Featured Research

Macroeconomic Insights: France CPI– Consumers are Waiting for Something Bad to Happen

Consumers are waiting for something bad to happen. Industrial weakness and worries about the government dominate the story, and French households are preparing for the worst. As discussed in earlier posts, unemployment concerns are pushing precautionary saving higher...

Macroeconomic Insights: France CPI– Consumers are Waiting for Something Bad to Happen

Consumers are waiting for something bad to happen. Industrial weakness and worries about the government dominate the story, and French households are preparing for the worst. As discussed in earlier posts, unemployment concerns are pushing precautionary saving higher and discretionary spending lower. That shift has kept inflation close to 1% YoY, with the balance of risks pointing toward further disinflation. Setting aside cyclical dynamics, Turnleaf’s models are emphasizing consumer behavior. French households are engaging with the economy differently and pulling back from the sectors that used to carry growth.

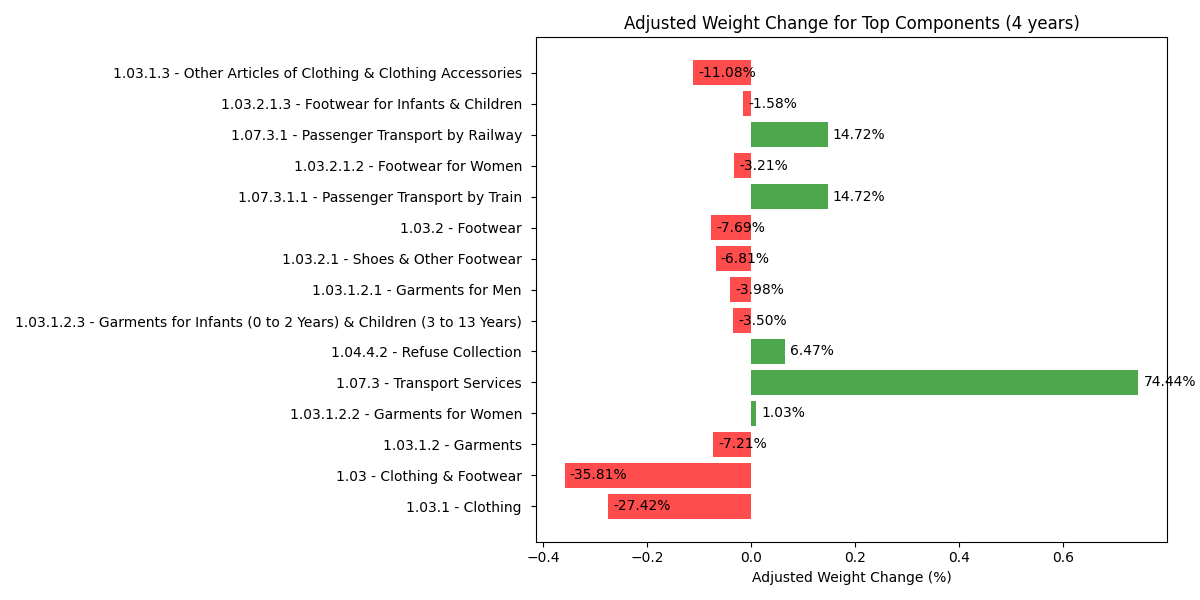

Spending has tilted away from goods like clothing and footwear and toward services like transport. Rail and other mobility services now carry higher CPI weights, reflecting post-pandemic travel normalization, strong tourism, policy support for rail, and wage costs feeding into fares (Figure 1). With goods disinflation carrying less weight, services increasingly set the tone for the headline print, especially given higher services inflation in September 2025 (2.4%YoY vs 2.1%YoY in August 2025).

