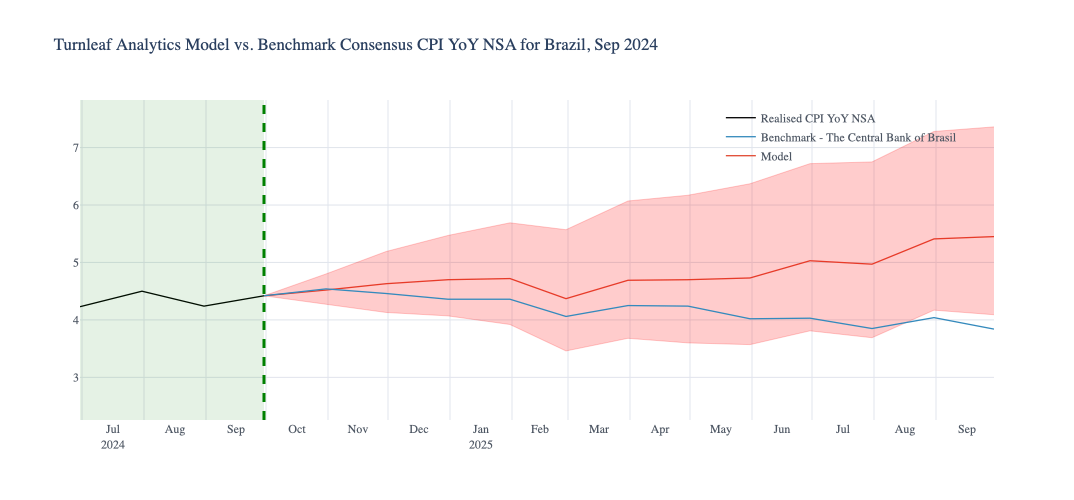

Turnleaf’s Brazil’ inflation outlook for the next 12 months has undergone an upward revision, driven by several significant factors. While shipping costs have eased, inflationary pressures are resurfacing due to both structural and recent developments in the economy. Brazil’s mid-month IPCA year-over-year inflation for October, often highly correlated with the final monthly figure, stood at 4.47% up from 4.12% in the previous month. This suggests escalating short-term inflationary pressures, which are also shaping expectations for the 12-month inflation trajectory. Turnleaf placed Brazil’s October forecast at 4.52% as of the 15th October 2024, slightly below the Central Bank of Brasil with a slight upward trend in the next 12 months.

With the the official October inflation data due November 8, 2024, here are some key factors that Turnleaf is incorporating into its inflation models this month:

- Tobacco Tax Increase

In August 2024, the Brazilian government announced a 50% tax increase on cigarette packs, raising the flat tax on 20-unit packs from R$1.50 to R$2.25, effective November 1, 2024. This policy is expected to place additional upward pressure on the inflation curve. - Labor Market and Household Consumption

Brazil’s labor market remains robust, with an August 2024 report from the Bank of Brazil showing a 2.94% decline in the rolling average unemployment rate. The job resignation rate remains high at 32%, indicating strong labor demand and wage competition. Government spending on social security benefits, family allowances, and other mandatory social programs has risen by 3.4%, 14.5%, and 17.7% over the past year, respectively, according to the Brazilian National Treasury. The resulting increase in disposable income has kept family consumption elevated, further fueling inflation. - Wage Pressures

Recent collective labor negotiations have led to wage adjustments that exceed inflation, contributing to sustained wage growth across sectors. These rising wage pressures are adding to overall inflationary momentum as higher labor costs are increasingly passed onto consumers. - Housing and Fuel Prices

Housing prices have been steadily climbing, adding pressure to core inflation metrics. Gasoline prices have increased consistently over the past three months, compounding inflationary pressures from the energy sector. - Electricity Price Surges

Due to severe weather events that caused power outages, electricity costs surged month-over-month by 119.5% in the North and 120.22% in the Southeast regions. These dramatic price hikes are likely to have a significant impact on overall inflation in the near term, particularly as utility costs feed into household expenses. - Currency Depreciation

The Brazilian real (BRL) depreciated by 3.5% over the past month, which has increased the cost of imported goods. The weakened currency could further drive inflationary pressures as imported goods become more expensive. - Agricultural Prices

Agricultural prices have also risen, with the Producer Price Index (PPI) for Agricultural Products increasing by 3.55% and the Agricultural Commodities Index up by 2.9%. Notably, sugar cane and soy production—key export products for Brazil—saw month-over-month declines of 2.09% and 0.53%, respectively, reducing supply and potentially increasing prices domestically.