The October–November 2025 CPI sequence contained meaningful measurement distortions linked to the federal government shutdown. BLS has since confirmed that most CPI operations were suspended from October 1 through November 12, including data collection, and that October survey prices for commodities and services were carried forward because collection could not occur. These mechanics matter because they interacted with sharp Black Friday promotional sales and the CPI’s staggered pricing cadence, increasing the odds that measured inflation would be distorted in promotion-heavy categories.

November inflation data reflected these disruptions. BLS reported a 0.2 percent increase over the two-month period from September to November for both headline and core CPI on a seasonally adjusted basis. This compressed measurement window, combined with data collection that only began November 14 and therefore captured a disproportionate share of Black Friday promotional activity, makes direct comparison with prior months problematic. The 2.7% YoY headline rate and 2.6% core rate in November represented declines from September’s 3.0% readings, but the extent of this weakness likely overstates the underlying trend.

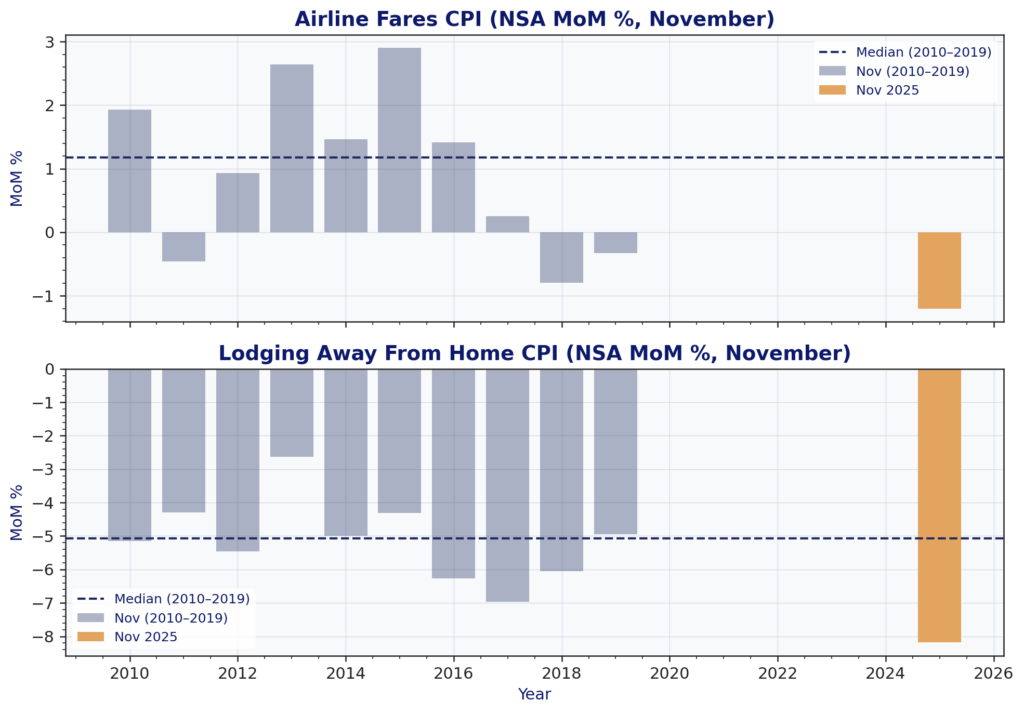

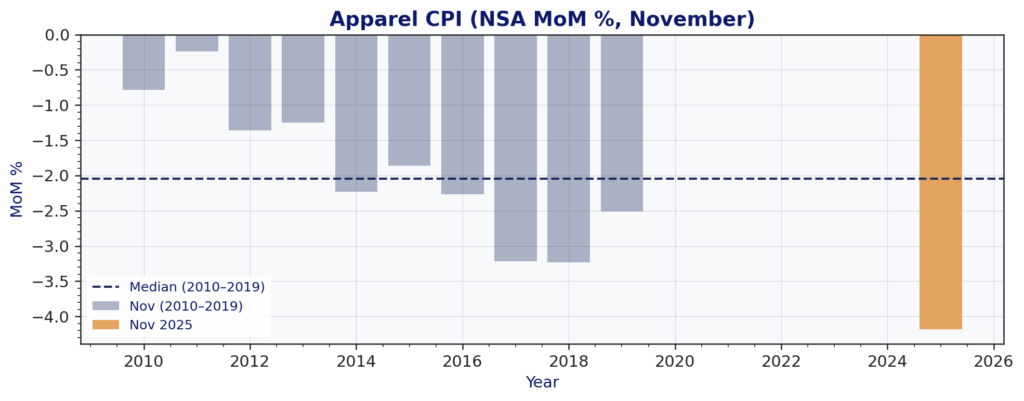

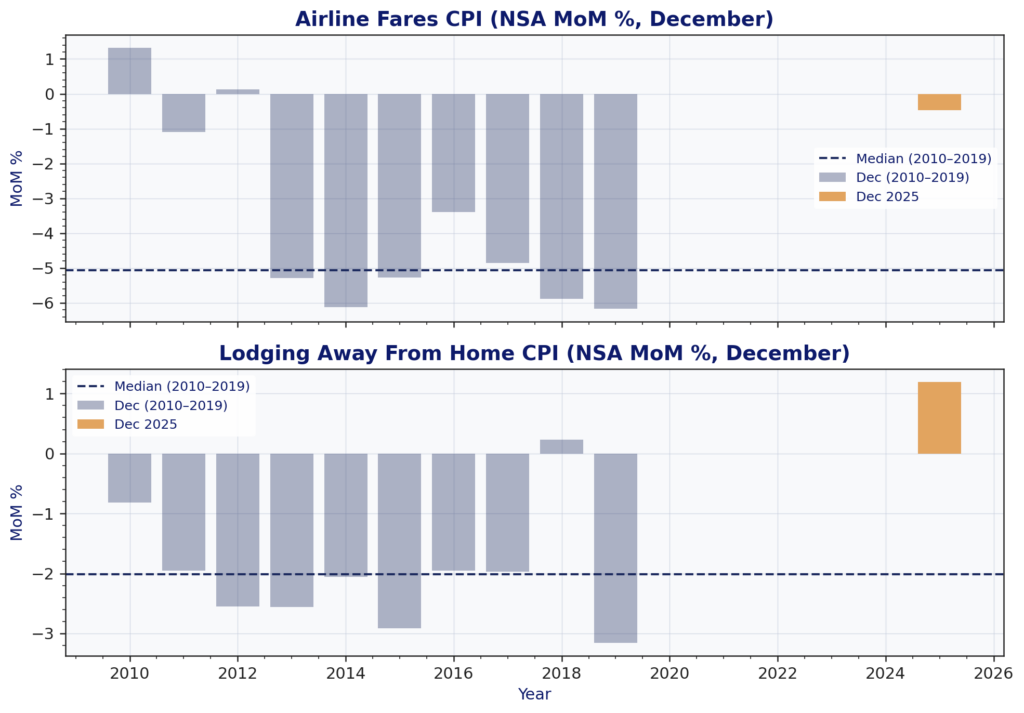

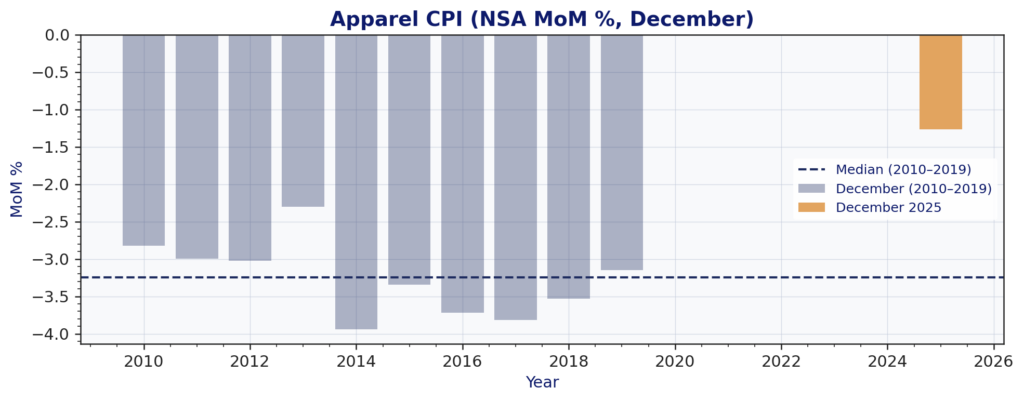

The December 2025 CPI release provides insight into how these distortions unwound. Headline CPI rose 0.3% MoM (SA) and 2.7% YoY, with core CPI up 0.2% MoM (SA) and 2.6% YoY. More importantly, the composition of December inflation aligns with a rebound where the distortion was concentrated. Categories most exposed to timing effects and promotional seasonality strengthened materially. Lodging away from home rose 2.9% MoM (SA), airline fares rose 5.2%, and apparel rose 0.6% (Figure 1). In our historical month-of-year comparisons, these categories moved from unusually weak November outcomes toward more typical December behavior, consistent with Black Friday discounting effects fading and collection timing normalizing.

Figure 1

November

December

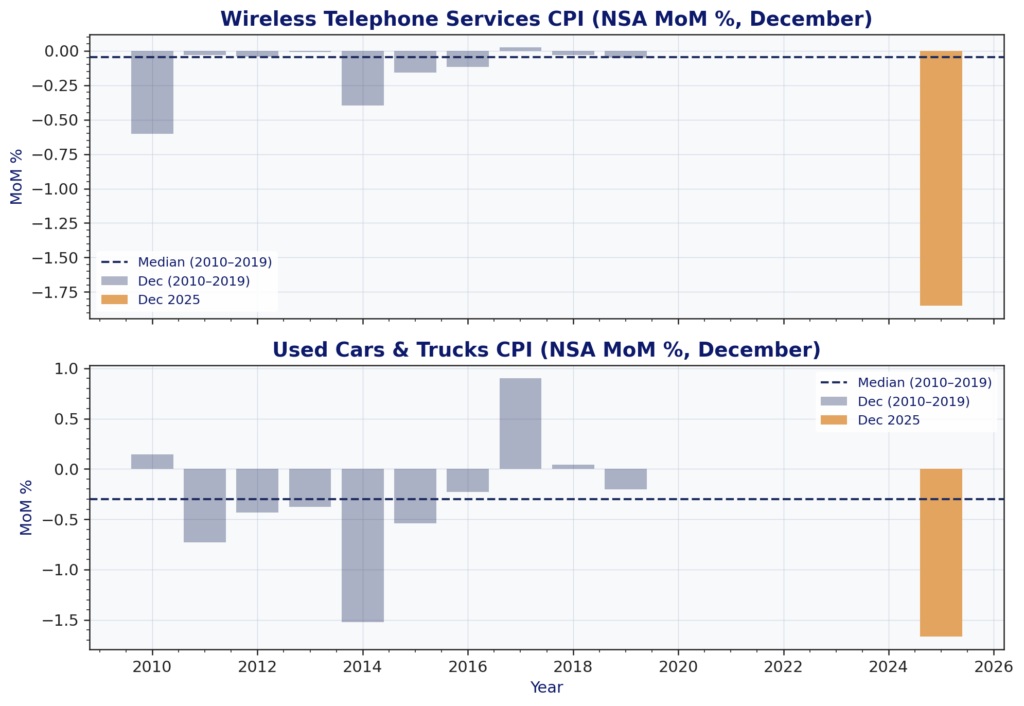

Nevertheless, the December data also demonstrate that shutdown-driven distortions were not the entire story. Several major categories fell in December, including communication at -1.9% MoM SA and used cars and trucks at -1.1%. Within communication, wireless telephone services declined 3.3 percent MoM (SA) (Figure 2). These declines indicate that December was not a uniform payback month across CPI. Alongside normalization in promotion-sensitive items, there were also pockets of genuine weakness or category-specific repricing.

