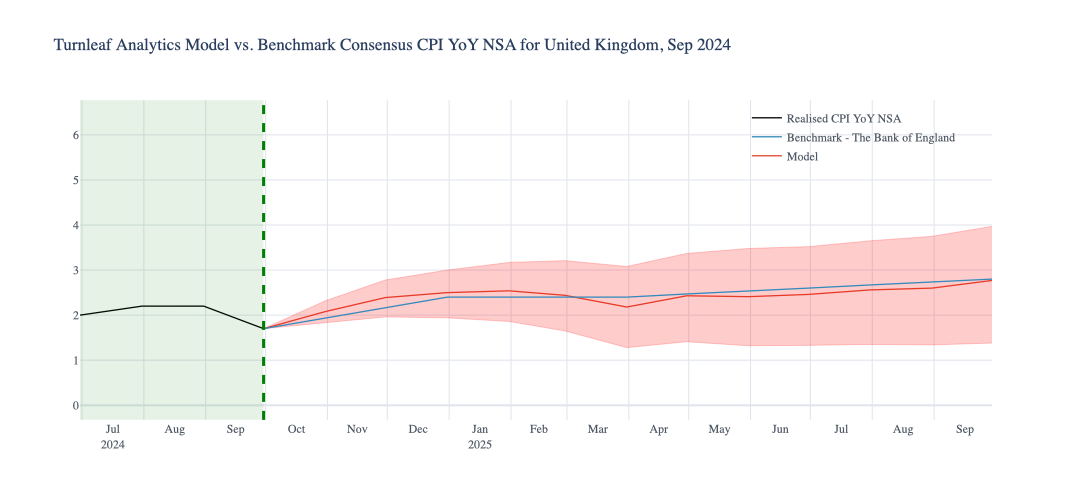

The UK government’s Autumn Budget for 2024, introduced on October 30, is designed to enhance public services through increased capital investments, funded by higher taxes along with adjustments in welfare and spending. The Office for Budget Responsibility (OBR) projects a slight rise in the Consumer Price Index (CPI), increasing from 2.5% to 2.6% between 2025 and 2026 due to these investments. Turnleaf’s analysis predicts a slightly less marked impact on inflation.

