This article marks the start of Turnleaf’s series on how U.S. tariffs shape inflation dynamics across Latin America (LATAM). Among the economies we monitor—Colombia, Brazil, Peru, and Chile—most have witnessed upward shifts in their inflation trajectories. Mexico, however, stands out with a downward revision, reflecting its heightened sensitivity to trade policies due to the large share of manufacturing in its export mix. Although this trajectory has dipped relative to earlier forecasts, Mexico’s inflation remains above target, underscoring how the country’s reliance on manufacturing leaves it particularly susceptible to tariff uncertainty.

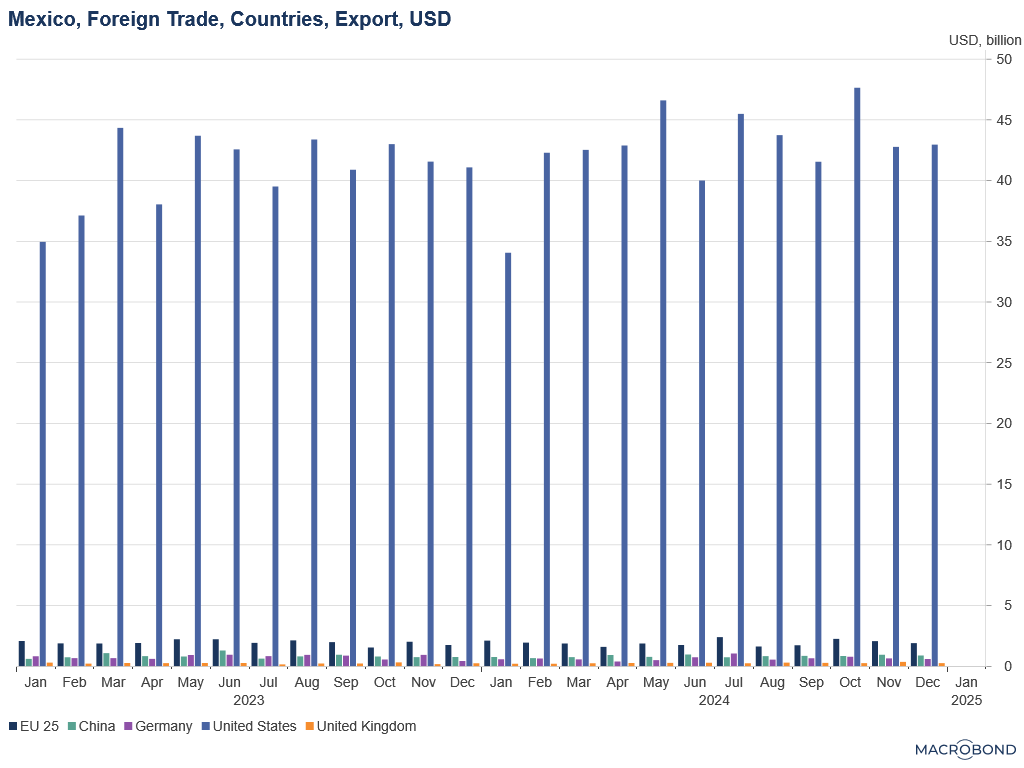

Compared to many LATAM peers, Mexico’s economy depends disproportionately on manufacturing exports—like vehicles—to the U.S. market (Figure 1a and 1b). For Mexico, even the possibility of higher tariffs can delay investment decisions, tempering industrial production and moderating near-term price pressures. From November 2024, Turnleaf’s inflation curve for Mexico remained elevated, but slightly declined since November 2024. We believe that this shift partially reflects policy uncertainty rather than monetary measures alone. Indeed, from President Trump’s inauguration onward, external risk factors have contributed more distinctly to the downward movement in Mexico’s inflation curve.

