Since the start of the year, housing market indicators have increasingly correlated with rising inflation pressures. Interestingly, Spain classifies mortgages as financial assets, excluding them from the CPI basket. Instead, tenant rents, a proxy reflecting potential rent charged by homeowners, are included. Notably, we observe an upward lagged trend in rent prices alongside greater seasonal volatility in this CPI component, signaling potential future inflationary pressure.

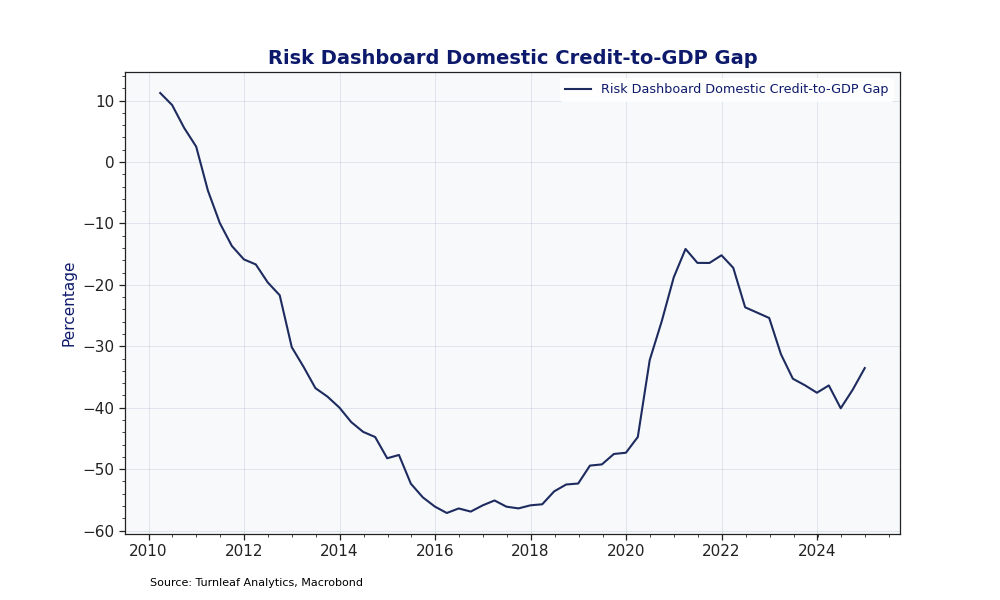

However, it’s important to acknowledge that Spanish consumers currently enjoy greater liquidity, providing increased spending capacity. GDP growth consistently outpaces domestic credit growth, although credit growth, particularly mortgages, is quietly accelerating (Figure 1). Robust economic growth accompanied by rising demand precedes higher prices, aligning with observed increases in consumer spending, especially in sectors like culture, recreation, and restaurants.

Figure 1 Spain was among the first countries to reach the ECB’s 2% inflation threshold, benefiting from significant economic growth driven by improving employment conditions and a stronger financial position, both of which have boosted mortgage uptake. Mortgage rates remain notably low in Spain, with the 3-month EURIBOR rate approaching 2%, significantly fueling mortgage demand that is nearing peak levels observed in 2021 (Figure 2).

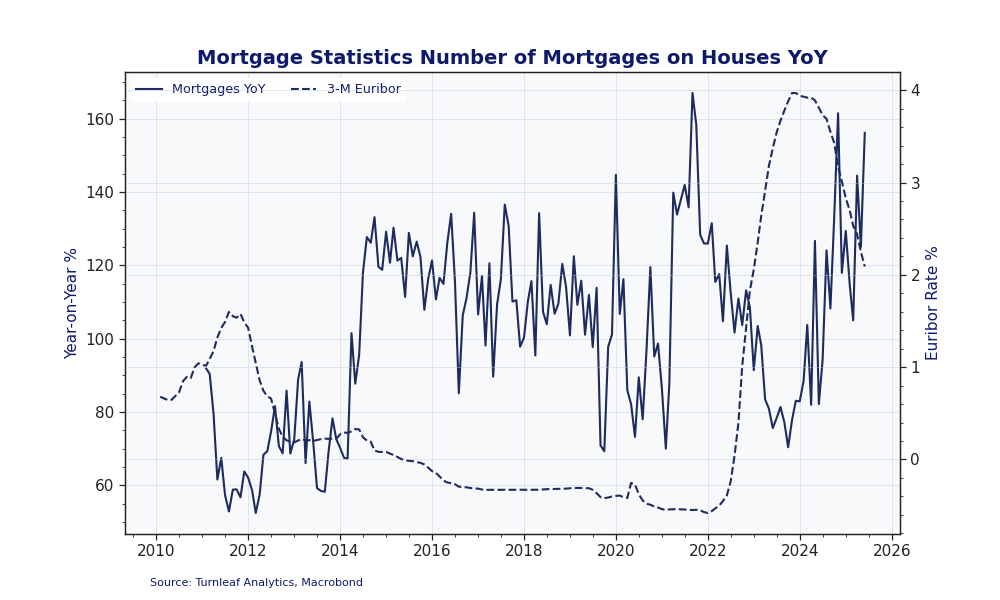

Spain was among the first countries to reach the ECB’s 2% inflation threshold, benefiting from significant economic growth driven by improving employment conditions and a stronger financial position, both of which have boosted mortgage uptake. Mortgage rates remain notably low in Spain, with the 3-month EURIBOR rate approaching 2%, significantly fueling mortgage demand that is nearing peak levels observed in 2021 (Figure 2).

