Turkey’s central bank has adopted a stringent monetary policy to combat inflation, a stark departure from previous unorthodox strategies. With borrowing costs now at a benchmark high of 50% since March 2024—the highest since 2002—this hawkish approach is beginning to stabilize the lira and manage inflation pressures.

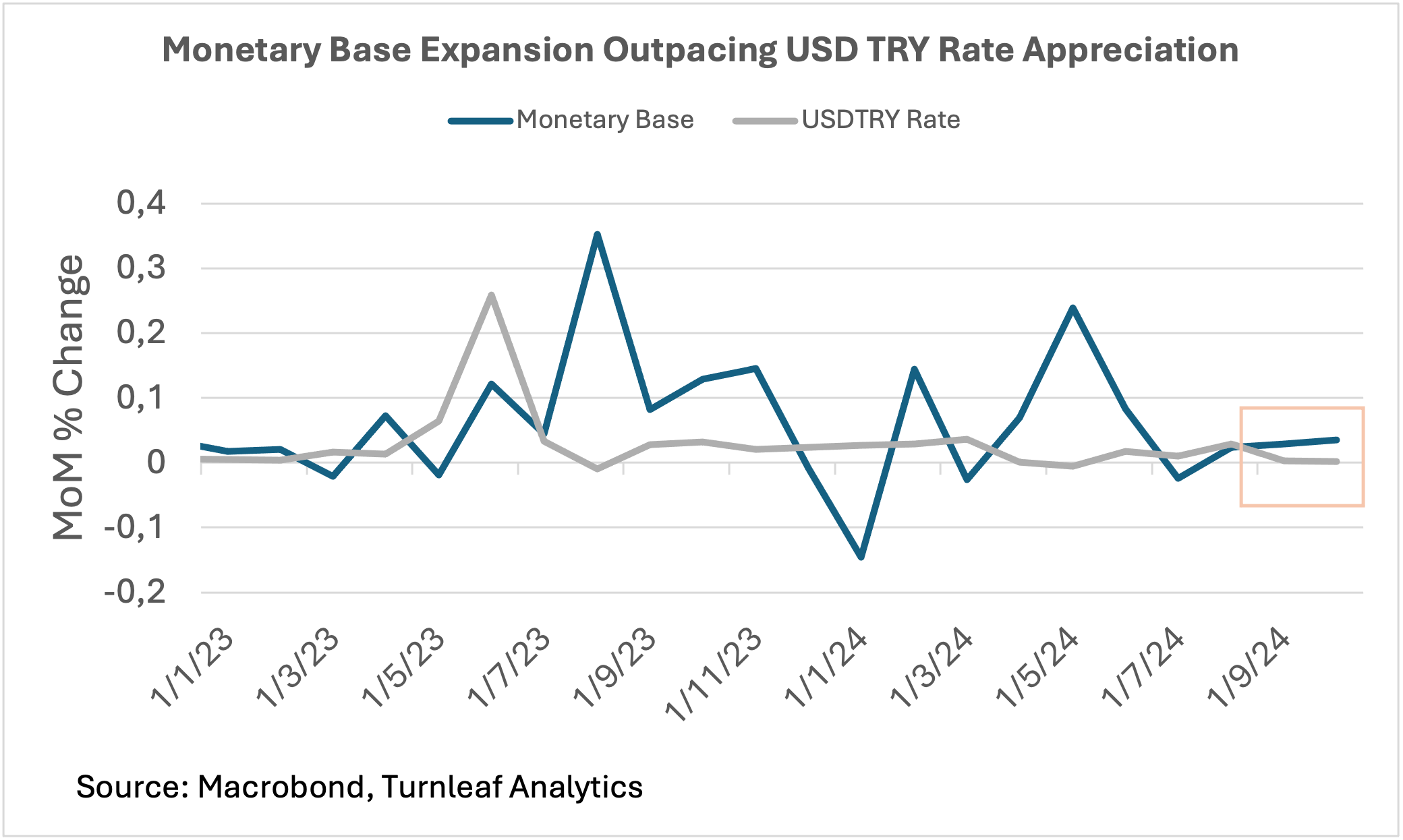

In July 2024, in an effort to rein in Turkish Lira volatility, the central bank initiated a swap auction, to exchange Turkish Liras for foreign currency and gold held by local banks. Since the program’s inception, the MoM USD-TRY spot-rate declined by 0.65%. However, our model still detects short-term inflationary effects from increases in gold and foreign exchange reserves, as rapid money supply growth outpaces the lira’s stabilization. We will continue to monitor the potential effects on inflation as changes in gold and FX reserves influence the USD-TRY exchange rate in the coming months.