Figure 1a

Figure 1b

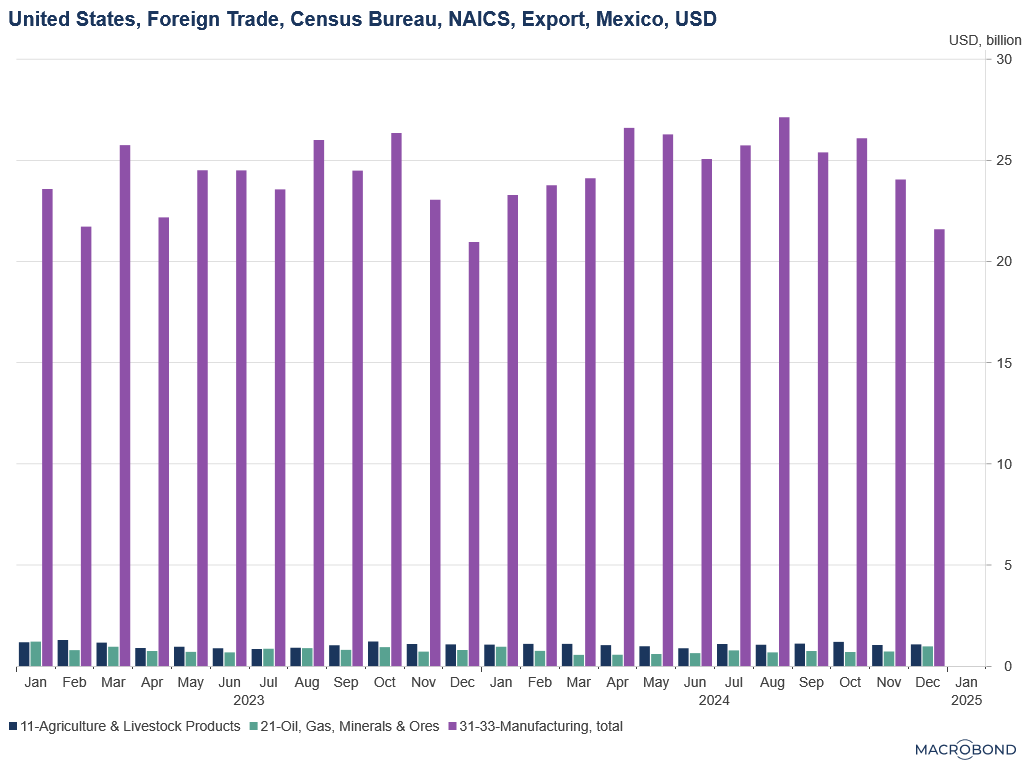

In the broader context, the imposition of 25% tariffs on both Canada and Mexico, alongside 20% tariffs on China, is reshaping the North American auto sector. While higher tariffs on Chinese imports might spur some firms to relocate production closer to home, the parallel 25% tariff on Canada and Mexico raises the cost of automotive parts crossing those borders, curtailing any advantage Mexico might have gained. The result is likely to reduce export volumes and lower domestic revenues, which generally dampens inflation. We have already seen disinflationary pressure from declining vehicle exports being reflected in our forecasts and will likely see this trend exacerbate as the tariffs immediately raised prices for vehicle units shipped from Mexico reducing their competitiveness in U.S. market (Figure 2).

In the broader context, the imposition of 25% tariffs on both Canada and Mexico, alongside 20% tariffs on China, is reshaping the North American auto sector. While higher tariffs on Chinese imports might spur some firms to relocate production closer to home, the parallel 25% tariff on Canada and Mexico raises the cost of automotive parts crossing those borders, curtailing any advantage Mexico might have gained. The result is likely to reduce export volumes and lower domestic revenues, which generally dampens inflation. We have already seen disinflationary pressure from declining vehicle exports being reflected in our forecasts and will likely see this trend exacerbate as the tariffs immediately raised prices for vehicle units shipped from Mexico reducing their competitiveness in U.S. market (Figure 2).

