When we forecast inflation, our goal is to account for as much explainable variation as possible, using available data and reasonable assumptions about how prices evolve. Indicators like softening unemployment or falling industrial production typically signal weaker future inflation, because they capture tangible shifts in employment and output. Yet in practice, there is always some portion of inflation that remains unaccounted for. Turnleaf believes right now much of this “missing” variation stems from uncertainty: when businesses and consumers lack consistent or credible information about the economy, they deviate from the behavior that conventional models predict.

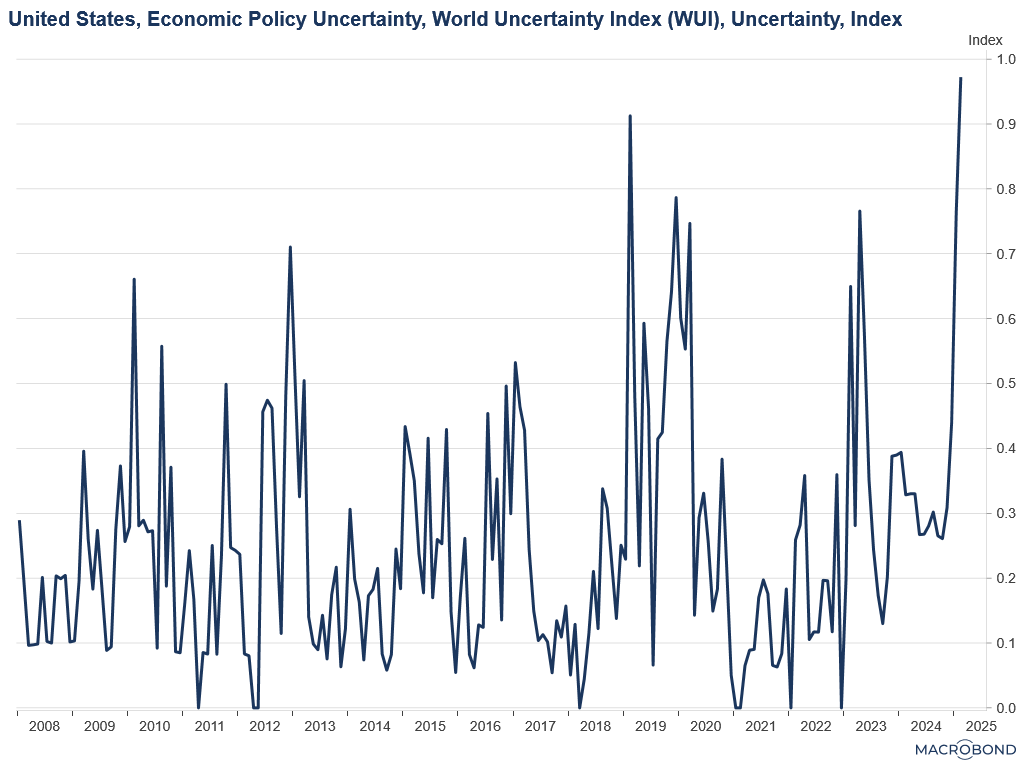

In the United States, this uncertainty has intensified under Trump’s unconventional tariff policies. Frequent shifts in position and foreign policy pronouncements make it harder for firms and consumers to plan. Turnleaf has flagged indicators that reflect these tensions, including increases in the World Uncertainty Index (Figure 1) and changes in the Rolled Corruption Media and Military Tone within our proprietary Media Volume Monitor. The Survey of Professional Forecasters and measures such as the University of Michigan’s Current Economic Conditions Index also point toward rising inflation expectations—and, at worst, a risk of stagflation.

Figure 1

Trump’s recent announcement of a 25% tariff on Canada and Mexico, alongside a 10% tariff on China, highlights how uncertainty can overshadow even concrete policy measures. Initially, affected countries negotiated for exemptions, and the market assumed tariffs might be softened. Yet despite subsequent adjustments—like granting automakers an extra month to adapt—fear of higher import costs spooked the Dow. Because investment decisions do not adjust immediately, our models have not yet fully captured the potential fallout. Instead, the mere anticipation of tariffs and the indecisiveness surrounding their scope have steadily driven up expectations of inflation.

