Last week, President Trump threatened to impose a 39% tariff on Switzerland, higher than the initial 31% discussed in April 2025. With the U.S. being a major importer of Swiss products like watches, chocolates, and machinery (12.3% of Swiss exports), such a steep tariff is likely to hurt Switzerland’s manufacturing sector. But given the Swiss Franc’s status as a safe-haven currency and its robusta consumer demand, just how much will tariffs hurt Switzerland and how will this affect its inflation path?

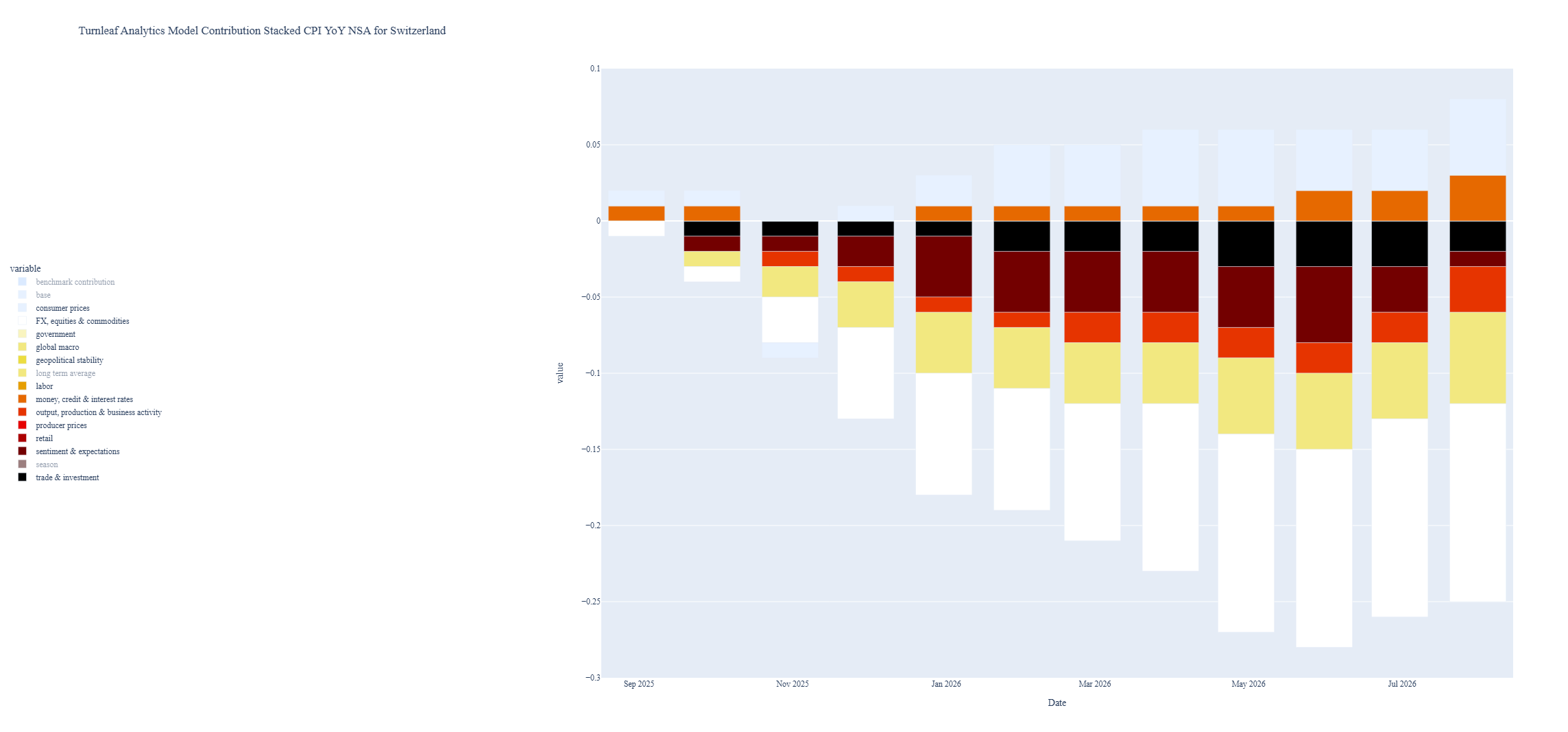

Switzerland’s economy has been magnificently resilient despite high global uncertainty. If we were to unpack groups of common drivers that are influencing our model, we see that disinflation dynamics are mainly driven by commodities and geopolitical stability factors (Figure 1). For example, muted Brent Crude Oil Price, a proxy for a global slowdown, suggests a weak manufacturing sector.

