The October and November 2025 CPI prints were materially affected by technical distortions related to the federal government shutdown. These distortions are likely to produce a period of temporary normalization in measured inflation over the coming months. The effect should be most visible in December 2025 and January 2026. A separate and smaller shelter related effect is likely to emerge in April 2026. Turnleaf expects inflation to trend close to 3%YoY in the next 12 months once base effects drop out of inflation calculations. The proceeding discussion is based on information available as of 23/12. In the following months, as the BLS releases more information on how they will treat missing data, we will update our estimates.

The first source of distortion arises from the interruption in CPI data collection. Survey based price collection was suspended in October 2025 and resumed only in mid November. As a result, a large share of November prices were sampled during the second half of the month. This period coincided with seasonal discounting tied to Black Friday and related promotions. Components that rely heavily on survey collection and exhibit sharp promotional seasonality were therefore more likely to be measured off a temporarily low base.

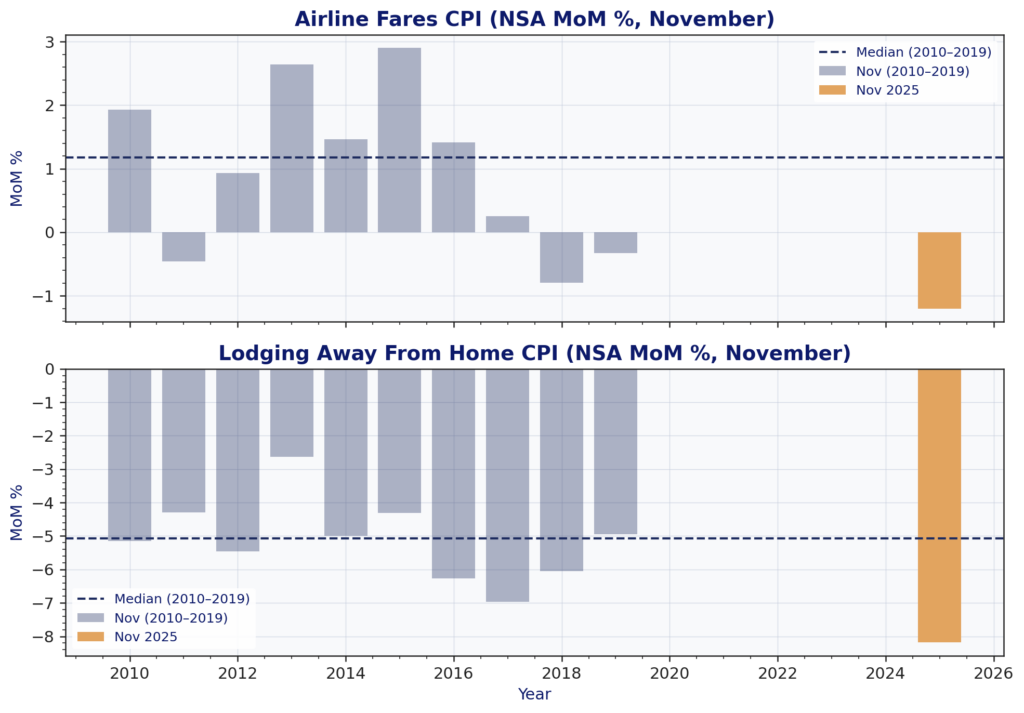

Figure 1 illustrates this point by comparing November MoM price changes across historical Novembers for survey-based items like Airline Fare and Lodging Away from Home.