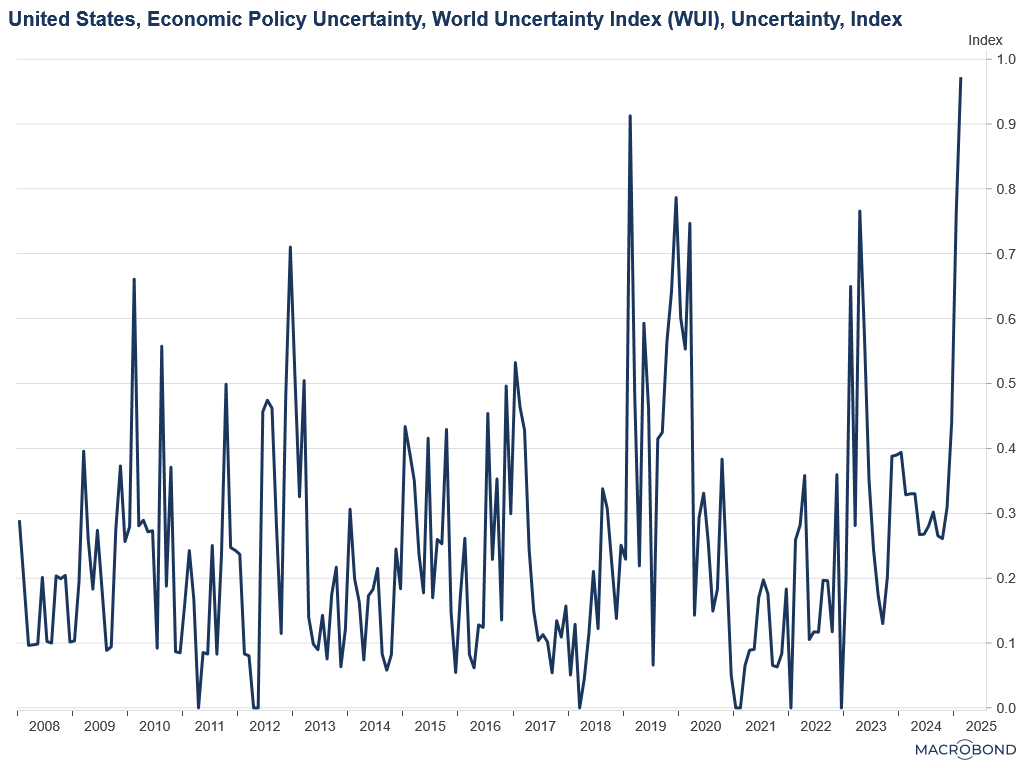

Interestingly, our models do not show a significant front-loading of inventories by manufacturers. From late 2024 into 2025, the inventories-to-sales ratio for total U.S. business in manufacturing and trade appears to edge downward, suggesting that companies are maintaining leaner inventories relative to their sales (Figure 2). With elevated uncertainty around tariffs, monetary policy, and global demand, firms are hesitant to overstock; carrying costs remain high.

Figure 2

The net effect is a ratio that is still above pre-pandemic lows but below the peaks of 2020–2021, when supply-chain disruptions caused severe imbalances. By late 2024 and into 2025, more predictable logistics and steady—though not booming—sales are prompting firms to hold inventories just high enough to meet demand without tying up unnecessary capital. This downward drift in the ratio often aligns with an economy that is growing at a moderate pace, where businesses are neither bracing for a sharp downturn (which would drive ratio spikes) nor racing to meet outsized demand. Instead, they are managing stock levels carefully, reflecting cautious optimism about the near-term outlook.

