Featured Research

Macroeconomic Insights: China CPI — Will the Chinese New Year Be Enough?

China's headline CPI rose to -0.3% YoY in September 2025, still capped by food deflation and soft energy prices. Core CPI printed 1.0% YoY, above headline but still subdued as goods disinflation and weak services demand restrain momentum. We expect Chinese New Year to...

Macroeconomic Insights: China CPI — Will the Chinese New Year Be Enough?

China’s headline CPI rose to -0.3% YoY in September 2025, still capped by food deflation and soft energy prices. Core CPI printed 1.0% YoY, above headline but still subdued as goods disinflation and weak services demand restrain momentum.

We expect Chinese New Year to deliver the primary near-term inflation impulse. The February 17, 2026 Spring Festival should trigger the typical seasonal spike in food prices, particularly meat, vegetables, and seafood. Historically, months with the Spring Festival show CPI readings 0.7–1.0% higher than normal months. This seasonal demand should lift food prices (with less favorable weather acting as an amplifier) and push services such as catering, travel, and recreation temporarily higher.

Pork prices represent a particularly important swing factor. As of September 2025, pork prices remained significantly depressed due to persistent oversupply, with wholesale prices hitting 18-month lows. However, the government has urged farmers to cut production and stabilize prices. With festive demand coinciding with tighter supply, pork prices are likely to rebound in early 2026, shifting from a CPI drag to a positive contributor. Base effects will further amplify this dynamic, as the early 2025 Lunar New Year created a low comparison base that will magnify YoY CPI growth in early 2026.

Beyond seasonal food dynamics, several policy shifts will exert upward pressure on prices. The EV purchase tax exemption ends in December 2025, with a partial tax reinstated from January 2026. This will directly raise vehicle prices and remove the earlier deflationary effects from subsidies. Additionally, several temporary stimulus measures, including local consumption vouchers and property transaction incentives, are expected to expire by late 2025. The withdrawal of these measures will reduce price suppression and marginally lift prices for certain goods and services.

