Featured Research

Macroeconomic Insights: South Africa CPI – Got Milk?

Turnleaf’s Headline CPI YoY forecast for South Africa has been revised lower following the unexpected August 2025 print of 3.3% YoY. The shift downwards of the inflation curve is driven mainly by softer food inflation in the last print—down from 5.7% YoY in July to...

Macroeconomic Insights: South Africa CPI – Got Milk?

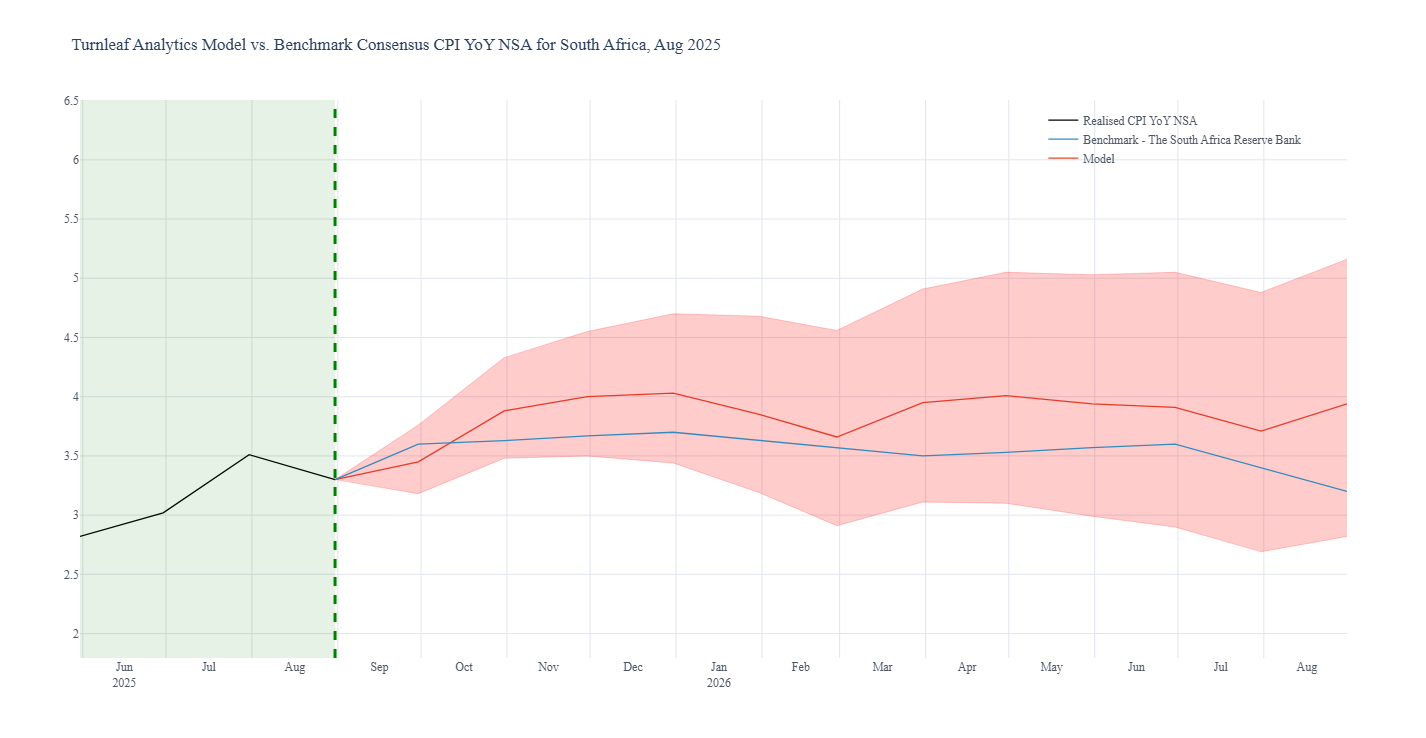

Turnleaf’s Headline CPI YoY forecast for South Africa has been revised lower following the unexpected August 2025 print of 3.3% YoY. The shift downwards of the inflation curve is driven mainly by softer food inflation in the last print—down from 5.7% YoY in July to 5.2% YoY in August (with dairy, notably milk, the key contributor)—and a deeper decline in fuel prices, from −5.5% YoY in July to −5.7% YoY in August. Since April 2025, a steadily firmer rand and subdued energy prices have contained input costs.

From 2026, however, the favorable base effects from lower energy prices will fade, limiting further disinflation. We therefore expect headline CPI to hover around 4% YoY over the next 12 months, with occasional upside risks around the seasonal Eskom tariff adjustments in April and July.

