As U.S. economic conditions continue to evolve, Turnleaf will actively monitor inflation trends and publish regular updates to keep you informed. Our focus remains on leading indicators that provide real-time insights into market sentiment on inflation, delivering early signals of economic shifts. These indicators allow us to gauge how different sectors are responding to emerging policy changes and potential inflationary pressures.

With significant uncertainty surrounding a potential Trump presidency, understanding inflation trends will be crucial for market participants. Trump’s policy stance—including potential higher tariffs on China and other trading partners, lower corporate taxes, and increased deficit spending—is likely to shape inflation expectations and economic conditions both in the U.S. and globally. Higher tariffs could raise imported input costs, while increased deficit spending may add to aggregate demand, both of which could contribute to inflationary pressures.

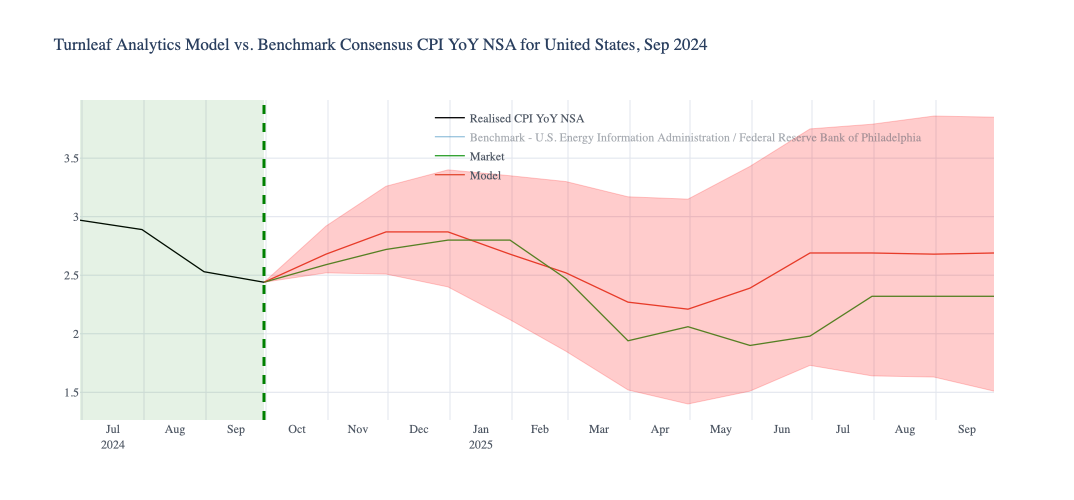

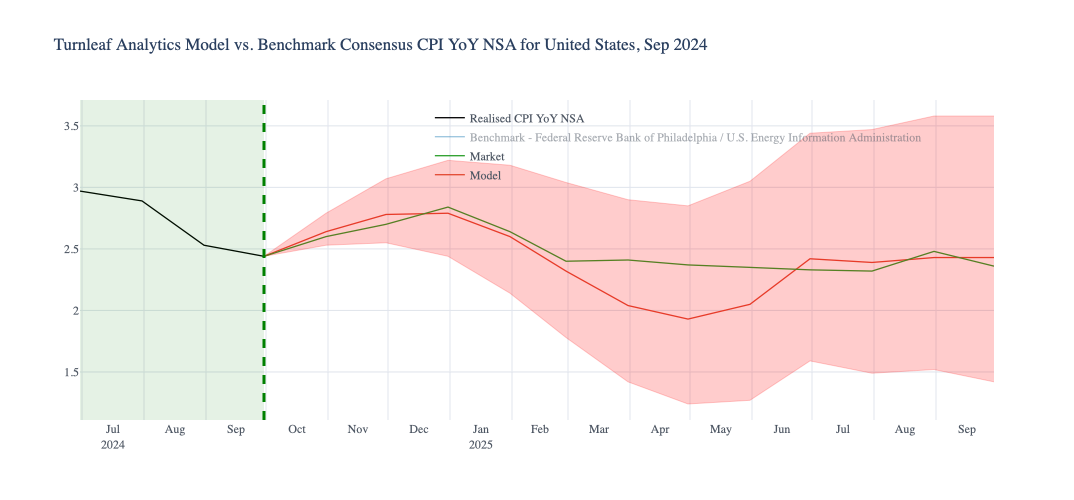

Our October 14 pre-election forecast (red) showed a clear divergence from market expectations (green). By our November 7 post-election update, the market had begun to align more closely with our model’s projections, indicating a growing recognition of the inflationary risks we anticipated.

October 14, 2024 Forecast

November 7, 2024 Update

November 7, 2024 Update

Federal Reserve’s Rate Decisions

Tariffs raise import prices, increasing inflationary pressure as companies pass these costs to consumers. This dynamic complicates the Federal Reserve’s ability to cut rates, as higher prices might force the Fed to maintain or even raise rates to keep inflation in check, despite potential negative impacts on growth. This balancing act between controlling inflation and supporting economic activity will be crucial in the months ahead.

