Featured Research

Macroeconomic Insights: Poland CPI – The 2025 ‘Cheap Energy’ Party Winds Down

Turnleaf expects Poland’s CPI to average around 3% YoY over the next 12 months. By 2026, the base effects from the 2024 energy surge will fade, leaving food and services as the primary inflation drivers (Figure 5 - paywall). Food prices are expected to remain elevated...

Macroeconomic Insights: Poland CPI – The 2025 ‘Cheap Energy’ Party Winds Down

Turnleaf expects Poland’s CPI to average around 3% YoY over the next 12 months. By 2026, the base effects from the 2024 energy surge will fade, leaving food and services as the primary inflation drivers (Figure 5 – paywall). Food prices are expected to remain elevated due to global supply constraints, while services inflation will stay sticky due to ongoing wage pressures, despite some moderation. A temporary dip to 2.5% in early 2026 is likely as service base effects fade, but inflation should return to 3% later in the year, driven by seasonal energy demand and firmer food prices. From 2026 onward, excise taxes and administered price changes will continue to pressure inflation, while slowing wage growth may moderate services inflation somewhat. Core goods inflation, however, will remain subdued due to weak industrial demand and global disinflationary trends. Supply shocks, particularly in energy, food, and services, represent a key upside risk to inflation, as disruptions in supply chains or geopolitical tensions could drive prices higher than expected.

High food prices in recent months raised concerns about a sustained inflation uptick for September 2025. However, food prices increased much less than expected. Our model identified several key contributors to the inflation print, including higher beef and golden apple prices, likely driven by a global trend of declining livestock supply and seasonality, respectively, which has pressured prices.