Figure 1

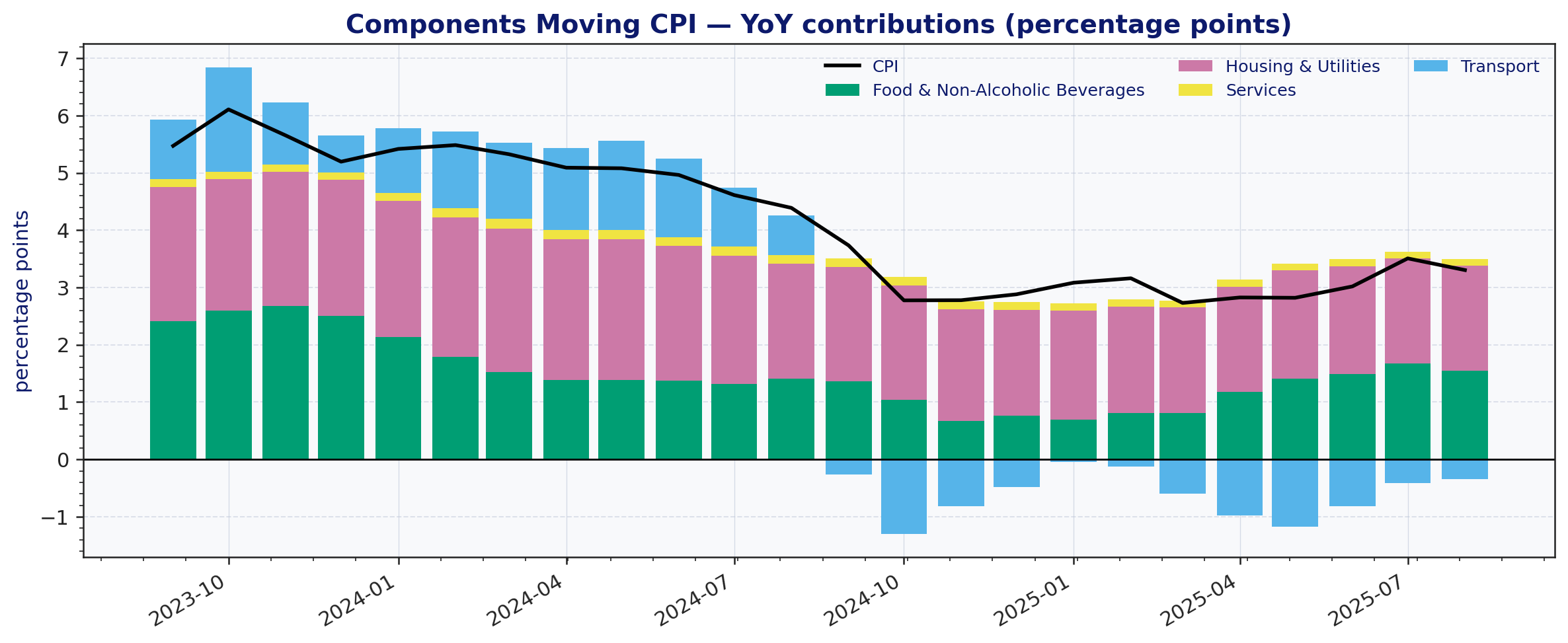

In Figure 2, we decompose the main CPI contributors using YoY bar plots and find that food is the key category to watch in the next few months, having driven much of the downswing in South Africa’s latest print.

In Figure 2, we decompose the main CPI contributors using YoY bar plots and find that food is the key category to watch in the next few months, having driven much of the downswing in South Africa’s latest print.

