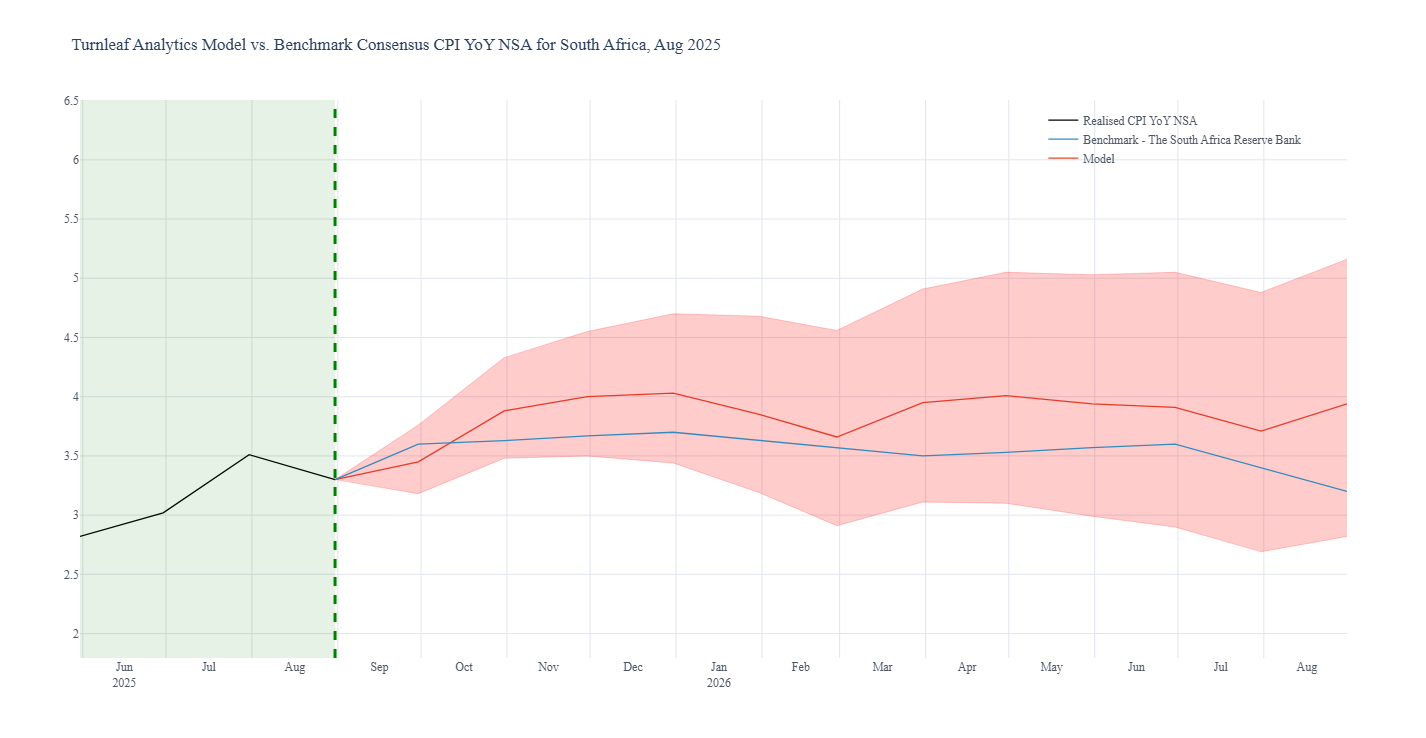

Turnleaf’s Headline CPI YoY forecast for South Africa has been revised lower following the unexpected August 2025 print of 3.3% YoY. The shift downwards of the inflation curve is driven mainly by softer food inflation in the last print—down from 5.7% YoY in July to 5.2% YoY in August (with dairy, notably milk, the key contributor)—and a deeper decline in fuel prices, from −5.5% YoY in July to −5.7% YoY in August. Since April 2025, a steadily firmer rand and subdued energy prices have contained input costs.

From 2026, however, the favorable base effects from lower energy prices will fade, limiting further disinflation. We therefore expect headline CPI to hover around 4% YoY over the next 12 months, with occasional upside risks around the seasonal Eskom tariff adjustments in April and July.