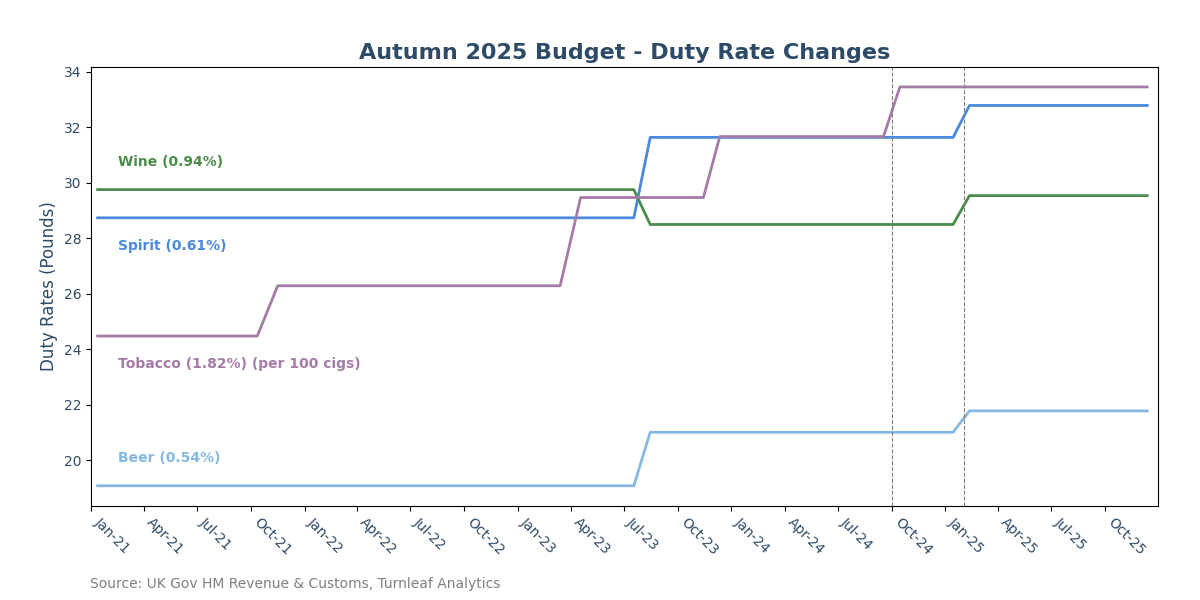

Directly measurable impacts of the Autumn Budget, as captured by our CPI forecasting model, include increased duties on alcohol and tobacco. These changes are readily quantifiable and can be effectively integrated into economic models to assess their precise effect on consumer prices. Beginning in October 2024, the duty on tobacco per 1,000 cigarette will increase about 5.65%. With tobacco comprising 1.82% of the total CPI basket, higher prices are expected to be reflected in the CPI readings for November 2024 as smokers, who make up 15.4% of the UK’s population, start to feel the pinch. Furthermore, in February 2025, duties on wine, spirits, and beer—which have CPI weights of 0.94%, 0.61%, and 1.82%, respectively—will be adjusted in line with RPI inflation, exerting additional upward pressure on prices. Turnleaf will continue to monitor these effects closely by incorporating these duties and relevant price indicators into our model.

Directly measurable impacts of the Autumn Budget, as captured by our CPI forecasting model, include increased duties on alcohol and tobacco. These changes are readily quantifiable and can be effectively integrated into economic models to assess their precise effect on consumer prices. Beginning in October 2024, the duty on tobacco per 1,000 cigarette will increase about 5.65%. With tobacco comprising 1.82% of the total CPI basket, higher prices are expected to be reflected in the CPI readings for November 2024 as smokers, who make up 15.4% of the UK’s population, start to feel the pinch. Furthermore, in February 2025, duties on wine, spirits, and beer—which have CPI weights of 0.94%, 0.61%, and 1.82%, respectively—will be adjusted in line with RPI inflation, exerting additional upward pressure on prices. Turnleaf will continue to monitor these effects closely by incorporating these duties and relevant price indicators into our model.

