Featured Research

Macroeconomic Insights: Expect the Unexpected

Mark Carney at Davos, January 20, 2026 "For decades, countries like Canada prospered under what we called the rules-based international order. We joined its institutions, we praised its principles, we benefited from its predictability... this bargain no longer works."...

Macroeconomic Insights: Expect the Unexpected

Mark Carney at Davos, January 20, 2026

“For decades, countries like Canada prospered under what we called the rules-based international order. We joined its institutions, we praised its principles, we benefited from its predictability… this bargain no longer works.”

The latest tariff threats from the U.S., backed by escalating rhetoric around Greenland, are shaking up 2026 just as Liberation Day disrupted 2025. Just last week, President Trump announced 10% tariffs on eight European NATO allies, escalating to 25% by June 1 unless an agreement is reached for the purchase of Greenland. A few days later, the U.S. president rolled back the tariffs after leaving the Davos conference with a framework for a U.S. presence in Denmark that – mostly – already existed.

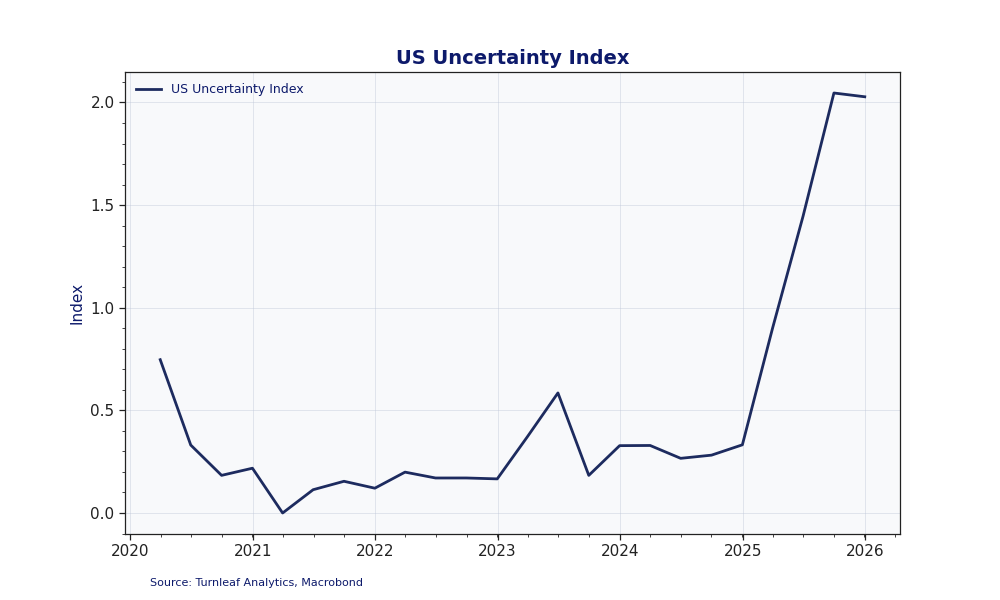

Yet Trump’s unpredictability isn’t the only wild card shaping global inflation. Over the past year, gold has surged to record highs (Figure 1) as rising sovereign debt and fiscal uncertainty have pushed reserve managers to diversify away from traditional reserve currencies.

Figure 1

Tracking Volatility Through Alternative Data

Over the past year, Turnleaf has accounted for volatility in tariffs and geopolitical risk by tracking alternative data that includes measures of global macroeconomic volatility, commodity indices, and expectations data. The patterns we’ve observed reveal several key transmission mechanisms that will define 2026.

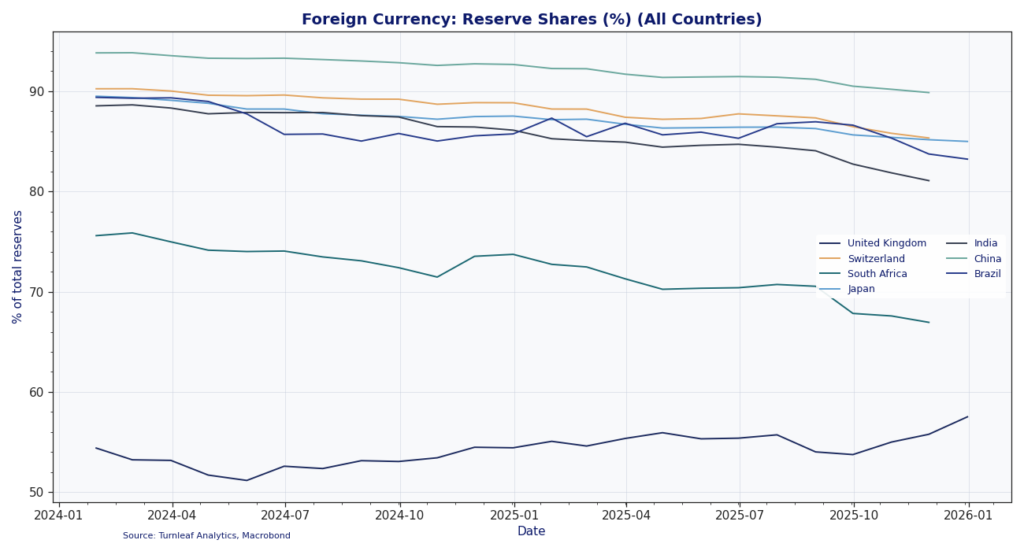

1) Uncertainty indices have spiked in tandem with policy announcements, creating measurable effects on import prices, inventory decisions, and forward-looking inflation expectations (Figure 2).

