As Poland navigates a complex economic landscape, its rapid growth, fueled by competitive wages and strong manufacturing, faces challenges from both domestic and external pressures. The country’s success in attracting manufacturing investments has driven robust growth, helping Poland “catch up” with its European Union counterparts. However, its deep integration with Western Europe, particularly Germany—which accounts for 28% of Poland’s exports—leaves Poland highly sensitive to regional economic fluctuations.

Poland’s economic outlook in 2024 underscores this interconnectedness, as slowing demand from Germany, persistent inflationary pressures, and fiscal challenges converge. By examining Poland’s current and financial accounts, which reflect trade flows and cross-border asset movements, we gain valuable insights into the trajectory of the country’s CPI and broader macroeconomic stability.

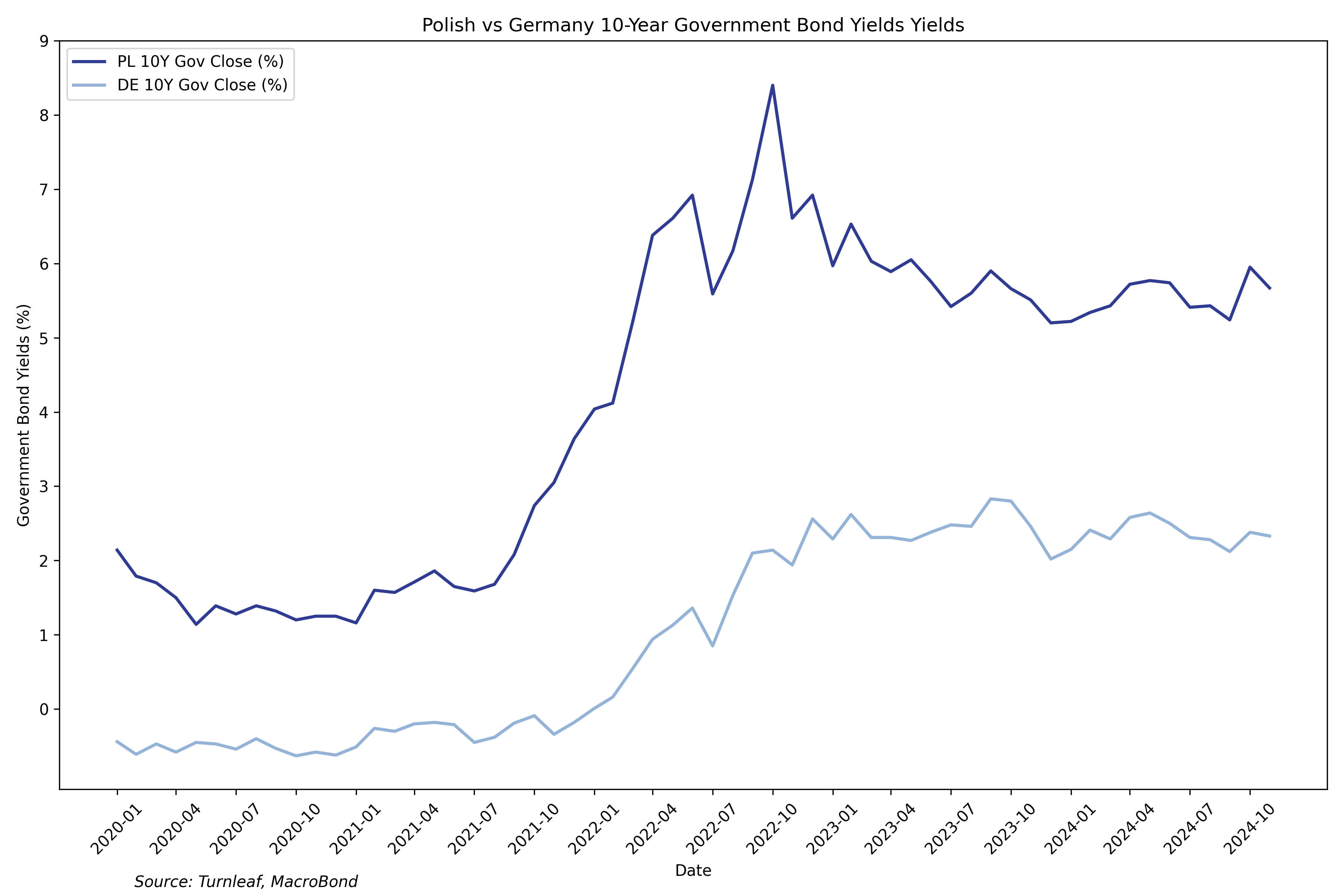

In 2024, Poland’s central government deficit widened significantly due to unforeseen tax revenue shortfalls, public sector wage increases (17.7% YoY in Q1 and 18.6% YoY in Q2 2024), and expenditures on flood-related damages. This fiscal strain forced the government to issue additional sovereign bonds. At the same time, Poland’s reliance on conventional monetary policy has kept interest rates elevated at 5.75%, far exceeding the Euro Area’s 3.40% following the ECB’s recent rate cut.

