Featured Research

Macroeconomic Insights: Turkey CPI – Inflation Pinned in Gold

Gold jewelry remains a common wedding gift in Turkey, reflecting a cultural practice where households preserve wealth through physical gold rather than financial assets. This preference, formed through decades of high inflation and currency instability, has...

Macroeconomic Insights: Turkey CPI – Inflation Pinned in Gold

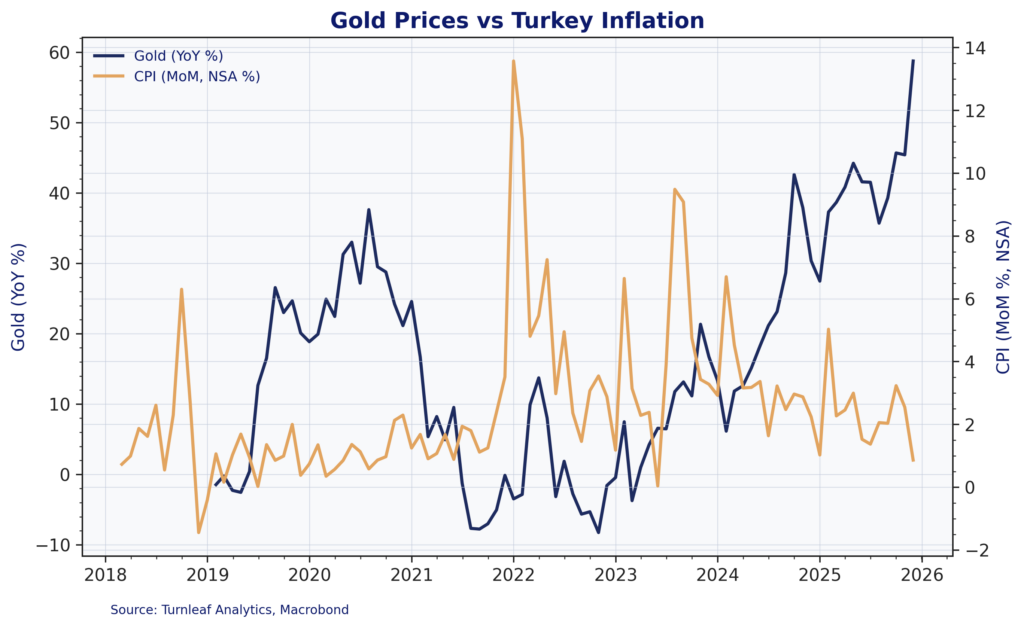

Gold jewelry remains a common wedding gift in Turkey, reflecting a cultural practice where households preserve wealth through physical gold rather than financial assets. This preference, formed through decades of high inflation and currency instability, has accumulated into a substantial economic force. Turkish households now hold approximately $500 billion in physical gold outside the banking system, according to central bank estimates as of October 2025. This represents more than a $100 billion wealth effect gain over the past year as gold prices surged.

Turnleaf tracks this phenomenon closely because household gold holdings directly affect how monetary policy influences consumer behavior. When gold prices rise, households become wealthier and can sustain consumption even when the central bank keeps interest rates high to cool demand. Turnleaf’s inflation models incorporate gold price movements as a key driver of household wealth effects, which helps explain why Turkey requires longer periods of restrictive policy to achieve disinflation.

Despite this structural constraint, Turkey’s disinflation accelerated through 2025. Annual inflation fell to 30.89% in December from 44% in May 2024. Turnleaf expects inflation to reach the mid-20s by year-end 2026, overshooting the central bank’s 16% interim target (Figure 1 – visit Turnleaf’s Substack to view the latest forecast). The gap between Turnleaf’s forecast and the official target reflects persistent services inflation and the gold wealth channel limiting how quickly demand cools.