Figure 2

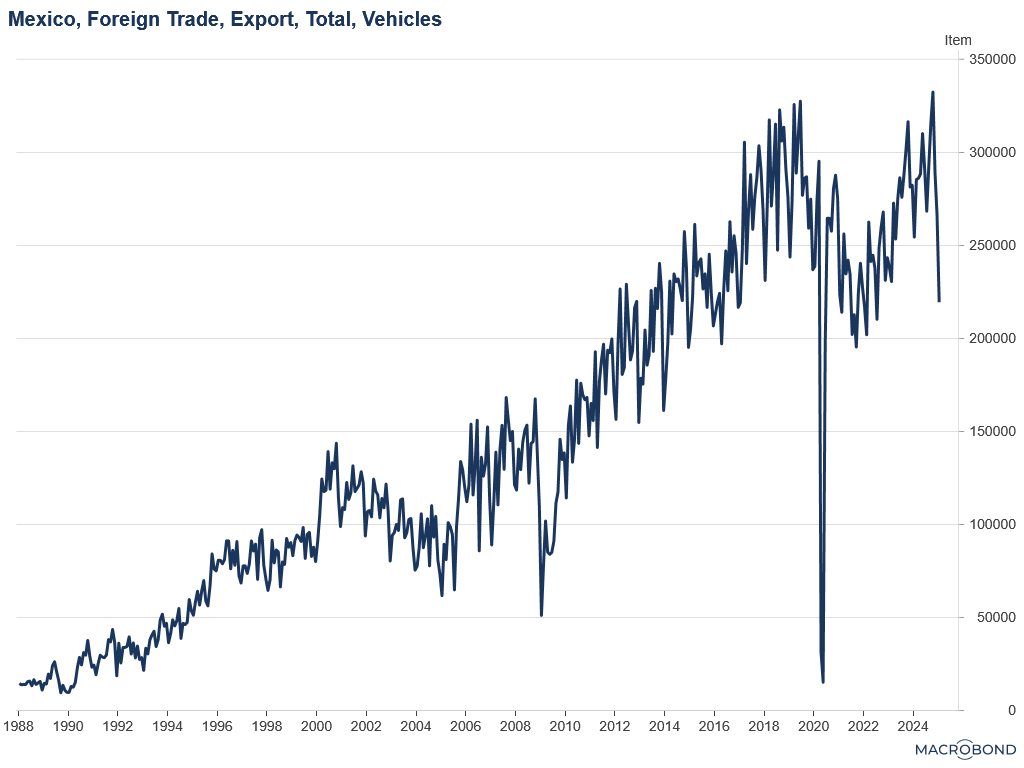

By late 2024, YoY import prices had already begun to climb amid elevated tariff uncertainty as sharper declines in export prices reflected lower demand for Mexican exports and therefore, lower demand for the Mexican peso (Figure 3). Now that the tariffs on Mexico are formalized, export revenue may be hit even harder, pushing export prices lower while ongoing peso depreciation and efforts to reconfigure manufacturing supply chains could push import prices higher. Mexico’s potential move toward retaliatory tariffs adds another layer of complexity, making the overall inflation outlook increasingly delicate.

Figure 3

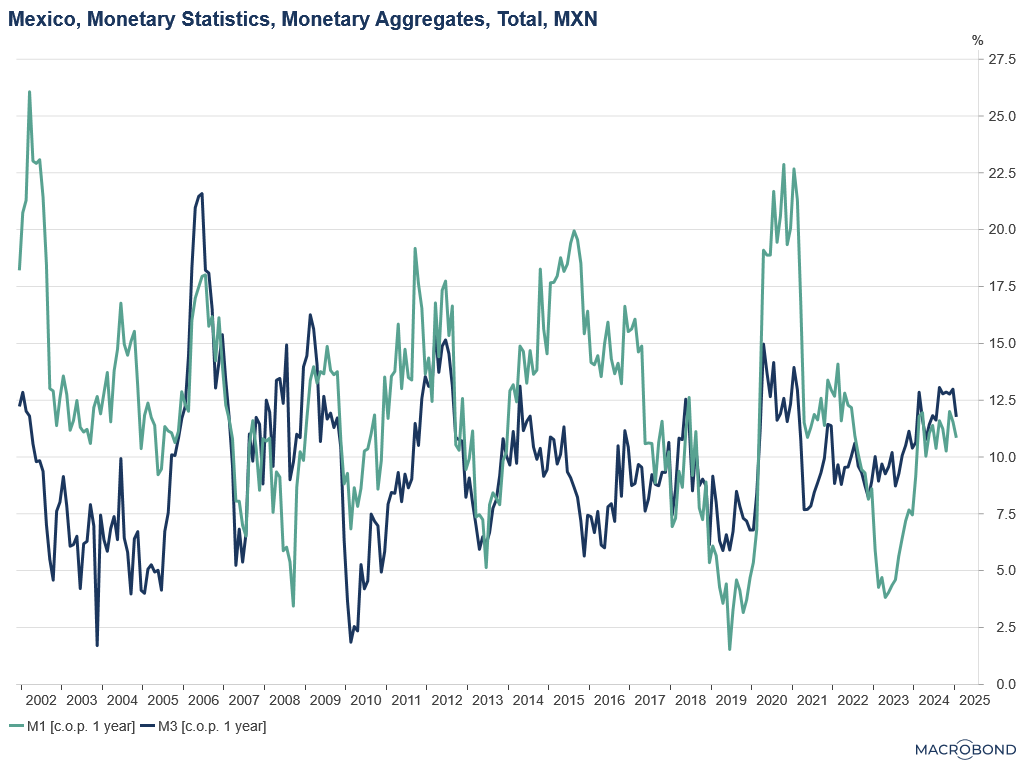

Evidence of slowing activity may already be reflected in monetary aggregates, which have been flagged by our models as disinflationary forces (Figure 4). M1, representing the most liquid form of money, tends to decelerate when consumer spending and business investment stall under conditions of uncertainty. M3, a broader measure including time deposits, may also grow more slowly if credit demand weakens. In typical circumstances, contracting liquidity indicates softening inflation, but currency depreciation can import inflationary pressure when export revenues fall short. This tension underscores why observing M1 and M3 under evolving tariff scenarios helps signal whether Mexico’s monetary conditions will amplify or dampen near-term price pressures.

