Turnleaf expects Switzerland inflation to oscillate around 0% over the next 12 months with some indication of healthy price growth towards the tail-end of our forecast (Figure 1 – PAID).

Robust appreciation of the Swiss franc has resulted in persistent disinflation led by goods deflation of -1.6% YoY as of October 2025, while services inflation has moderated to +1.1% YoY. This pattern is expected to continue throughout 2026. Switzerland imports about 60% of GDP (with consumer goods representing approximately 30% of total imports in 2021), and with the franc showing no weakness, we expect downward price pressures to continue. From January 2026, we expect a concentrated spike in prices to keep inflation slightly above 0 due to plans to increase VAT by 0.7% from 8.1% to 8.8% to finance the 13th monthly pension payment for the next year. Given that prices could fall into deflation territory, we expect these plans to pass with high probability in the next fiscal meeting in December 2025.

Central Bank Policy and the Limits of Intervention

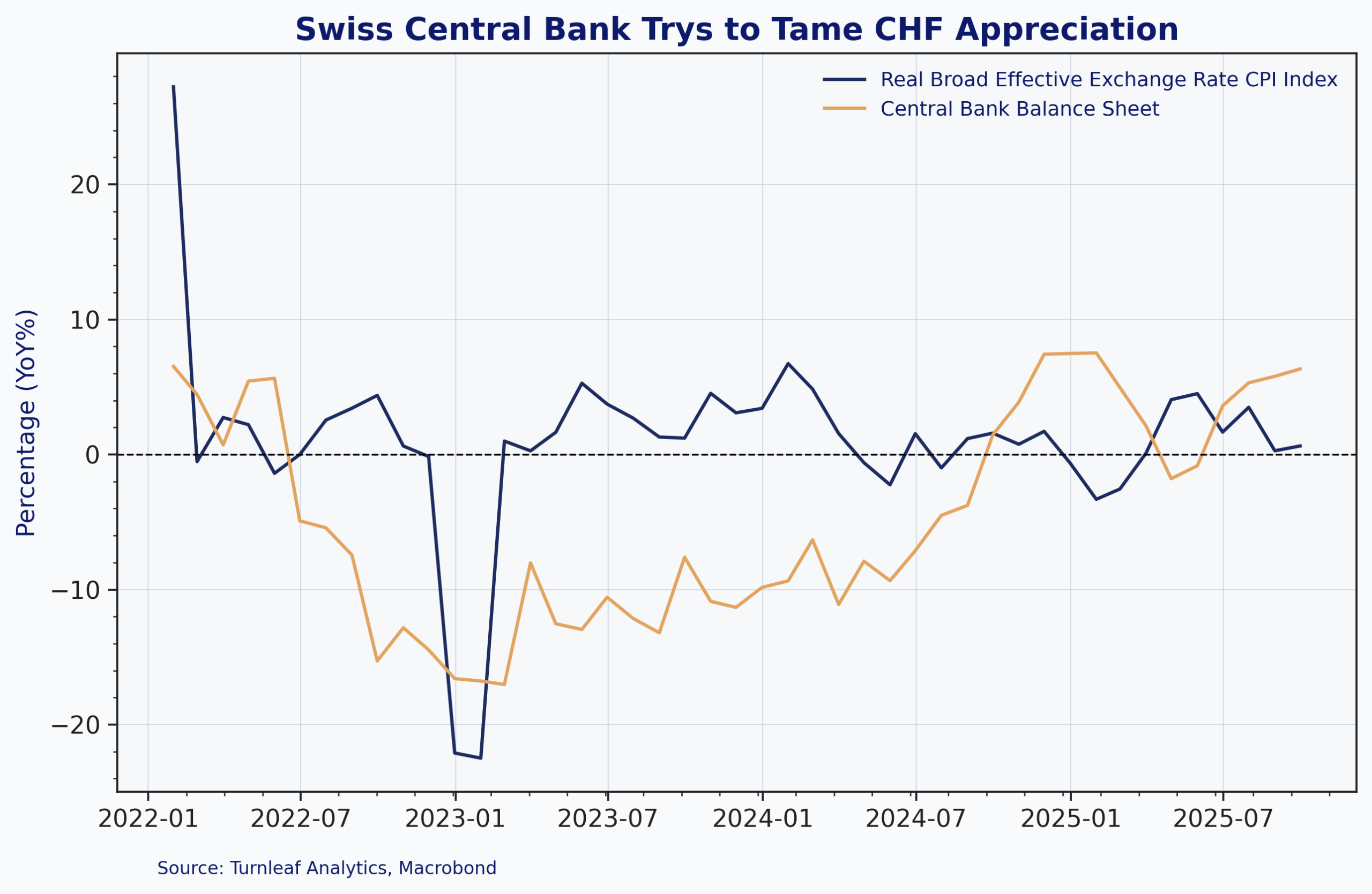

In our model, we account for central bank attempts to manage CHF valuation that have ultimately proven insufficient. Comparing SNB’s balance sheet dynamics relative to the Real Broad Effective Exchange Rate reveals evolving policy effectiveness. The SNB’s balance sheet contracted sharply from CHF 1,057 billion at end-2021 to CHF 881 billion by end-2022, a 17% decline, and continued decreasing through 2023 to approximately 800 billion CHF. This contraction reflected both valuation losses on foreign holdings and a strategic shift away from massive foreign exchange interventions (Figure 2).

Figure 2

However, by August 2025 the balance sheet had stabilized at approximately 852 billion CHF, indicating modest expansion from 2023-2024 levels. Despite this recent balance sheet stabilization, which would typically dampen franc strength through resumed foreign exchange purchases, the real effective exchange rate has continued to appreciate. This divergence demonstrates that structural safe-haven demand, driven by geopolitical uncertainty, mounting global sovereign debt concerns, and de-dollarization trends, has overwhelmed the SNB’s ability to meaningfully influence the exchange rate. The persistent real appreciation ensures that imported goods remain relatively cheaper, reinforcing the disinflationary pressures we observe in Core CPI.

The Swiss franc has exhibited remarkable strength as a safe-haven asset throughout 2024-2025, with the currency appreciating 12.6% against the U.S. dollar since the beginning of 2025. This appreciation has significant implications for import prices and inflation dynamics. Research on the 2015 franc appreciation episode reveals that exchange rate pass-through to consumer prices is highly incomplete, with estimates suggesting approximately 0.55% of retail price reduction for every one percentage point reduction in border prices after two quarters.

The franc’s strength has significantly reduced the cost of imported goods, and given that imports make up 23% of the CPI basket, this has a notable impact on overall inflation in Switzerland. In October 2025, imported goods prices contracted 1.3%YoY while domestic goods increased 0.5%YoY. The pass-through mechanism operates with some lag, meaning that persistent franc strength observed throughout 2024-2025 will continue to exert downward pressure on consumer prices well into 2026. We continue to see downward pressures driven by Core CPI, likely via a mix of broad seasonal factors and persistent appreciation that have lagged downward price changes.

To continue reading, visit Turnleaf’s latest Substack post, here.