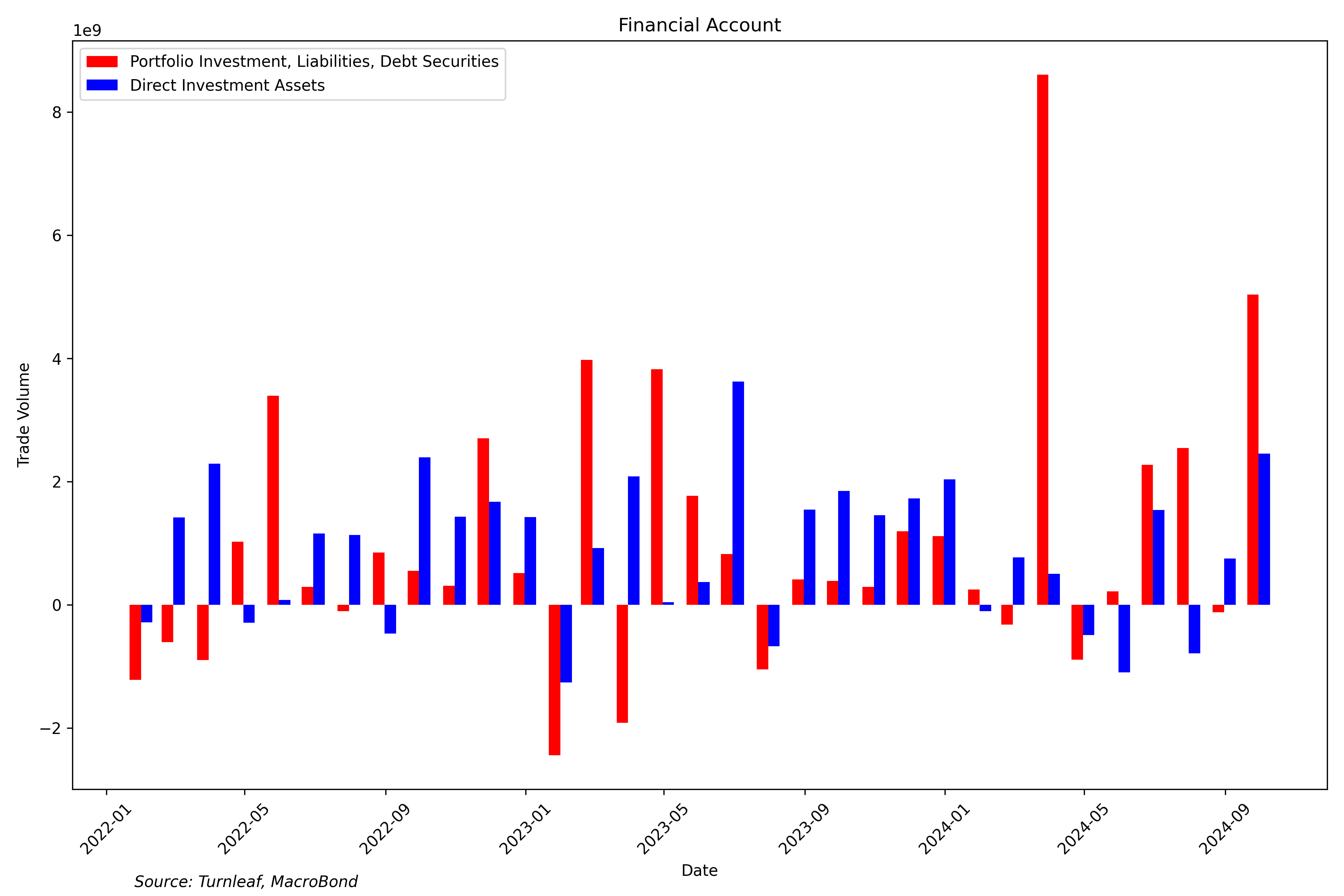

This rate differential has attracted capital inflows, as foreign investors seek higher returns in Polish sovereign debt. Demand for Polish bonds has surged, evidenced by a 4,128.79% MoM increase in September 2024 in the flow of Polish debt securities held by foreign investors. These inflows have strengthened the Polish zloty (PLN), which appreciated by 0.12% MoM in September 2024, and contributed to increased liquidity. However, such inflows could also fuel domestic asset price inflation, particularly in real estate, as suggested by rising inflows into direct investment assets.