Figure 1

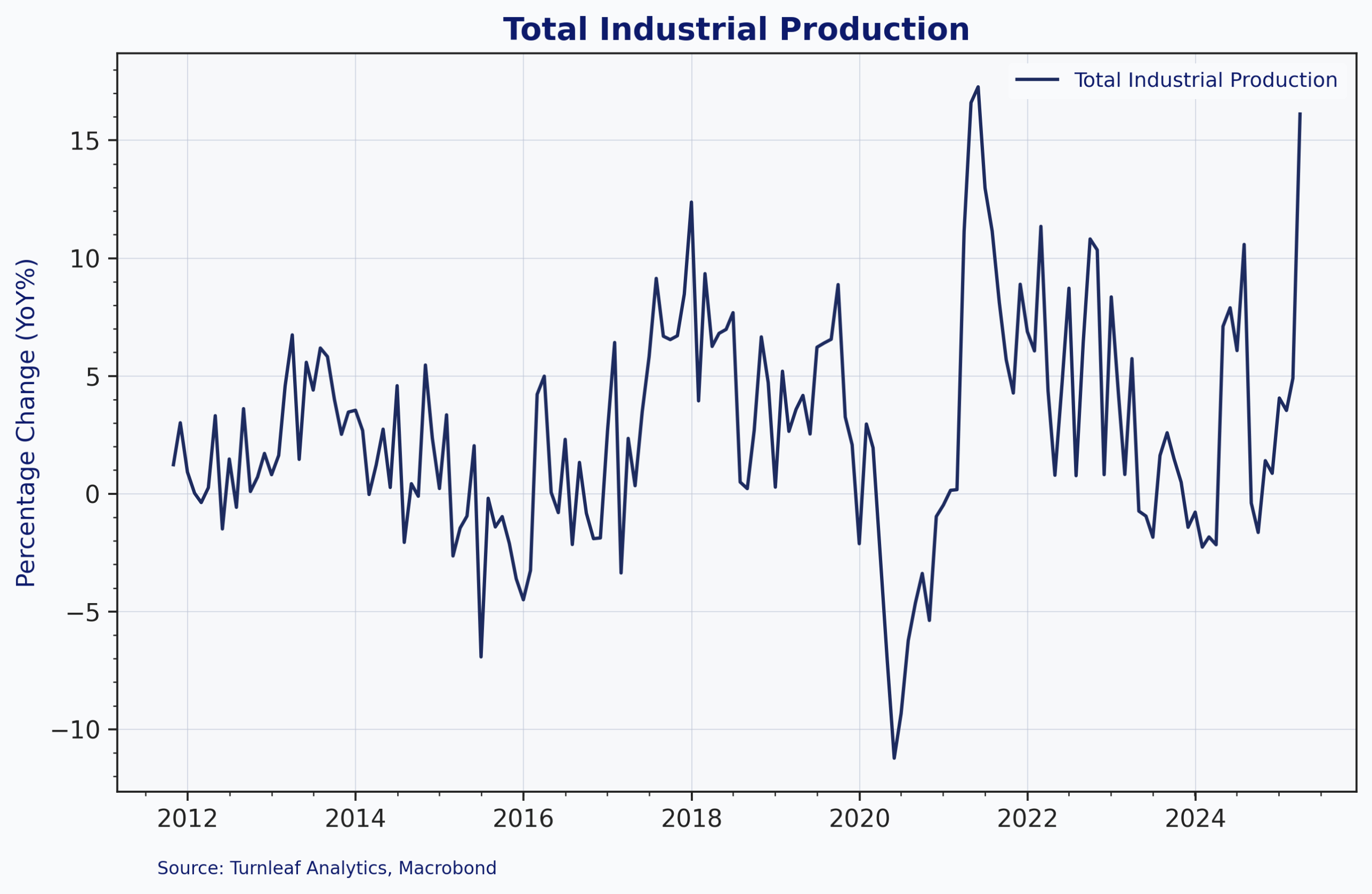

Yet, in March 2025, Total Industrial Production Ex Construction CA surged, rising 16%YoY (Figure 2), likely in response to robust domestic demand, as reflected in a 3.8% YoY increase in retail sales in June 2025.

Figure 2

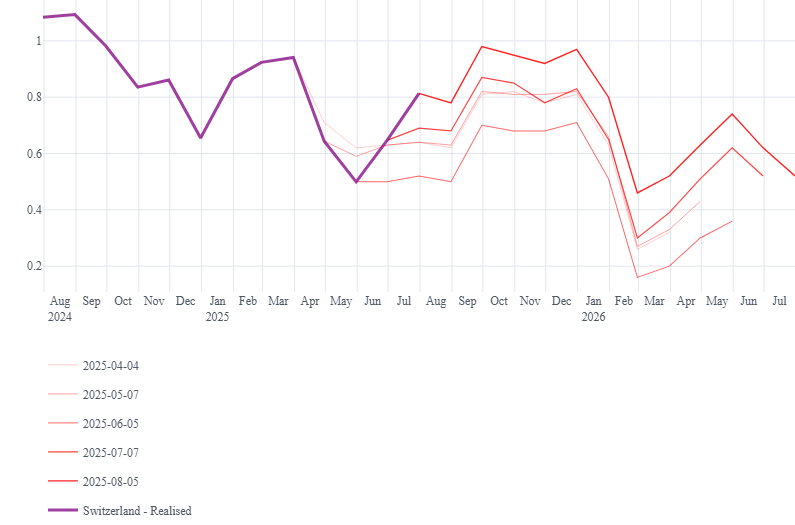

Turnleaf’s core inflation model captures this uptick in demand while also indicating that a stronger Swiss franc has contributed to containing input costs. Previously projecting core inflation to reach approximately 0.2% YoY at the start of 2026, the model now forecasts a rise to around 0.6% YoY (Figure 3).

