There’s just something about being in Geneva that makes you want to reduce tariffs on all Chinese goods from 145% to 30%. Recently, the U.S. and China reached an agreement to cut tariffs on each other’s goods for the next 90 days. Trump followed up by confirming that he wouldn’t unilaterally raise the combined China tariff back to 145%. The announcement drove a stronger dollar and pushed oil prices higher, while tariffs on Chinese imports remain elevated at 30%. We expected U.S. inflation to go up because of tariffs against China. Should we expect inflation to go down now given the recent news?

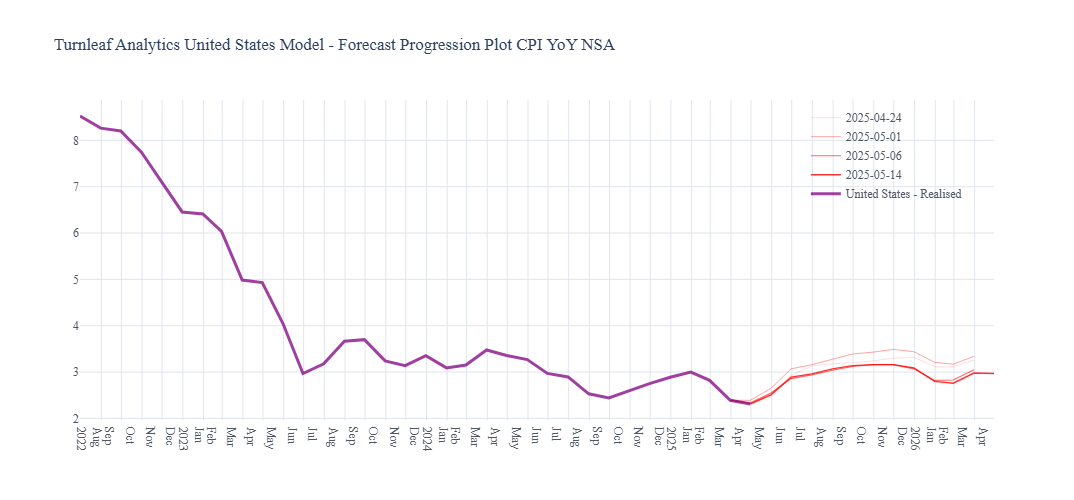

The real impact of tariffs on the U.S. consumer price basket has proved to be quite difficult to isolate considering the ambiguity and persistence surrounding the tariff rate. As a proxy for potential trade disruptions, Turnleaf factored in movements in high-frequency data like port and rail cargo volume data to identify its potential impact on domestic prices. Though we find evidence in recent forecasts that declining port volumes are correlated with overall higher price trends, we expect this effect to reverse slightly as relatively lower but elevated tariffs are in effect until a more accommodating trade deal can be reached.

Longer-term decisions impacted by the trade war like slowing capital investments and hiring are unlikely to change the curve immediately, especially given prevailing uncertainty beyond 90 days. These decisions keep inflation expectations for both firms and consumers high raising the tail end of our curve relative to a counterfactual in which the trade war never occurred in the first place. Turnleaf’s forecasts have consistently indicated that uncertainty indices related to trade and economic policy as upward drivers of prices and have previously highlighted indicators related to firm behavior in reaction to tariffs.

