In 2024, volatile vegetable prices repeatedly triggered in-market releases from India’s Price Stabilisation Fund (PSF). PSF, launched in 2014–15, was designed to curb extreme price swings in key perishables—initially onions and potatoes, later pulses—by allowing the government to buy and stockpile these crops and then release them into the market as needed. This is a dynamic our model could only initially infer through proxies such as rainfall, crop yields and broad agricultural indices. Those proxy signals muddied our view of true supply–demand trends and led us to overstate underlying food-price momentum when interventions were at their peak – though we performed better than consensus.

A generously wet monsoon and an abundant kharif harvest reversed last year’s scarcity. Wholesale and retail prices for onions and potatoes plunged, and PSF activity disengaged. This quieter intervention environment cut the volatility in PSF operations in half versus 2024 and taught our model to expect lower food inflation—contributing to our more subdued CPI outlook for mid-2025. Though retail prices for some vegetables have begun to increase, they mostly remain low in annual terms.

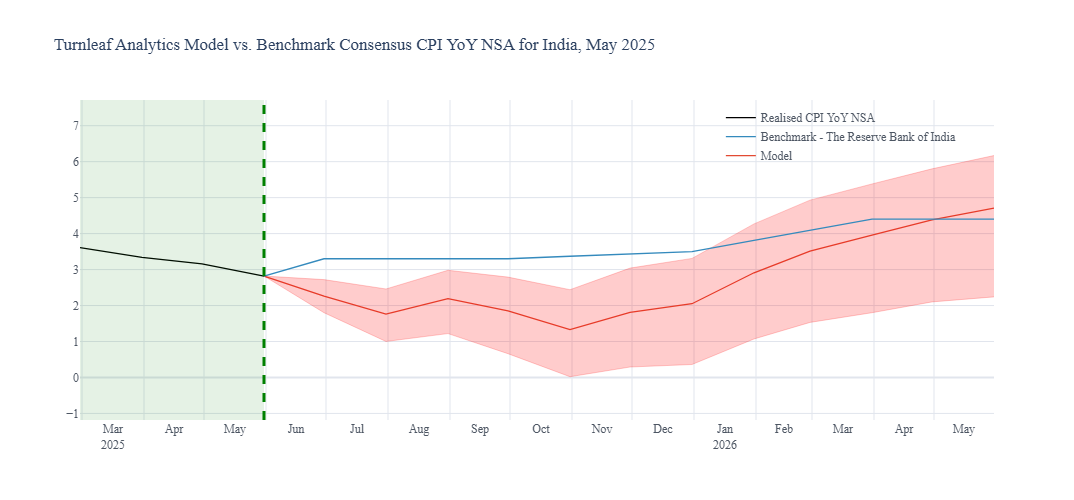

Several factors underpin our more subdued outlook. First, the seasonal rhythm of India’s fields means prices traditionally plunge after the September–October harvest—something we’re already seeing in pulse, cereal and vegetable data. Second, above-normal monsoon rains have only deepened that bounty, removing the supply shocks that drove last October’s CPI leap to nearly 4.9 percent. Third, global pressures—oil, import costs and producer-price inflation—remain muted, while core domestic demand shows no sign of running hot. Together, these elements have driven food CPI down to about 1 percent year-on-year by May and are expected to keep it there through mid-2025.

We’re not alone in this view. After May’s dramatic drop in food prices, many forecasters have pushed their FY 2025–26 CPI projections into the mid-3 percent range—well beneath the RBI’s 3.7 percent target (itself trimmed from 4.0 percent just one quarter earlier). For example, Nomura cited data for the first 10 days of June suggests inflation will drop to around 2%YoY month-end, reflecting softer food prices and weak demand and strengthening our conviction that disinflation in India will continue.