Figure 1

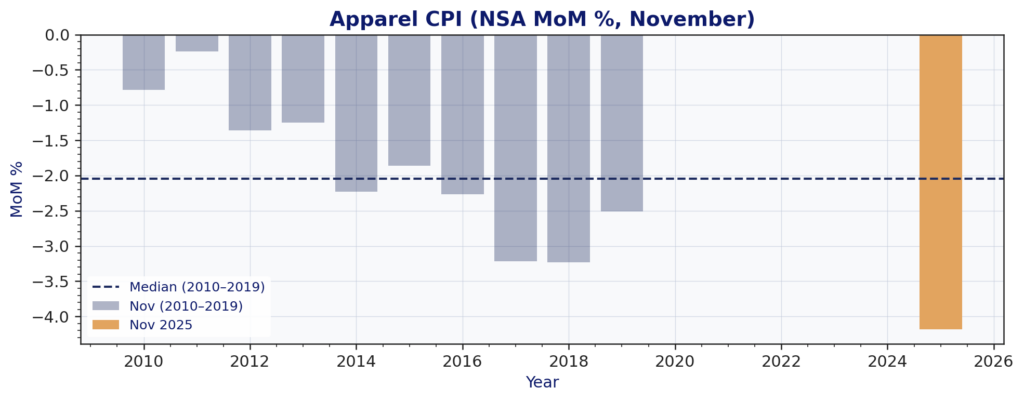

Additionally, the dispersion in November 2025 is concentrated mostly in promotion sensitive categories like Apparel, rather than broad based across the index (Figure 2). This pattern suggests that late 2025 weakness reflects timing distortions rather than a generalized slowdown in demand.

Additionally, the dispersion in November 2025 is concentrated mostly in promotion sensitive categories like Apparel, rather than broad based across the index (Figure 2). This pattern suggests that late 2025 weakness reflects timing distortions rather than a generalized slowdown in demand.

Figure 2

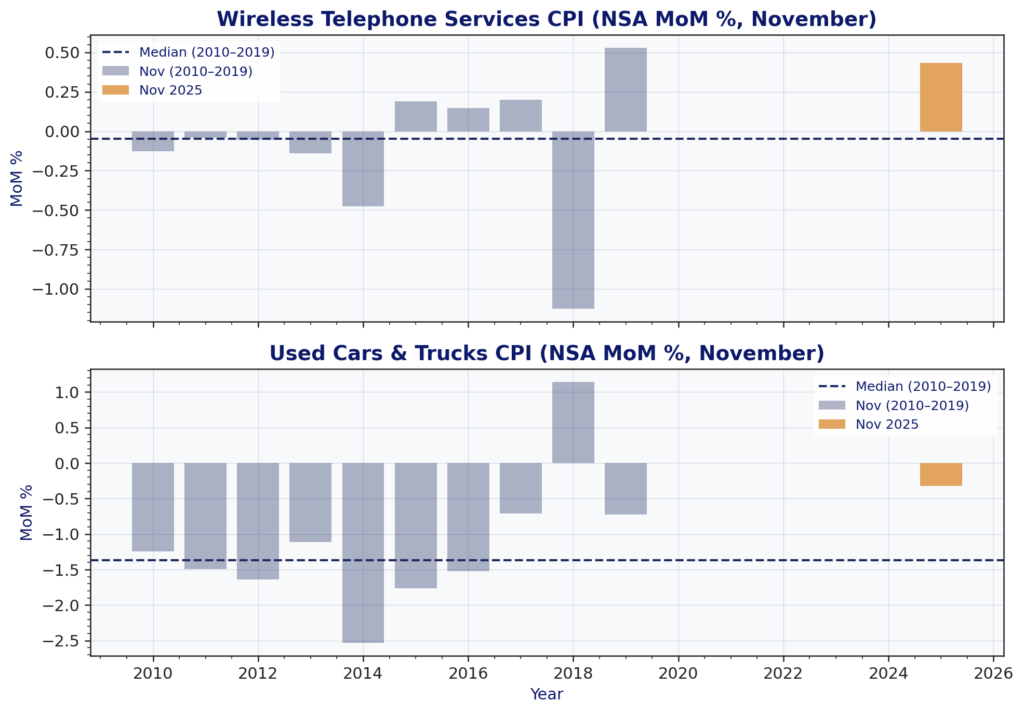

By contrast, components that rely more heavily on non-survey data or model-based pricing behaved in a more typical manner. Figure 3 shows November MoM changes in Wireless Telephone Services and Used Vehicles relative to their historical November distributions. In both cases, November 2025 falls within the historical range and shows sustained increases. This behavior reinforces the conclusion that shutdown related distortions were not pervasive across CPI but instead concentrated in specific survey-based categories.

Figure 3

A second technical factor amplifying the December effect is the interaction between the shutdown and CPI’s bimonthly pricing structure. Many CPI items are normally priced every other month at the city item level. The absence of October survey data and the use of carry forward imputation disrupted the usual pricing cadence. As a result, December prices for a large set of survey based components are likely to reflect a longer effective price change window than usual. Historical CPI mechanics imply that this feature alone can mechanically boost December inflation even if underlying momentum is unchanged.

