Global Inflation Amid Trade Uncertainties

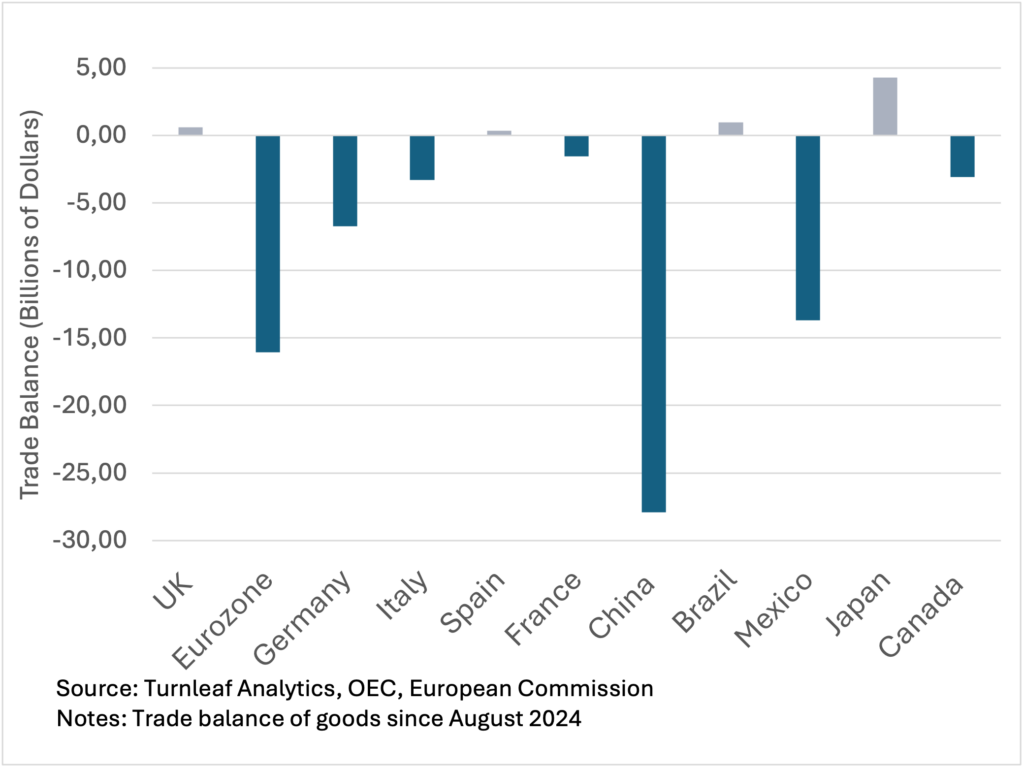

Good afternoon and welcome to Turnleaf’s global inflation call. For the past month, global inflation expectations have been shaped by global trade uncertainty as proposed U.S. tariffs could hurt key global industries while China’s struggle with low inflation and growth drags on external demand for many countries. Trump has continuously emphasized the need to rebalance trade by imposing tariffs against economies that run significant trade deficits. Since August 2024, the Eurozone, China, Canada and Mexico have maintained some of the largest deficits of traded goods with the United States and to a minor extent Germany, Italy, and France as well. Since the beginning of this week, Trump has proposed imposing a 25% blanket tariff against Canada and Mexico, and an additional 10% tariff against China on his first day in office in January 2025.

Economies Maintaining Trade Deficits with the U.S.

The outlook of global inflation will depend on whether tariffs become more targeted toward specific industries or continue as blanket measures against countries. It will also depend on how affected countries respond by redirecting trade routes or adding equivalent levies to their own American imports. Meanwhile, a hostile trading environment leaves China increasingly vulnerable, as subdued domestic demand and high local government debt strain liquidity. Together, trade uncertainty continues to strain currencies, hurt manufacturing, and destabilize global post-COVID economic recovery.

United States:

Trump’s anticipated tariff announcements and threats of mass deportations of undocumented workers have pushed our U.S. inflation outlook higher over 2025. Here, we present our forecast for how U.S. inflation is expected to evolve over the next year and compare our estimates in red to the market, in green. Turnleaf expects U.S. inflation to peak by the beginning of 2025 but remain above its 2% target through the end of the next year. With uncertainty around the impact of Trump’s policies, we focused on incorporating data into our models that captured consumer and business expectations for the future that indirectly capture probabilities of different policy outcomes Trump decides to pursue. After the election, we saw the market adjust in line with our projections, highlighting Turnleaf’s ability to leverage these forward-looking indicators ahead of the broader market.