Figure 2

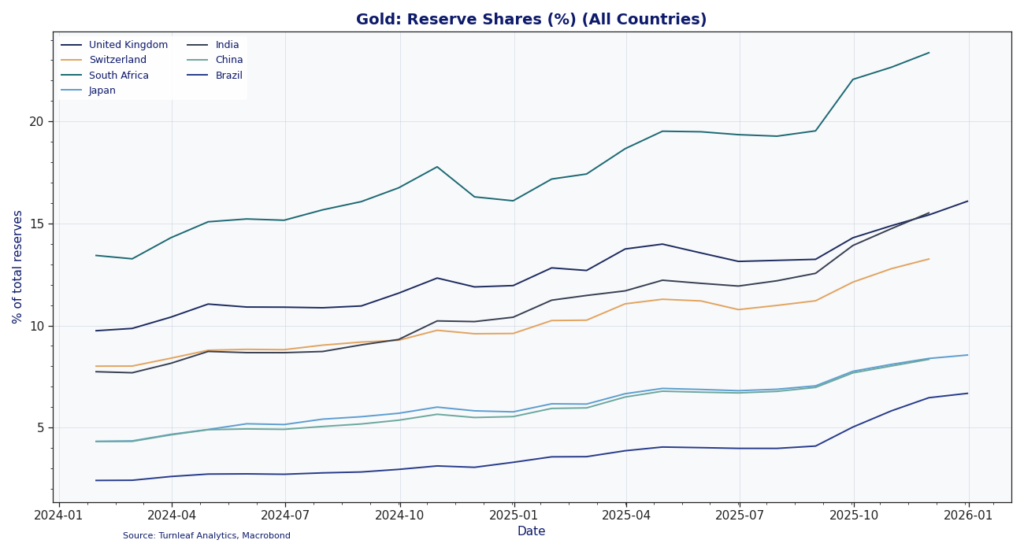

2) The relationship between reserve composition and currency volatility has tightened, particularly in economies where gold now represents a growing share of total reserves relative to foreign currency holdings.

Central banks across emerging markets and select advanced economies have accelerated gold accumulation, shifting the composition of international reserves in ways that signal declining confidence in dollar-denominated assets and heightened concern over financial stability (Figure 3a & 3b).

Figure 3a

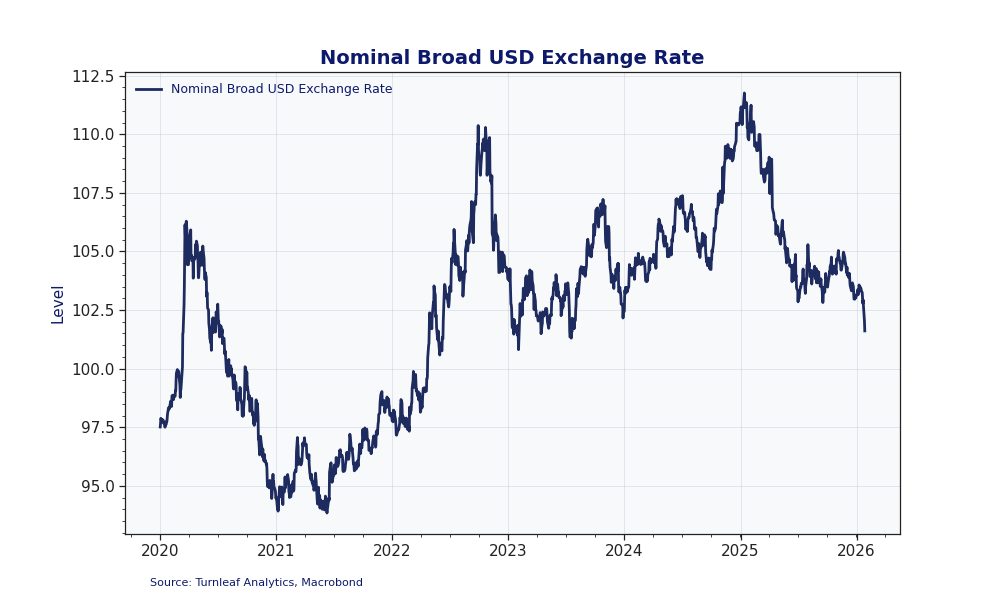

Figure 3b

What This Means for Inflation Forecasts

Reserve composition shifts are changing how currencies respond to shocks. Countries with higher shares of gold in reserves relative to foreign currency will likely demonstrate lower sensitivity to dollar volatility but face greater exposure to gold price fluctuations in the event of reversal. Exchange rate pass-through is evolving as hedging behavior changes in response to reserve diversification, while the dollar continues to fall in value (Figure 4).