A second technical factor amplifying the December effect is the interaction between the shutdown and CPI’s bimonthly pricing structure. Many CPI items are normally priced every other month at the city item level. The absence of October survey data and the use of carry forward imputation disrupted the usual pricing cadence. As a result, December prices for a large set of survey based components are likely to reflect a longer effective price change window than usual. Historical CPI mechanics imply that this feature alone can mechanically boost December inflation even if underlying momentum is unchanged.

Taken together, December 2025 inflation is likely to appear stronger than implied by the October-November data. This should be interpreted as a seasonal and technical normalization. A portion of the November weakness is likely to reverse in December as promotional effects fade, and the pricing window normalizes. A smaller residual effect may extend into January 2026. The impact should remain concentrated in goods and selected services rather than across the entire CPI basket.

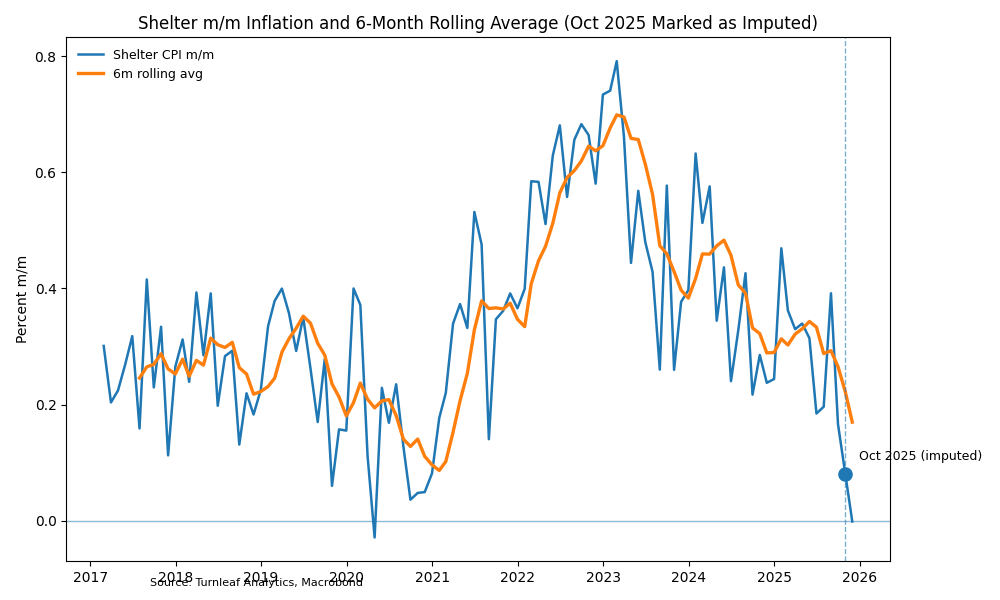

The shelter component follows a different dynamic. Shelter is calculated using a six-month rolling methodology for its subcomponents designed to smooth short term volatility (Figure 4). Therefore, shelter inflation does not mechanically rebound in December following a weak month. Instead, the missing October 2025 shelter data assumed flat under carry forward imputation affect the calculation only when that missing observation rolls through the six-month window. From April 2026, a positive base effect could temporarily lift measured shelter inflation.

Figure 4

These technical adjustments have particularly important implications for YoY inflation late in the forecast horizon. By October and November 2026, YoY inflation is still referencing index levels from late 2025 that were affected by shutdown related pricing disruptions, carry forwards, and abnormal collection timing. At the same time, the informational quality of the base period deteriorates meaningfully, with October 2025 providing little to no reliable price signal and November 2025 offering only partial coverage.

The combination of an artificially elevated base level and reduced base period information mechanically biases unadjusted YoY inflation upward in standard models. This effect is most pronounced in October and November 2026, when residual level distortions and base period information loss overlap. The downward MoM adjustments applied in those months correct for both sources of bias, ensuring that late 2026 YoY readings better reflect underlying price dynamics rather than technical artifacts from the shutdown period.

In the near term, inflation dynamics are being shaped by the unwinding of shutdown related measurement distortions that temporarily suppressed observed prices and are now normalizing in stages. As a result, upcoming inflation prints are likely to be noisy, with headline measures at times overstating underlying momentum. Turnleaf continues to incorporate alternative data and high frequency indicators to account for these sources of volatility in inflation measurement. We expect inflation to converge toward 3% YoY by mid-2026.