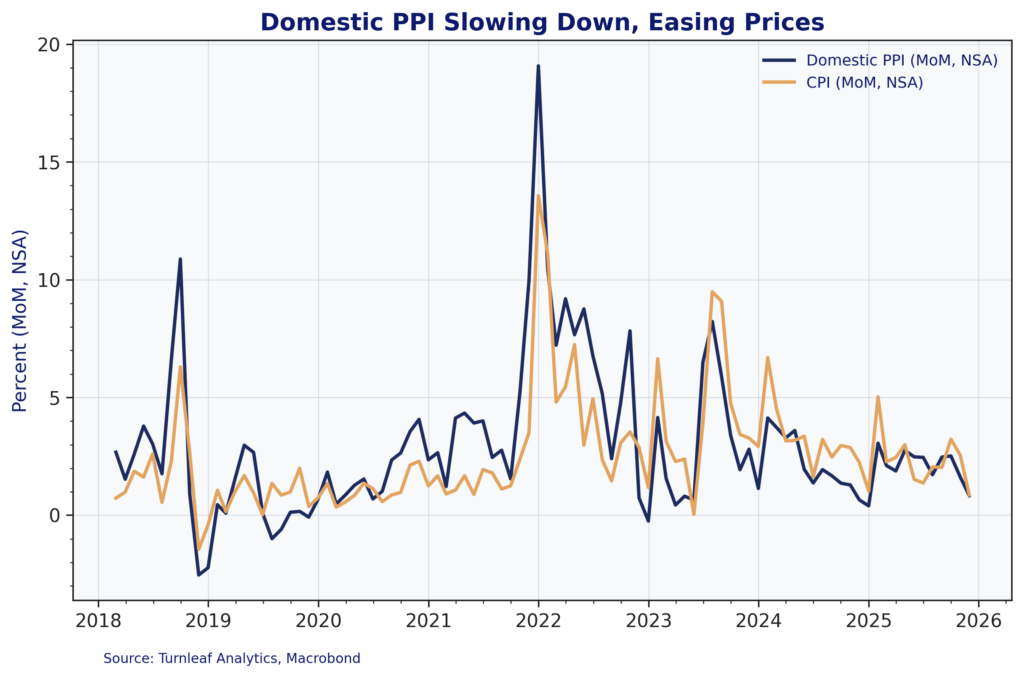

Policy rate increases have transmitted more effectively to goods prices than services prices. Domestic producer prices decelerated as weaker demand forced firms to choose between maintaining prices and losing volume, which drives most of the headline improvement (Figure 2). This channel works as expected with manufacturing firms facing hard demand constraints and adjusting prices accordingly.

Figure 2

However, producer prices respond quickly to currency depreciation and energy costs, creating vulnerability to external shocks. Lower US and Eurozone inflation has reduced imported cost pressure, providing temporary relief. Turnleaf monitors external inflation developments closely because Turkey’s import dependence means foreign price pressures can quickly reverse domestic disinflation progress.

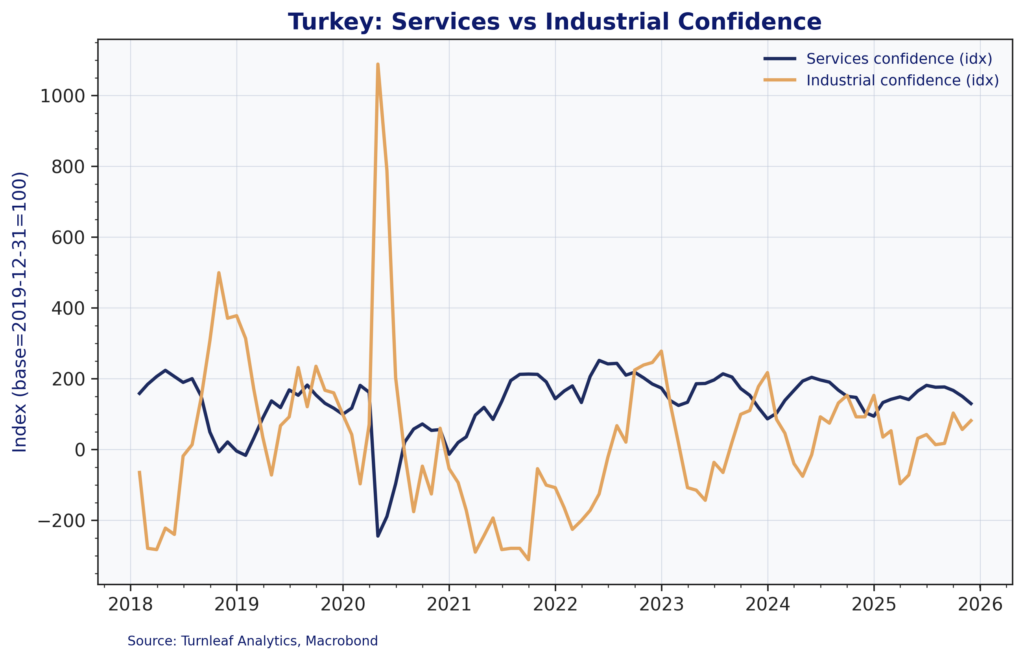

Services Inflation Persistent

The divergence between goods and services inflation follows the pattern Turnleaf’s models predict. Services sectors are labour-intensive and set wages based on past inflation rather than forward-looking targets, creating inertia in their price adjustments. While industrial confidence has fallen alongside goods price pressures, services confidence remains elevated (Figure 3). Construction, hospitality, and similar sectors retain pricing power tied to historical wage settlements.

