Featured Research

Macroeconomic Insights: Colombia CPI: The Minimum Wage Shock

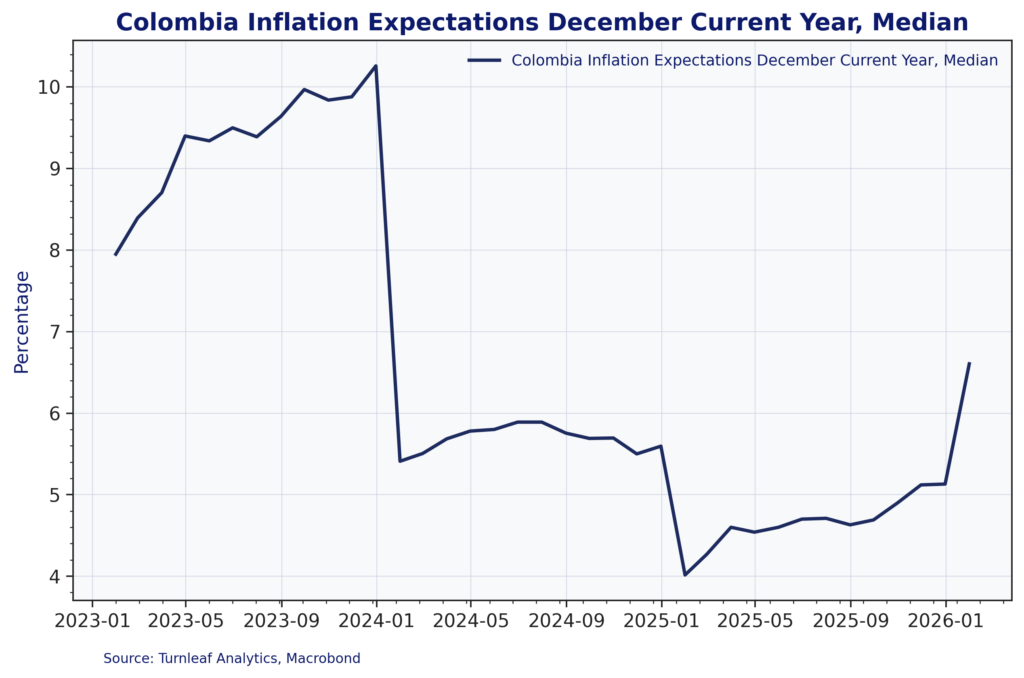

Colombia’s 12-month inflation outlook for 2026 has been revised higher. We now expect inflation to hit up to 6.7%YoY by the end of the year (Figure 1). This is a clear break from the lower path implied before the minimum wage decision. The shift follows the 23%...

Macroeconomic Insights: Colombia CPI: The Minimum Wage Shock

Colombia’s 12-month inflation outlook for 2026 has been revised higher. We now expect inflation to hit up to 6.7%YoY by the end of the year (Figure 1). This is a clear break from the lower path implied before the minimum wage decision. The shift follows the 23% minimum wage increase by government decree, which is expected to add substantial upward pressure to prices. To understand this trend shift, we need to understand the minimum wage’s role in indexation and cost pass-through, particularly in services and regulated or administrative prices.

Figure 1 – See Turnleaf’s latest Substack post, here.

The Indexation Mechanism

In Colombia, an estimated 27.9% of the CPI basket is affected by indexation linked to the minimum wage (BBVA Research). At the same time, indexation doesn’t happen all in January, but is distributed across the year as prices adjust based on contract renewal dates, regulatory calendars, and annual reset clauses for items such as:

- Education/tuition (often adjusted around the academic cycle)

- Public utilities and other regulated/administered prices (often adjusted on scheduled reviews, which can be quarterly or semi-annual depending on the item)

- Service contracts (adjusted at various points throughout the year at renewal/reset dates)

- Government fees and fines (often updated at the beginning of the year or when the relevant administrative unit is updated)

- For urban housing leases, increases are typically capped by the prior year’s CPI and applied at contract renewal. That said, higher minimum wages can still affect housing-related services and maintenance costs via pass-through.

The minimum wage increase decreed by President Gustavo Petro on December 29, 2025, raised the base minimum wage to COP 1,750,905 per month, with a transport subsidy bringing the total to COP 2,000,000. This is one of the largest annual increases in recent decades.

Inflation Expectations Surge

Besides the minimum wage increase mechanically increasing a portion of indexed prices, inflation expectations have adjusted sharply (Figure 2).

Figure 2

In the first central bank/bank-survey readings following the decree, economists raised their forecasts for end-2026 inflation to ~6.4% (Bloomberg reports ~6.37%, consistent with the central bank survey shift from ~4.6% to ~6.4%). Prior to the decree, Colombia’s central bank had projected ~3.6% inflation for end-2026.

Decoupling Efforts

It’s no surprise that after a minimum wage hike of this magnitude, the government has also begun to discuss how the country can reduce automatic linkages between the minimum wage and certain prices to prevent additional price pressure. Petro has discussed “deindexing” some regulated/administered prices and administrative charges from the minimum wage and instead adjusting them based on annual inflation or other criteria.

