Featured Research

Macroeconomic Insights: Australia CPI – Could Higher Unemployment Change Everything?

Turnleaf expects Australia's 12-month inflation forecast path to remain close to the Reserve Bank's upper bound 3% target range as stronger than expected demand continues to stimulate growth, petrol prices begin to increase as low energy base effects slip out of YoY...

Macroeconomic Insights: Australia CPI – Could Higher Unemployment Change Everything?

Turnleaf expects Australia’s 12-month inflation forecast path to remain close to the Reserve Bank’s upper bound 3% target range as stronger than expected demand continues to stimulate growth, petrol prices begin to increase as low energy base effects slip out of YoY calculations, and housing costs remain elevated.

With China-U.S. trade tensions introducing some volatility in currency markets, we could see prices turn to the upside, but weakening of the U.S. dollar due to government shutdown concerns has helped mitigate some depreciation of the Australian dollar, keeping imports subdued. At the same time, the end of electricity rebates in the next few months has the potential to shift the curve upwards as energy prices normalize globally and increase potential input costs.

For the past few months, we have seen our 12-month inflation forecast curve shift upwards (Figure 1 – paid subscribers only), but that trend could change after a higher than expected unemployment figure for September 2025 hit 4.5%, its highest since 2021. In addition, we’re also beginning to see some evidence of some supply-side relief for housing and we could expect some downside pressures to come in. If consumer sentiment continues to improve and petrol prices remain relatively stable, we expect our curve to have a slight downward bias as unemployment figures push our forecast slightly lower.