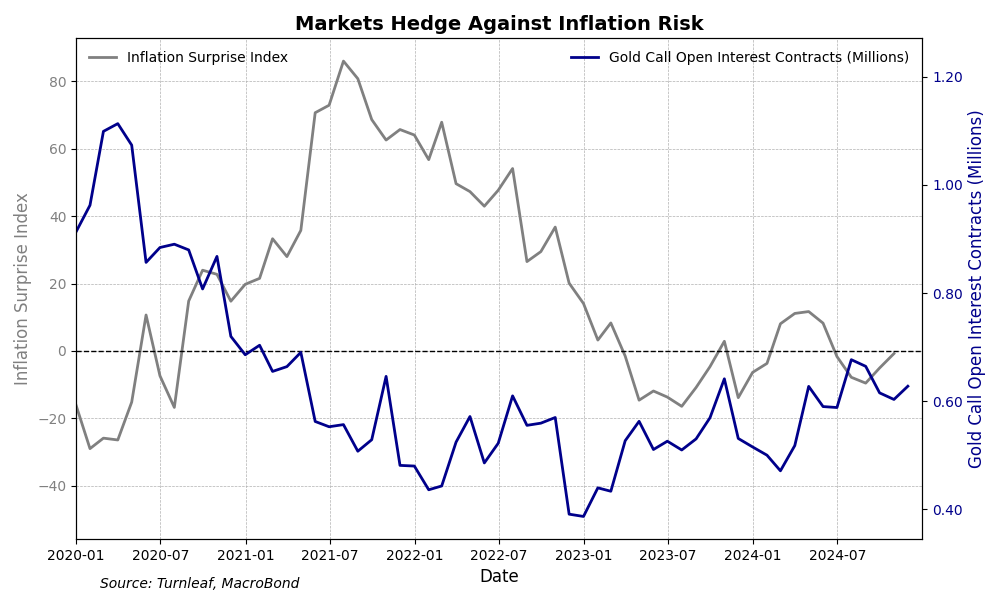

Watching Markets

Tracking inflation-related market movements will be important in gauging the trajectory of inflation post-inauguration. The negative reading on the Citi Inflation Surprise Index (-0.77 in October 2024) indicates that recent inflation is below expectations. However, rising call open interest in gold suggests that markets are hedging against a resurgence in inflation, possibly due to anticipated policy changes under a Trump administration. In November 2024, call open interest in gold options rose by 2.7% MoM, reflecting increased market positioning in anticipation of rising demand for gold.