The sharp decline in wireless telephone services warrants particular attention. While BLS switched to alternative data sources and hedonic quality adjustment methods for this category starting in July 2025, the December decline appears to reflect genuine competitive dynamics. In early December, Verizon introduced aggressive promotional pricing that reduced rates for multi-line accounts across its Unlimited plans with three-year price locks. This competitive repricing, captured by BLS’s new alternative data methodology, likely explains much of the December decline in wireless services. Similarly, the decline in used vehicle prices appears to reflect legitimate market softening.

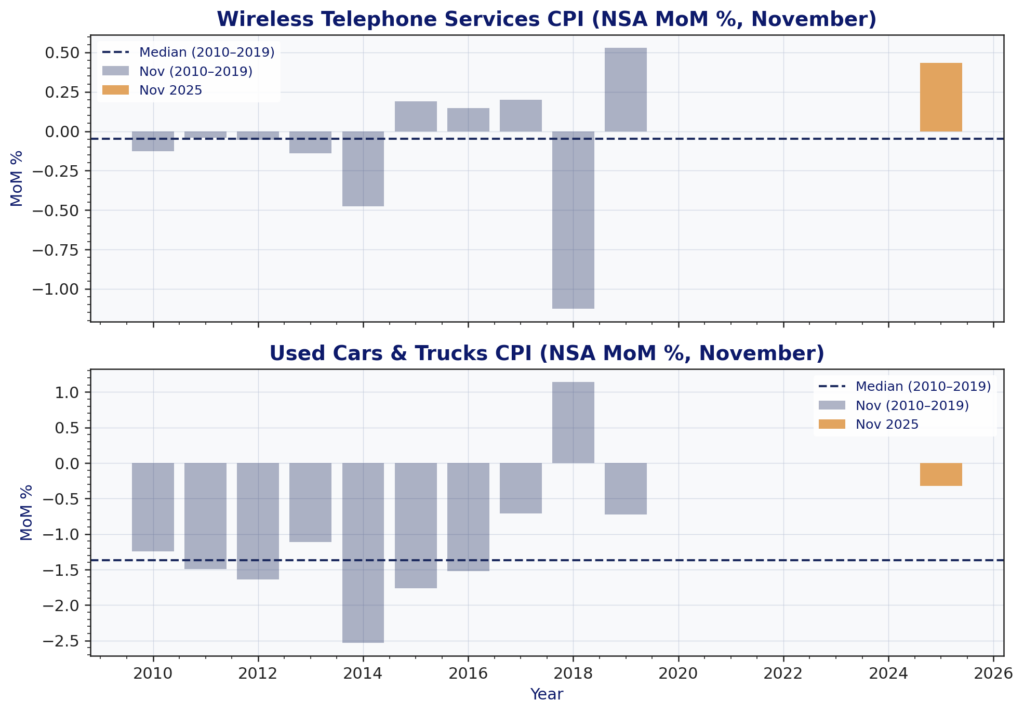

Figure 2

November

December

BLS’s own methodological note clarifies why near-term prints may remain noisy. Prices are collected either monthly or every other month depending on item and geography, and bimonthly pricing schedules create situations where the effective pricing window can shift when a month of survey data is missing. In addition, when the imputation hierarchy cannot use like-kind current-month price movements, such as when survey collection is broadly disrupted, it can fall back to carry-forward imputation, which has well-known directional biases depending on the prevailing inflation environment.

December 2025 makes clear that November’s apparent weakness was largely an artifact of shutdown timing, Black Friday promotional distortions, and compressed data windows, particularly in the most exposed categories. A mechanical rebound was therefore a high-probability, almost inevitable outcome. At the same time, December’s weakness in communication and used vehicles warns against over-attributing the entire CPI path to technical factors. Some normalization is occurring as measurement distortions fade, but the underlying inflation trend still depends on what happens once these shutdown echo effects fully pass through the data.