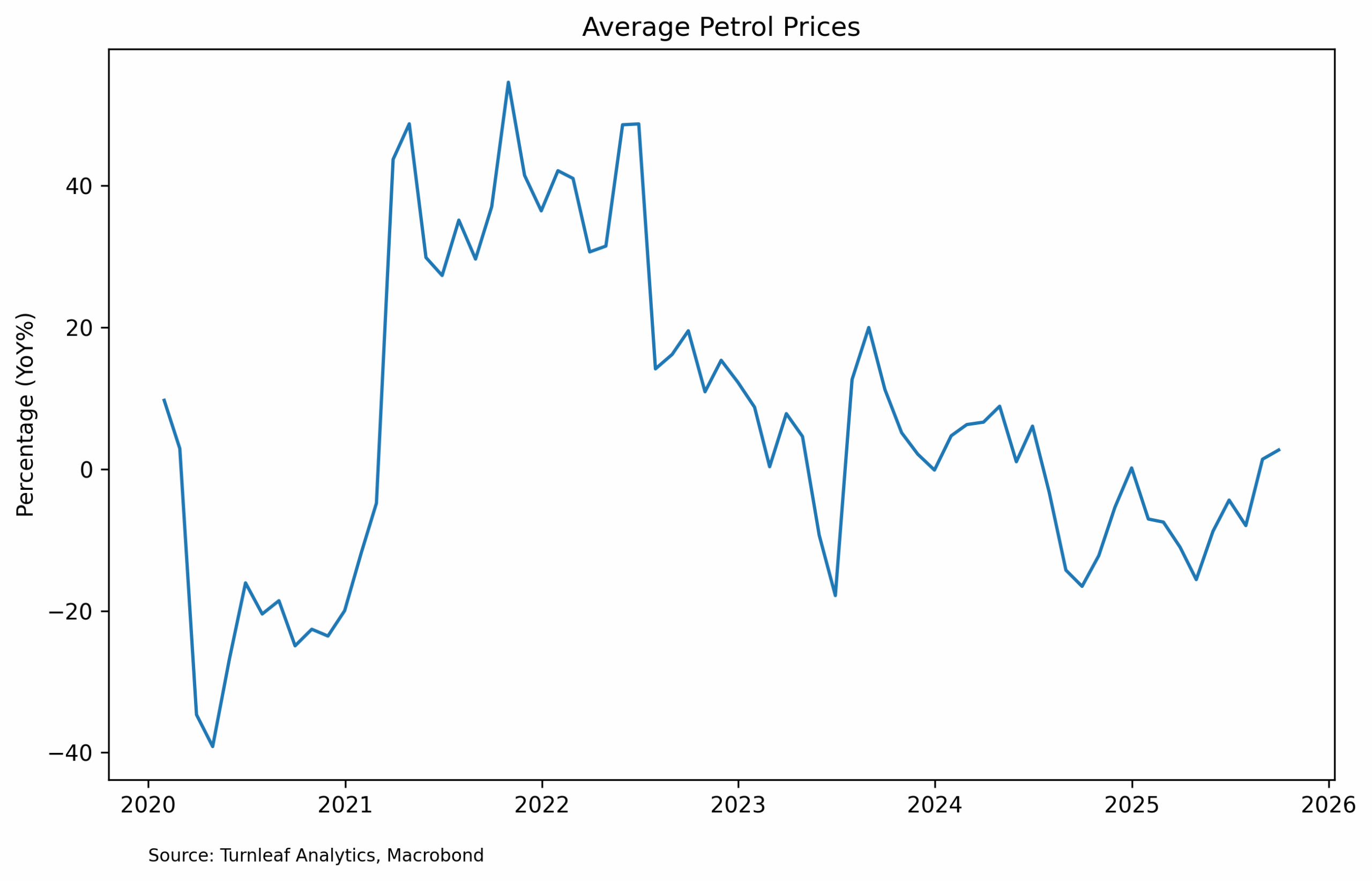

Energy Prices

Average petrol prices have increased compared to 2024, with prices continuing to grow as favorable base effects from the past year fall out of calculations (Figure 2). Crude oil is sitting below $60 a barrel and, with a Gaza ceasefire holding and U.S. stockpiles looking comfortable, it’s likely to stay in a similar range unless shipping near Venezuela is disrupted or OPEC+ surprises markets in November. Separately, when electricity bill rebates end at the end of the year, household power costs jump back to full price, which will nudge inflation higher even if nothing else changes.

