Featured Research

Macroeconomic Insights: Australia CPI – Could Higher Unemployment Change Everything?

Turnleaf expects Australia's 12-month inflation forecast path to remain close to the Reserve Bank's upper bound 3% target range as stronger than expected demand continues to stimulate growth, petrol prices begin to increase as low energy base effects slip out of YoY...

Macroeconomic Insights: Australia CPI – Could Higher Unemployment Change Everything?

Turnleaf expects Australia’s 12-month inflation forecast path to remain close to the Reserve Bank’s upper bound 3% target range as stronger than expected demand continues to stimulate growth, petrol prices begin to increase as low energy base effects slip out of YoY calculations, and housing costs remain elevated.

With China-U.S. trade tensions introducing some volatility in currency markets, we could see prices turn to the upside, but weakening of the U.S. dollar due to government shutdown concerns has helped mitigate some depreciation of the Australian dollar, keeping imports subdued. At the same time, the end of electricity rebates in the next few months has the potential to shift the curve upwards as energy prices normalize globally and increase potential input costs.

For the past few months, we have seen our 12-month inflation forecast curve shift upwards (Figure 1 – paid subscribers only), but that trend could change after a higher than expected unemployment figure for September 2025 hit 4.5%, its highest since 2021. In addition, we’re also beginning to see some evidence of some supply-side relief for housing and we could expect some downside pressures to come in. If consumer sentiment continues to improve and petrol prices remain relatively stable, we expect our curve to have a slight downward bias as unemployment figures push our forecast slightly lower.

