Turnleaf’s Oct 9, 2025 nowcast for September 2025 prints slightly higher than the Oct 1, 2025 weekly, reflecting a mix of policy and pricing signals that point to firmer levels over the next year (Figure 1 – available on Substack). The curve is tilted upward chiefly by pending administered changes, notably the CMA-driven water-bill increases announced on Oct 9, 2025, while retail indicators such as the Nielsen Shop Price Index for All Items continue to firm. At the same time, the 30-hour free childcare expansion, effective Sep 1, 2025, is exerting an immediate downward level effect within childcare services. Looking ahead, the HFSS multibuy and location restrictions and the packaging EPR fees that began on Oct 1, 2025 are likely to phase through with a short operational lag, showing more fully in the November 2025 reading. Taken together, these incremental shifts propagate through Turnleaf’s 12-month outlook, nudging the entire forecast curve modestly higher year ahead.

Government fundamentals, including elevated public-sector net borrowing, shape our fiscal outlook for 2026 and increase the likelihood of policy-driven price steps over the next year. Our model ingests fiscal data and media-volume indicators that aggregate coverage of anticipated price changes by scanning global professional news for relevant token combinations. The resulting probabilities of administered price increases feed mechanically into the curve.

For example, water bills carry additional upside risk following the Competition and Markets Authority’s provisional determination on October 9, 2025, which allowed further rises for several English water companies. Air Passenger Duty rates are also scheduled to increase from April 2026, contributing incrementally to price levels, and they are incorporated directly into the model. By contrast, the Ofgem energy price cap is confirmed only for October–December 2025 at £1,755 (a 2% QoQ increase), and any April 2026 effect remains forecast-dependent. Because the cap is tied to wholesale energy costs, a firming in fuel prices late in 2025 or early in 2026 would raise the risk of a higher cap and would mechanically lift the curve. As Budget details emerge, we will reassess the curve and ensure base effects from 2025’s administrative changes are handled correctly so that non-routine policy shocks are captured as discrete level shifts rather than seasonal noise.

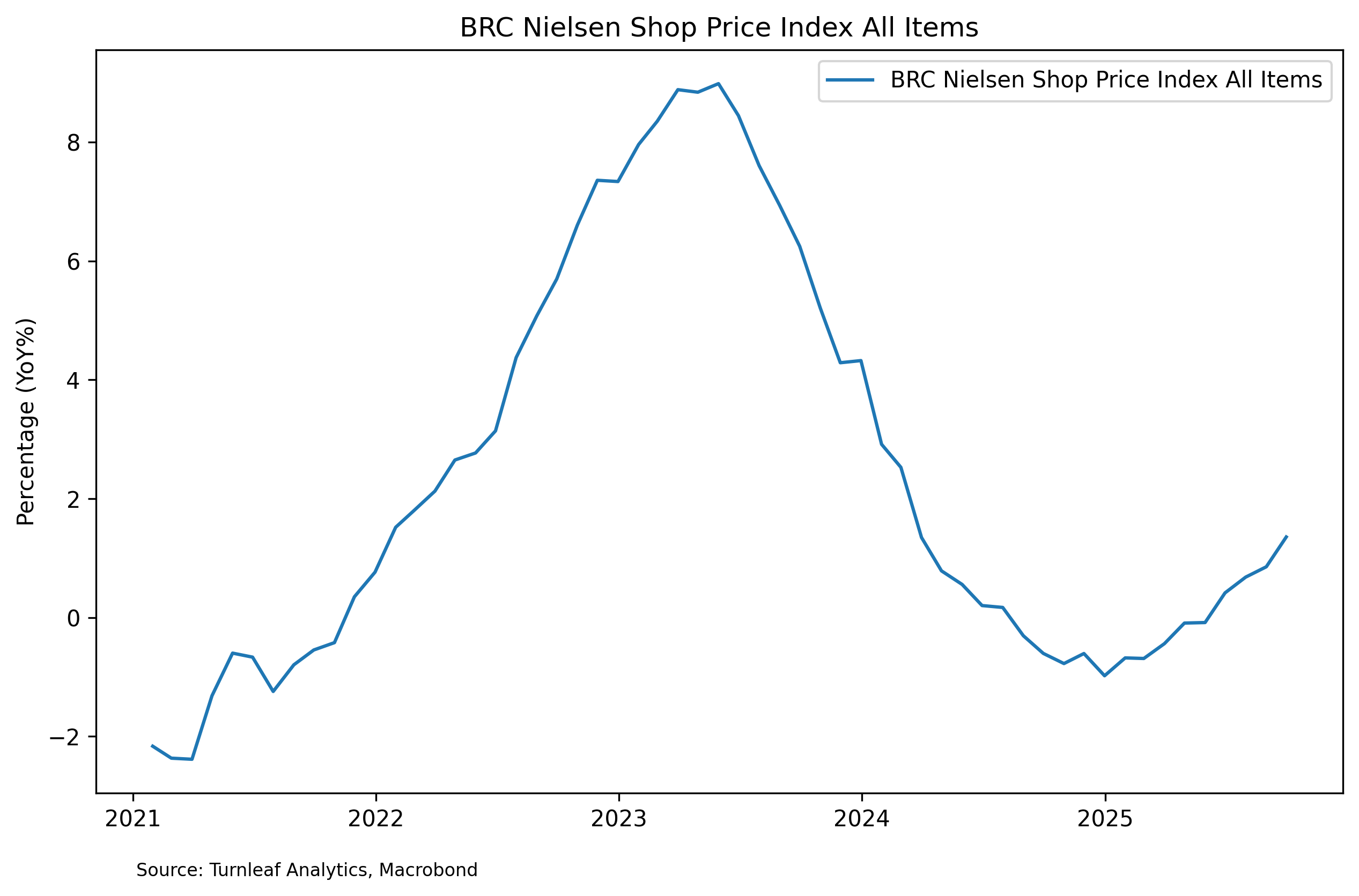

Other broad factors are consistent with an inflationary retail backdrop. The Nielsen Shop Price Index rose to 1.4%YoY in September 2025 from 0.9% in August 2025, which signals firmer retail pricing momentum and aligns with the persistent food inflation observed throughout the year (Figure 2). This development suggests that food prices are likely to have increased in September 2025 as well.

Figure 2

At the same time, the 30-hour free childcare expansion in England, effective September 1, 2025, is putting downward pressure on the September print by lowering out-of-pocket fees for eligible households. By contrast, policy shocks that began on 1 October, specifically the HFSS multibuy and location restrictions and the packaging Extended Producer Responsibility fees, are likely to pass through with a short operational lag as retailers cycle promotions and reset price files. Because of that lag, part of the effective price impact should build through October and show more fully in the November reading, with residual effects extending into early Q42025.

Turnleaf will continue to monitor high-frequency retail price feeds, wholesale energy curves, and regulator announcements alongside fiscal and media-tone indicators, and any material shift in these signals will feed directly into the model in subsequent updates.