Looking forward, the appointment of hedge fund manager Scott Bessent as Treasury Secretary could indicate a softer stance on tariffs, support for regulatory rollbacks, and prioritize deficit reduction—factors that collectively exert downward pressure on inflation expectations. We will make sure to adjust our forecasts accordingly as we have more clarity on Trump’s policies in the coming months.

United Kingdom:

Given increased public spending outlined in the 2025 Autumn Budget and growing concerns over the impact of U.S. tariffs, Turnleaf has revised its inflation forecasts for the UK upwards, expecting inflation to fluctuate between 2% to 3% for the next 12 months. Our projection for inflation is largely in line with the Bank of England’s benchmark in blue, albeit slightly lower. Tariffs affecting Chinese rubber and metal commodity markets, alongside shifting demand within an already vulnerable automotive industry, could lead to downward pressure on UK manufacturing prices. Trump’s interest in revitalizing American fossil-fuel industries could also mean lower energy prices for the UK, a major importer of U.S. fuel. Interestingly, the UK and US both report trade surpluses with each other due to differences in data collection, which could help avoid direct tariffs on its exports.

Eurozone:

The Eurozone, which reached its 2% inflation target in September 2024, is expected to hold inflation slightly above 2% through 2025. Our estimates, in red, follow the market, in green, but oscillate around the European Commission’s benchmark estimate. Our core inflation outlook — another important indicator for the ECB in deciding whether to cut rates—aligned with our expectations this month, and we expect a similar number next month. However, a significant drop in core inflation over the following months could provide the ECB with more reason to lower rates. That said, the seasonal adjustment patterns for core inflation in the Eurozone are very important, but have been shifting in recent years, making the January 2025 inflation forecast more difficult to predict.

The recent rise in inflation in the last month primarily reflects base effects, as last year’s steep energy price declines are no longer included in YoY CPI calculations. A steady drop in service prices will be key to keeping inflation stable around the target. Declining manufacturing output and weakening business sentiment, amplified by tariff threats, could prompt the ECB to cut rates sooner as recession fears grow across the bloc. An influx of diverted Chinese goods into the European market could also lower prices and push domestic competitors out of business. Export-dependent economies like Germany are particularly vulnerable. However, if the ECB cuts rates before inflation is firmly anchored, rising prices—compounded by higher import costs from potential retaliatory tariffs—could reignite inflationary pressures.

A closer look at the Eurozone:

As we take a closer look at the Eurozone, it’s worth highlighting that our estimates, forecasted a week ago, align closely with the estimated values for November 2024, released this morning. An updated forecast will be uploaded on Monday.

Germany:

Germany continues to struggle with sluggish economic growth, weighed down by weak business confidence in manufacturing, growing global competition in exports, and less favorable base effects for energy prices. While wage growth is outpacing consumer price increases, higher savings rates and declining consumer confidence underscore Germany’s negative growth outlook. The country’s automotive industry faces significant challenges from Trump’s tariffs, whether applied directly to Germany or indirectly to key markets in its supply chain, such as China. Given Germany’s high exposure to tariff risks, Turnleaf expects its inflation to stay above 2% through 2025, surpassing the inflation outlook of its Eurozone peers.

France:

In contrast, France, which hit its inflation target in September 2024, is expected to keep inflation below 2% throughout next year. The country’s service PMI eased as client spending dropped, reflecting weaker demand amid economic and political uncertainty. While past wage gains provided some support, concerns about a declining standard of living and reduced savings capacity point to slower growth ahead. Additionally, France’s relatively high reliance on manufacturing leaves it more exposed to tariff risks.

Spain:

Spain has managed to enjoy considerable growth relative to its peers, while overcoming its inflation challenges. While recent flooding temporarily pushed up energy prices in some areas, Turnleaf expects inflation to stay below 2% for most of 2025, well within target. However, concerns linger as recent ECB rate cuts have lowered mortgage rates, driving up house prices in Spain.

Italy:

In Italy, inflation is expected to stabilize slightly above 1% throughout 2025, as high interest rates continue to shrink the economy, impacting the manufacturing sector. Low consumer confidence is keeping domestic demand subdued. Meanwhile, tariffs are expected to impact Italy’s automotive industry, which relies heavily on the U.S. as its largest export market. Tariffs are expected to raise the cost of Italian cars for American buyers, reducing demand and driving down industry prices, while reduced government subsidies further strain revenues.

