Trading US Treasury Futures using daily US nowcast

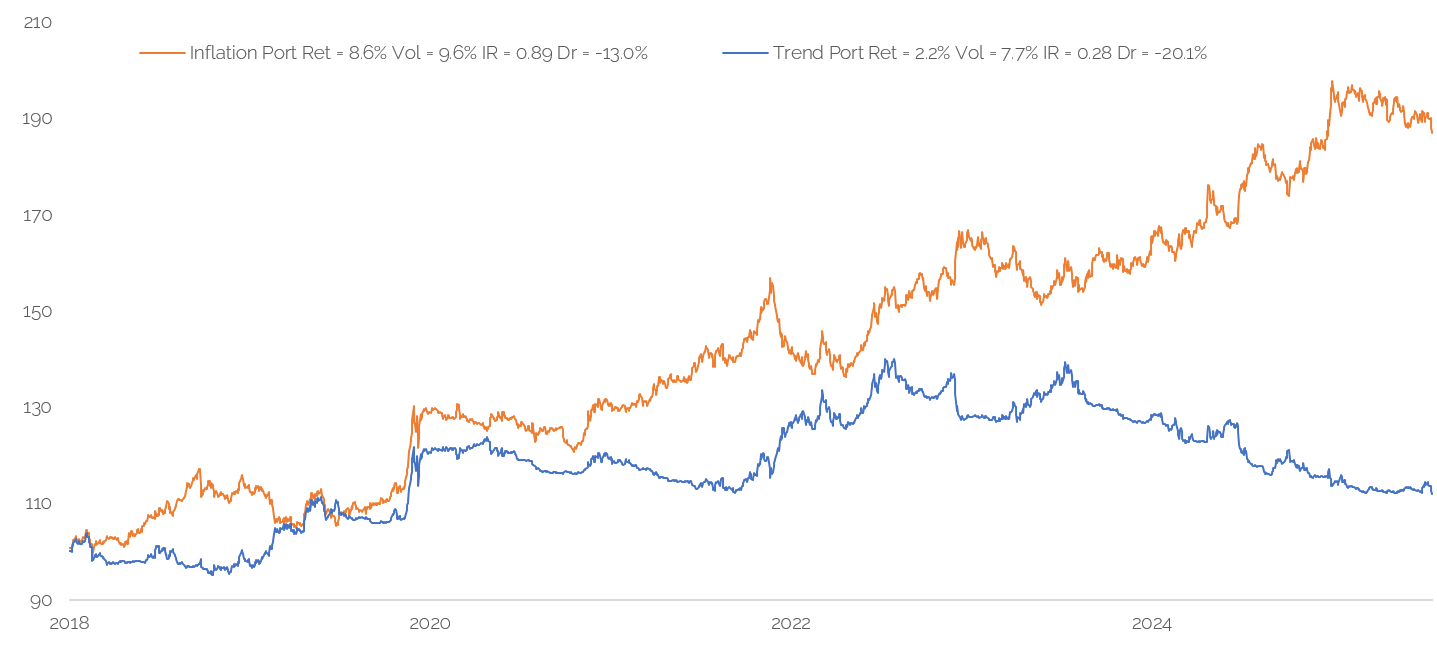

In this paper, we look at how we can trade US Treasury futures using Turnleaf Analytics daily forecast for US CPI YoY NSA. Our systematic trading basket for US Treasury futures using Turnleaf Analytics daily US CPI YoY NSA forecast has risk adjusted returns of 0.89 in a historical sample since 2018, outperforming trend which has risk adjusted returns of 0.28 during the same period. Furthermore, the correlation between the inflation trading rule and trend is fairly low (around 20% in our sample). This suggest that the inflation trading rule can offer diversification for investors already exposed to trend following strategies on US Treasury futures.