Figure 3

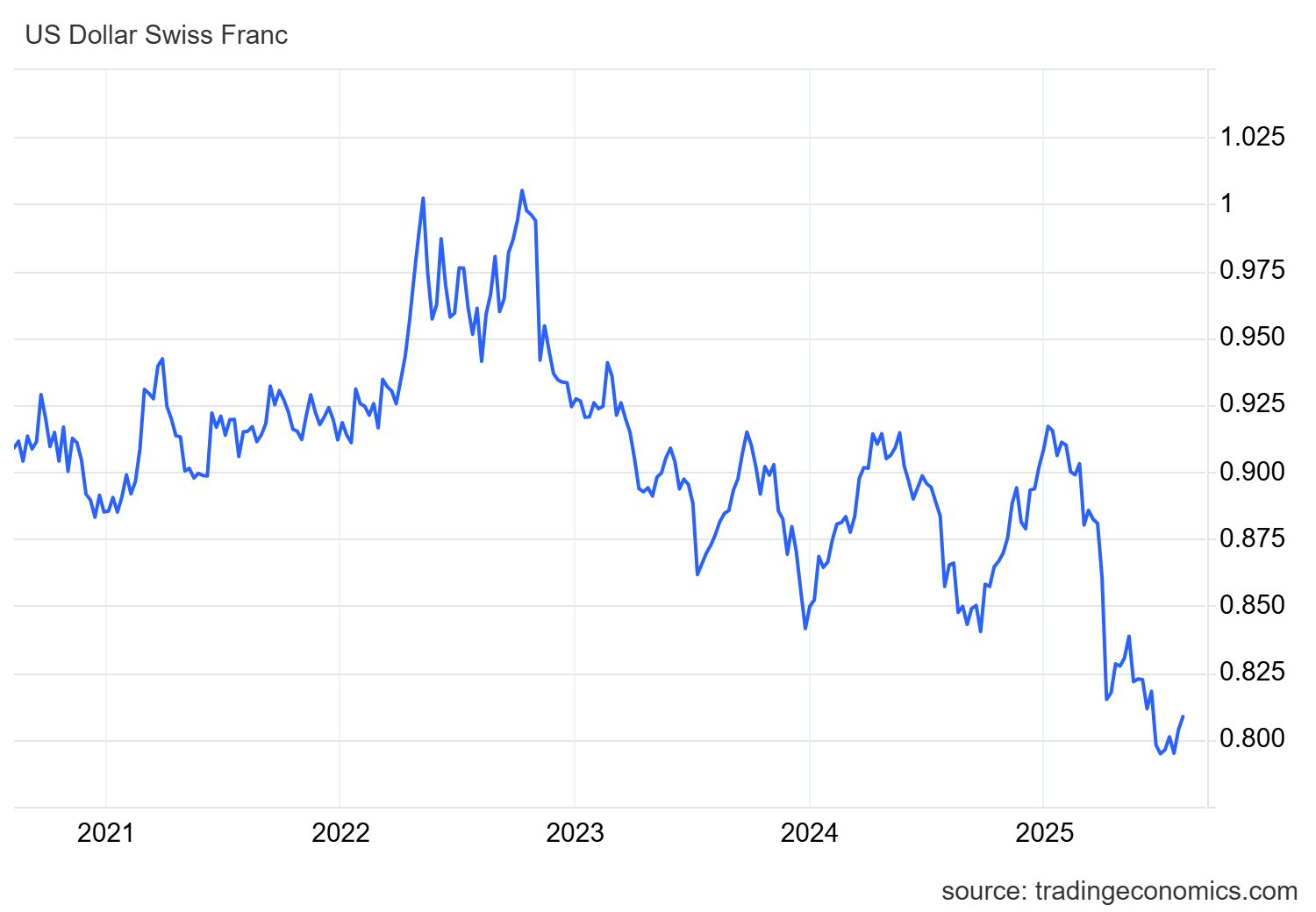

Official data show the import-price index still 0.7% lower than a year earlier in June, a direct drag on core goods prices that explains why headline CPI briefly slipped below zero. A twelve-month surge in the Swiss franc, about 11% stronger against the dollar so far in 2025 and 13% over five years, has slashed import costs (Figure 4). In our model, the exchange-rate pass-through, which has driven down the cost of inputs such as wood-pulp, dairy, energy, and other agricultural commodities, provides the most powerful short-term disinflationary impulse, largely offsetting the tariff-related uncertainty that is weighing on factory orders.

