Featured Research

Macroeconomic Insights: Eurozone CPI – Services Keeping the Economy Running

At the start of 2025, tariffs posed a meaningful downside risk to Eurozone inflation. Yet Eurozone growth has proven more resilient than many expected. The potential loss of external demand from higher tariffs has been partly offset by dollar depreciation,...

Macroeconomic Insights: Eurozone CPI – Services Keeping the Economy Running

At the start of 2025, tariffs posed a meaningful downside risk to Eurozone inflation. Yet Eurozone growth has proven more resilient than many expected. The potential loss of external demand from higher tariffs has been partly offset by dollar depreciation, stronger-than-expected and sustained demand, and lower global energy prices—together supporting growth.

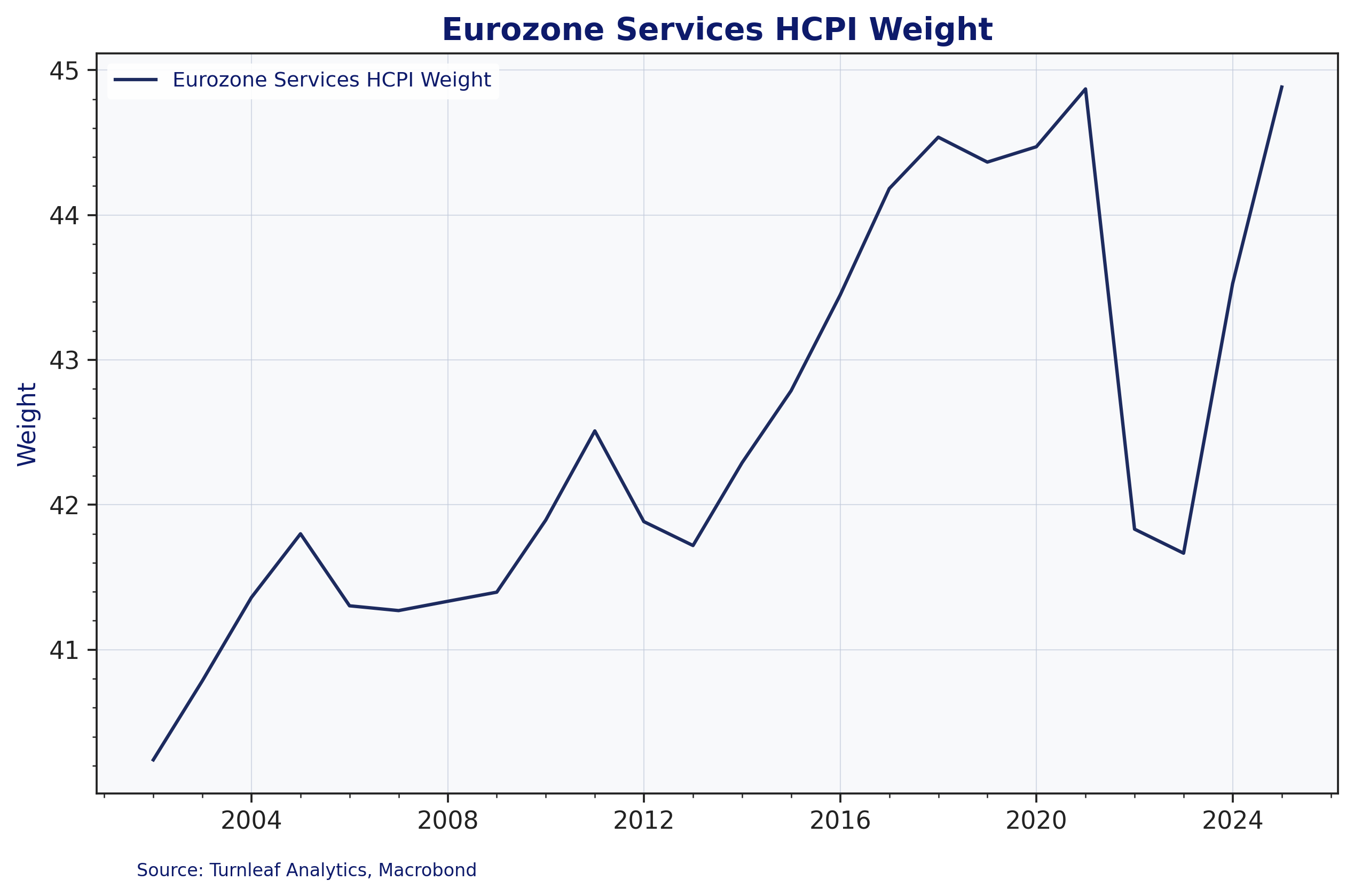

This year, services have been the key source of resilience. Services now account for over 45% of the consumer price basket, and their contribution has been rising, making it essential to capture price shifts in this subcomponent when interpreting moves along the curve (Figure 1). Sensitivity here depends on service demand, which in turn is shaped by wage growth and shows through in household savings behavior and overall consumer spending which have been accounted for by our model.