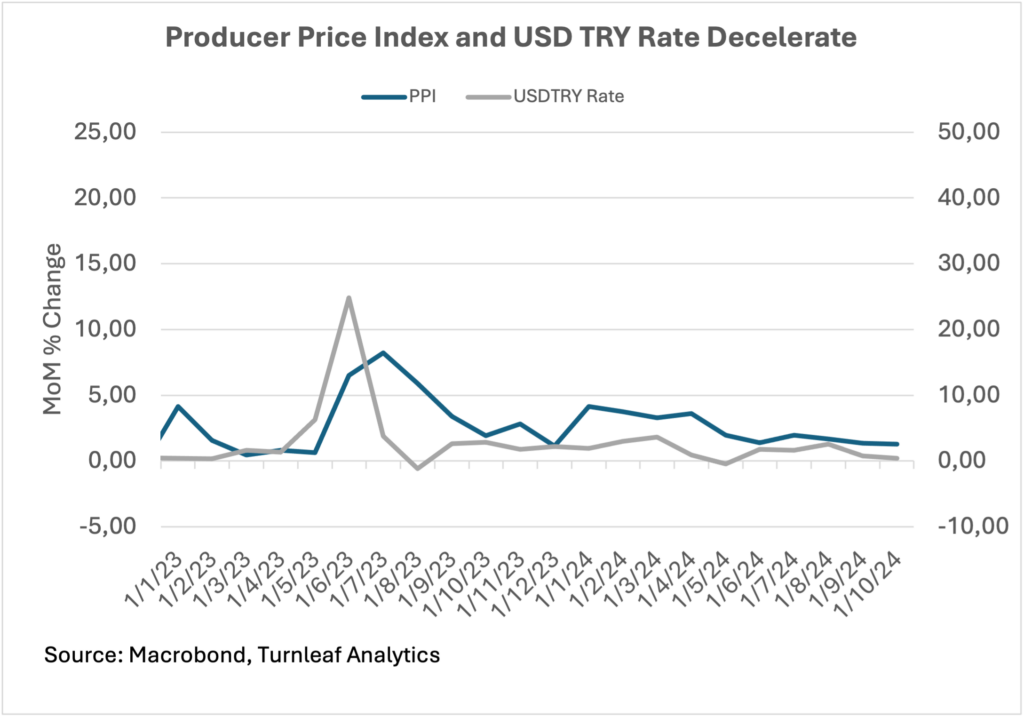

This stabilization has helped curb some imported inflation, with the Producer Price Index posting a modest 0.07% MoM decline in October 2024. Housing prices are also cooling, with a decrease from 34.4% YoY in August 2024 to 27.4% YoY in September 2024, as average home loan interest rates approach 41% in October 2024. Geopolitical pressures have further dampened CPI, with global natural gas and Brent crude oil prices down 20.97% and 33.58% YoY, respectively, in October 2024. Disinflationary trends are also temporarily supported by base effects, as last year’s high inflation rates fall out of current calculations.