Figure 2

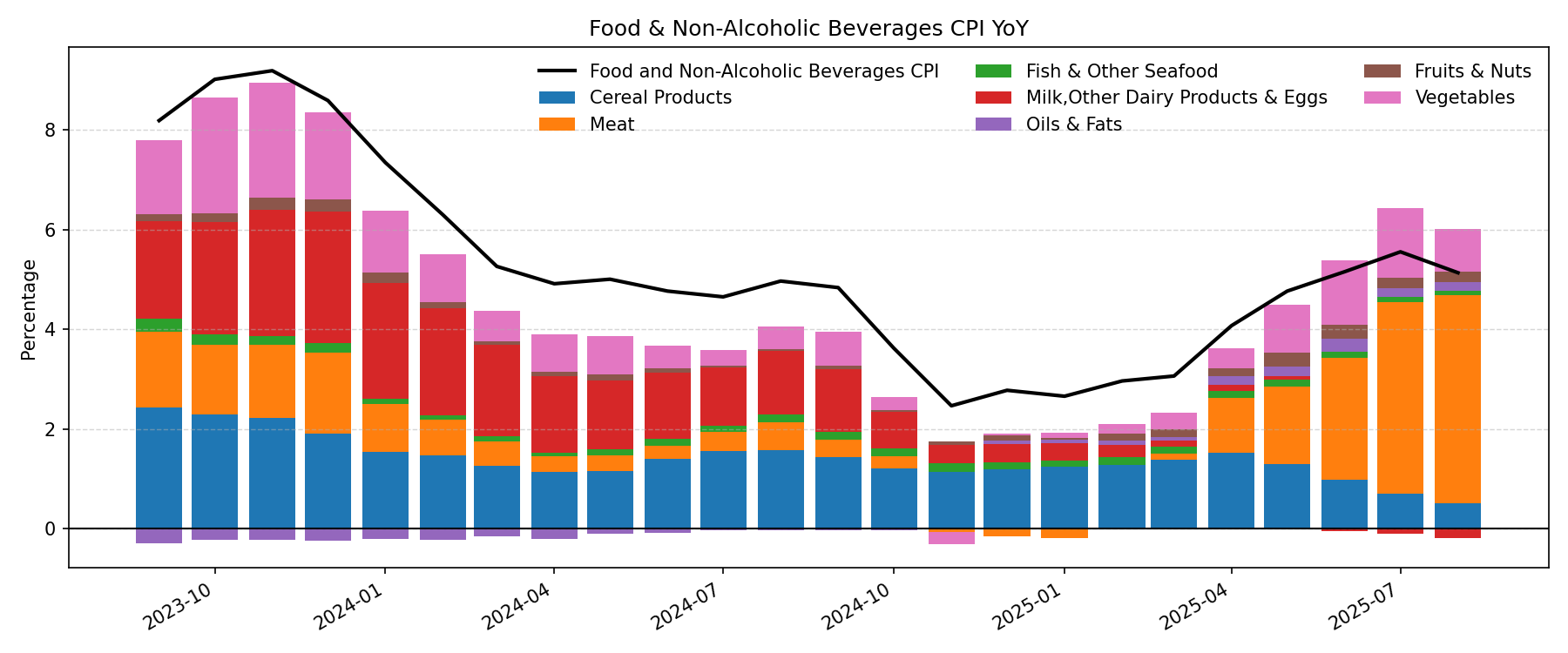

When we unpack Food & Non-Alcoholic Beverages CPI, several subcomponents show atypical dynamics including vegetables and cereal products. For example, milk fell to its lowest YoY rate since March 2011—down to 1.1% YoY in August 2025 (Figure 3). In contrast, overall food prices have been edging higher, with meat contributing the bulk of the recent upswing.

Figure 3

To continue reading, please visit our latest Substack post.

Research Archive

Macroeconomic Insights: U.S. Inflation Outlook Under Another Trump Presidency

As U.S. economic conditions continue to evolve, Turnleaf will actively monitor inflation trends and publish regular updates to keep you informed. Our focus remains on leading indicators that provide real-time insights into market sentiment on inflation, delivering...

Macroeconomic Insights: Turkey’s Two-Front Fight with Inflation and the Lira

Turkey’s central bank has adopted a stringent monetary policy to combat inflation, a stark departure from previous unorthodox strategies. With borrowing costs now at a benchmark high of 50% since March 2024—the highest since 2002—this hawkish approach is beginning to...

Inflation Outlook for Canada in October 2024- Producer Optimism, Consumer Pains

Canada’s inflation outlook is shaped by a complex mix of declining energy costs, rising food prices, and evolving trade dynamics. At Turnleaf Analytics, we’re closely tracking these factors to provide our clients with a clear view of CPI trends and their potential...

How Bad is Too Bad? Japan’s Reckoning with Inflation and New Leadership

Japan’s battle with inflation has become a key issue, reshaping public sentiment and influencing recent election results. With the Liberal Democratic Party (LDP)–Komeito coalition losing its majority in the recent elections, Turnleaf is watching how economic...

Turnleaf’s Inflation Outlook for Brazil: Rising Costs Amid Currency Pressures

Turnleaf’s Brazil’ inflation outlook for the next 12 months has undergone an upward revision, driven by several significant factors. While shipping costs have eased, inflationary pressures are resurfacing due to both structural and recent developments in the economy....

Turnleaf’s October 2024 Economic Forecast: Deflationary Pressures Persist in China

Turnleaf Analytics’ forecast for YoY NSA CPI published in October 2024 suggests an inflation trajectory expected to remain well below 2% over the coming 12 months. Specifically, our model projects a 0.74% YoY NSA CPI increase for October, underscoring persistent...