Energy Prices

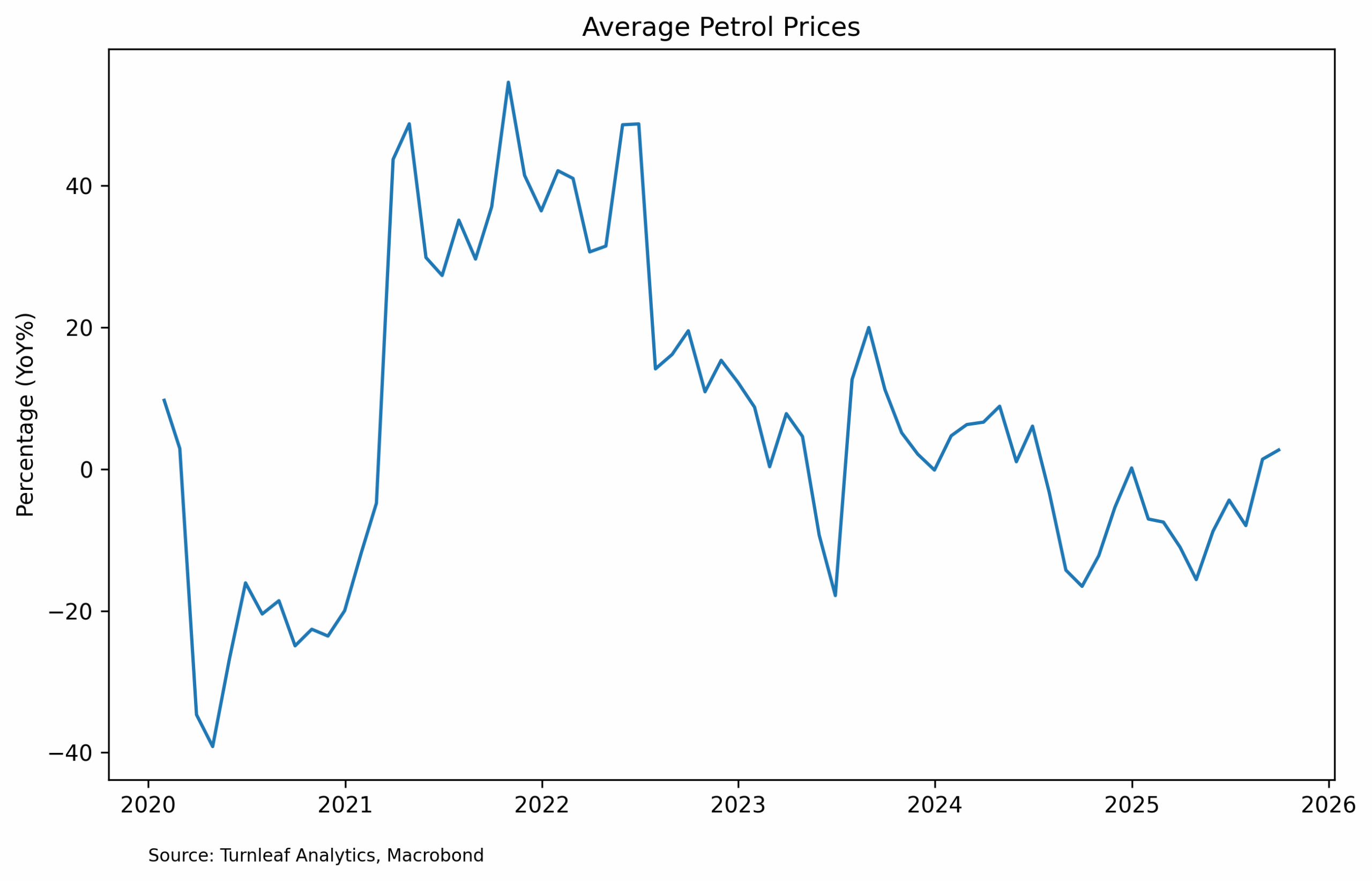

Average petrol prices have increased compared to 2024, with prices continuing to grow as favorable base effects from the past year fall out of calculations (Figure 2). Crude oil is sitting below $60 a barrel and, with a Gaza ceasefire holding and U.S. stockpiles looking comfortable, it’s likely to stay in a similar range unless shipping near Venezuela is disrupted or OPEC+ surprises markets in November. Separately, when electricity bill rebates end at the end of the year, household power costs jump back to full price, which will nudge inflation higher even if nothing else changes.

