Featured Research

Macroeconomic Insights: Colombia CPI – Minimum Wage Shock Meets Fiscal Emergency

Turnleaf expects Colombia CPI to accelerate towards 6% YoY starting January 2026 following a 23.7% minimum wage increase that took effect on January 1—a significant upward revision from our Jan 2, 2025 forecast. Our initial projection applied conservative assumptions...

Macroeconomic Insights: Colombia CPI – Minimum Wage Shock Meets Fiscal Emergency

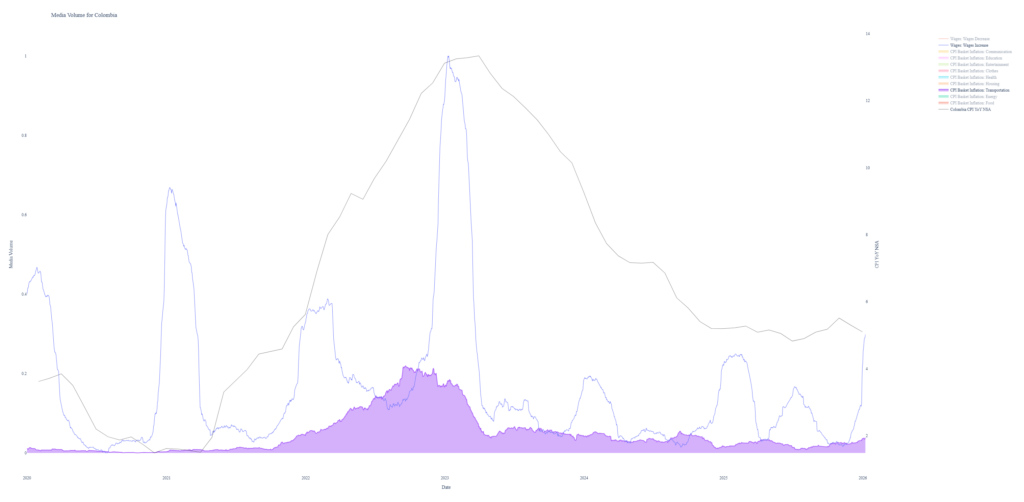

Turnleaf expects Colombia CPI to accelerate towards 6% YoY starting January 2026 following a 23.7% minimum wage increase that took effect on January 1—a significant upward revision from our Jan 2, 2025 forecast. Our initial projection applied conservative assumptions given limited historical precedent for pass-through from a wage shock of this magnitude. However, recent high-frequency data from Turnleaf’s proprietary inflation volume index for transportation, which tracks media mentions of transportation price changes, now shows sharp upward momentum consistent with the anticipated spike in services inflation as annual service prices indexed to the minimum wage reset at the start of the year.

Simultaneously, emergency tax measures announced via presidential decree on December 29, 2025 will reinforce upward price momentum, as the government prioritizes fiscal consolidation. This also adds to sharp upward price momentum, The emergency measures include VAT increases on alcoholic beverages from 5% to 19% and new excise taxes on tobacco products and tobacco derivatives like vapes. Notably, the controversial fuel tax increases proposed in the original tax reform were excluded from the final emergency decree, providing some relief to consumers.

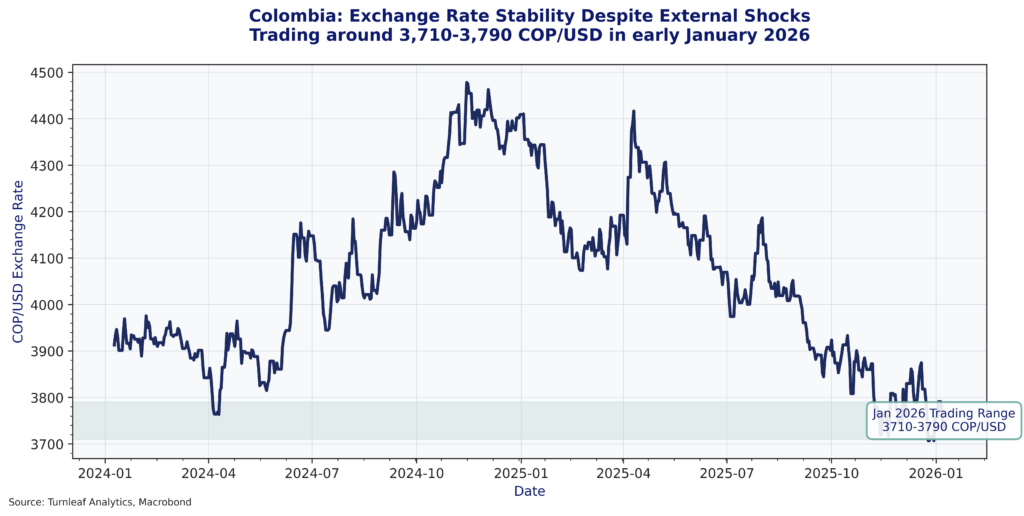

Geopolitical developments in neighboring Venezuela have introduced fresh uncertainty into Colombia’s inflation outlook. Following US military strikes on Venezuela on January 3, 2026 and the capture of President Nicolás Maduro, tensions between the US and Colombia have escalated. Despite this volatility, the Colombian peso has remained relatively stable, trading around 3,710-3,790 COP/USD in early January 2026 (Figure 1).

