Featured Research

Macroeconomic Insights: Eurozone CPI — “Sweater Weather” Is Repricing Energy Risk

Energy markets have moved back to the foreground as a near-term driver of Eurozone headline inflation. Colder January temperatures lifted heating and power demand into a winter that began with below-normal gas storage, pushing TTF higher and increasing the system’s...

Macroeconomic Insights: Eurozone CPI — “Sweater Weather” Is Repricing Energy Risk

Energy markets have moved back to the foreground as a near-term driver of Eurozone headline inflation. Colder January temperatures lifted heating and power demand into a winter that began with below-normal gas storage, pushing TTF higher and increasing the system’s sensitivity to incremental shocks.

At the same time, Europe’s post-2022 reliance on US LNG supply has strengthened the link between domestic weather outcomes and global LNG clearing prices, reinforcing the transmission from gas into electricity in gas-marginal markets. While CPI pass-through remains uneven across countries and is partly damped by regulated and tax-heavy retail price structures, Turnleaf expects a modest upwards shift in its Eurozone baseline inflation forecast over the next 12 months (Figure 1 – see our latest Substack post here).

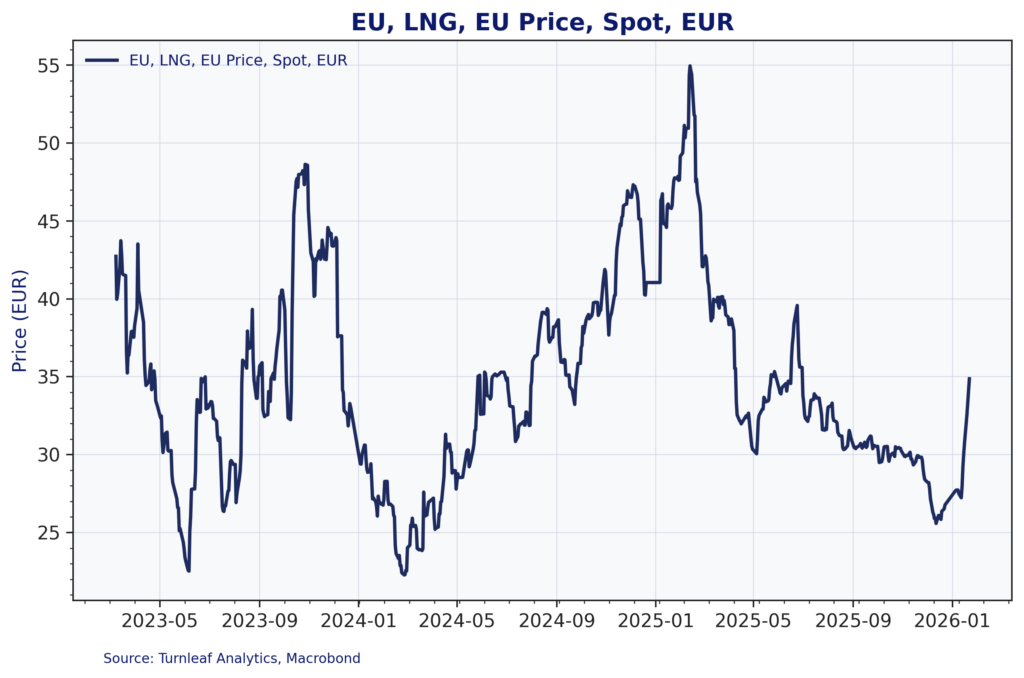

European gas prices (Dutch TTF) rose sharply in January as colder temperatures tightened the heating and power balance against an already constrained storage position (Figure 2). EU storage has fallen to roughly 50% full versus a seasonal five-year average near 65%, which increases sensitivity to additional weather shocks and accelerates the need for spot procurement.