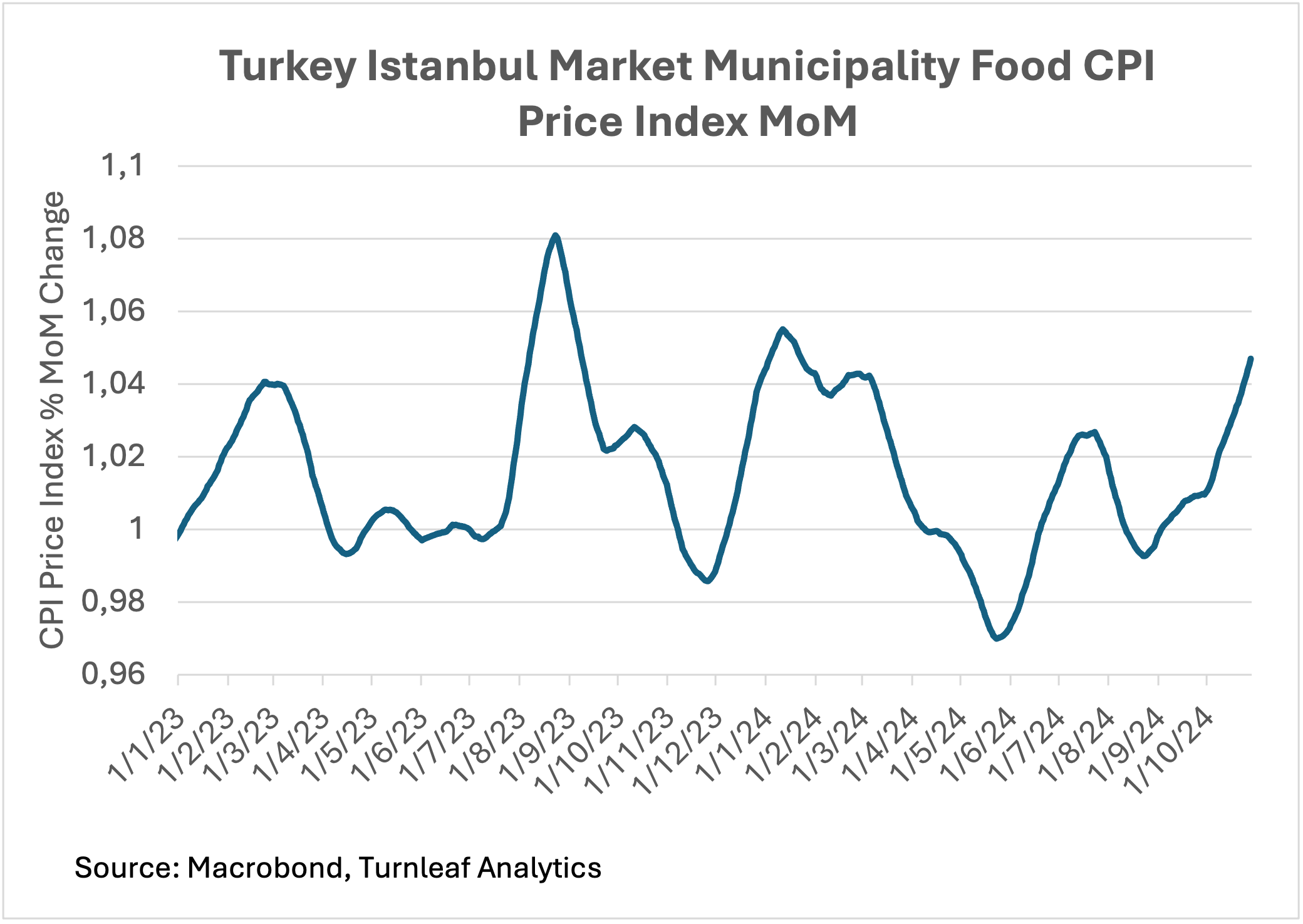

However, inflationary forces remain strong. Food costs, tracked by Turnleaf’s Istanbul Market Municipality Food Index, rose 2.1% in October 2024, reflecting persistent inflation in essential goods. Additionally, construction costs, accounting for 4.9% of Turkey’s GDP, increased 1.25% MoM for materials and 1.16% MoM for labor in October 2024. Rising input costs are evident across sectors, with the Industrial Raw Materials Index up 3.92% in October 2024, adding further pressure on manufacturing and consumer prices.

Turkey’s central bank faces a complex balancing act as it seeks to stabilize the lira and rein in inflation. Reduced liquidity in the banking sector has limited banks’ lending capacity to businesses and consumers, thereby slowing economic growth. This is reflected in a 2.19% decline in monthly expected GDP growth from the previous month. Moving forward, the bank’s ability to maintain currency stability without stifling growth will be critical.

Turkey’s central bank faces a complex balancing act as it seeks to stabilize the lira and rein in inflation. Reduced liquidity in the banking sector has limited banks’ lending capacity to businesses and consumers, thereby slowing economic growth. This is reflected in a 2.19% decline in monthly expected GDP growth from the previous month. Moving forward, the bank’s ability to maintain currency stability without stifling growth will be critical.

At Turnleaf, our CPI models are built to account for external shocks—ranging from tariffs to subsidies—by integrating high-frequency and alternative datasets to provide precise CPI forecasts. As trade conditions shift, our model equips clients with insights to anticipate inflationary impacts and navigate an uncertain economic landscape. We’ll closely monitor the consequences of the U.S. election results and adjust our forecast accordingly, keeping our clients informed of any potential changes.