Figure 4

Continued elevated levels of uncertainty will lead to increased likelihood of upside inflation surprises for economies with high import content in consumption baskets (i.e. Japan, South Korea). We’re incorporating this into our baseline scenarios by adjusting pass-through assumptions and allowing for greater persistence in cost shocks.

Looking Ahead

Ultimately, 2026 will be dominated by the unexpected. Volatility will push costs upward as firms attempt to navigate uncertainty in imported input costs and softer demand. The abandonment of predictable trade policy frameworks means firms are building in risk premia to pricing decisions. They are effectively embedding a volatility tax into goods prices. This shows up in our alternative data as elevated import price volatility and longer supplier delivery times, both leading indicators of inflation persistence. At the same time, governments are beginning to rethink defense spending in the wake of what Canadian Prime Minister Mark Carney described at Davos as the end of a “rules-based international order.” European nations have announced significant increases in defense budgets, with Canada doubling its defense spending and Europe moving toward strategic autonomy. All of this will contribute to elevated baseline inflation as structural shifts in trade relationships, supply chains, and security arrangements create persistent cost pressures that monetary policy alone cannot address.

Research Archive

Macroeconomic Insights: U.S. Inflation Outlook Under Another Trump Presidency

As U.S. economic conditions continue to evolve, Turnleaf will actively monitor inflation trends and publish regular updates to keep you informed. Our focus remains on leading...

Macroeconomic Insights: Turkey’s Two-Front Fight with Inflation and the Lira

Turkey’s central bank has adopted a stringent monetary policy to combat inflation, a stark departure from previous unorthodox strategies. With borrowing costs now at a benchmark...

Inflation Outlook for Canada in October 2024- Producer Optimism, Consumer Pains

Canada’s inflation outlook is shaped by a complex mix of declining energy costs, rising food prices, and evolving trade dynamics. At Turnleaf Analytics, we’re closely tracking...

How Bad is Too Bad? Japan’s Reckoning with Inflation and New Leadership

Japan’s battle with inflation has become a key issue, reshaping public sentiment and influencing recent election results. With the Liberal Democratic Party (LDP)–Komeito...

Turnleaf’s Inflation Outlook for Brazil: Rising Costs Amid Currency Pressures

Turnleaf’s Brazil’ inflation outlook for the next 12 months has undergone an upward revision, driven by several significant factors. While shipping costs have eased, inflationary...

Turnleaf’s October 2024 Economic Forecast: Deflationary Pressures Persist in China

Turnleaf Analytics’ forecast for YoY NSA CPI published in October 2024 suggests an inflation trajectory expected to remain well below 2% over the coming 12 months. Specifically,...

FILS Europe 2024 Takeaways

Paris is home to many things, the Eiffel Tower, the Arc de Triomphe, burgers (ok, I made that one up!). In recent years, Paris' financial community has grown, and indeed, every...

Don’t look back in hanger steak

I'm currently in the queue for Oasis tickets. Rather than mindlessly watching the counter of people in the queue ahead of me fall (currently 184,984 people), I thought I'd start...

The Olympic spirit for forecasting

The Olympics finally finished, and the Paralympics are about to begin. I managed to go to some of the Olympic football matches in both Lyon (in the photo above) and Nice. The...

Eleven years of independence

Regrets become ever more edged with the passing of time. Recalling a time long gone, when perhaps a decision made, was not the decision you should have made, wastes little more...

The human part of machine learning forecasts

I've seen a few videos showing a robot making a burger (here's one of RoboBurger for example). It seems pretty impressive that a machine can create a fresh burger. However, one...

Takeaways from Eagle Alpha London 2024

Over the years the number of datasets which have come to the market have increased significantly. How do data buyers in the buy and sell side find such data? One way has been to...

Takeaways from Berkshire Hathaway 2024

It's springtime in Omaha. It can mean only one thing, the Berkshire Hathaway shareholder meeting is back in town. It is a relatively unusual event in the financial calendar....

Using experience in financial research

I end up buying a lot of books. Inevitably, I end up reading far fewer books than I end up buying. The unread books peer at me from my bookcase, knowing they'll likely never be...

Forecasts and decisions

A lot of measurements go into the perfect burger. First, there's the patty. What is the weight of the patty? How much fat is in the patty? Then there's the other parts. How much...