This backward-looking wage formation slows services disinflation substantially. The 27% minimum wage increase for 2026, though consistent with projected inflation, locks in high nominal labour costs for the year ahead. Turnleaf’s model has flagged upward pressure from labour-intensive industries, particularly construction, where pricing typically lags the broader disinflation trend by six to nine months. Services prices will therefore decline more gradually than goods prices even as overall demand conditions weaken.

Figure 3

Gold Prices and Household Demand

The scale of household gold holdings fundamentally shapes monetary policy transmission in Turkey. Turnleaf’s consumption models incorporate gold price changes as a direct input to household wealth, which has proven essential for accurate inflation forecasting. Higher gold prices increase household net worth and provide liquidity when credit tightens (Figure 4). Households can maintain consumption by drawing on gold wealth rather than cutting spending when borrowing costs rise.

Figure 4

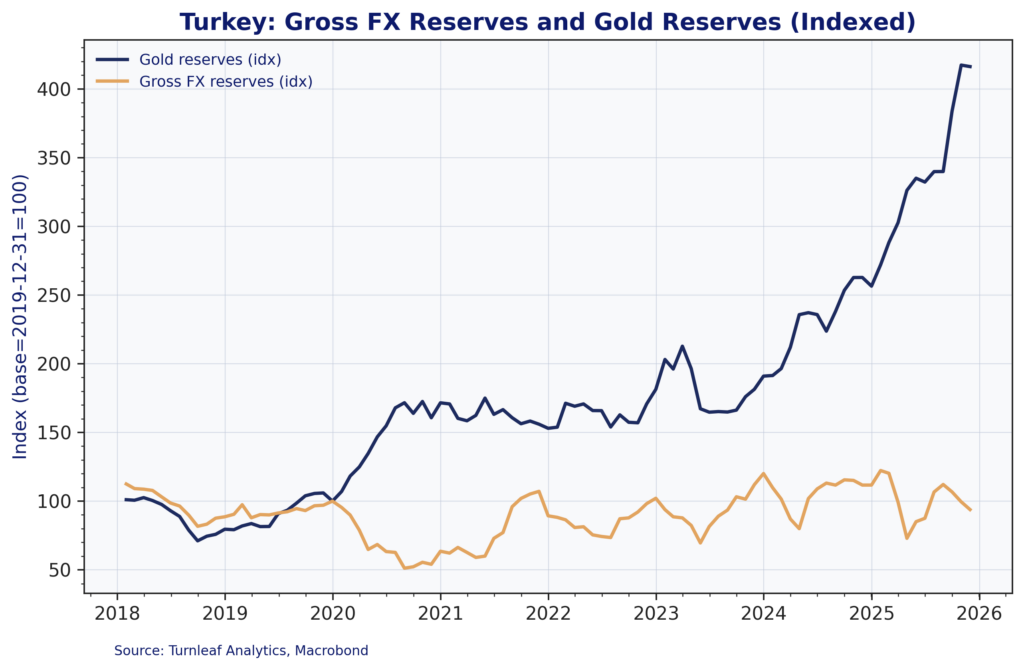

Reserves, Liquidity, and Financial Conditions

The central bank’s reserve position improved substantially through 2025. Rising gold prices alone added $30 billion to this total, lifting reserve buffers without requiring equivalent foreign exchange accumulation (Figure 5).

Figure 5

While stronger reserves support exchange-rate stability, the composition creates a dual dynamic that Turnleaf monitors closely. The same gold appreciation that improves the central bank’s balance sheet also strengthens household balance sheets, sustaining domestic demand. Financial conditions tightened without corresponding demand contraction. Consumer credit continued growing in some segments despite restrictive monetary policy, reflecting households’ ability to maintain consumption through gold-backed liquidity.

The successful unwinding of the KKM deposit protection scheme without triggering dollarization demonstrates improved policy credibility. High nominal interest rates on lira deposits reinforced this stability by sustaining lira savings. This allowed policymakers to cut the policy rate by 950 basis points since June to 38% without destabilizing the currency. But this flexibility depends on continued control of cost pressures and inflation expectations, neither of which is guaranteed given structural rigidities in services pricing and wealth effects sustaining demand.