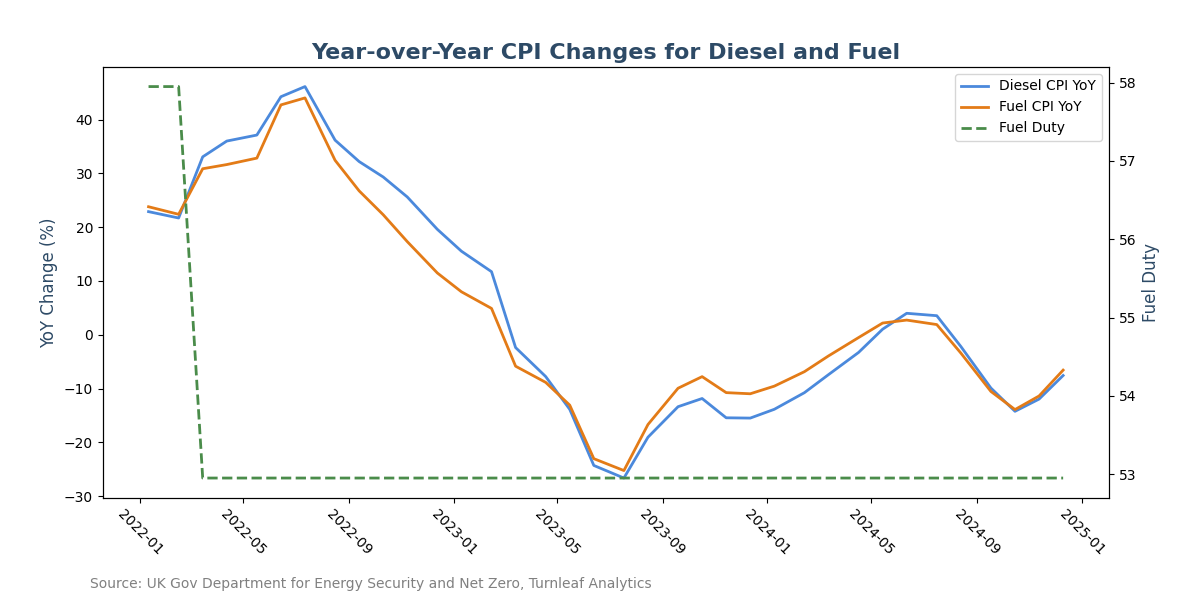

The UK government also announced that the 5 pence per liter reduction in fuel duty, in effect since March 2022, and the freeze on fuel duty will be extended for another year, lowering average fuel costs. YoY, diesel and petrol prices showed a steady decline from mid-2022 to mid-2023, contributing as disinflationary pressures for most of 2023 and 2024. However, there is a minor uptick towards the end of 2024 that is worth monitoring. These disinflationary effects, along with subdued global energy prices, are expected to continue exerting downward pressure on the headline CPI. We will also keep an eye on the impacts of the fuel duty freeze, which the OBR projects will save the average car driver £59 during 2025-26. Meanwhile, electricity prices increased 23.8% YoY in October 2024, likely due to a 10% increase in the Ofgem electricity price cap from the previous quarter, creating some additional inflationary pressure.

Employment trends within the UK reveal a mixed picture. While there has been a slight decrease in the number of online job adverts (-0.5% MoM in October 2024), suggesting a cooling in job market activities, the overall employment outlook remains positive, with 21% of employers in October 2024 (from 18% in the previous month) anticipate raising staff levels over the next three months. This robustness in employment, despite slight MoM fluctuations, suggests a resilient job market.