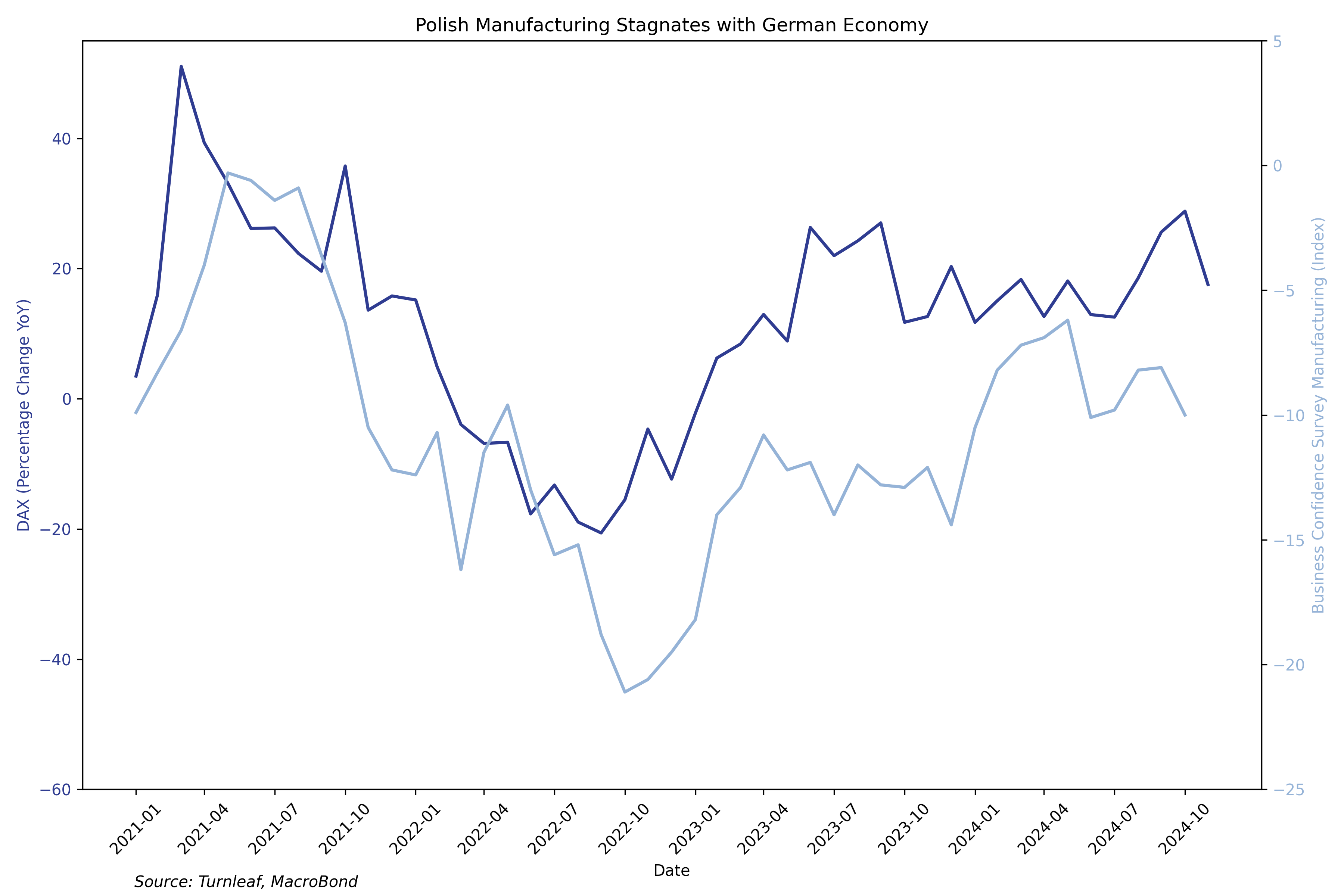

Recently, the Poland Business Tendency Survey for Manufacturing, which tracks the General Business Climate Indicator, revealed worsening sentiment in October 2024, with 10% more respondents viewing business conditions as poor rather than good. This pessimism reflects Poland’s reliance on external demand from Western Europe, overshadowed by a slowdown in Germany’s industrial production. As Poland’s largest trading partner, Germany accounts for 28% of Poland’s exports. However, Germany’s recent recession has significantly impacting Poland’s manufacturing sector. The DAX Frankfurt Equities Index, a benchmark for Germany’s economic health, has remained relatively flat in 2024, recovering from its 2023 losses but signaling subdued economic growth.