Figure 2

Housing Costs

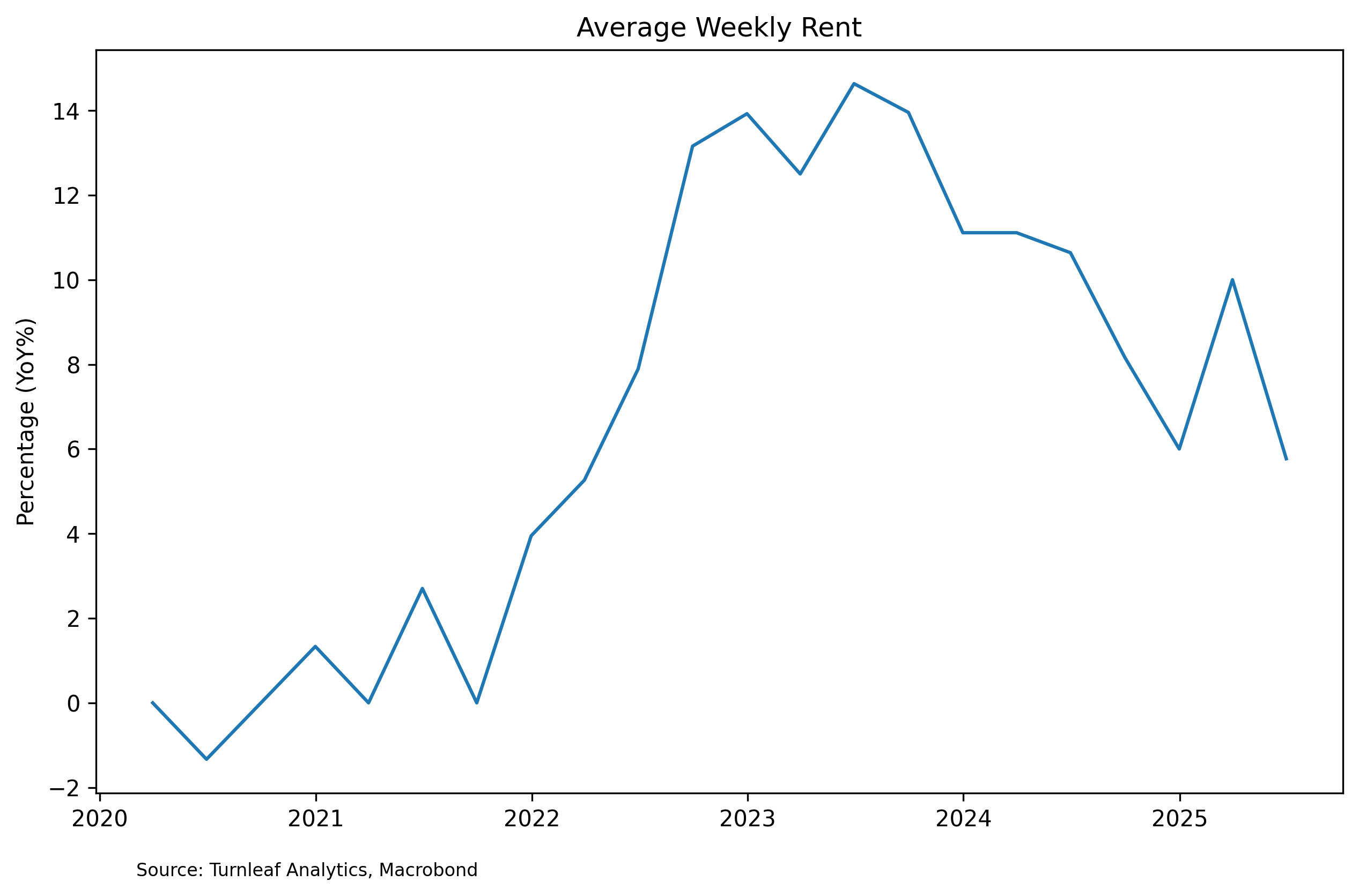

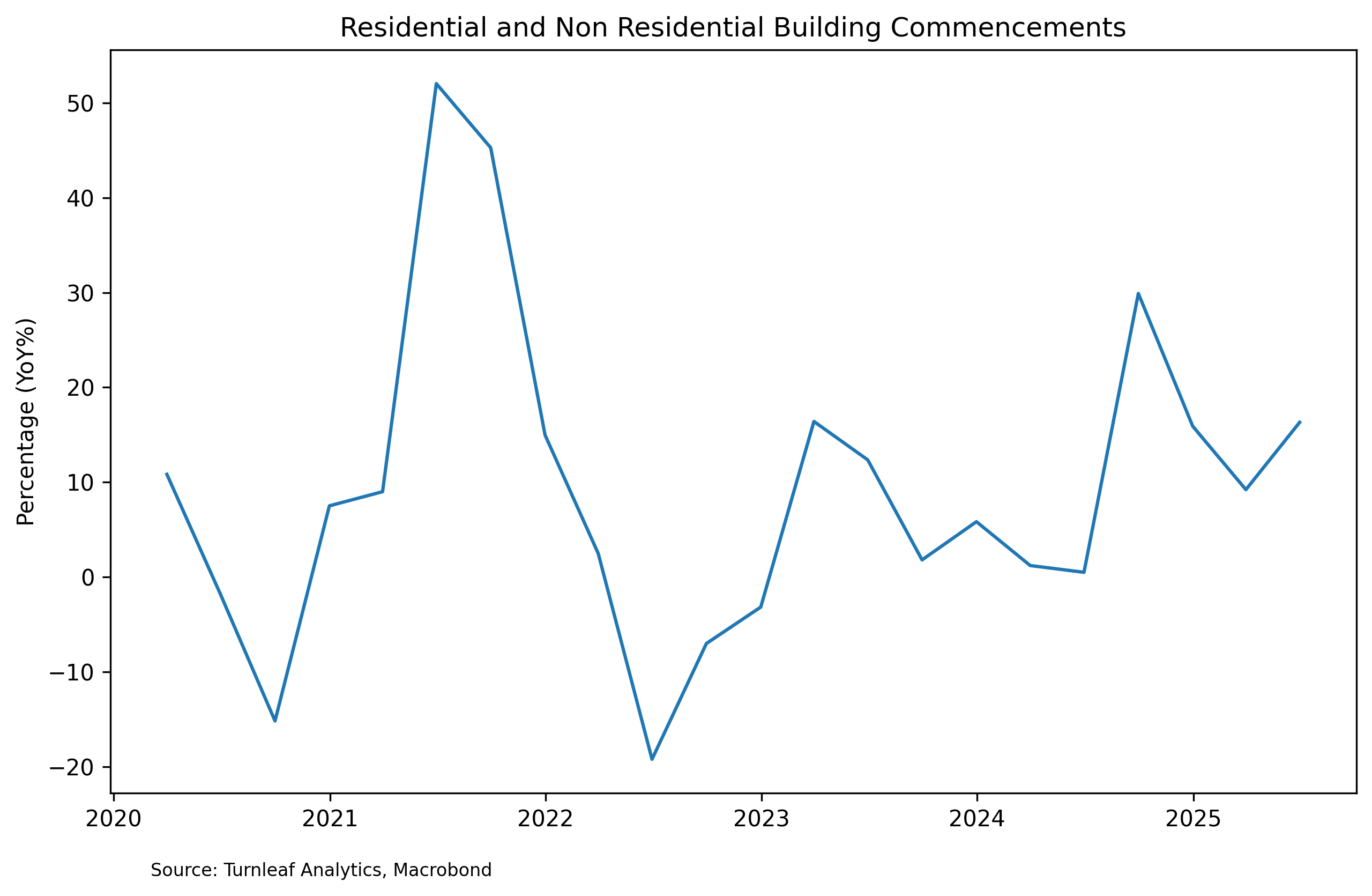

Housing costs have been a primary talking point for Australia’s cost-of-living crisis for the past few years. The average weekly rent recorded quarterly, though steadily declining, remains fairly elevated at 6%YoY for 2025 Q3 (Figure 3). With a recent uptick in residential and non-residential building commencements underway (Figure 4), we could see housing supply loosen in the next six to nine months, putting downward pressure on prices. However, at this rate, demand continues to outstrip supply, meaning any relief will be gradual rather than immediate.

Figure 3

Figure 4

To read the rest, visit Turnleaf’s latest Substack post, here.

Research Archive

Macroeconomic Insights: Tariffs, Manufacturing, and Mexico Inflation

This article marks the start of Turnleaf’s series on how U.S. tariffs shape inflation dynamics across Latin America (LATAM). Among the economies we monitor—Colombia, Brazil, Peru, and Chile—most have witnessed upward shifts in their inflation trajectories. Mexico,...

Macroeconomic Insights: How U.S. Tariffs and Eurozone Weakness Are Shaping Chinese Inflation

The trajectory of Chinese inflation will largely depend on its sensitivity to U.S. tariffs and its ability to sustain domestic GDP growth through external demand, particularly from key partners like Germany. While U.S. tariffs on China present a challenge, our models...

