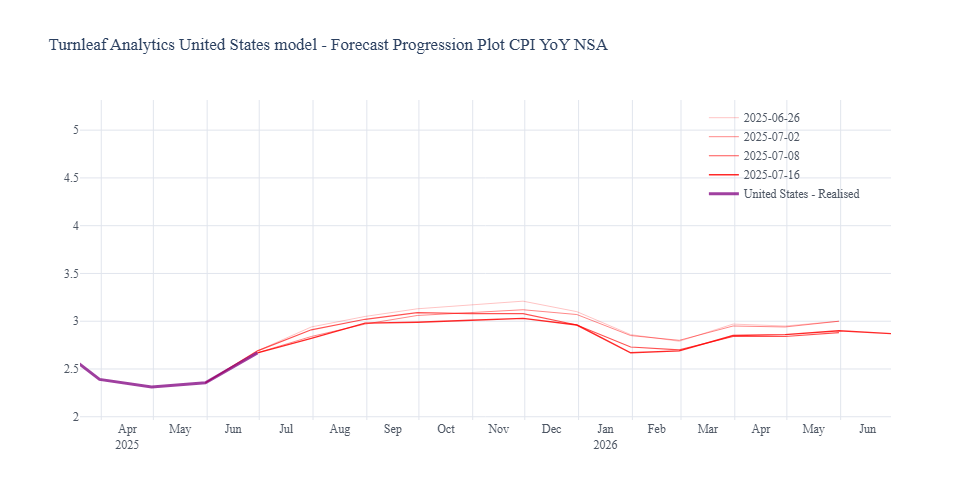

To date, uncertainty has been the defining feature of the inflation story. Volatile trade policy has deterred many firms from making strategic investments, slowing business activity across the board. Now, as companies learn to anticipate the cadence of the Administration’s tariff announcements, the 90‑day reprieves offer a temporary window of certainty that can support capital spending. For example, the recent agreement to maintain a 30% tariff on Chinese goods until August 12 (before it jumps to 55%) has triggered a clear front‑loading opportunity (Figure 1).

Figure 1

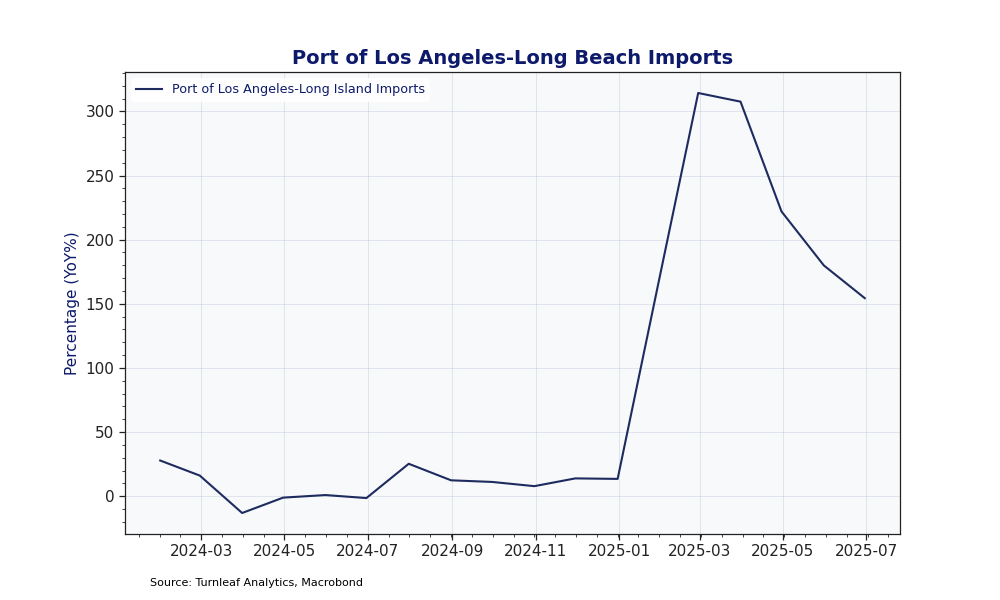

Tracking daily trade flow estimates for the Port of Los Angeles-Long Beach—where Chinese goods alone constitute 40% of Port of Los Angeles’ and 61% of Port of Long Beach imports, provide a glimpse of how firms are responding to tariff threats and its implications for inflation. Since the tariff war began, YoY imports at these ports have surged as companies front‑load inventories to insulate themselves from rising duties. However, that pre‑tariff rush is now easing as market expectations catch up with the final, permanent tariff rates (Figure 2).