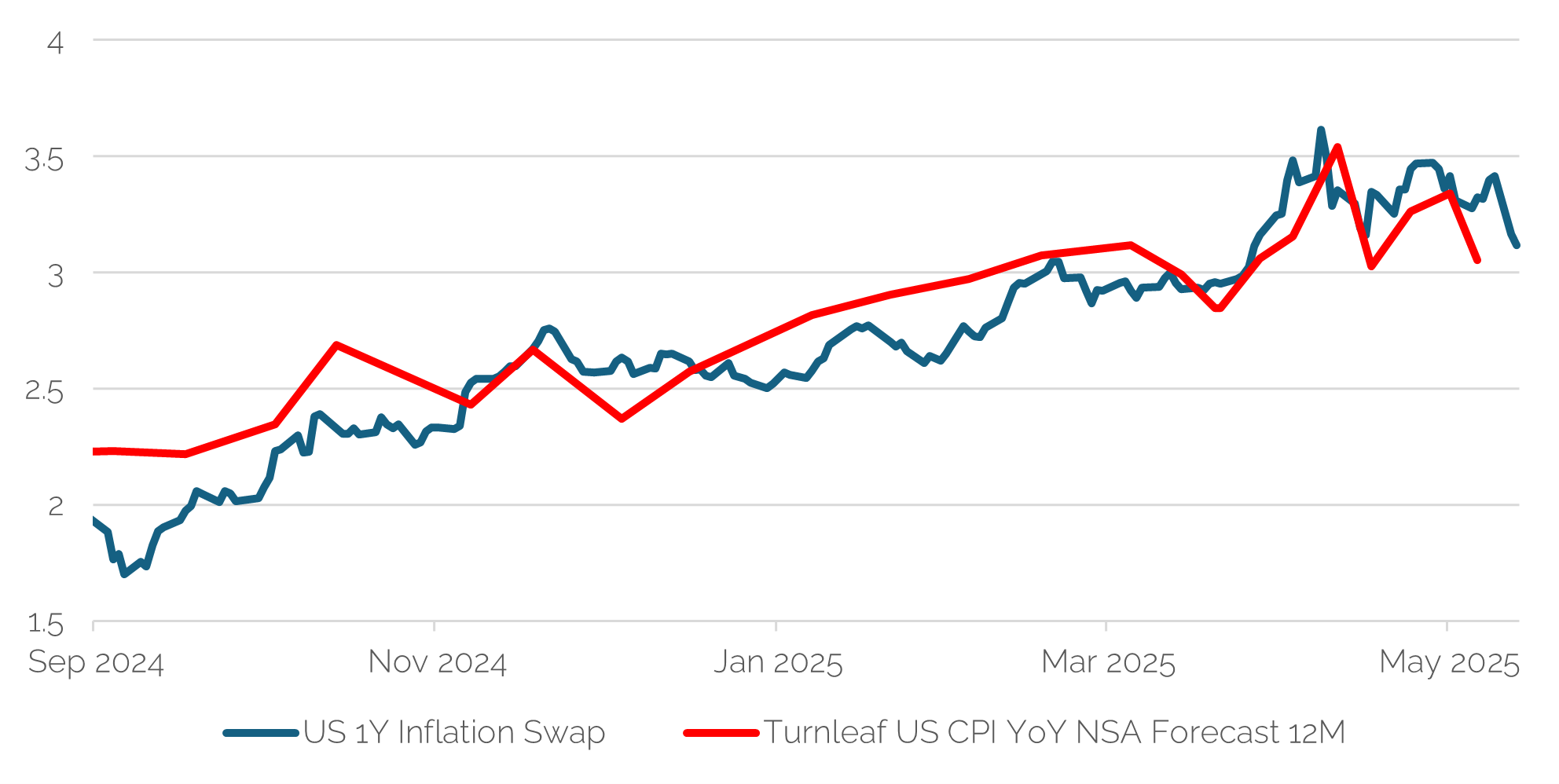

Tariffs have been a significant driver of inflation expectations. When prices are expected to go up, the inflation market shifts upwards under the assumption that the Fed would have to keep interest rates high to combat high prices. Yet, after the trade deal announcements in the past week, inflation expectations have decreased and yields have increased. This suggests that the bond market had expected the Fed to cut rates to avert a recession but now believes that the Fed has more room to keep rates higher for longer. By leveraging high-frequency data and surveys measuring firm behavior, Turnleaf was able to accurately model the projection of inflation expectations onto realized inflation while conditioning for recession risk. As a result, Turnleaf has benefitted from this foresight since September 2024 and watched the market converge towards our elevated forecasts before and after the U.S. presidential election, and then, now lower after the tariff debacle (Figure 1).

Figure 1

Short-term inflation estimates are likely to remain consistent with prevailing trends given the limited impact of the actual tariffs on prices. Inflation estimates towards the end of our curve will remain low conditional on consistent communication by Trump that tariffs are to remain permanently low and recession risks do not reemerge (Figure 2). In addition, a stronger dollar is likely to reduce imported input prices for firms, freeing up some capital investment that was stalled due to uncertainty. We will continue to watch for changes in inflation expectations as we remain convinced that inflation expectations are mainly driving long-term inflation outcomes.

Figure 2