Last month Turnleaf argued that Switzerland was escaping deflation but still stuck near 0% inflation over the next year, with any firming coming mainly from tax changes and services inflation, while a strong franc kept goods prices pressured. November’s 0.02% YoY print (Turnleaf: 0.05% YoY) largely validates this view, with discretionary items like package holidays, hotels, cars and food falling, partially offset by higher rents, heating oil and air fares.

Looking ahead, we expect headline CPI to hover around 0% YoY until mid-2026, with brief negative readings as base effects roll through, before returning toward 0% (Figure 1 – PAID). Core CPI should track slightly higher but follow the same path. With the franc continuing to appreciate and energy prices subdued, we see almost no underlying price drift. The only upward pressure comes from: (1) electricity solidarity surcharges covering grid enhancements and steel/aluminium industry aid, and (2) modest services inflation from rents. Importantly, the previously expected VAT increase from 8.1% to 8.8% has been delayed to 2028, removing a key upside risk for 2026.

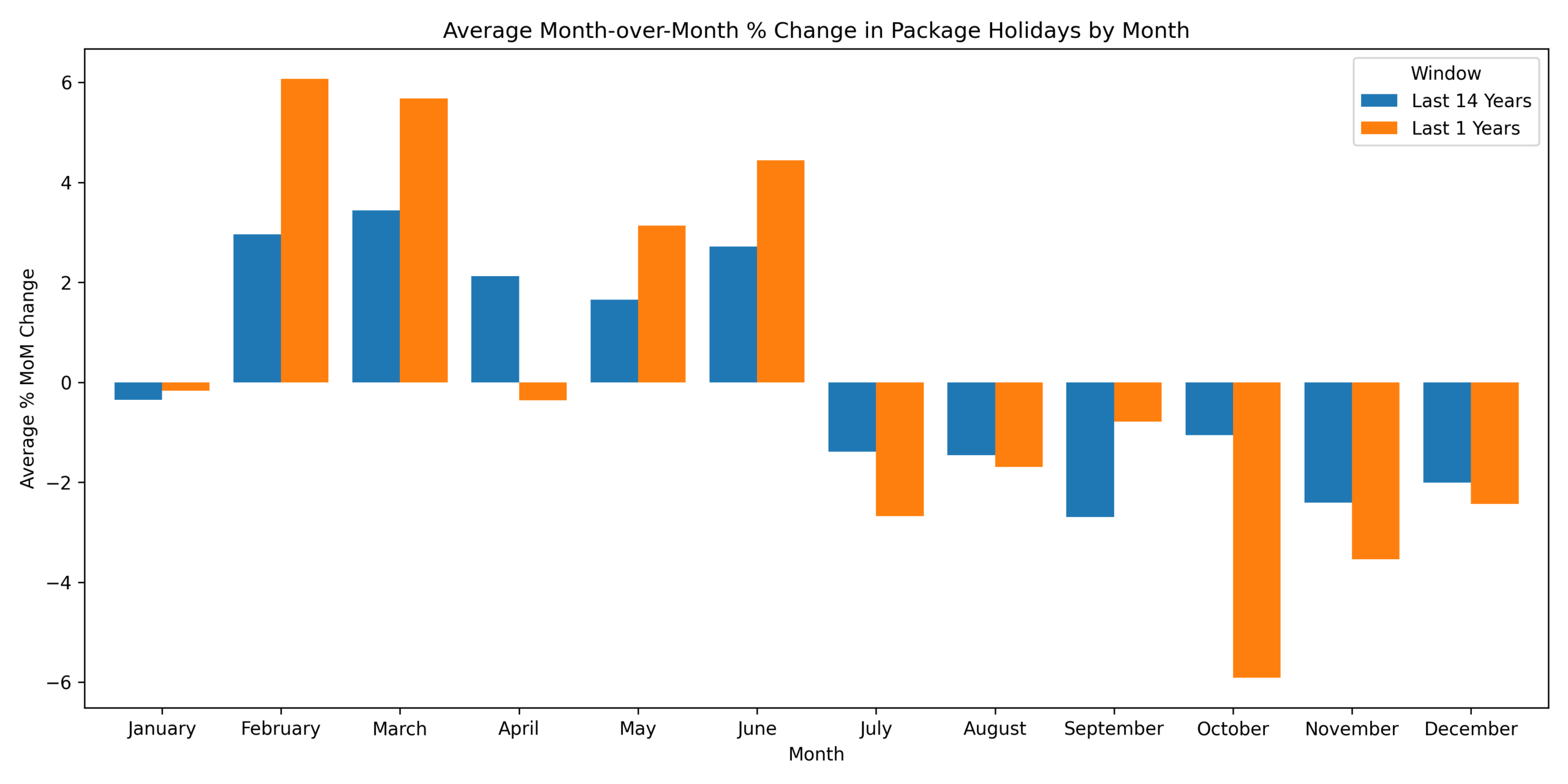

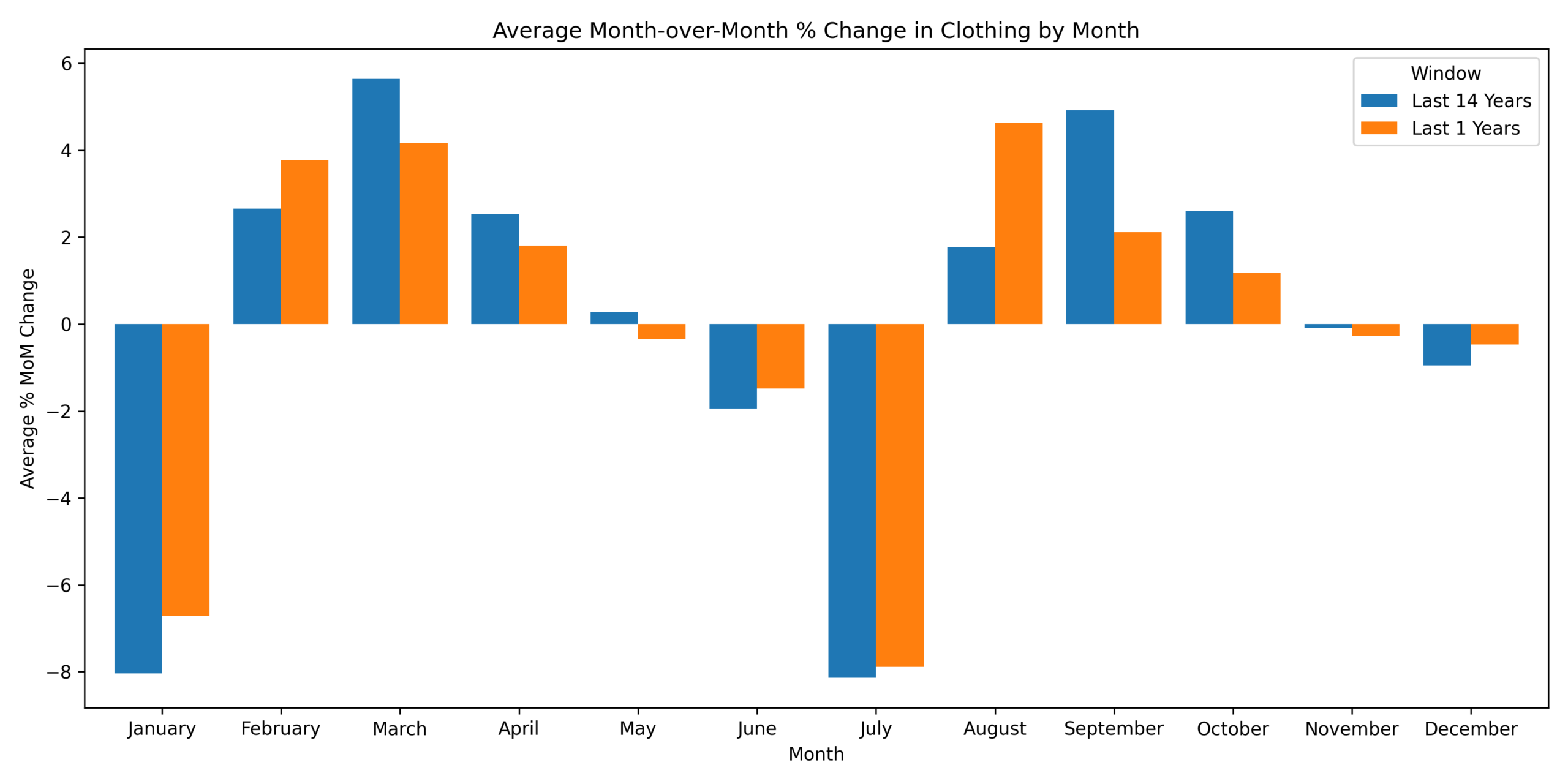

Seasonal factors dominate near-term dynamics. Travel, clothing and some food categories should see heavy year-end discounting, though franc appreciation hasn’t notably altered these patterns (Figure 2A & 2B). The turn of the year typically brings regulated tariff resets including health insurance premia, rent adjustments with one exception: public transport prices are frozen for 2026. We still expect a modest early-2026 rebound as discounts unwind and annual adjustments feed through, but the magnitude will be smaller than initially anticipated given the VAT delay and transport freeze.