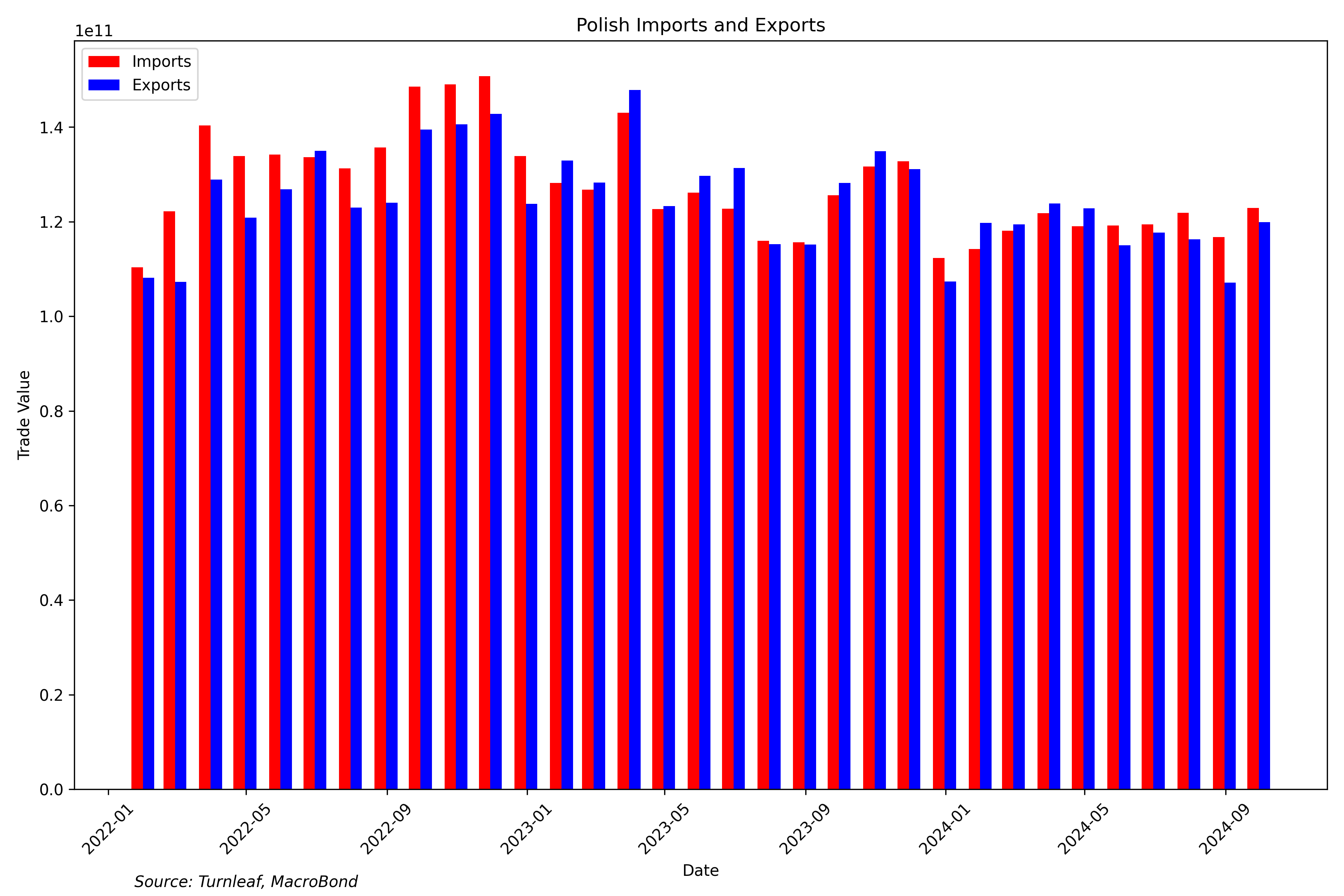

This stagnation has ripple effects on Poland, particularly in the automotive sector, where exports are closely tied to German demand. The appreciation of the zloty, which rose 1.96% YoY in October 2024, has added to Poland’s trade deficit by reducing the competitiveness of exports in the second half of the year. Poland’s vehicle exports to Germany, valued at $11.04 billion in 2023, have stagnated over recent months, reflecting the challenges in maintaining external demand. With fewer euros exchanged for zloty to purchase Polish goods, the weakened export momentum has increased pressure on the currency, further amplifying the trade imbalance. As a result, Poland entered a current account deficit in October 2024, highlighting the dual impact of a stronger currency and diminished external demand on the country’s economic outlook.

