Featured Research

Macroeconomic Insights: India CPI – Structural Pressures Emerge

In the past month Turnleaf's 12-month inflation forecast for India has edged lower as the pace of food and energy price increases slowed. This moderation reflects seasonal dynamics and temporary declines in current market prices rather than any meaningful improvement...

Macroeconomic Insights: India CPI – Structural Pressures Emerge

In the past month Turnleaf’s 12-month inflation forecast for India has edged lower as the pace of food and energy price increases slowed. This moderation reflects seasonal dynamics and temporary declines in current market prices rather than any meaningful improvement in the structural forces that keep inflation elevated. Turnleaf’s models show that despite current disinflation, external cost channels including exchange-rate depreciation, tightening freight markets and rising forward energy prices are already rebuilding inflationary pressure beneath the surface. We expect external frictions to continue to push inflation above 3%YoY by the end of 2026 (Figure 1-PAID).

Record Low Food Prices Creates Rebound Risk

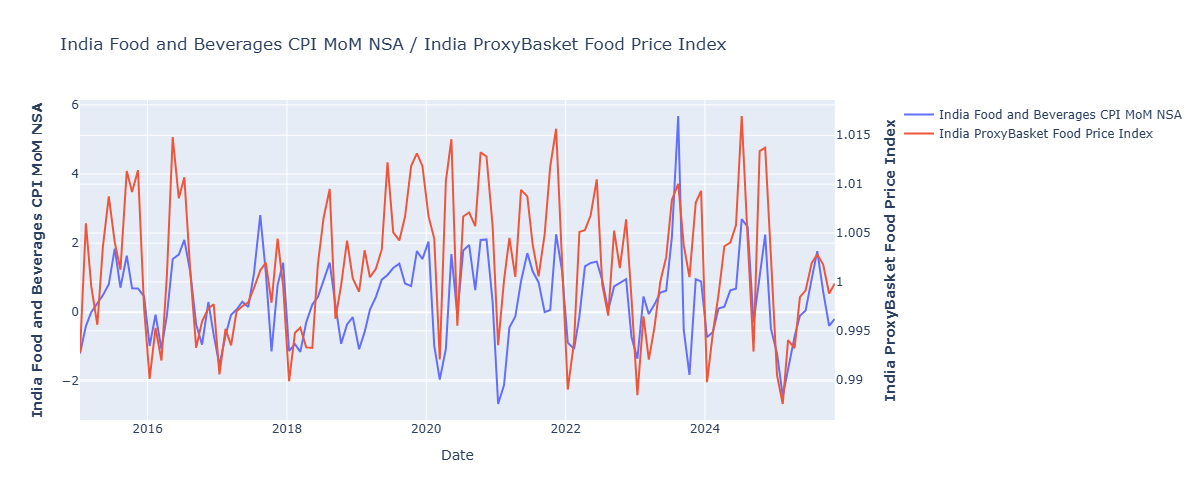

India’s headline CPI inflation slowed to 0.25% YoY in October 2025, largely because food inflation fell to -5.02% YoY. The decline was concentrated in vegetables—especially tomatoes, onions and potatoes—as prices normalized after mid-year supply shocks. Turnleaf’s ProxyBasket Food Price Index captured this move by incorporating daily tomato, onion and potato prices, as well as other inputs like India Agricultural Index that help trigger supply interventions and minimum sell prices for farmers (Figure 2).

Figure 2

This unusually low October reading creates a very low base for 2026, so even modest food price increases next year are likely to lift YoY food inflation. Although current data point t higher rainfall and increased sowing in the second half of 2026, any weather-related shock will be amplified by this base effect. Monitoring climate indicators together with Turnleaf’s alternative data like NASA weather metrics and minimum price triggers will be essential to gauge emerging food inflation risks.

Currency Depreciation and External Cost Pressures

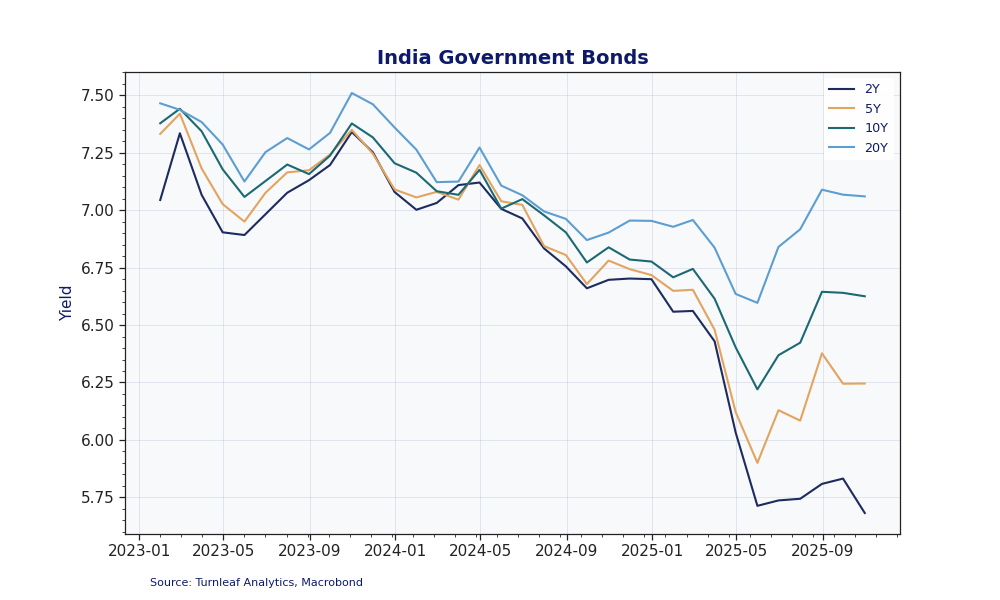

The rupee weakened to 89.39 INR/USD as of November 27, 2025, down 5.82% over twelve months and 1.30% in November alone, driven by acute trade frictions with the U.S. and foreign portfolio outflows. Over the past month, 5- and 10-year government bond yields have edged higher while the 2-year remains near cycle lows, indicating that markets are demanding a higher term premium for inflation and fiscal risks even as they continue to price in near-term RBI easing (Figure 3).