Tracking Business Sentiment

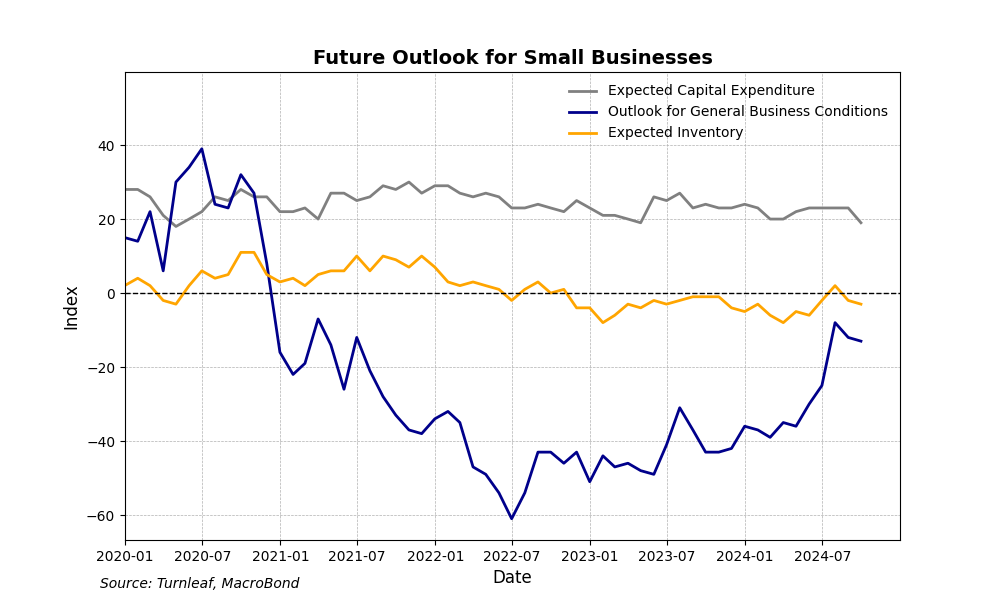

The NRIB survey results for September 2024 suggest that small businesses are approaching the next six months with caution, reflected in subdued capital and inventory growth plans. The six-month business conditions index is at -13%, indicating that more business owners expect worsening conditions than those expecting improvement. While this is an improvement from the more pessimistic sentiment in the year’s first half, the index remains firmly negative, highlighting ongoing concerns about economic stability and future demand. Plans for capital expenditure and inventory growth among small businesses have also declined. The net percentage planning to increase capital spending has dropped by 1% to -2%, while inventory expansion plans have fallen 4% from previous highs. A negative capital expenditure reading indicates that more businesses are reducing investment in long-term assets than those planning to increase it. This is a sign that small businesses are holding back on expansion and capacity-building, likely due to economic uncertainty and the potential for rising costs. If input prices increase, businesses with lean inventories may find it challenging to meet demand without passing higher costs onto consumers. Conversely, a renewed increase in capital and inventory investment could signal confidence in stable demand and economic recovery

Trends in small business outlooks reflect broader trends across all industries. The NABE Business Conditions Survey reveals a significant pullback in expected capital spending across all industries in the third quarter (-52.22% QoQ), underscoring widespread hesitancy to invest in light of high borrowing costs and economic uncertainty. This is a strong signal that businesses are anticipating slower growth and may not ramp up production or hiring in the near term.

In this environment, sectors sensitive to trade disruptions will be crucial to monitor. Manufacturing indices offer insights into economic health and business sentiment under evolving inflation conditions. For instance, the Kansas City Federal Reserve Composite Index, which reflects the perceived economic health of manufacturers in the Tenth District for the next six months, remains positive but is trending towards a slowdown. Similarly, Chicago’s National Activity Index, which aggregates 85 economic indicators, suggests contractionary pressures that could dampen inflation. These indicators provide essential insights into the sectors driving production and economic growth.

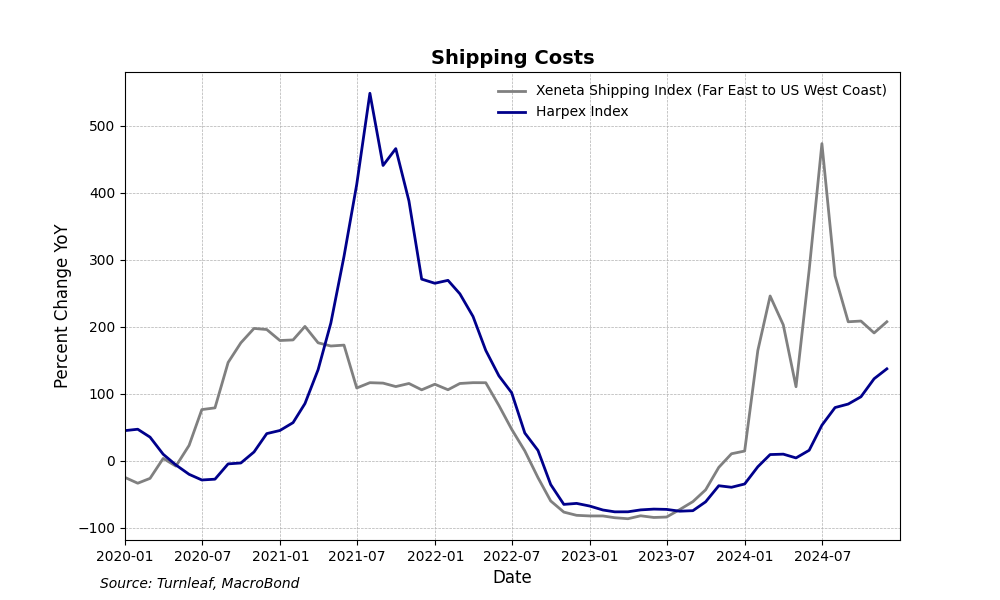

The Potential Shift Towards Domestic Goods and Rising Shipping Costs

High import tariffs could encourage a shift from imported to domestically-produced goods, as firms look to avoid increased costs associated with tariffs. However, if domestic supply cannot meet demand, this could drive up prices for domestic goods and their complements, further fueling inflation. For now, domestic producer prices remain on a disinflationary path. Howver, a reversal in these trends could signal elevated price pressures from input costs. Tariffs could also prompt businesses to relocate production from countries facing higher levies like China, to countries facing lower levies like Vietnam. Reconfiguring global supply chains may lead to increases in shipping costs due to transitional frictions. To track these potential cost pressures, Turnleaf will monitor the Harpex Index, which measures weekly global container shipping rates, and the Xeneta Shipping Index, which captures daily shipping costs between East Asia and the West. Increased shipping costs directly impact the price of imported goods, and indirect effects could cascade to domestic prices if companies pass these costs to consumers.