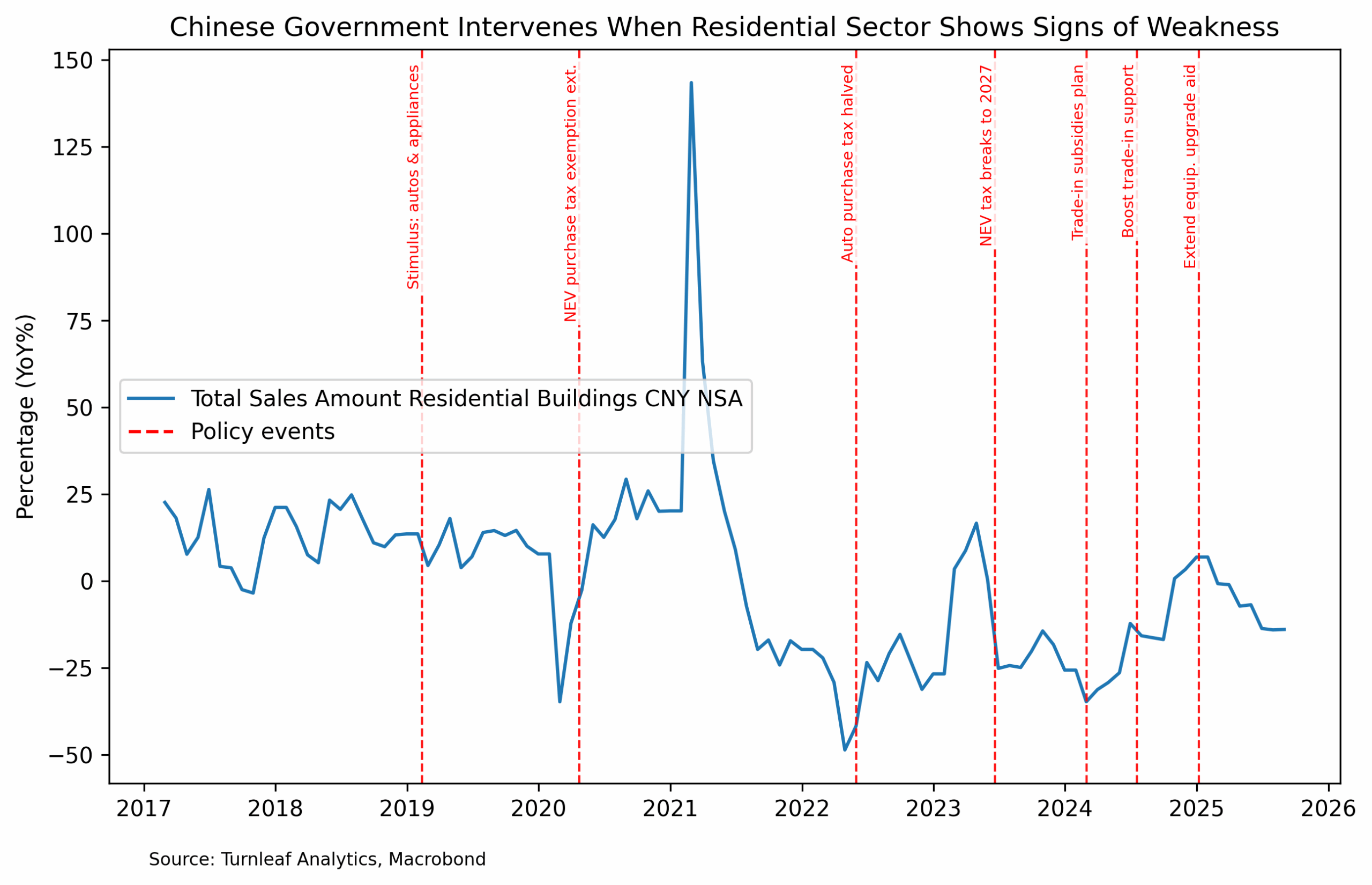

By contrast, with the residential sector still weak, demand for durables such as home appliances is likely to remain flat absent new policy support. Historically, when residential building sales weaken or bottom, authorities respond with targeted stimulus like tax breaks, trade-in subsidies, and credit support (Figure 1). In our framework, residential sales are flagged as inflationary not because sales are strong (YoY changes remain negative), but because they act as a policy trigger. Housing stress raises the probability of demand-support measures that later lift prices with a lag.

Figure 1

To continue reading, visit Turnleaf’s latest Substack here.

Research Archive

Turnleaf Forecast Review: Recent Misses and Outcomes

This issue aims to clarify several of Turnleaf’s and the market’s forecast deviations over the past few months. Below, we outline key insights and performance drivers across a selected group of countries. If you have any questions or would like to discuss further,...

Macroeconomic Insights: India’s Inflation Paradox – Headline Drops, Core Rises

In recent forecasts, Turnleaf has observed an interesting trend in India’s inflation dynamics. While headline inflation has been trending downward, largely driven by a decrease in vegetable prices, core inflation—which excludes food and energy—has been rising (Figure...

Macroeconomic Insights: Polish Inflation – What Could Be, What Won’t Be in 2025

Recent retail sales in Poland have come in below expectations (-0.5%YoY in February 2025), with a significant decline driven by vehicle sales, followed by reduced consumption in food and fuel. Our model incorporates factors that directly influence the underlying...

Macroeconomic Insights: Mexico’s Inflation Path In Tariff Uncertainty Limbo

The tail of our inflation curve is currently driven by two key factors: U.S. tariffs set for April 2, 2025, and Plan Mexico, which aims to revitalize domestic manufacturing and reduce reliance on cheap imports from Asia. These factors are creating upward price...

Macroeconomic Insights: How Germany’s Fiscal Stimulus Could Reshape Its Inflation Outlook

Amid shifting geopolitical tensions and the need to revitalise its economy, Germany is preparing for a massive fiscal stimulus that will allocate up to $1 trillion in defence and infrastructure spending over the next 12 years. This spending plan will require borrowing...

Emerging Markets: Turnleaf Discusses Impact on Hungary’s 10% Profit Margin Cap Restriction on Inflation

Policy: In Hungary, from March 17 to May 31, 2025, a 10% profit margin cap will be imposed on 30 essential products, limiting companies' profits on these items. Small independent shops with net revenue below HUF 1 billion (approximately EUR 2.5 million) in 2023 will...