Evidence of slowing activity may already be reflected in monetary aggregates, which have been flagged by our models as disinflationary forces (Figure 4). M1, representing the most liquid form of money, tends to decelerate when consumer spending and business investment stall under conditions of uncertainty. M3, a broader measure including time deposits, may also grow more slowly if credit demand weakens. In typical circumstances, contracting liquidity indicates softening inflation, but currency depreciation can import inflationary pressure when export revenues fall short. This tension underscores why observing M1 and M3 under evolving tariff scenarios helps signal whether Mexico’s monetary conditions will amplify or dampen near-term price pressures.

Figure 4

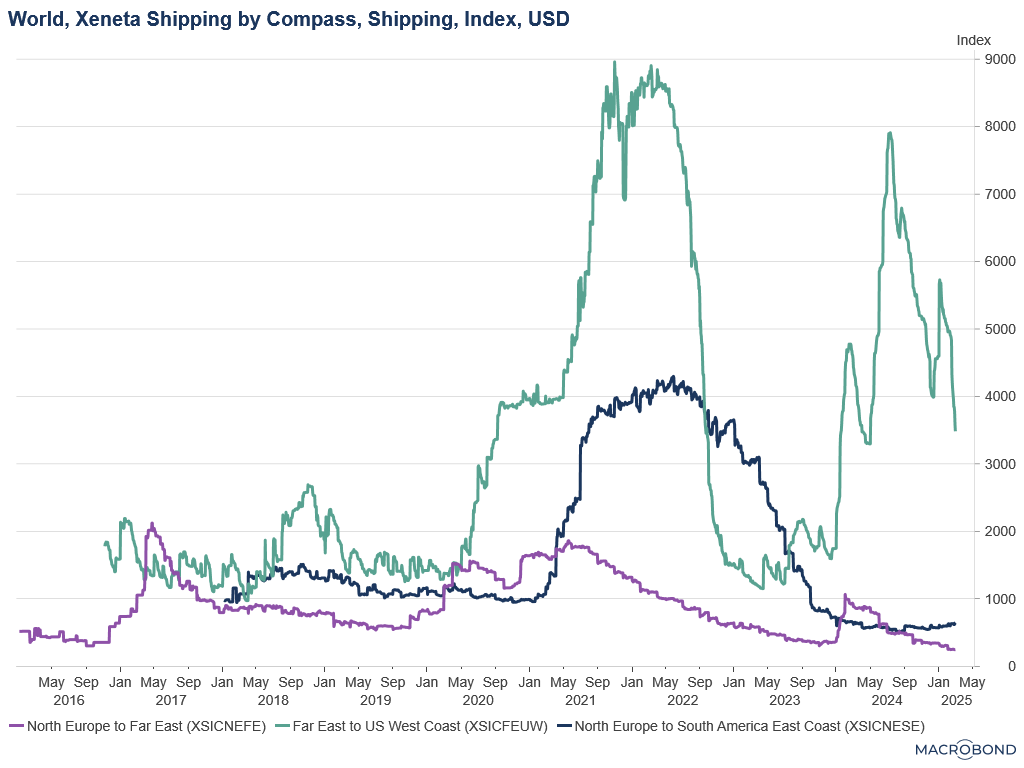

Recent shipping data reveals how global and regional trade disruptions are weighing on Mexico (Figure 5). Lower freight costs typically signal weaker demand; Negative export price growth underscores declining external revenue, driving firms to delay investments and households to cut back on spending—slowing the growth of both M1 and M3. Although Mexico’s inflation forecast has inched down, it remains above target, reflecting a delicate balance between reduced export-driven income and the risk of import-based inflation if the peso weakens.

Recent shipping data reveals how global and regional trade disruptions are weighing on Mexico (Figure 5). Lower freight costs typically signal weaker demand; Negative export price growth underscores declining external revenue, driving firms to delay investments and households to cut back on spending—slowing the growth of both M1 and M3. Although Mexico’s inflation forecast has inched down, it remains above target, reflecting a delicate balance between reduced export-driven income and the risk of import-based inflation if the peso weakens.

Figure 5

Although tariffs have partially driven Mexico’s inflation forecasts below initial expectations, they have not yet yielded widespread disinflation. Instead, Mexico’s experience reveals a series of counterbalancing pressures where reduced export revenue collide with the risk of a weaker peso and rising import prices. In future articles, Turnleaf will continue to track these interactions, drawing on high-frequency indicators—including commodity prices, trade volumes, and production data—to offer insights into how evolving tariffs shape LATAM’s inflation landscape.