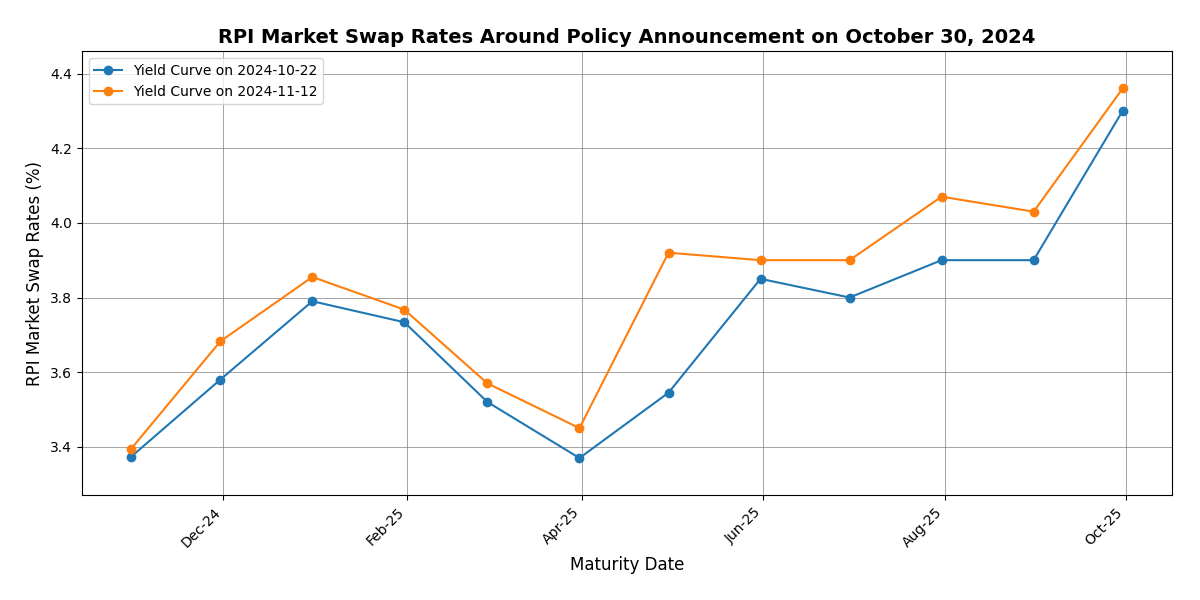

Nevertheless, other aspects of the budget, such as increases in employer taxes, present more complex challenges for economic modeling. The effects of these changes are less direct and involve understanding potential multiplier effects—how businesses might pass these costs on to consumers or reduce their investment spending, which in turn could affect employment and wage levels. We also rely on RPI market swap data, which allows us to adjust our price curves in response to new economic developments that we cannot directly observe. RPI swap rates serve as a forward-looking measure, also on CPI, encapsulating the collective market view on future inflation. This method ensures our model aligns with current market expectations, thereby increasing its responsiveness to policy changes and other economic indicators. Following the Autumn Budget of 2024, we noted an upward shift in RPI swap rates, suggesting that investors expect the government’s planned expenditures to propel inflation higher over time. Essentially, markets quickly recalibrated to reflect anticipated fiscal policy impacts on the economy, offering a real-time, aggregated view of future inflation.