Figure 2A

Figure 2B

Figure 2B

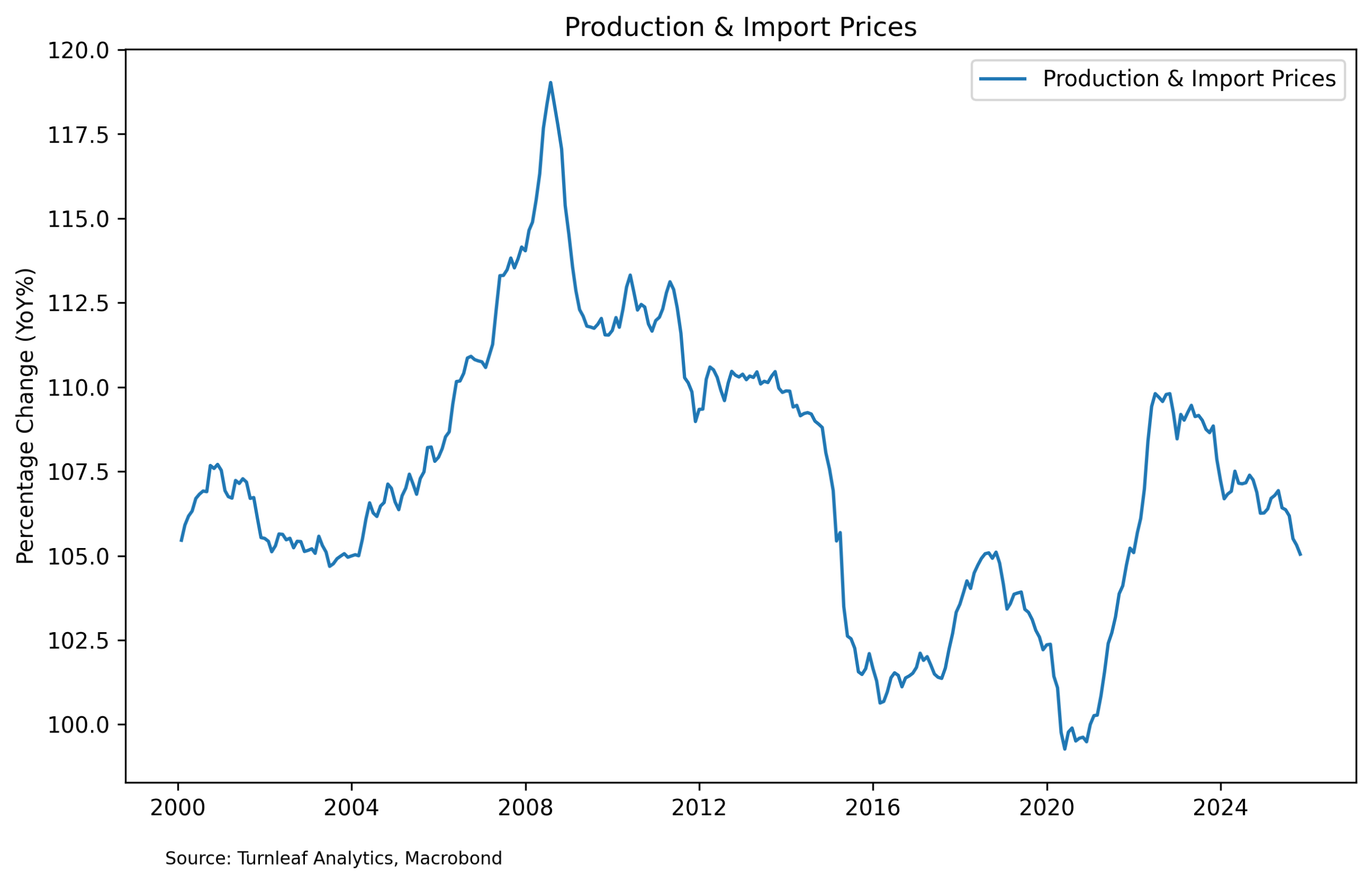

Producer and import prices confirm absent pipeline pressures. The index has fallen from its 2022 peak of 119 to 105-106, with continued softening through late 2025 erasing the 2023 rebound (Figure 3).