China:

Low inflation continues to challenge China’s ability to meet its 5% year-end GDP growth target. While Turnleaf expects a modest rise in inflation over the coming months following the October 2024 economic stimulus package, overall stabilization is projected around 1% through 2025. It’s also worth noting that Chinese inflation is highly seasonal, with sudden spikes in consumer spending during celebrations like Chinese New Year potentially influencing the country’s future inflation trajectory.

Over the past year, China has faced declining domestic demand, which has weighed heavily on its manufacturing sector. At the same time, rising tensions with the West have led to restrictive trade policies, cutting into exports of key products like electric vehicles and semiconductors—areas where China has become a strong global competitor. The recently announced 10% tax on all Chinese goods entering the U.S. is likely to worsen China’s low inflation concerns.

Japan:

Rising import costs, resulting from yen devaluations, are expected to push Japan’s preferred inflation measure – CPI Excluding Fresh Food – upwards. Tokyo Core – which was released today, also came in line with our expectations. Next year, Turnleaf anticipates that Japan’s inflation will remain elevated, with any potential decline likely occurring around mid-year. Growing public dissatisfaction with rising living costs has pushed the government to extend electricity subsidies between January and March 2025, alongside adjustments to a stimulus package designed to ease consumer cost pressures for low-income earners. At the same time, Trump’s tariffs targeting China, Canada, and Mexico, along with weakened Chinese demand, are expected to further strain Japan’s economy by reducing its export potential to China.

LATAM

U.S. tariffs on China could significantly impact Latin American markets with strong trade ties to China. As these trade dynamics shift, closely monitoring currency trends will be important, as devaluation often signals weakening external demand for LATAM exports.

Brazil:

Brazil has so far avoided direct U.S. tariffs but remains vulnerable to external demand risks from both China and the U.S. Drought-related pressures have driven up agricultural costs, while a strong labor market and increased government spending continue to add to inflationary pressures. Weaker demand from China is also contributing to the depreciation of the Brazilian real. Turnleaf projects Brazil’s inflation to stay elevated at around 5% through 2025, consistent with the higher-than-expected mid-November inflation reading, which aligned with our long-term outlook. The future path of Brazilian inflation will largely depend on the success of structural reforms in government spending. Recently, Brazil’s Finance Minister recently unveiled a fiscal package that included plans to cut spending and increased tax cuts to the middle-class that will be paid by high earners.

Mexico:

While 2025 is expected to bring some inflationary relief for Mexico, inflation is still projected to remain above its 3% target through year-end. As an export-driven economy and the U.S.’s largest trading partner, Mexico will face significant challenges from Trump’s 25% tariffs. These tariffs are expected to raise export prices to the U.S., leading to sharp declines in external demand and subsequent devaluations to the Mexican peso. Under the Trump administration, these dynamics are likely to amplify inflationary pressures, increasing the strain on both consumers and businesses.

Global Inflation Outlook: Key Insights

Protectionist trade policies and increased deficit spending under Trump place upwards pressure on U.S. inflation. Trade uncertainty disincentives investments which drag export production regardless of whether tariffs are imposed. Therefore, we should expect markets to price in different tariff scenarios conditional to risk exposure and to probabilities of trade diversion or tariff retaliation until formal policy commitment are made.

Countries in the Eurozone, particularly, Germany, with greater exposure to affected export markets, may face disinflationary pressures in their manufacturing industries as value-chains linked to China face cost pressures from tariffs. Moreover, China may shift its focus to the Eurozone, the world’s third-largest market, to offset losses in other export markets, potentially driving down prices in the region as competition intensifies. European Central Bank President Christine Lagarde recently stated that embracing Chinese exports in a tariff scenario would be a more favorable approach than further isolating Europe from China.

High exposure to commodity markets make LATAM and Japan more sensitive to China’s slowdown. Together, expectations related to low external demand and tariffs could make exports less competitive leading to currency devaluations and worsening manufacturing conditions as we’ve seen in the last couple of months. This is turn, could raise import costs as we’ve seen in Brazil and Japan, coupled with wage gains put upwards pressure on inflation. At the same time, diversion into less competitive markets for China could strengthen trade relations with other export-driven economics affected by tariffs insofar as China’s growth improves over the next year. Inflation pressures may increase broadly if tariff-hit countries decide to retaliate with their own tariffs.

Turnleaf is committed to closely monitoring shifts in domestic and global policies that could impact the trajectory of global inflation, updating our forecasts as needed. Should you have any questions, feel free to send us an email. We’ll be looking forward to our next global inflation call.