Macroeconomic Insights: Prices to Increase in February 2025 as Canada’s Tax Holiday Takes a Holiday

Between mid-December 2024 and mid-February 2025, the Canadian government implemented a GST/HST tax holiday, exempting beverages, restaurants, children’s clothing and footwear, children's diapers, children car seats, children's toys, jigsaw puzzles, video games...

Macroeconomic Insights: Fueling the Inflation Fire – Turnleaf’s Turkish Inflation Curve Shifts Upwards

Turnleaf’s latest data has pushed Turkey’s inflation outlook higher than consensus forecasts. There are multiple reasons for this which we will explain in this note. One of the reasons is the expanding liquidity for small and medium-sized enterprises (SMEs) by the...

Macroeconomic Insights: Assessing the Inflationary Impact of U.S. Steel & Aluminum Tariffs

The newly announced 25% tariff on U.S. steel and aluminum imports introduces cost pressures across global supply chains. However, the key question is not just how markets react, but how producers adjust their spending behavior in response to rising cost risks....

Emerging Markets: January 2025 Colombia and Hungary CPI YoY Forecast Review

2025 Colombia CPI YoY Above Consensus Due to Global Inflation Pressures Turnleaf’s CPI YoY model projects Colombia inflation well above consensus 12 months out, as it more aggressively captures global inflation linkages, particularly through energy costs and external...