Figure 1

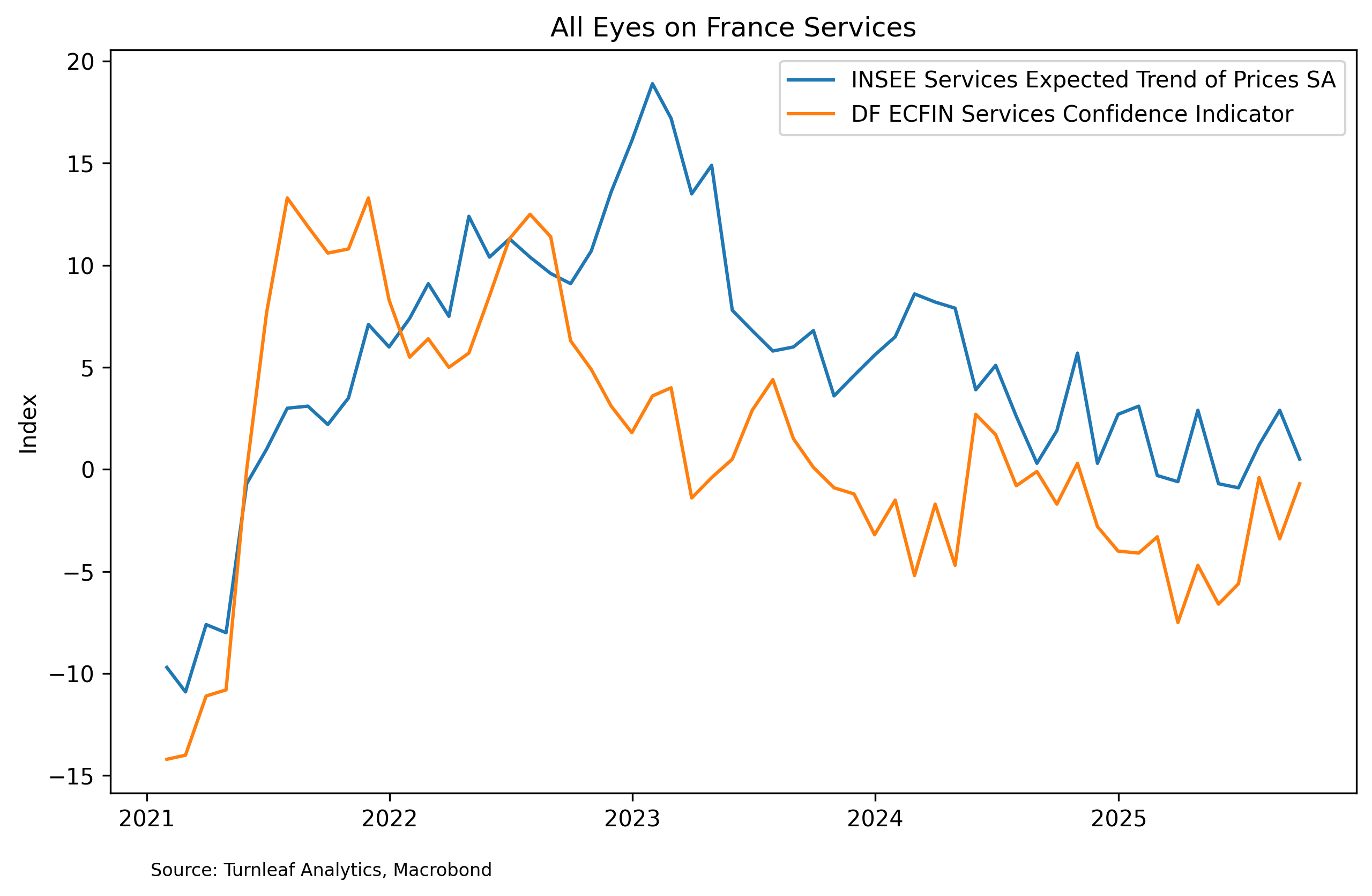

Despite those heavier weights, price expectations for services have eased toward low-positive readings while services confidence remains soft (Figure 2). Firms are finding it harder to lift prices against cautious demand. In our framework, services will contribute less to CPI momentum in the next few months but continue to partially offset goods and energy disinflation.