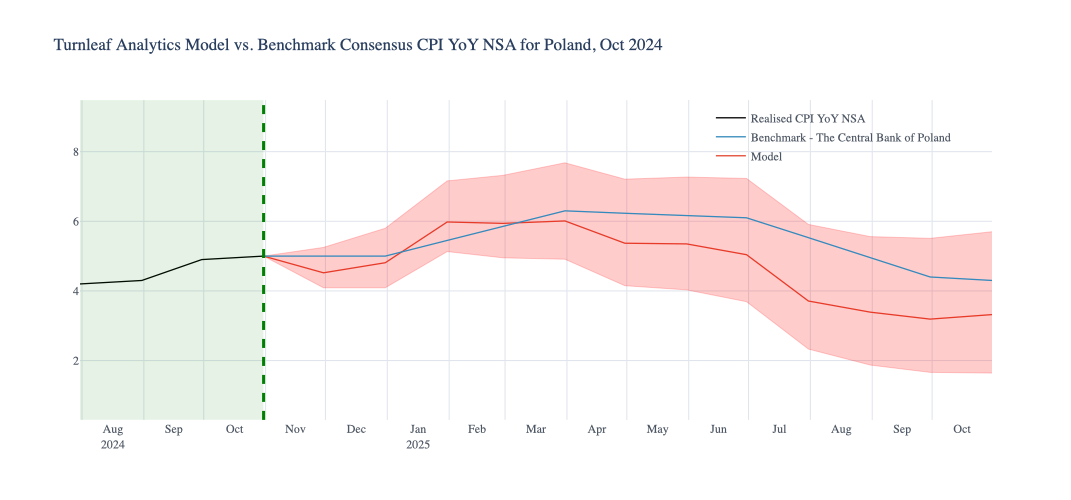

Global energy prices continue to provide disinflationary pressures for Poland’s headline CPI. However, uncertainty surrounding the extension of the government’s electricity price freeze through 2025 has created mixed inflationary effects. While the freeze caps electricity prices at 500 zloty per MWh (€114.92)—123 zloty below the market tariff—coal dependency have kept electricity generation costs high, indirectly placing upward pressure on inflation for households. Despite these pressures, the capped rates should temper CPI readings, with Turnleaf forecasting Poland’s inflation peak in March 2025 to remain within 6% YoY.