Figure 2

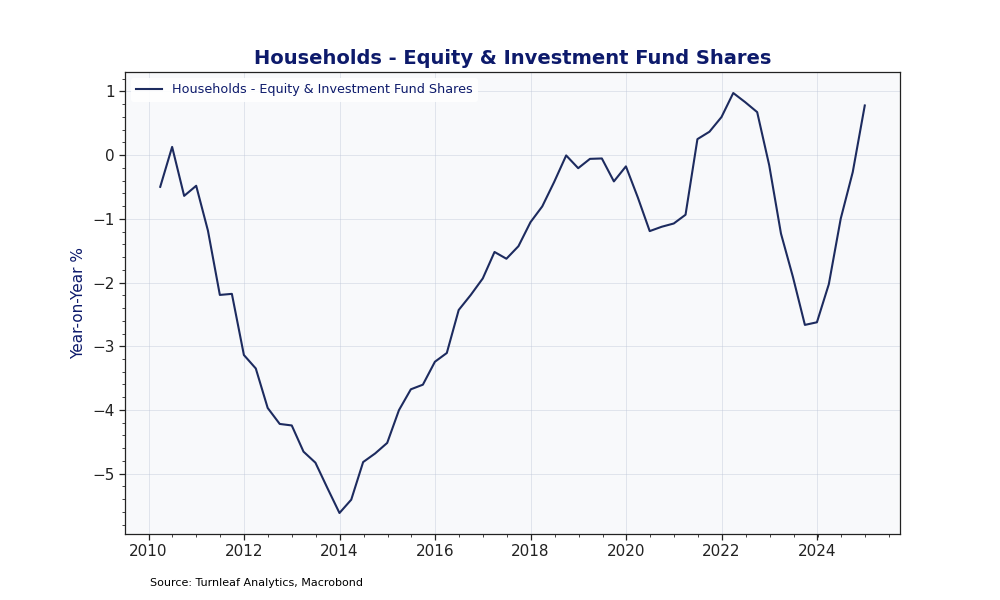

Additionally, household investments in equities and investment funds have rebounded since late 2023, leaving many households financially positioned to form new homes (Figure 3).

Figure 3

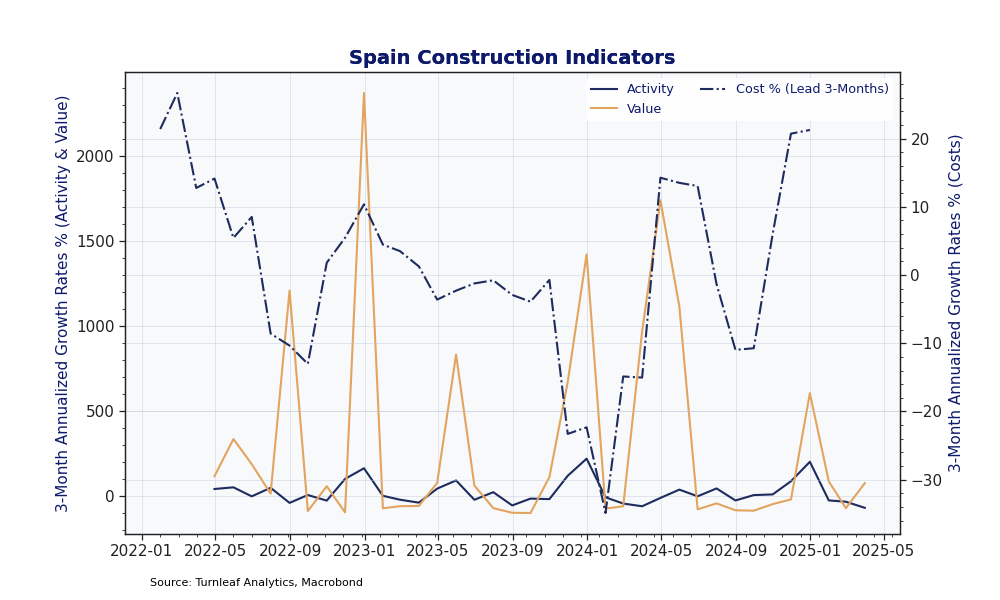

Housing demand growth coincides with rising construction valuations, though the inflationary pressure appears largely driven by supply-side factors. Increases in construction values observed over the past 18 months correlate with sharp rises in construction input costs, combined with steady wage growth, rather than purely from increased demand activity (Figure 4). Given global trade uncertainty, ongoing increases in input costs could translate into higher home prices, ultimately influencing CPI upward.

Figure 4

Overall, the inflation narrative in Spain primarily reflects robust demand, supported by favorable financial conditions enabling increased spending and homeownership. Simultaneously, this demand is amplifying supply-side cost pressures within construction, prompting firms to pass on higher input costs to homebuyers. While strong economic growth currently mitigates supply frictions, Turnleaf will closely monitor credit market trends and global uncertainties impacting input costs to assess ongoing CPI dynamics accurately. For now, though some upside risks exist, Spain CPI is set to increase closer to 2.8%YoY in September 2025- largely due to base effects,- but mostly hover around 2% over the next 12 months.

Word Cloud Contribution Plot, Spain, May 2025

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, ‘Inflation Market Forecast’ is large, indicating their significant weight in the model, while its color suggests whether it contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.