Turnleaf’s Assessment

Turkey’s disinflation has progressed further than most observers anticipated, driven by sustained tight policy, favourable external conditions, and stronger reserves. Turnleaf’s forecast for mid-20s inflation by end-2026 reflects both this progress and the remaining structural constraints. Services inflation will decline more slowly than goods inflation due to backward-looking wage indexation. The gold wealth channel will continue buffering household consumption against monetary tightening, particularly if gold prices remain elevated or rise further.

Administrative price adjustments in utilities and regulated items add volatility to monthly readings but do not fundamentally alter the disinflation path. The larger risks come from deviations from fiscal discipline, renewed external market stress, unanchored inflation expectations, or currency volatility — any of which could interrupt progress toward the central bank’s medium-term price stability goal.

Research Archive

Emerging Markets: Turnleaf Discusses Impact on Hungary’s 10% Profit Margin Cap Restriction on Inflation

Policy: In Hungary, from March 17 to May 31, 2025, a 10% profit margin cap will be imposed on 30 essential products, limiting companies' profits on these items. Small independent...

Macroeconomic Insights: U.S. Inflation is Coming, But Not Where You Expect

Since taking office, President Trump has aggressively worked to revitalize domestic manufacturing by focusing on the U.S. trade balance. A key part of this strategy has been...

Learning from running financial models live

Let's say you are the world's best burger chef (we all have ambitions, right). You'd be serving up all manner of burgers for your customers. It would be odd though, wouldn't it,...

Macroeconomics Insights – Beyond Tariffs: How Uncertainty is Steering U.S. Inflation Expectations

When we forecast inflation, our goal is to account for as much explainable variation as possible, using available data and reasonable assumptions about how prices evolve....

Macroeconomic Insights: Tariffs, Manufacturing, and Mexico Inflation

This article marks the start of Turnleaf’s series on how U.S. tariffs shape inflation dynamics across Latin America (LATAM). Among the economies we monitor—Colombia, Brazil,...

Macroeconomic Insights: How U.S. Tariffs and Eurozone Weakness Are Shaping Chinese Inflation

The trajectory of Chinese inflation will largely depend on its sensitivity to U.S. tariffs and its ability to sustain domestic GDP growth through external demand, particularly...

Macroeconomic Insights: Prices to Increase in February 2025 as Canada’s Tax Holiday Takes a Holiday

Between mid-December 2024 and mid-February 2025, the Canadian government implemented a GST/HST tax holiday, exempting beverages, restaurants, children’s clothing and footwear,...

Macroeconomic Insights: Fueling the Inflation Fire – Turnleaf’s Turkish Inflation Curve Shifts Upwards

Turnleaf’s latest data has pushed Turkey’s inflation outlook higher than consensus forecasts. There are multiple reasons for this which we will explain in this note. One of the...

Macroeconomic Insights: Assessing the Inflationary Impact of U.S. Steel & Aluminum Tariffs

The newly announced 25% tariff on U.S. steel and aluminum imports introduces cost pressures across global supply chains. However, the key question is not just how markets react,...

Emerging Markets: January 2025 Colombia and Hungary CPI YoY Forecast Review

2025 Colombia CPI YoY Above Consensus Due to Global Inflation Pressures Turnleaf’s CPI YoY model projects Colombia inflation well above consensus 12 months out, as it more...

Emerging Markets: January 2025 India CPI YoY Forecast Review

In our January 2025 YoY CPI forecast, we projected inflation at 4.57%, slightly above the realized 4.3%, yet outperforming consensus (4.71%)—even with our estimate released a...

Macroeconomic Insights: 2025 Eurozone Inflation Outlook – 4 Key Charts to Watch

Turnleaf is forecasting 2–2.5% headline inflation for the Eurozone in 2025, while core inflation is expected to decline through the end of the year towards 2% as momentum in wage...

DeepSeek, objectives and constraints

When a new burger joint opens up, there's often a buzz. Everyone (well, at least me) wants to try the new burger. Is it as good as it looks on Instagram? Or is it just style over...

Hundreds of quant papers from #QuantLinkADay in 2024

I tweet a lot (from @saeedamenfx and at BlueSky at @saeedamenfx.bsky.social)! In amongst, the tweets about burgers, I tweet out a quant paper or link every day under the hashtag...

What we’ve learnt from reading thousands of Fed communications

We recently had the last FOMC decision of 2024. Market l participants reacted to the hawkish tone including Powell’s comments that the Fed’s year-end inflation projection has...