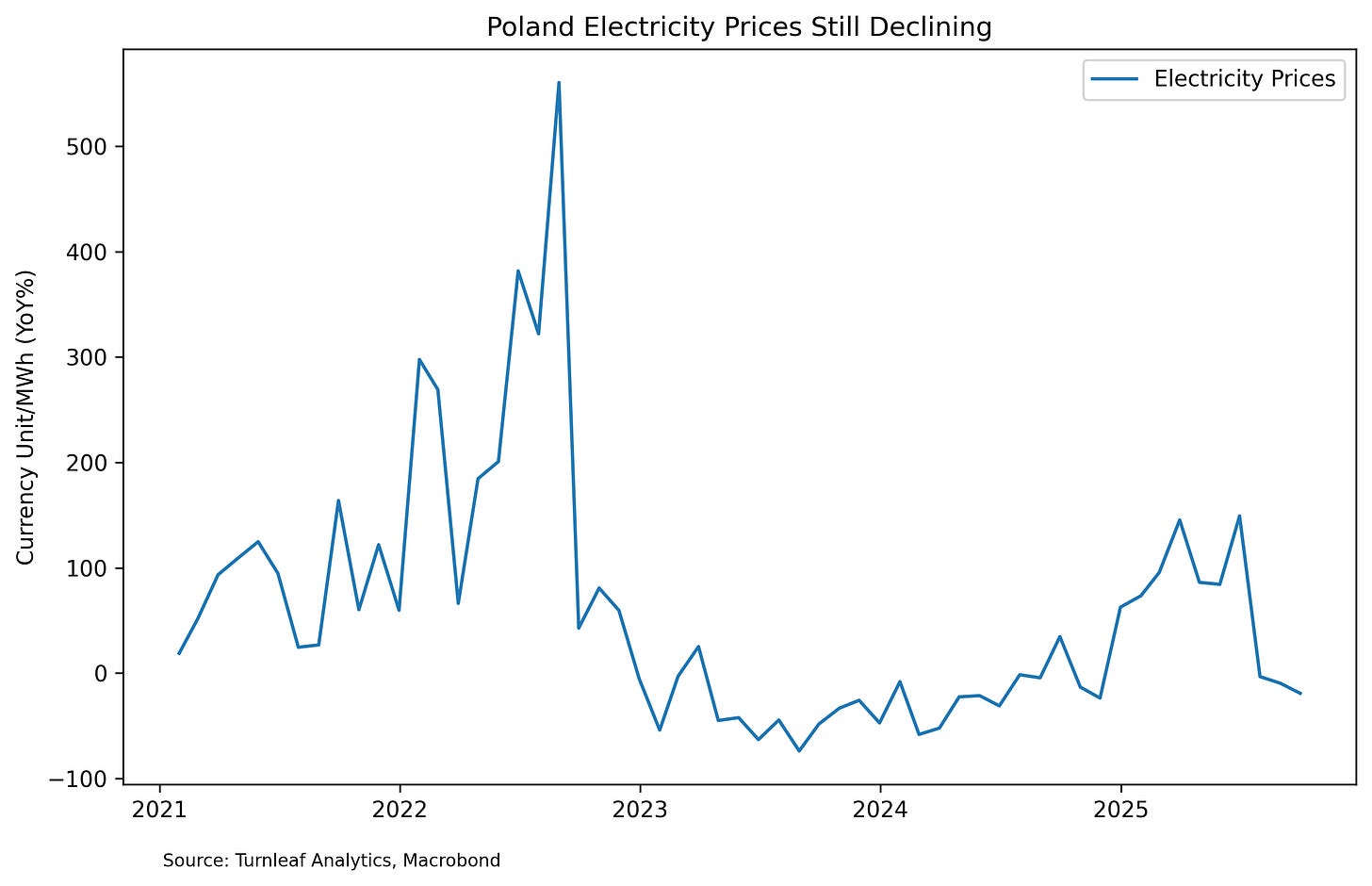

The electricity price cap in Poland, initially set to end by October 2025, has been extended through the end of the year, helping to keep electricity prices subdued for the foreseeable future (Figure 1). Meanwhile, fuel costs remain low due to a drop in global Brent crude prices. However, upside risks remain, particularly if geopolitical tensions or supply disruptions drive prices up in the latter half of 2025 or into 2026.