Figure 3

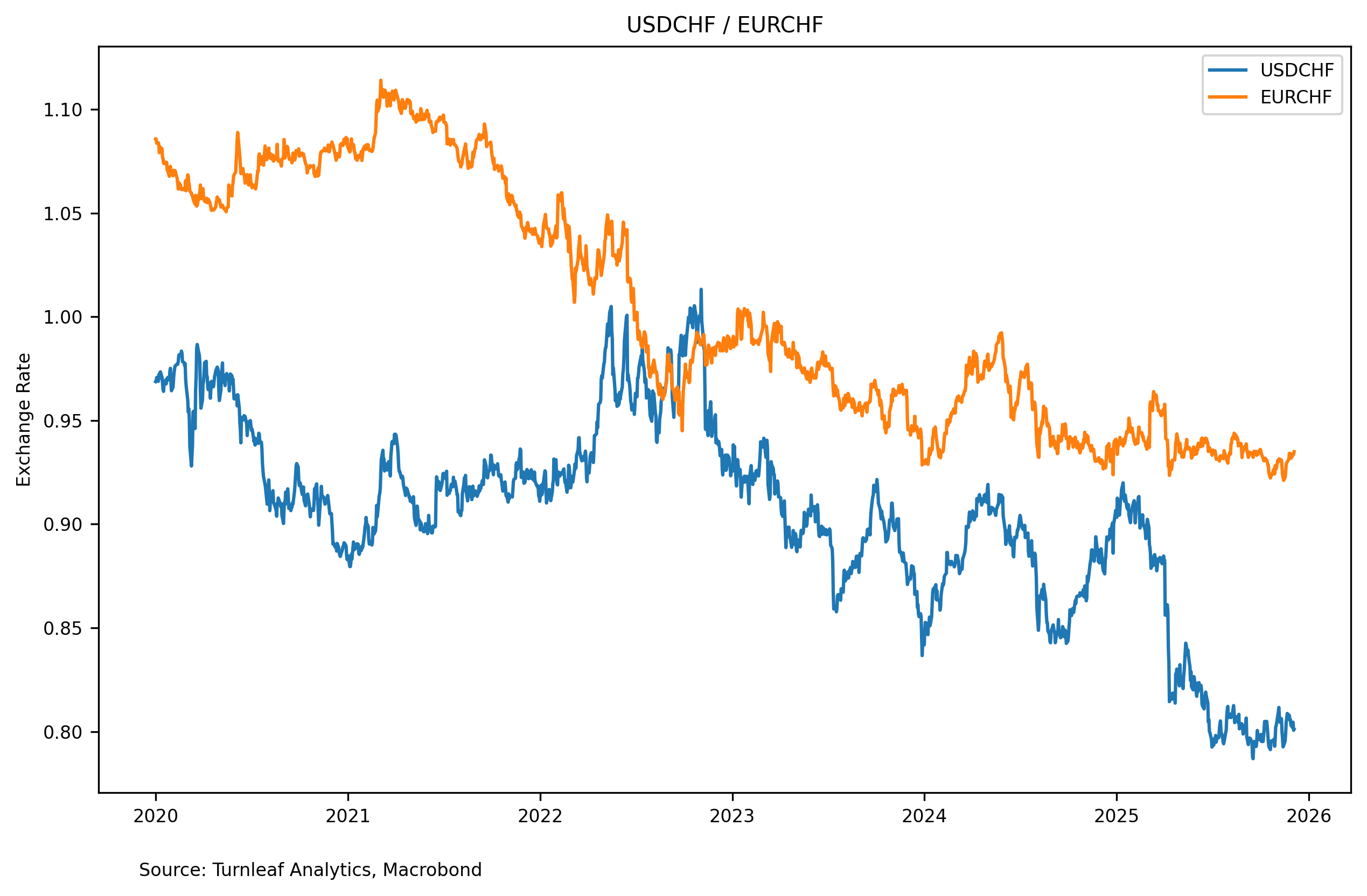

This leading indicator signals goods inflation will remain subdued, leaving any price increases to come from domestic services or regulated tariffs which are both constrained by weak demand. Unemployment has drifted to 3.0% from very low levels, and while lending grows, overall activity remains unspectacular. Housing is the notable exception where rent inflation has been positive, representing the main domestic factor preventing outright deflation. Without rent support, Switzerland would likely be experiencing negative CPI readings more consistently. Oil, shipping costs, and Eurozone/US imported inflation stay benign, while the strong franc continues to act as a structural brake on goods prices (Figure 4).

Figure 4

The persistent inflation undershoot puts the SNB in an uncomfortable position heading into its December 12th meeting. Markets currently price only a 20% probability of negative rates returning, but 2Y government bonds have traded below zero since May 2025, suggesting investors see subzero territory as inevitable. With Switzerland’s debt-to-GDP at just 37% and minimal new bond supply planned for 2026, fiscal constraints aren’t the binding issue. Instead, the economy depends heavily on international trade, particularly with the US and EU, where recent US tariff announcements and hopes for German recovery are needed to weaken the franc and restore export competitiveness.

November’s release confirms Switzerland is operating at the lower boundary of its target with little endogenous pressure to move higher. Near-term, a technical bounce at the start of 2026 is likely, followed by readings fluctuating around zero and occasionally dipping negative. Further out, as seasonal noise fades, the forecast edges up but stays below 1%, supported by rents and slightly firmer energy prices, restrained by muted growth, contained imported inflation and anchored expectations.