Figure 2

Housing Costs

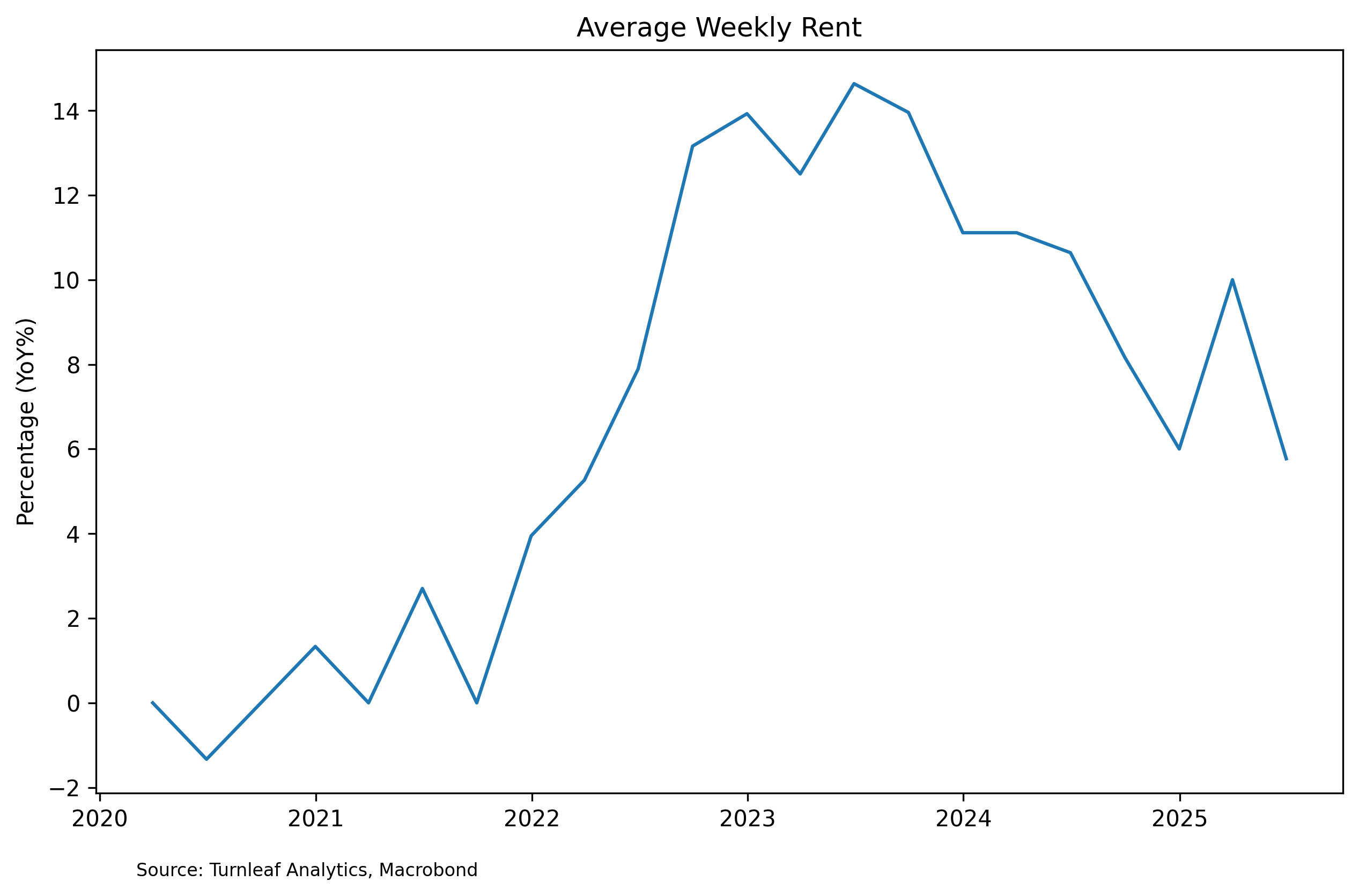

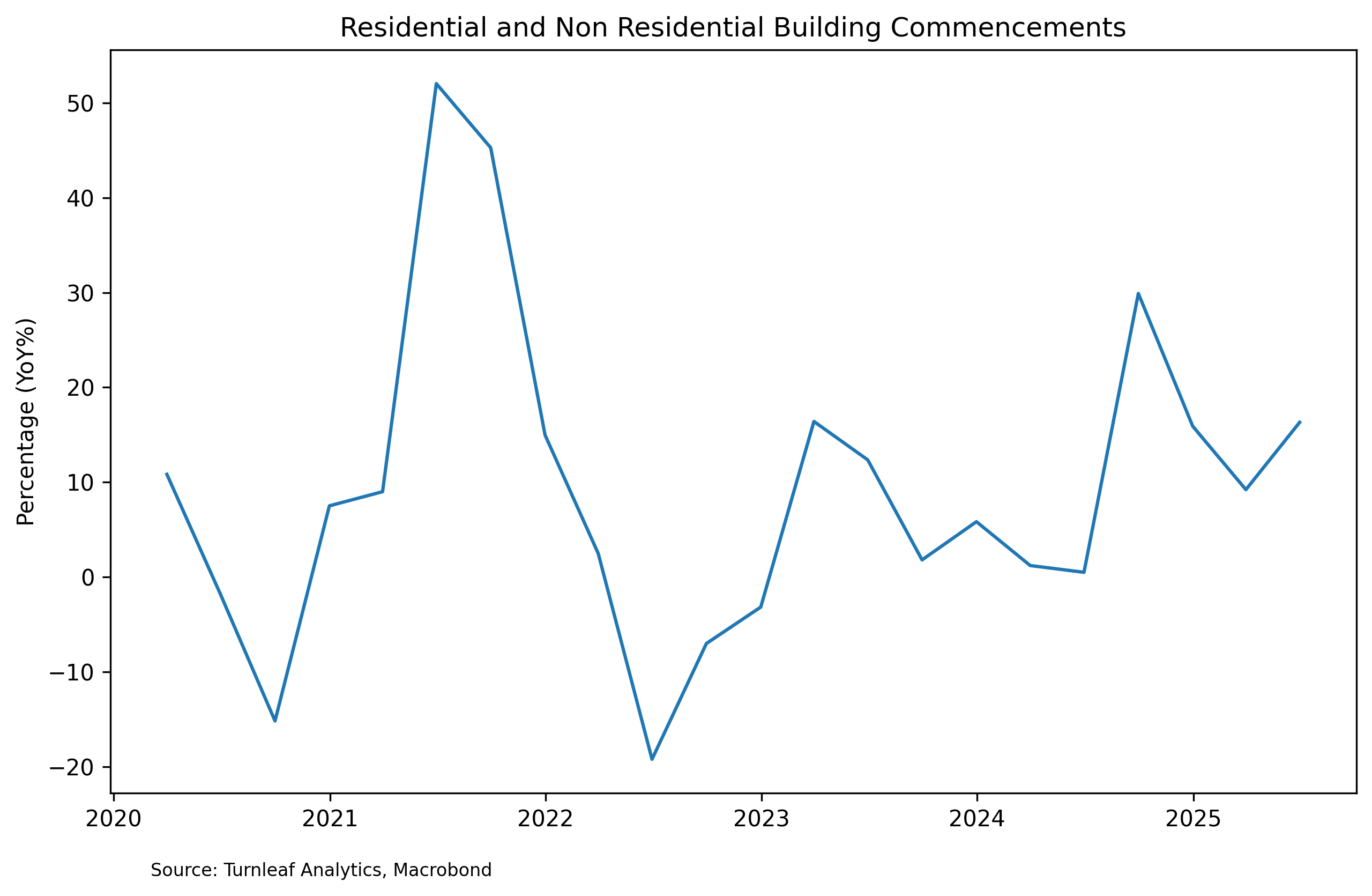

Housing costs have been a primary talking point for Australia’s cost-of-living crisis for the past few years. The average weekly rent recorded quarterly, though steadily declining, remains fairly elevated at 6%YoY for 2025 Q3 (Figure 3). With a recent uptick in residential and non-residential building commencements underway (Figure 4), we could see housing supply loosen in the next six to nine months, putting downward pressure on prices. However, at this rate, demand continues to outstrip supply, meaning any relief will be gradual rather than immediate.

Figure 3

Figure 4

To read the rest, visit Turnleaf’s latest Substack post, here.

Research Archive

Macroeconomic Insights: Tariff Reprieves and Market Uncertainty — Implications for Inflation and Growth

Late last Friday, the U.S. administration announced exemptions for phones, computers, and chips from Trump's tariffs after imposing a 145% tariff against China – a large exporter of electronics - a few days ago. It is becoming increasingly clear that the upward price...

The dollar, yields and inflation

Harold Wilson once said a week is a long time in politics. He might have had the foresight to be referring to Liberation Day and the subsequent fallout into markets. One particular point that has been raised by many market participants is the recent fall in the dollar...

Macroeconomic Insights: 90 More Days of Letting the Data Speak

Within hours of the large-scale tariffs taking effect, the Trump administration announced a 90-day pause, replacing the full tariff package with a baseline 10% rate. China—among the first countries to respond with retaliatory tariffs—was excluded from this pause and...

Macroeconomic Insights: Tariffs Shock U.S. Inflation Expectations

The recent imposition of sweeping U.S. tariffs has triggered a sharp stock market selloff, erasing up to $2.5 trillion in market value. More importantly, this sell-off reflects rising expectations of inflation pressure and global recession risk. In response to this...

Neudata 2025 London conference

I recently attended the Neudata conference on alternative data in London. I had last gone quite a few years ago, and I was pleasantly surprised about how much bigger the event had become. Alternative data has become an important part of the financial services...

Liberation Day Arrives – Market Prints Fall in Line with Turnleaf Expectations

Yesterday, President Trump announced a minimum 10% tariff on all imports into the United States, with higher rates targeted at countries running large trade surpluses with the U.S. Notably, Canada and Mexico are exempt from these new measures. For many analysts, the...