Figure 1

The magnitude of the minimum wage increase will drive significant services inflation as annual service prices indexed to the minimum wage reset at the start of the year. Turnleaf’s proprietary inflation volume index for transportation, which tracks media mentions of transportation price changes, has shown upward momentum consistent with this transmission channel (Figure 2). The wage-indexed nature of many service contracts suggests immediate pass-through to consumer prices in January.

Figure 2

Inflation expectations will likely rise in the short term as households perceive broad-based service price increases, potentially keeping Colombia’s inflation trajectory elevated relative to 2025. The government has discussed potential price controls to mitigate the impact of the minimum wage hike, though such measures introduce additional uncertainty. Food prices remain vulnerable to weather shocks but have been relatively stable, with December 2025 food inflation declining to 5.07% YoY from 5.74% in November.

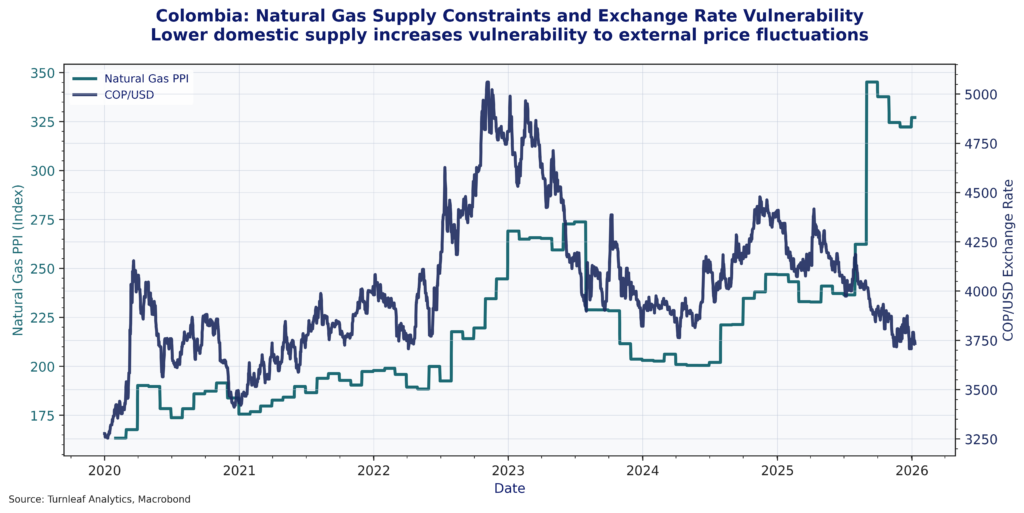

A lingering upside risk stems from Colombia’s natural gas market. Volatile extraction prices signal unstable domestic production capacity, as seen during 2022-2023 when sharp cost increases coincided with peso weakness. Should extraction price pressures re-emerge in 2026, limited domestic supply would force greater import dependency, amplifying inflation risks through both direct energy costs and potential currency depreciation (Figure 3).

Figure 3

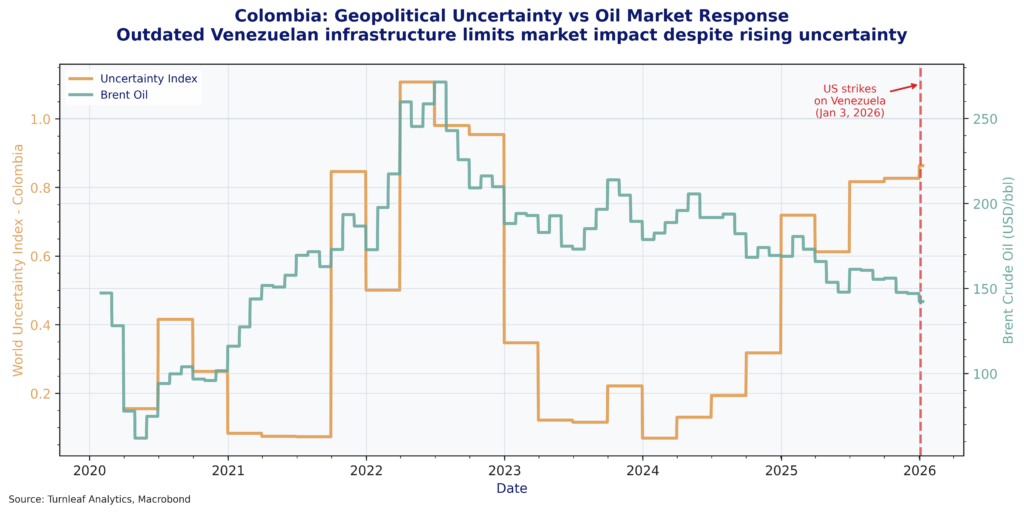

While the World Uncertainty Index for Colombia has begun rising due to US intervention in Venezuela, oil market reactions have been muted (Figure 4). Outdated Venezuelan infrastructure and political instability have limited market expectations for immediate oil supply increases. The current combination of lower oil prices, constrained natural gas supply, and stable exchange rate dynamics suggests moderate inflation pressure from commodity markets, though any external shock could trigger elevated inflation paths.