Figure 1

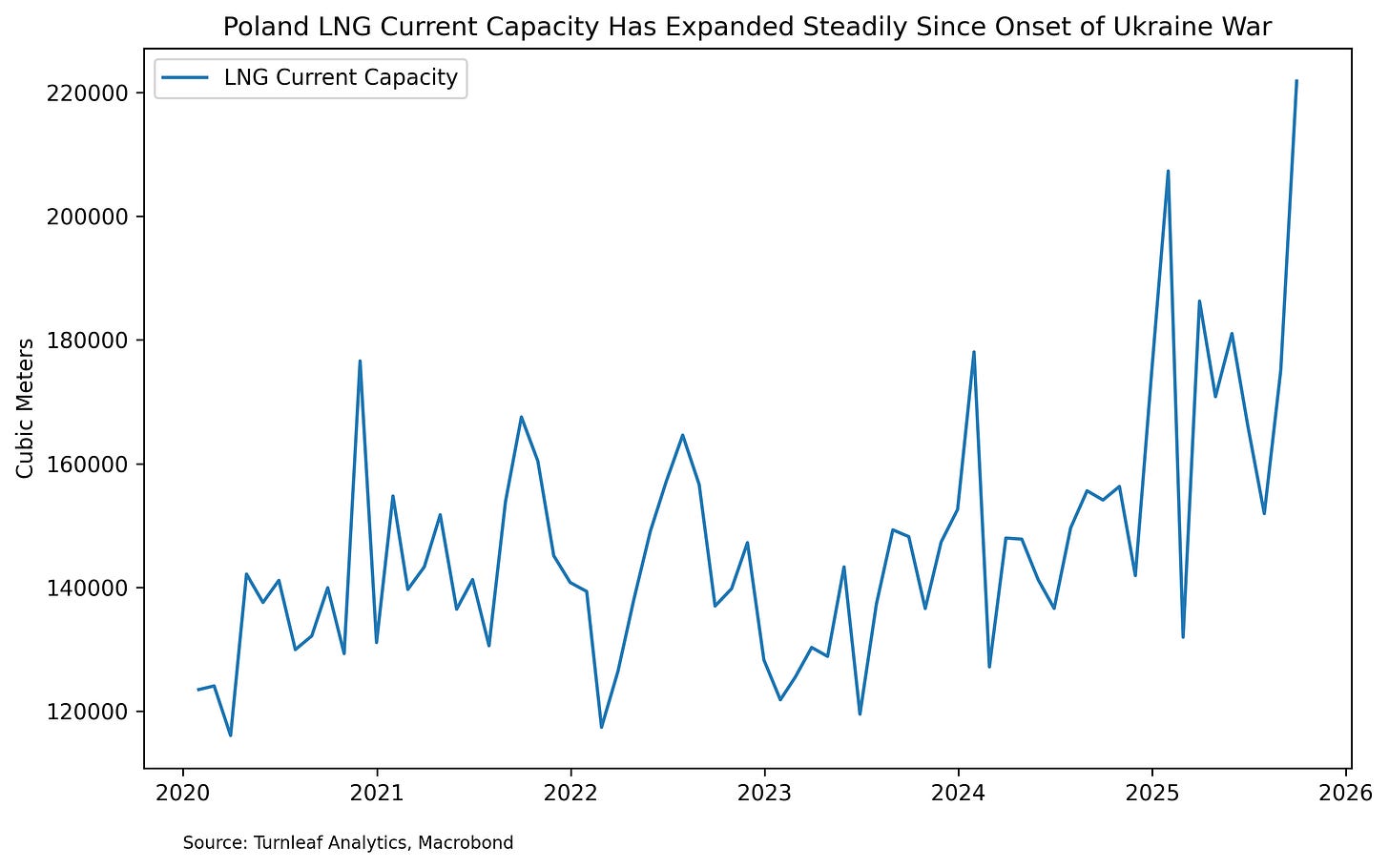

As part of its strategy to decouple from Russian gas, Poland has focused on expanding LNG capacity to diversify its energy mix and ensure greater energy security (Figure 2). However, with favorable base effects from high energy prices fading from the 2026 inflation calculations, gas prices could rise again if supply conditions do not improve. While the expansion of LNG infrastructure is a positive step, Poland’s energy future will depend on securing consistent and affordable energy supplies, with risks of price volatility if supply disruptions or insufficient capacity arise.

Figure 2

Research Archive

Flash Inflation Outlook: South Korea Inflation Amid Political Instability

South Korea’s brief declaration and subsequent revocation of martial law by President Yoon has damaged investor confidence, further weakening the won and placing pressure on the country’s inflation trajectory. This political instability comes at a critical time for...

November 2024 Global Inflation Call: Transcript

Global Inflation Amid Trade Uncertainties Good afternoon and welcome to Turnleaf’s global inflation call. For the past month, global inflation expectations have been shaped by global trade uncertainty as proposed U.S. tariffs could hurt key global industries while...

Takeaways from QuantMinds 2024 in London

Over the past years, the quant industry has changed substantially. My first visit to Global Derivatives was just over a decade ago. At the time, perhaps unsurprisingly, the conference was dominated by presentations about option pricing. Over the years, the content has...

Macroeconomic Insights – Poland’s Fight with External and Domestic Demand

As Poland navigates a complex economic landscape, its rapid growth, fueled by competitive wages and strong manufacturing, faces challenges from both domestic and external pressures. The country’s success in attracting manufacturing investments has driven robust...

Takeaways from Web Summit 2024

Think of Lisbon and no doubt it’ll conjure images of explorers setting sail in centuries past across the ocean, the hills that climb across the city, pastel de nata and salted cod… Of course, there is much to Lisbon which cannot be summed in a sentence of...

Macroeconomic Insights: UK Autumn 2024 Budget and Global Trade Pressures Add to Inflation Challenges

The UK government's Autumn Budget for 2024, introduced on October 30, is designed to enhance public services through increased capital investments, funded by higher taxes along with adjustments in welfare and spending. The Office for Budget Responsibility (OBR)...