Figure 2

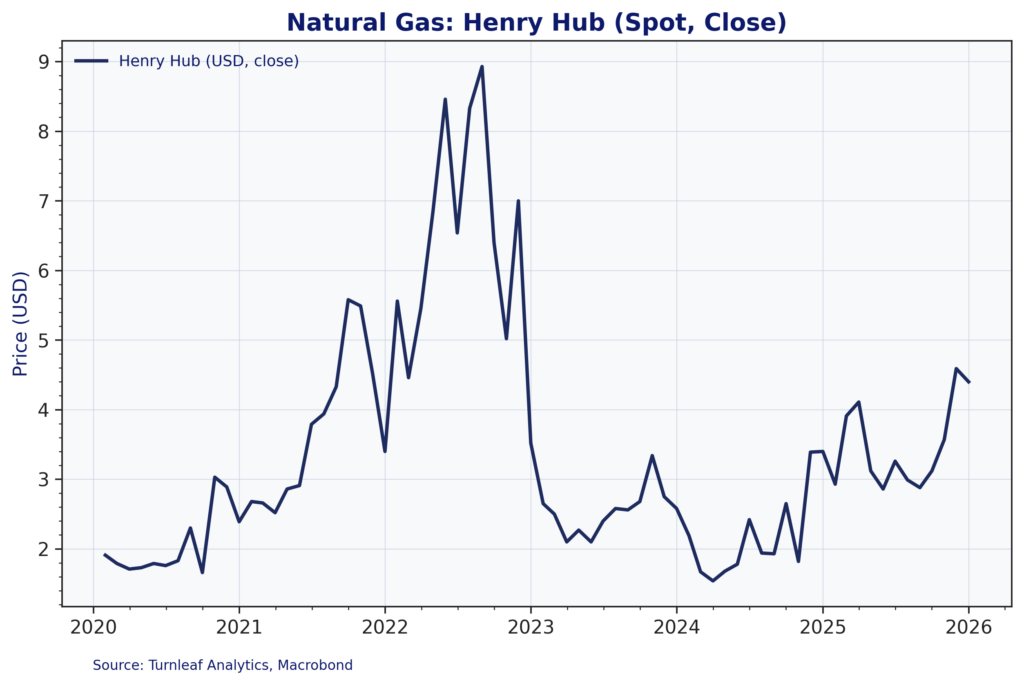

That tightening has been reinforced by global dynamics. U.S. gas prices also spiked as an Arctic blast boosted heating demand and raised concerns around operational disruptions, lifting Henry Hub and increasing marginal costs for LNG exporters (Figure 3). Colder conditions in Asia have added further competition for LNG cargoes.

Figure 3

Natural gas remains a key marginal fuel for electricity pricing across much of Europe, and the inflation relevance of this channel is being reinforced by structurally higher power demand tied to electrification. As peak-load conditions become more frequent, the system leans more often on dispatchable generation—precisely when gas is most likely to set the marginal price.

Since 2022, Europe’s pivot away from Russian pipeline gas has coincided with rapid growth in U.S. LNG shipments into the region. By Q3 2025, the United States supplied roughly 60% of EU LNG imports, materially increasing Europe’s exposure to global LNG market conditions. This winter’s weaker storage starting point has compounded that vulnerability, leaving TTF more responsive to cold snaps and to disruption risk in global LNG flows. Policy headlines have also contributed a short-lived risk premium at the margin. In mid-January, President Trump threatened tariffs on several European countries in connection with the Greenland takeover, before subsequently stepping back from an immediate tariff plan following talks in Davos.

CPI Pass-Through

In gas-marginal electricity markets (e.g., Italy), CPI pass-through is typically faster because wholesale power prices respond directly to moves in gas spot costs. This is one reason heating gas remains a key input in our Italy framework given its linkage to electricity pricing.

France, supported by a larger nuclear base, is relatively more insulated through the power channel, although gas still influences heating and parts of industry. We expect the brunt of the impact in February, when France resets regulated electricity tariffs, and our latest 12-month forecast curve has moved higher (Figure 4 – see our latest Substack post here).