Critically, public transport and other wage-intensive, regulated or administered services can face higher cost pressure after a large minimum wage increase, and those increases can ripple through the economy via logistics and distribution costs. A reversal toward a downward inflation trend is likely only in 2027, especially if further minimum wage increases are much lower than that of 2026.

Currency Appreciation vs. Price Pressures

Though Colombia benefited from peso appreciation versus the dollar in late 2025, uncertainty continues to strain the outlook (Figure 3).

Figure 3

The price shock of a minimum wage increase of this magnitude is likely to push prices higher across broad segments of the economy, particularly in labor-intensive service sectors. The combination of strong indexation pressures, staggered adjustment timing throughout the year, and elevated inflation expectations creates a challenging environment for monetary policy. Turnleaf will keep updating its inflation forecasts as new data comes in, including developments that could signal higher-for-longer interest rates.

The price shock of a minimum wage increase of this magnitude is likely to push prices higher across broad segments of the economy, particularly in labor-intensive service sectors. The combination of strong indexation pressures, staggered adjustment timing throughout the year, and elevated inflation expectations creates a challenging environment for monetary policy. Turnleaf will keep updating its inflation forecasts as new data comes in, including developments that could signal higher-for-longer interest rates.

Research Archive

Macroeconomic Insights: Colombia CPI — Understanding Prices Through the Media

In Colombia, almost 17% of the consumer price basket are administratively set. This includes household public services, transport, fuel, and education fees. The legislation...

Macroeconomic Insights: Energy Prices —The Arbiter of Czech Republic CPI

Turnleaf expects Czech CPI to fall close to 2% YoY by the end of 2025 and then float back up towards 3% YoY through 2026. In the short term, our model places greater weight on...

Macroeconomic Insights: What’s on the Inflation Menu? – Turnleaf’s Food Index Catalogue

In Spain, it’s jamón. In Italy, Parmigiano Reggiano. In Japan, fresh fish. Every country has its culinary treasures, but when the prices of these beloved staples rise, the...

Macroeconomic Insights: Italy and Spain CPI: Unpacking Energy

Understanding how energy costs feed into CPI is crucial for accurately interpreting headline inflation in Europe. Both Spain and Italy offer unique case studies of how specific...

Macroeconomic Insights: South Africa CPI – Inflation and the Rand

Currently, the SARB has revised its forecasts downwards in response to rand appreciation and weaker economic growth. In contrast, Turnleaf’s model paints a more optimistic...

Macroeconomic Insights: Romania CPI Runs Hot

The recent surprise increase in electricity prices in Romania has pushed inflation close to 8%YoY. As Romania begins to rollback inflation fighting policies in the next couple of...

Macroeconomic Insights: U.S. CPI, Evaluating the Impact of Tariffs at Home and Abroad

When evaluating the impact of tariffs on consumer prices, we consider how they affect prices both domestically and abroad. Key factors include the effective tariff rate, the...

Macroeconomic Insights: Switzerland CPI – Just How Much Will Tariffs Hurt Switzerland?

Last week, President Trump threatened to impose a 39% tariff on Switzerland, higher than the initial 31% discussed in April 2025. With the U.S. being a major importer of Swiss...

Macroeconomic Insights: Eurozone CPI – Inflation Running Hotter Than Expected

The Eurozone Grew More Than Expected – Germany & Italy Overall, the Eurozone has enjoyed 0.6%QoQ growth in 2025Q1 despite disinflationary forces like weaker consumer and...

Macroeconomic Insights: Israel CPI – Air Travel Expected to Bump Up August Print

On August 3, 2025, Ben Gurion Airport will resume over 120 international flights for the month, though this remains insufficient to fully meet demand. Israeli travel companies...

Macroeconomics Insights: Europeans Can Finally Buy An Apocalypse Hellfire at 0% Tariff

Recently Trump announced a trade deal with the EU with terms that impose a 15% tariff on all E.U. imports (including motor vehicles) and a 0% retaliatory tariff on the U.S....

Macroeconomic Insights: U.S. Core CPI – Who’s Paying for the Tariffs?

In the first five months of 2025, the U.S. government collected $68.9 billion in tariffs and excise taxes, as the Yale Budget Lab reports the effective tariff rate surged from...

Macroeconomics Insights: Navigating Inflation and Deflation – China and Japan

As we approach the second half of 2025, the inflation trajectories of China and Japan reflect contrasting dynamics shaped by domestic economic conditions, external influences,...

Run to Research

Left foot forward, right foot forward, puncturing the mud, plodding along, the wind in winter, the sun in summer, in the trees’ shadows, patterns of light and dark along the...

Macroeconomic Insights: Ea-Nasir’s Fine Quality Copper Hit with 50% Tariffs in August

Since the inauguration of President Trump, uncertainty has significantly influenced inflation dynamics, primarily through unpredictable tariff policies. However, firms are now...