimulus efforts aim to counter these challenges, the combination of a weak property market, declining exports, and low consumer sentiment continues to weigh on China’s economic outlook.