Figure 4

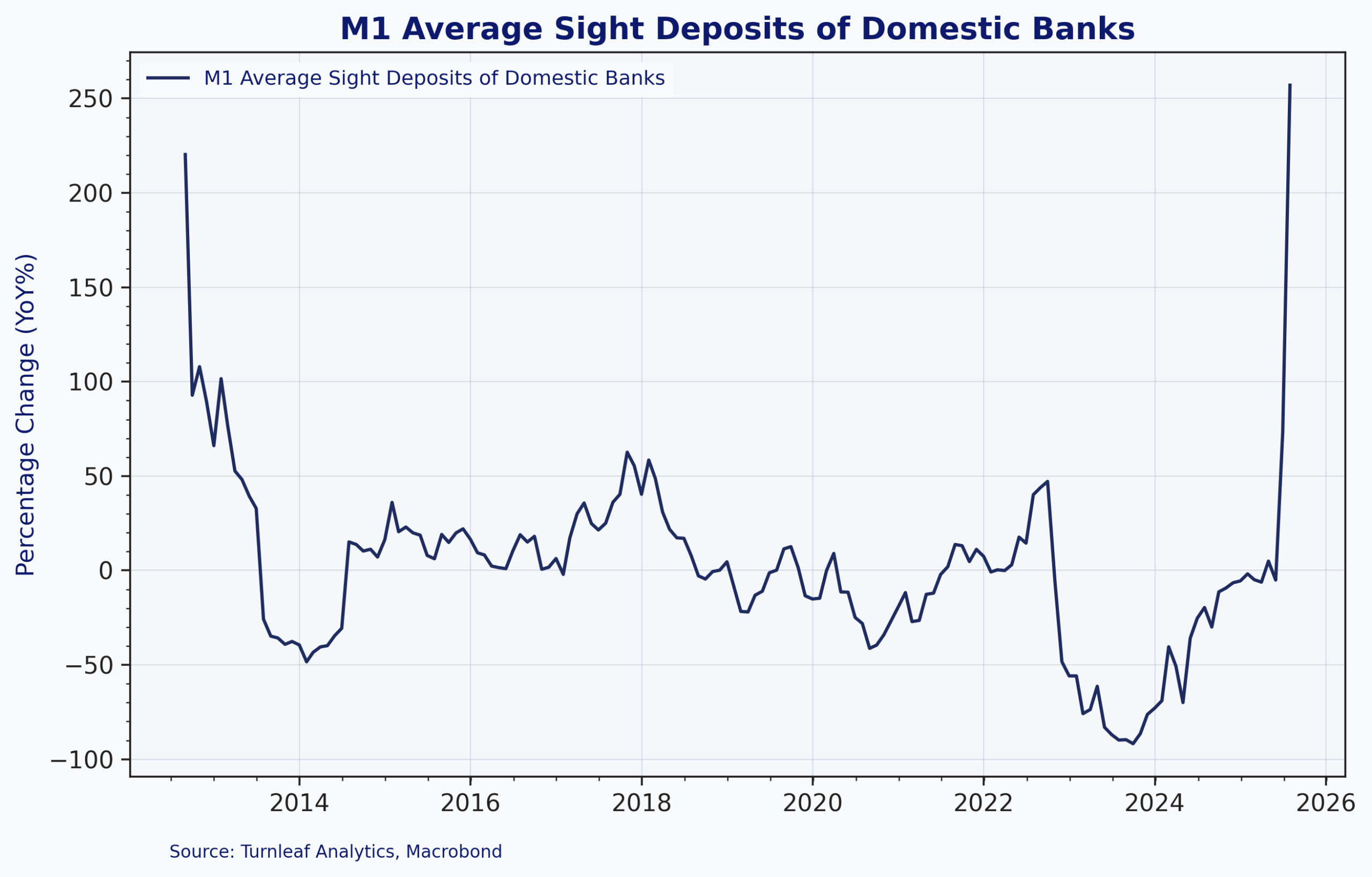

Domestic liquidity is amplifying both demand and price pressures. Following the SNB policy rate cut to zero in June 2025 and the cessation of reserve drainage operations, banks’ sight deposits at the SNB surged 250%YoY by July 2025 (Figure 5). Turnleaf’s model interprets this sharp expansion in narrow money as a leading indicator of future inflationary pressure, contributing to a sustained upward trajectory in the 12-month core inflation forecast via consumer spending channels.

Figure 5

It will be crucial to monitor how industrial production responds to waning demand from the U.S. as tariffs make Swiss products less competitive. If the tariff undermines Switzerland’s trade surplus and dents the franc’s safe-haven appeal, even a modest currency pull-back would make imported consumer goods more expensive and amplify the liquidity-driven rise in prices already projected for 2026.