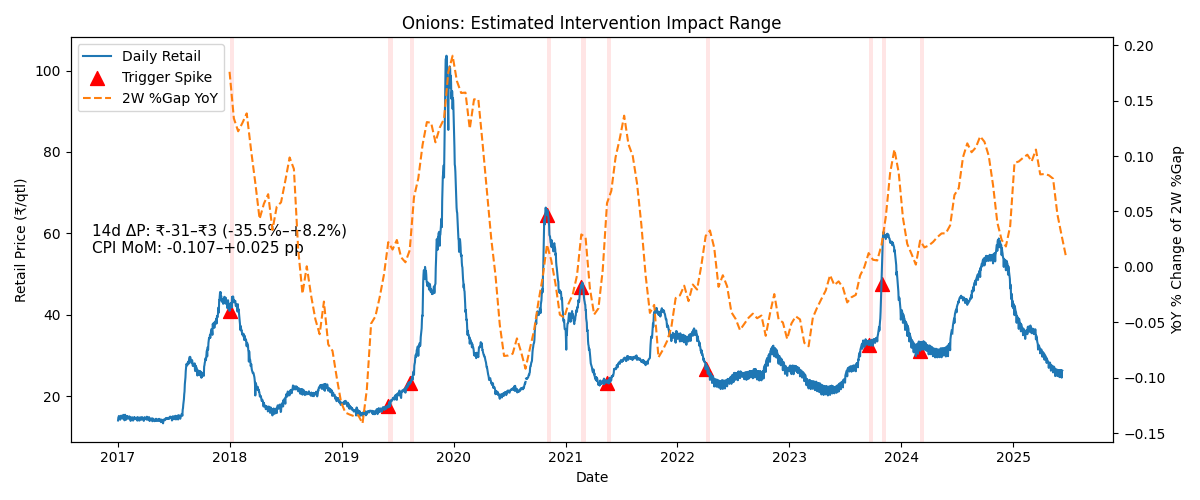

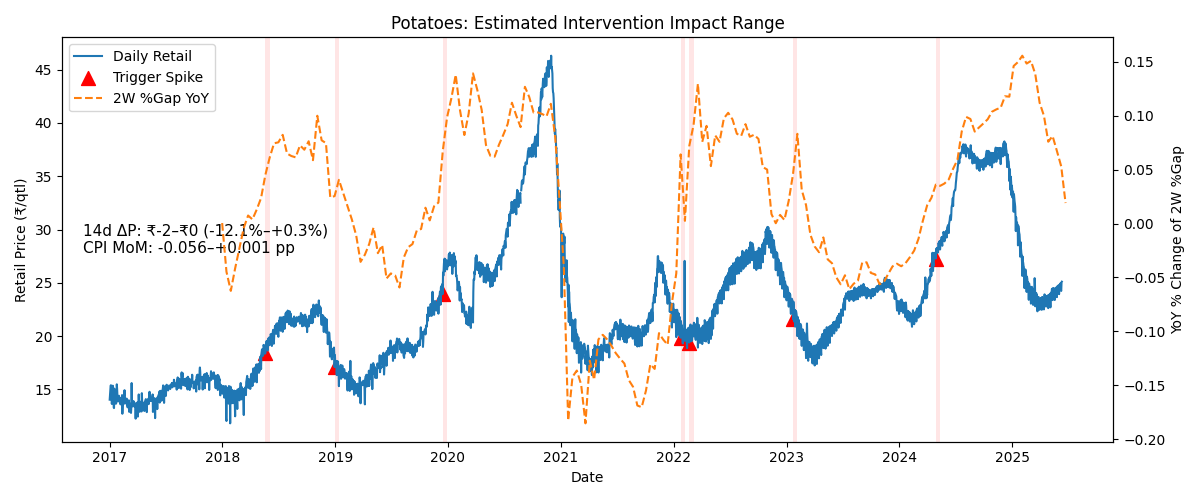

Yet to ensure we avoid a PSF surprise, Turnleaf has built a direct “intervention trigger” reference: a simple, real-time gauge of the two-week, year-on-year gap between retail and wholesale prices for onions and potatoes. We assume that when that gap spikes above its median and crosses a 2 percent threshold, the PSF is triggered to intervene in markets.

To estimate the overall CPI impact, we estimate counterfactual prices absent intervention and compare them with actual prices two weeks later. Translating price corrections into overall CPI impact by accounting for each vegetable’s weight and a 14-day window we estimate the following ad-hoc average adjustments.

- Onions: up to –0.10 pp CPI over 14 days

- Potatoes: up to –0.06 pp CPI over 14 days

By flagging those triggers, estimating counterfactual price paths, and translating the resulting corrections into their CPI impact, we can anticipate government interventions rather than exclusively through proxies.

The result is a richer, more resilient forecast: one that captures both the seasonal rhythms of India’s food market and the policy levers that smooth them. As we head toward the next monsoon and harvest cycle, our model anticipates fewer shocks, more abundant markets, and headline CPI comfortably under 4 percent for at least the next year. We will continue to watch the retail-wholesale price gap each week, so any return of PSF activity will be caught immediately and reflected in our outlook.