Figure 2

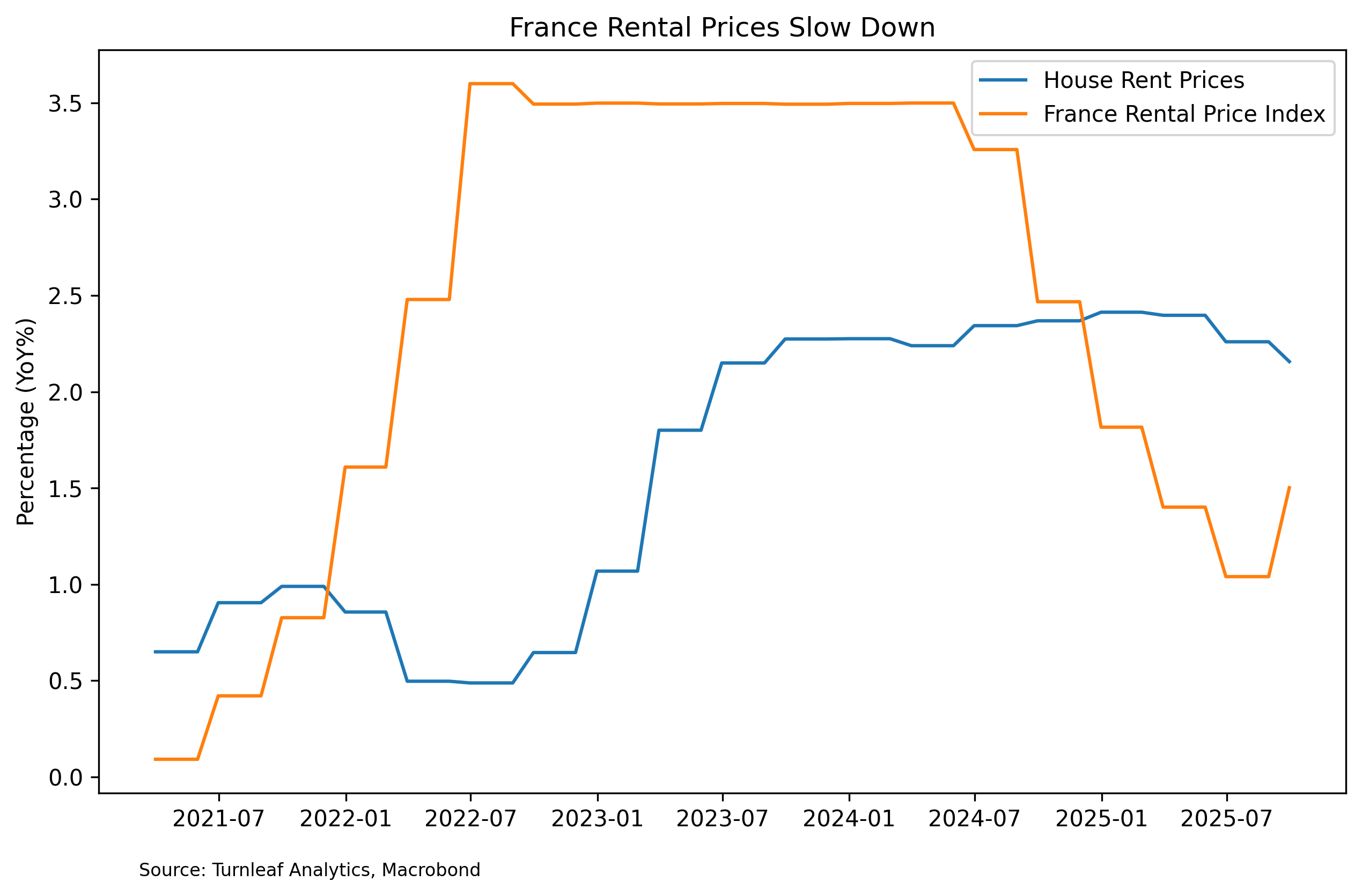

The housing channel tells a similar story and is illustrated in Figure 3. France’s rent revisions are governed by the Indice de Référence des Loyers (IRL), which is tied to CPI ex-tobacco. As disinflation took hold through 2024, the IRL fell from about 3.3% to near 1% by mid-2025, mechanically capping permissible rent increases and cooling housing services. It edged back toward 1.5% late in the year, but with most leases revised annually, the near-term passthrough should be modest. This helps reconcile the model signals. House rent prices are still running a little above 2% YoY and thus flags as inflationary, while the IRL, having dropped sharply, flags as disinflationary. In other words, current rent levels remain elevated, but the lower benchmark constrains upcoming revisions, so any lift from rents in the next prints should be limited rather than a new source of upside pressure.

Figure 3

Meanwhile, energy prices are broadly benign though in last month’s print fuel prices slowed down less than expected given base effects in petroleum. main swing risk is regulated prices, with electricity tariffs typically adjusted around February and changes to local fees and taxes taking effect at the start of the year. These can move the print even when underlying momentum is stable. Rents may add a small sequential lift as IRL-linked adjustments pass through, but contract timing keeps the impulse modest. Industrial activity looks broadly flat over the next couple of months and is unlikely to shape the near-term inflation narrative.

Ultimately, the decisive margin is the consumer. If households continue to save more and resist price increases, services should remain neutral to mildly disinflationary, keeping headline near 1% YoY. If confidence firms, expect more pricing power in transport and other labor-intensive services and accordingly, a higher print (Figure 4).

To read the rest of the article, visit Turnleaf’s Substack.

Research Archive

Hundreds of quant papers from #QuantLinkADay in 2024

I tweet a lot (from @saeedamenfx and at BlueSky at @saeedamenfx.bsky.social)! In amongst, the tweets about burgers, I tweet out a quant paper or link every day under the hashtag of #QuantLinkDay, mostly around FX, rates, economics, machine learning etc. Some are...

What we’ve learnt from reading thousands of Fed communications

We recently had the last FOMC decision of 2024. Market l participants reacted to the hawkish tone including Powell’s comments that the Fed’s year-end inflation projection has “kind of fallen apart.”, as well as shifts in the dot plot. It is intuitive that what the Fed...

Flash Inflation Outlook: The Cost of Stability, Poland’s Extended Energy Caps

The Polish government’s decision to extend the cap on electricity prices at 500 PLN/MWh is a critical measure to limit inflationary pressures on households. To understand its implications, consider an average 3-person household with an annual electricity consumption...

Macroeconomic Insights: A Pinch of Real Rates, a Dash of Slack: Turnleaf’s 2025 U.S. Inflation Recipe

At Turnleaf Analytics, leveraging our machine learning models, we project U.S. inflation to stabilize between 2–3% through 2025, shaped by the interplay of import inflation, expectations, and economic slack, especially with the possibility of new tariffs. Rising...

Macroeconomic Insights: Rising Costs Hit Germany Where It Can’t Afford It—Manufacturing

Germany, long regarded as Europe’s economic powerhouse, owes much of its success to its export-driven industrial base. However, recent years have seen this foundation weaken under the weight of declining global demand, shifting supply chain dynamics, and rising...

Macroeconomic Insights: France’s Inflation Outlook Amid Fiscal and Economic Pressures

France’s inflation remains near the European Central Bank’s (ECB) 2% target despite significant fiscal spending during the pandemic and in response to the war in Ukraine. However, this spending has sustained a fiscal deficit of 5.5% of GDP since 2023—well above the...