Although record high YoY increases in public sector wages in the first two quarters of 2024 (+17.7% in Q1 and 18.6% in Q2) have supported household spending, food inflation continues to strain consumers. Seasonal pressures will likely drive prices of special food items like center loin (+4,07% MoM in October 2024) and roast beef (+21.89% MoM in October 2024) even higher towards the end of 2024, challenging household budgets. Retail sales in September 2024 saw a notable contraction from the 3% growth it saw the previous month that could be partially do to flooding, but likely due to other factors that will become more clear in the following months. It will be important to watch to see if retail sales go back to its initial trajectory or will continue to place disinflationary pressure on CPI.

Meanwhile, construction remains in recession, contributing to further disinflationary pressure. Compared to the beginning of the year, the construction sector appears to be improving with positive growth in the Construction Production Index in October 2024 (111). Recent endorsements from the European Commission for Polands second and third installments for 9.4 billion euros under the Recovery and Resilience Facility are likely driving recent enthusiasm in the construction sector. These funds, which must be utilized by late 2026, will likely be allocated for infrastructure, energy, and housing projects.

Poland’s sensitivity to external demand, evolving global trade dynamics, and the government’s decision to extend the electricity price freeze are shaping the inflation outlook. For Turnleaf’s November 1, 2024 forecast, we project YoY inflation to peak near 6% before gradually decelerating throughout 2025. This decline is supported by stabilizing household energy costs due to the price freeze and anticipated easing of external inflationary pressures. We will be updating our forecasts in the next couple days as we receive new data.

Improving economic conditions in Western Europe, particularly in Germany—Poland’s largest trading partner—could further contribute to Poland’s inflation moderation. Recovery in German industrial production and demand is expected to bolster Poland’s manufacturing exports, particularly in key sectors such as automotive and machinery. This would provide a positive offset to domestic inflationary pressures by boosting export revenue and alleviating trade imbalances. By the end of 2025, YoY inflation is forecasted to drop below 4%, reflecting both domestic and external improvements in macroeconomic conditions. However, Turnleaf will closely monitor consumer spending patterns and energy prices, especially as real wage gains diminish in 2025 and inflationary pressures persist through March 2025. Continued recovery in Western Europe will play a vital role in supporting Poland’s economic resilience and inflation stability in the months ahead.

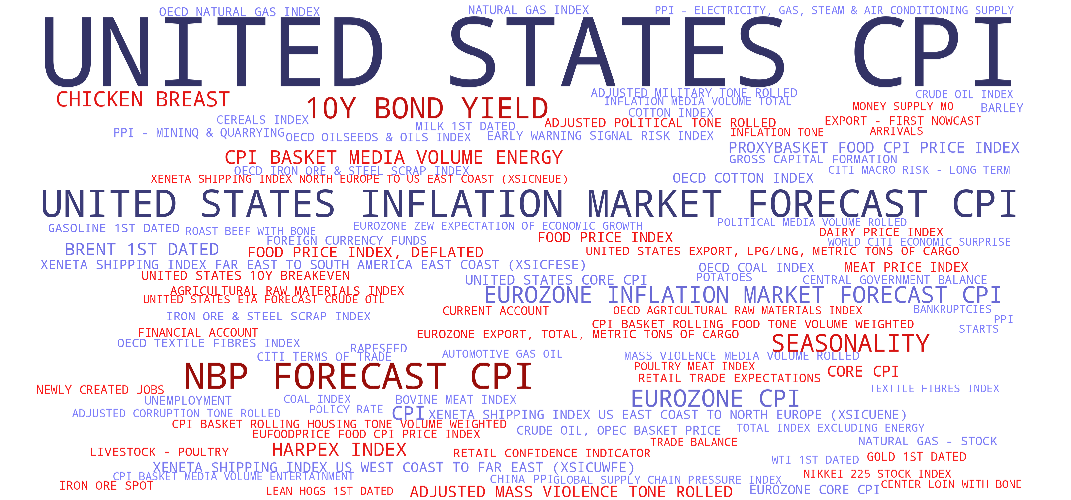

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, ‘United States CPI’ is large, indicating their significant weight in the model, while their color suggests whether they contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.

Contribution Word Cloud for November 1, 2024 Forecast