Other Factors Affecting UK Inflation

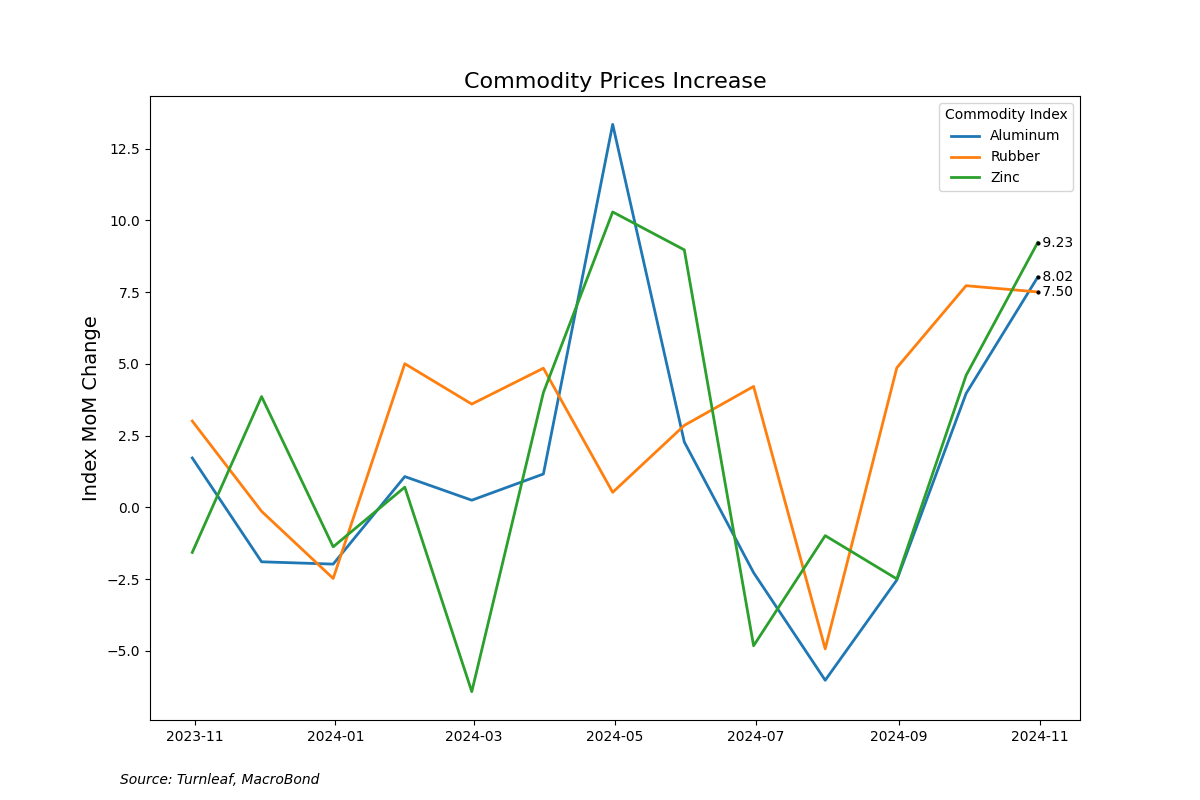

The global economic environment continues to exert upward pressure on British CPI. Prices remain sensitive to global supply chain pressures, as evidenced by the Harpex Index—a measure of global shipping costs—which has risen since the start of the year but has recently stabilized. Yet, its YoY changes in October and November 2024 (122.51% and 137.28%, respectively) signal that shipping costs are likely to continue their ascent as uncertainty pervades global trade. Moreover, global trade pressures and external economic factors continue to influence the UK’s outlook. Commodity price pressures have shown significant volatility in the aftermath of a Trump election and disruptions in China’s supply chains. Since October 2024, commodity indexes for major Chinese exports—including zinc (USD), aluminum (EUR), and rubber (EUR)—have risen by 9.2%, 8.0%, and 7.5% MoM, respectively, as China contends with tightness in concentrate supply chains. For instance, the price of alumina, a critical component for aluminum, has doubled over the past year due to delays in bauxite shipments from Guinea and Australia, caused by government restrictions. Despite a 0.51% MoM rise in industrial production prices, subdued demand in the European market has helped contain input cost increases. As demand is expected to grow throughout 2025 and Trump tariffs will likely take effect in the beginning of next year, it will be crucial to observe how these market dynamics influence industrial manufacturing prices.

While the Bank of England achieved its inflation target of 2% in May 2024, the 2024 Autumn Budget introduces new inflationary factors that may reduce the central bank’s control over price stability. The Autumn Budget could potentially drive inflation nearly 1% higher than it would be without such fiscal measures. This increase is compounded by unpredictable global trade conditions, notably due to upcoming tariff policies from a Trump administration and ongoing challenges in Chinese supply chains, which could exert additional upward pressure on the UK’s CPI. Given these complexities, Turnleaf will closely monitor economic indicators affected by fiscal and trade policy changes. It will be also important to track market sentiment indicators to gauge risk premiums from external factors, which will enable to effectively respond to both anticipated and unexpected economic shifts.

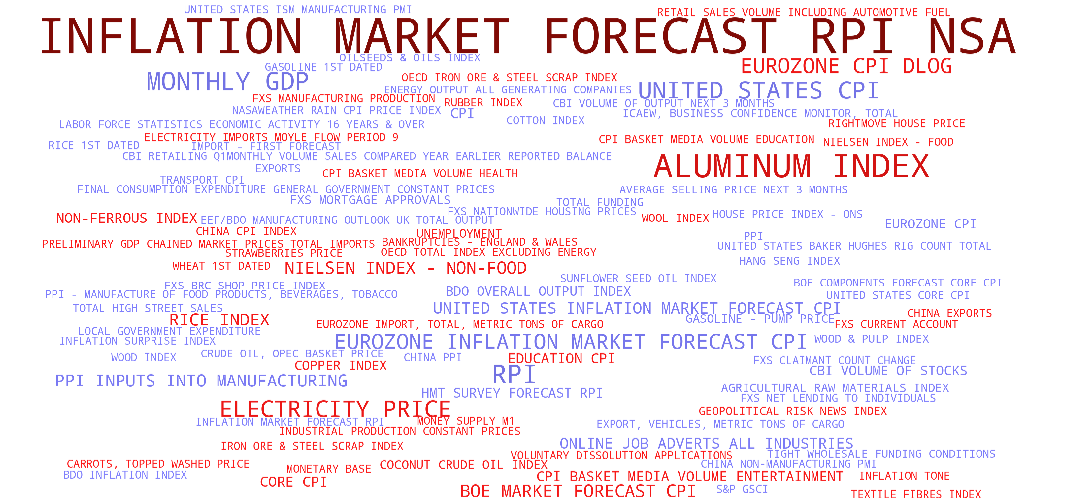

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, ‘Inflation Market Forecast RPI NSA’ and ‘Aluminum Index’ are large, indicating their significant weight in the model, while their color suggests whether they contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.

Contribution Word Cloud for November 14, 2024 Forecast