Figure 4

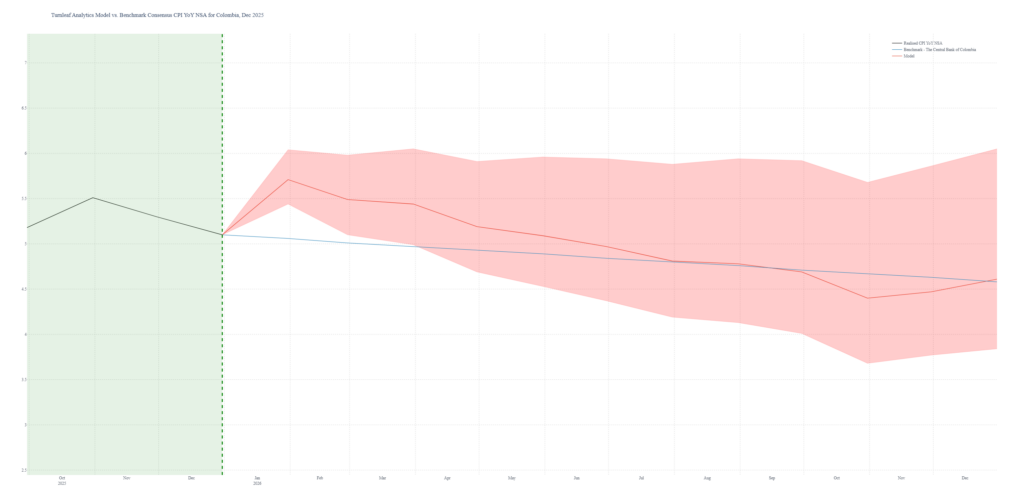

Based on current macroeconomic conditions, Turnleaf expects Colombia inflation to accelerate towards 6% YoY in January 2026 and gradually decline towards 5% by year-end as base effects normalize and the minimum wage shock dissipates through the system (Figure 5 – PAID).

Figure 5

To access Turnleaf’s 12-month inflation forecast for Colombia, visit our latest Substack post here.

Research Archive

Turnleaf’s October 2024 Economic Forecast: Deflationary Pressures Persist in China

Turnleaf Analytics’ forecast for YoY NSA CPI published in October 2024 suggests an inflation trajectory expected to remain well below 2% over the coming 12 months. Specifically,...

FILS Europe 2024 Takeaways

Paris is home to many things, the Eiffel Tower, the Arc de Triomphe, burgers (ok, I made that one up!). In recent years, Paris' financial community has grown, and indeed, every...

Don’t look back in hanger steak

I'm currently in the queue for Oasis tickets. Rather than mindlessly watching the counter of people in the queue ahead of me fall (currently 184,984 people), I thought I'd start...

The Olympic spirit for forecasting

The Olympics finally finished, and the Paralympics are about to begin. I managed to go to some of the Olympic football matches in both Lyon (in the photo above) and Nice. The...

Eleven years of independence

Regrets become ever more edged with the passing of time. Recalling a time long gone, when perhaps a decision made, was not the decision you should have made, wastes little more...

The human part of machine learning forecasts

I've seen a few videos showing a robot making a burger (here's one of RoboBurger for example). It seems pretty impressive that a machine can create a fresh burger. However, one...

Takeaways from Eagle Alpha London 2024

Over the years the number of datasets which have come to the market have increased significantly. How do data buyers in the buy and sell side find such data? One way has been to...

Takeaways from Berkshire Hathaway 2024

It's springtime in Omaha. It can mean only one thing, the Berkshire Hathaway shareholder meeting is back in town. It is a relatively unusual event in the financial calendar....

Using experience in financial research

I end up buying a lot of books. Inevitably, I end up reading far fewer books than I end up buying. The unread books peer at me from my bookcase, knowing they'll likely never be...

Forecasts and decisions

A lot of measurements go into the perfect burger. First, there's the patty. What is the weight of the patty? How much fat is in the patty? Then there's the other parts. How much...

We still need to learn to code

If I go to burger joint somewhere outside the UK, I’ll usually look at the price and mentally convert it into GBP. I guess I could use a calculator, but it seems slightly...

Takeaways from TradeTech FX USA 2024

In recent years, more financial firms have begun to open up offices in Miami, in particular a number of prominent hedge funds. It has also been the home of TradeTech FX USA for a...

Different ways to assess forecasts

Let's say you want to know what a burger will taste like. You look at the ingredients, and to some extent you'll be able to "forecast" what it'll taste like. Part of the...

How can we improve inflation forecasts

Just imagine you ordered a cheeseburger. Then low and behold, a salad is brought to your table. The probability of such a thing happening is not zero, especially in a busy...

Hundreds of quant papers from #QuantLinkADay in 2023

I tweet a lot (from @saeedamenfx)! In amongst, the tweets about burgers, I tweet out a quant paper or link every day under the hashtag of #QuantLinkDay, mostly around FX, rates,...