In Germany, renewables represent a larger share of power generation, but gas still often sets electricity prices during periods of high demand and/or low renewable output. Ongoing plans for additional gas-fired capacity as backup generation reinforce the point that elevated gas prices can still feed through into German inflation via electricity.

Spain, with higher renewable penetration, typically experiences less direct pass-through under normal conditions, but can still see sharp power price spikes when gas plants set the marginal price, creating episodic inflation pressure through electricity costs and regulated tariff adjustments.

Limited Upside Pressure for Fuel

While higher fuel prices add some upward pressure to inflation, Turnleaf’s Eurozone model suggests near-term pass-through remains constrained. This largely reflects retail fuel price structures across the Euro Area, where taxes and regulated components make up a significant share of the final price and dampen short-term volatility. In France, these features tend to smooth and delay the impact of wholesale swings; in Italy, transmission can be quicker but remains limited by the high tax content of pump prices.

More broadly, the latest fuel-price gains appear driven by a mix of tighter natural-gas fundamentals and a temporary rise in geopolitical and supply-risk premia. Taken together, this points to an inflation impulse that is likely to be modest and short-lived, and we do not view recent fuel price movements as a material shift in the broader inflation outlook at this stage.

What We Leverage in Turnleaf’s Eurozone Framework

Turnleaf’s Eurozone framework is built to translate energy-market shocks into inflation outcomes as they develop. We use high-frequency uncertainty indices to separate volatility driven by geopolitical and policy headlines from changes in underlying fundamentals. We incorporate high-frequency weather data (daily temperatures and precipitation) to quantify demand shocks that flow through heating and power load. We then track wholesale gas and electricity prices, which embed both marginal input costs and risk premia and are typically the first markets to reflect tightening conditions. Finally, where available, we anchor the signal using explicit supply-demand indicators like storage trajectories and LNG flow constraints which determine how quickly the market must clear through spot pricing when buffers are thin.

This structure allows us to capture the full chain from weather and risk sentiment to gas and power pricing, and ultimately to CPI pass-through in near real time. As new prints come in, we update the forecast path accordingly.

Research Archive

We still need to learn to code

If I go to burger joint somewhere outside the UK, I’ll usually look at the price and mentally convert it into GBP. I guess I could use a calculator, but it seems slightly...

Takeaways from TradeTech FX USA 2024

In recent years, more financial firms have begun to open up offices in Miami, in particular a number of prominent hedge funds. It has also been the home of TradeTech FX USA for a...

Different ways to assess forecasts

Let's say you want to know what a burger will taste like. You look at the ingredients, and to some extent you'll be able to "forecast" what it'll taste like. Part of the...

How can we improve inflation forecasts

Just imagine you ordered a cheeseburger. Then low and behold, a salad is brought to your table. The probability of such a thing happening is not zero, especially in a busy...

Hundreds of quant papers from #QuantLinkADay in 2023

I tweet a lot (from @saeedamenfx)! In amongst, the tweets about burgers, I tweet out a quant paper or link every day under the hashtag of #QuantLinkDay, mostly around FX, rates,...

What can Warren Buffett and Charlie Munger teach quants?

I've been a fan of Warren Buffett and Charlie Munger for many years. Indeed, I’ve lost count of the number of times I’ve been to Omaha to hear Warren Buffett and Charlie Munger...

Forecasting Inflation: Can Machines Outperform Economists?

On the cusp of a new year, the question top of mind for many governments, businesses and individuals must be “What will economic growth and inflation be in 2024?” After all,...

Data Insights – Our first high frequency forecast for the United States

We are pleased to announce that we are starting to update our inflation forecasts on a weekly basis. Our first weekly forecast is for the United States, where: our model expects...

Data Insights – What Happened to Eurozone Inflation

Headline inflation for Eurozone was released today (8.5%) and it came as a surprise against the short-term consensus (9%). Our prediction for this reading (8.8%) published one...

Data Insights – Spain Inflation (Not a Surprise)

Headline inflation for Spain was released today (5.8%) and it came as a surprise against the short-term consensus (4.7%). Our prediction for this reading (5.79%) published one...