Figure 2

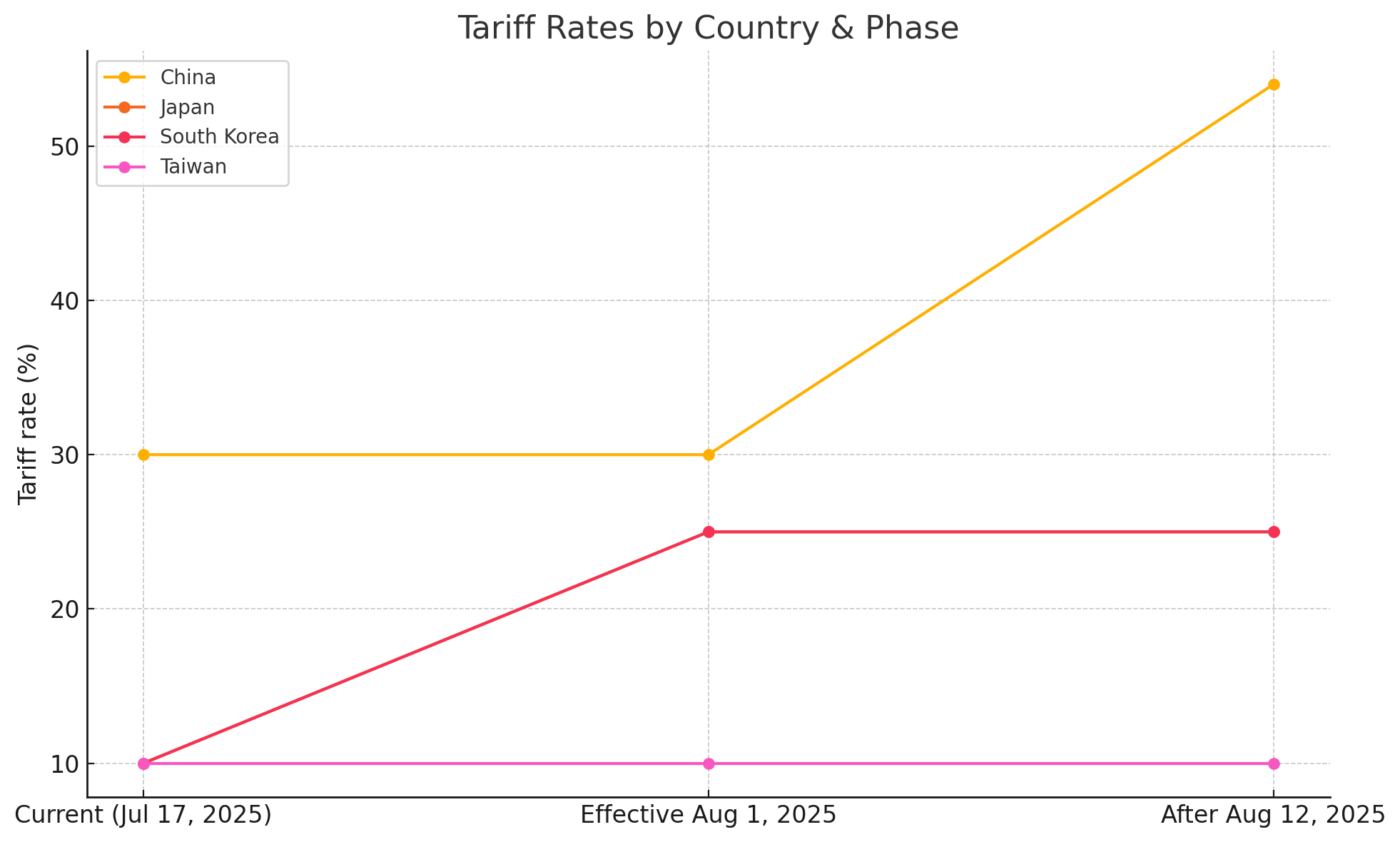

Our models now forecast headline CPI running around 2.7%YoY in July 2025, edging toward 3% towards the end of the year (Figure 3). While tariffs have raised inflation above where it otherwise would have been, it hasn’t spiked as sharply as worst‑case scenarios predicted. Businesses’ cautious front‑loading—reflected in sentiment indicators—has been just enough to preserve margins without fueling a sustained surge in consumer prices. Permanently high tariffs remain a key upside risk to inflation.

Figure 3