Figure 3

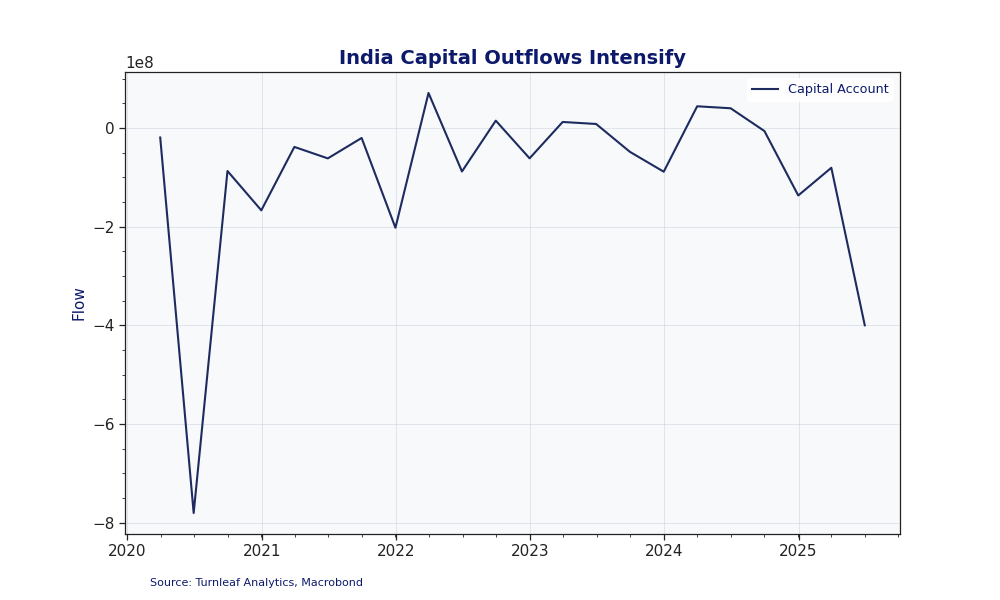

Capital flows show about $400 million leaving India in 2025Q2 as global trade volatility weakened appetite for emerging-market risk (Figure 4). For India, this pressure has been amplified by the U.S. decision to impose a 50% tariff in response to India’s deepening energy ties with Russia. Since the start of the war in Ukraine in 2022, Russia’s share of India’s crude imports has jumped from under 1% to nearly 40%, increasing India’s exposure to geopolitical shocks.

Figure 4

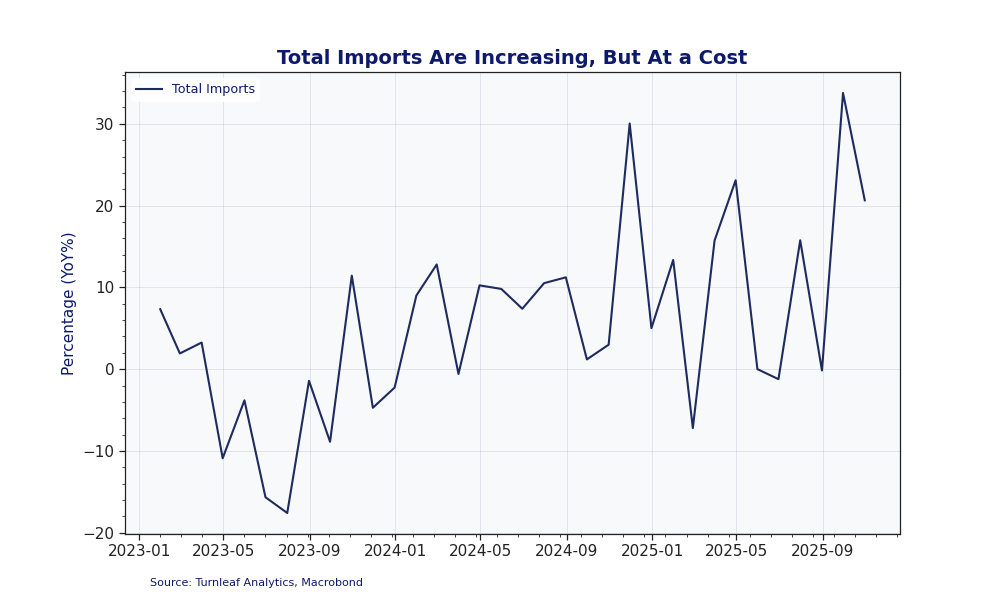

Currency depreciation compounds external cost pressures through dollar-denominated freight and commodity prices, effectively hitting India twice. With global shipping costs still slightly above pre-shock norms, imports are more expensive both because of higher USD prices and the weaker rupee. Despite some slowdown after a peak above 30% YoY in September 2025, import volumes—equivalent to 23.5% of GDP in 2024—continue to grow, reinforcing the upside risk to India’s inflation outlook into 2026 (Figure 5).

Figure 5

To read the rest, visit Turnleaf’s latest Substack post here.

To read the rest, visit Turnleaf’s latest Substack post here.

Research Archive

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.