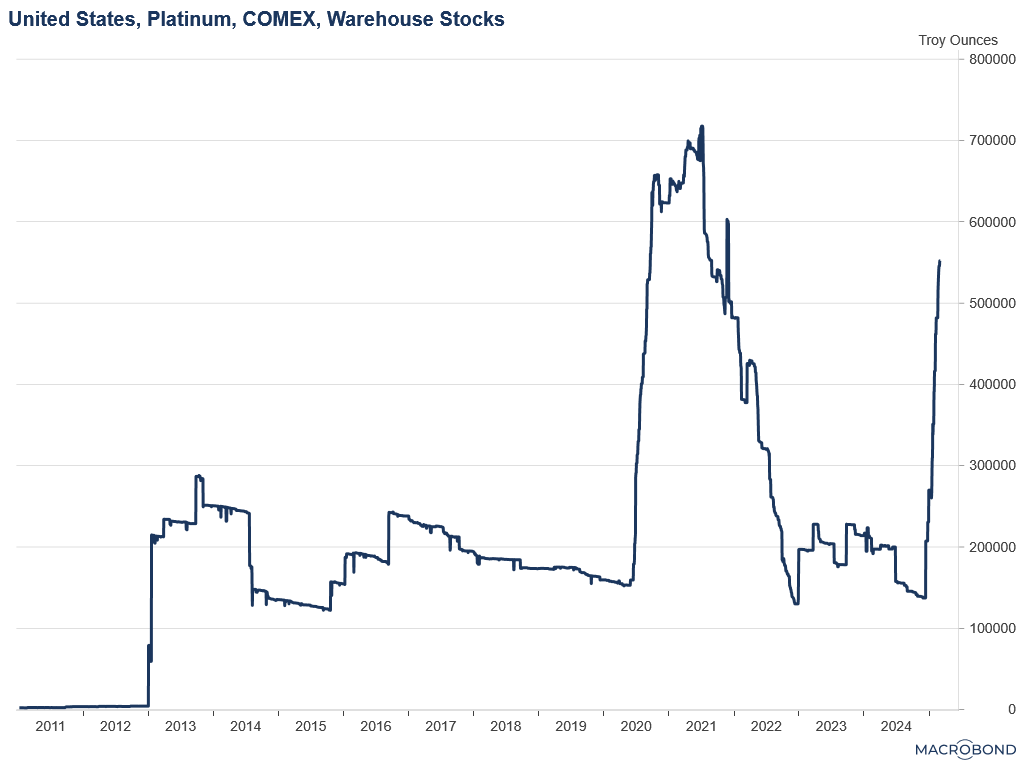

In the context of manufacturing, COMEX platinum inventories continue to rise (Figure 3), suggesting industrial metal holders prefer warehousing their assets rather than using them in production. That choice aligns with a global auto slowdown: the U.S. auto sector remains under pressure, with exports weakening further -13.07% YoY since February 2025.

Figure 3

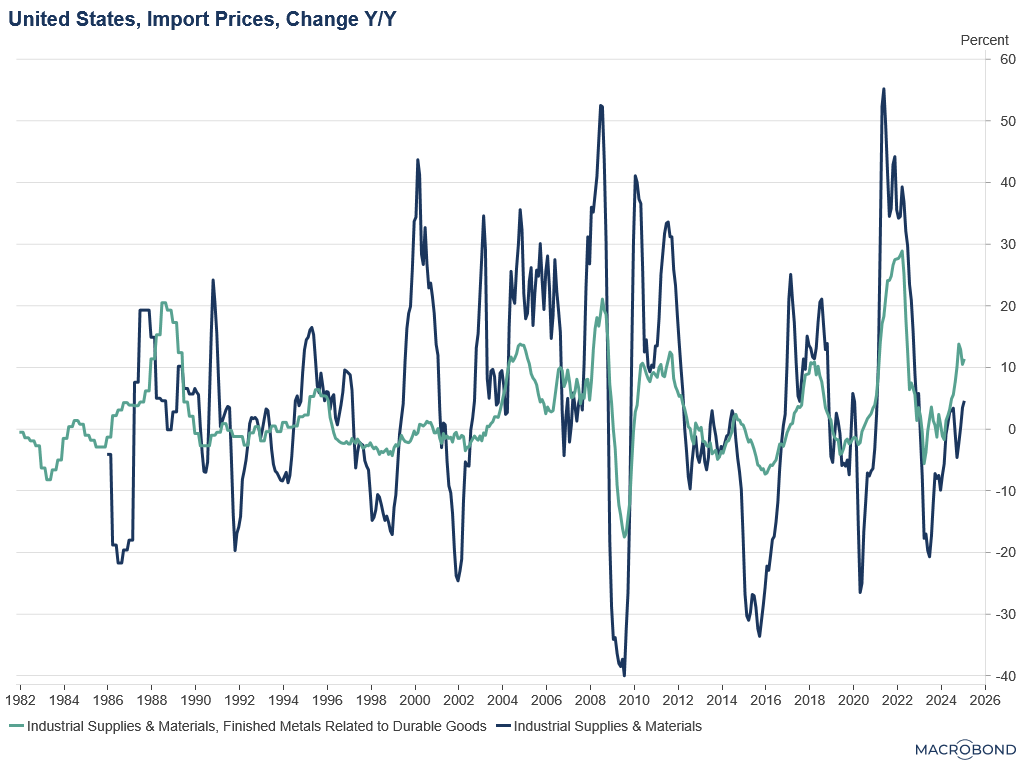

Slapping tariffs on already-vulnerable industries without any meaningful buffer for higher input costs raises the possibility of a recession (Figure 4). Until those conditions become acute, however, producers may pass on higher input costs to consumers, fueling inflation. In this scenario, behavioral shifts can override traditional economic signals, especially when firms and households act on the belief that future conditions will deteriorate.

Figure 4

Given how much uncertainty is now influencing inflation markets, we must rely on alternative data—such as firm-level investment decisions and speculative commodity positions—to complement more traditional indicators. Whether or not tariffs ultimately dent the U.S. inflation curve is less critical than acknowledging the damage wrought by their uncertain status. Turnleaf projects inflation will hover at around 3% by mid-2025 and persist through year’s end. Our models capture the subtle but powerful effects of behavior under uncertainty, highlighting a future where even moderate shifts in policy or global sentiment could further reshape the inflation path.