Figure 1

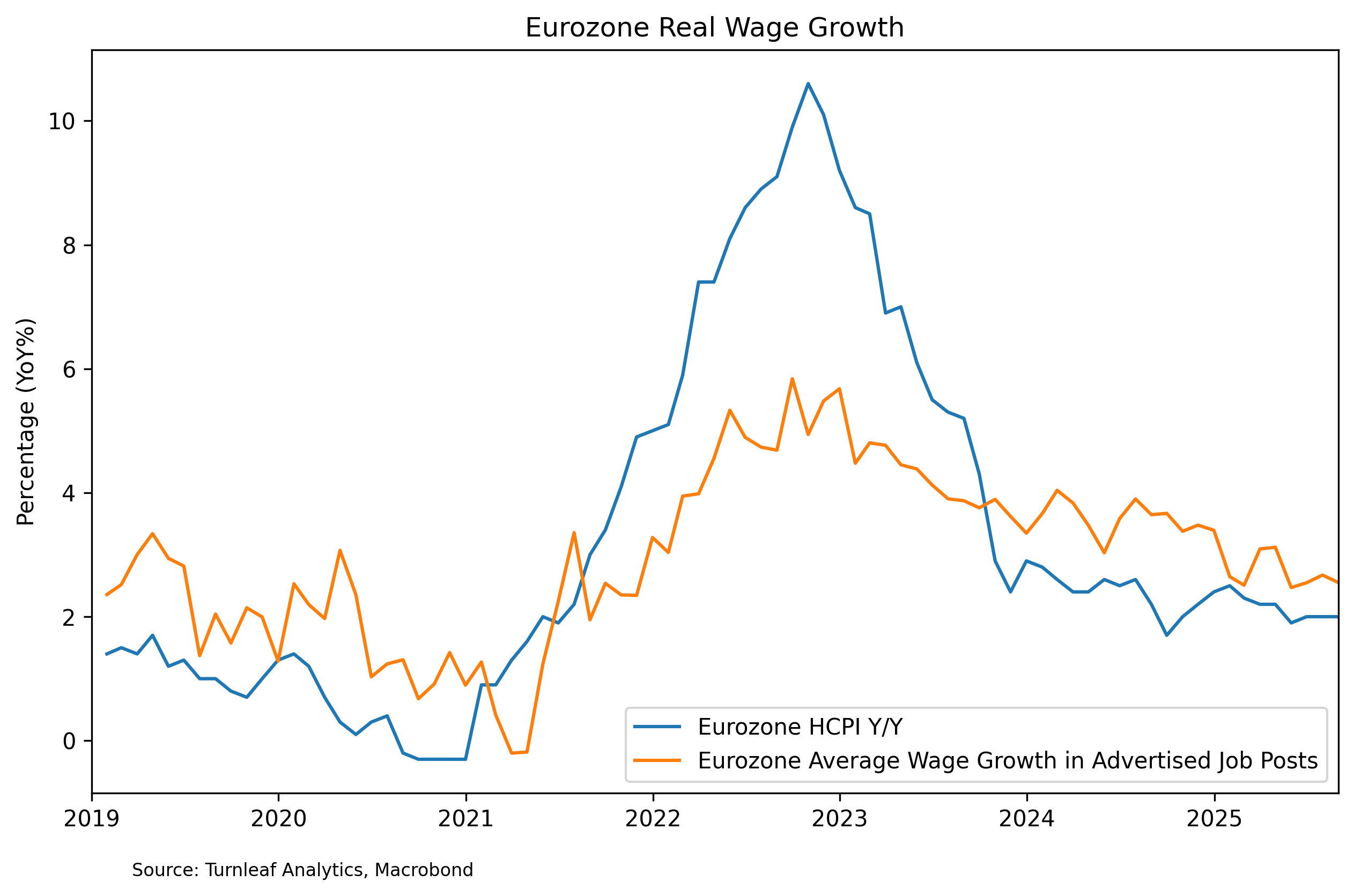

Our Eurozone services CPI forecasts have been trending higher over the past few months (Figure 3). While wage growth is easing across major economies they remain above average nominal YoY wage growth in advertised job listings (Figure 2), supporting household savings that are robust enough to sustain service demand. That has allowed weather indicators, like our proprietary ‘temperature price index’ and air-quality measures which have been flagged by our models, to play a larger role in explaining services inflation and, by extension, the headline figure. An additional upside risk is a reversal in global energy trends and changes in electricity prices, which are frequently passed through to service prices.

Figure 2

To read the rest of the article, please visit our latest Substack post.

Research Archive

Takeaways from Berkshire Hathaway 2024

It's springtime in Omaha. It can mean only one thing, the Berkshire Hathaway shareholder meeting is back in town. It is a relatively unusual event in the financial calendar. Whilst obviously the primary purpose is to discuss how Berkshire Hathaway has been performing...

Using experience in financial research

I end up buying a lot of books. Inevitably, I end up reading far fewer books than I end up buying. The unread books peer at me from my bookcase, knowing they'll likely never be read. One book which I bought recently and immediately started reading was the Trading Game...

Forecasts and decisions

A lot of measurements go into the perfect burger. First, there's the patty. What is the weight of the patty? How much fat is in the patty? Then there's the other parts. How much lettuce? How much onion? How large should the bun be? All these proportions are going to...

We still need to learn to code

If I go to burger joint somewhere outside the UK, I’ll usually look at the price and mentally convert it into GBP. I guess I could use a calculator, but it seems slightly pointless. Traders use Excel all the time, but it doesn’t negate the need to be numerate. Would a...

Takeaways from TradeTech FX USA 2024

In recent years, more financial firms have begun to open up offices in Miami, in particular a number of prominent hedge funds. It has also been the home of TradeTech FX USA for a number of years, where participants from the sell side, buy side and vendors converge...

Different ways to assess forecasts

Let's say you want to know what a burger will taste like. You look at the ingredients, and to some extent you'll be able to "forecast" what it'll taste like. Part of the difficulty is that your input data isn't going to be super descriptive. For example, the menu...