Figure 1

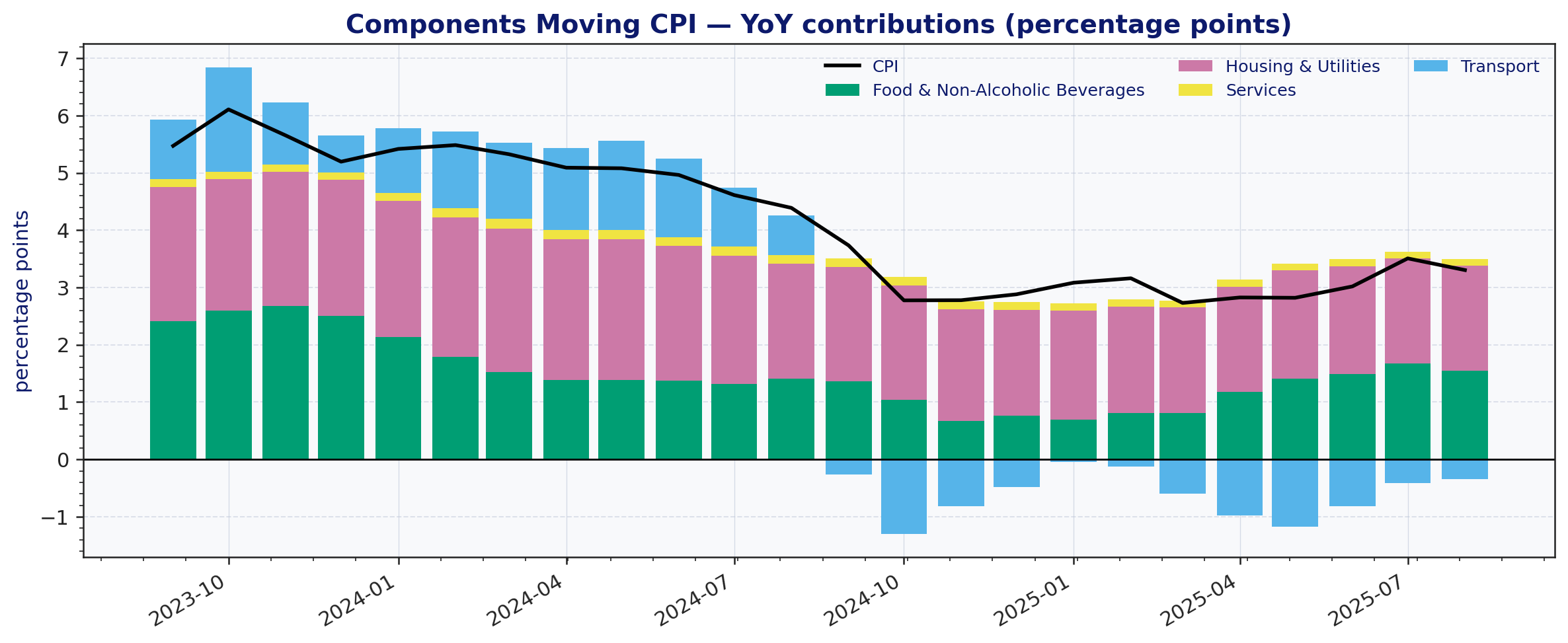

In Figure 2, we decompose the main CPI contributors using YoY bar plots and find that food is the key category to watch in the next few months, having driven much of the downswing in South Africa’s latest print.

In Figure 2, we decompose the main CPI contributors using YoY bar plots and find that food is the key category to watch in the next few months, having driven much of the downswing in South Africa’s latest print.

Figure 2

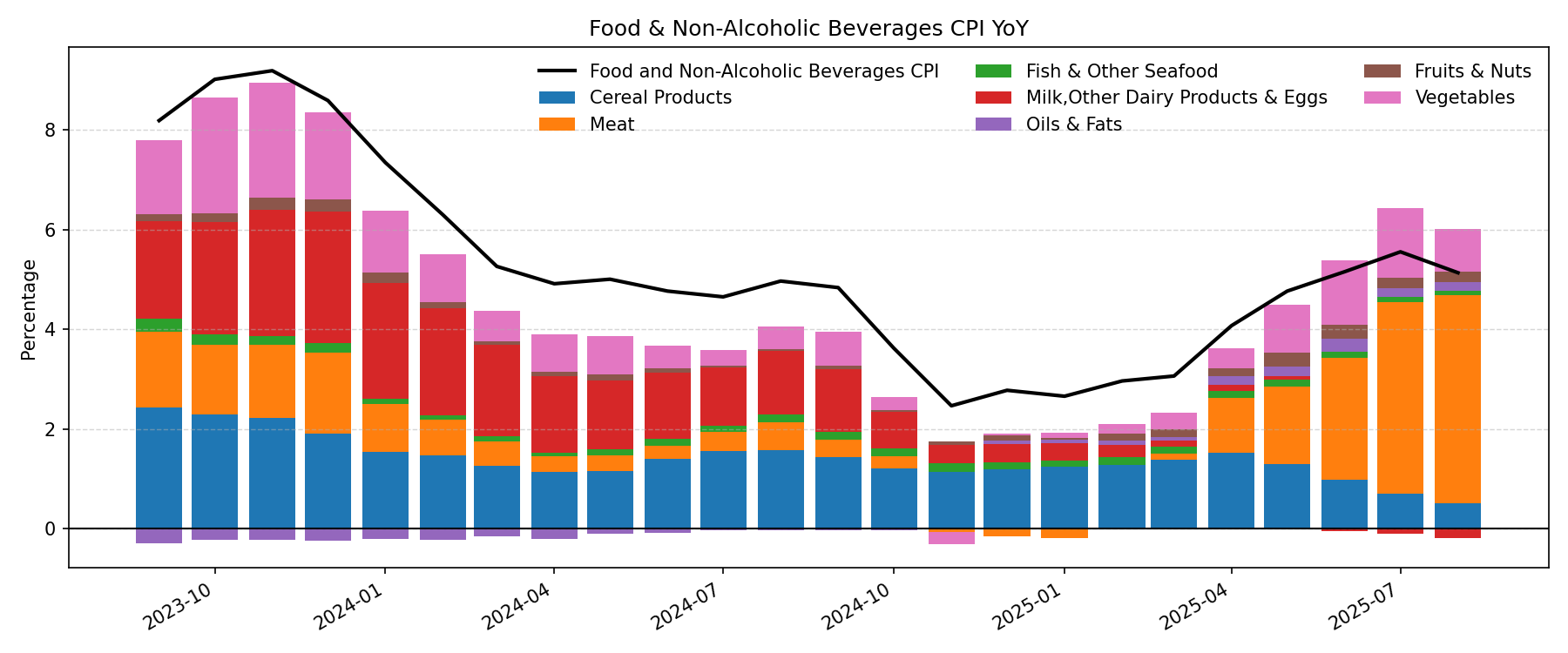

When we unpack Food & Non-Alcoholic Beverages CPI, several subcomponents show atypical dynamics including vegetables and cereal products. For example, milk fell to its lowest YoY rate since March 2011—down to 1.1% YoY in August 2025 (Figure 3). In contrast, overall food prices have been edging higher, with meat contributing the bulk of the recent upswing.

Figure 3

To continue reading, please visit our latest Substack post.