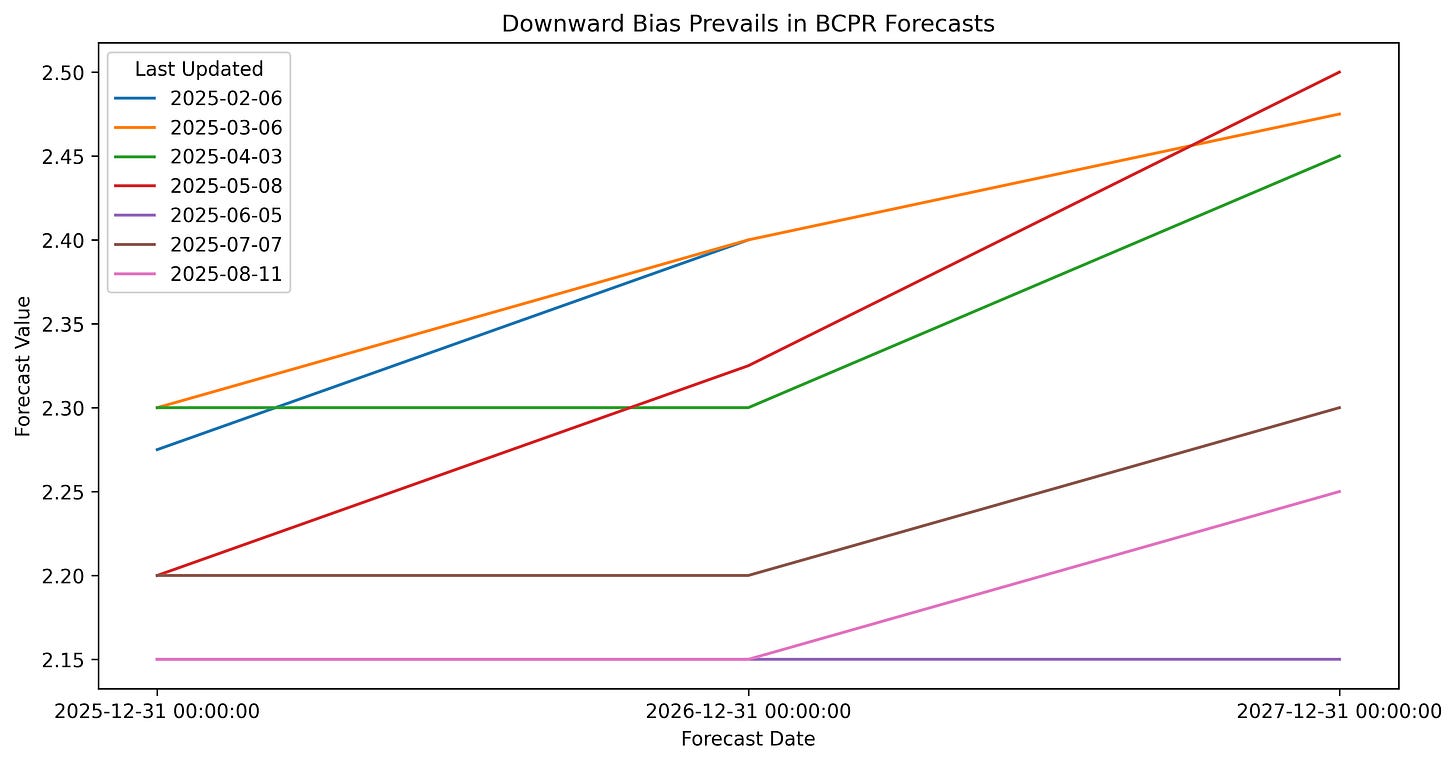

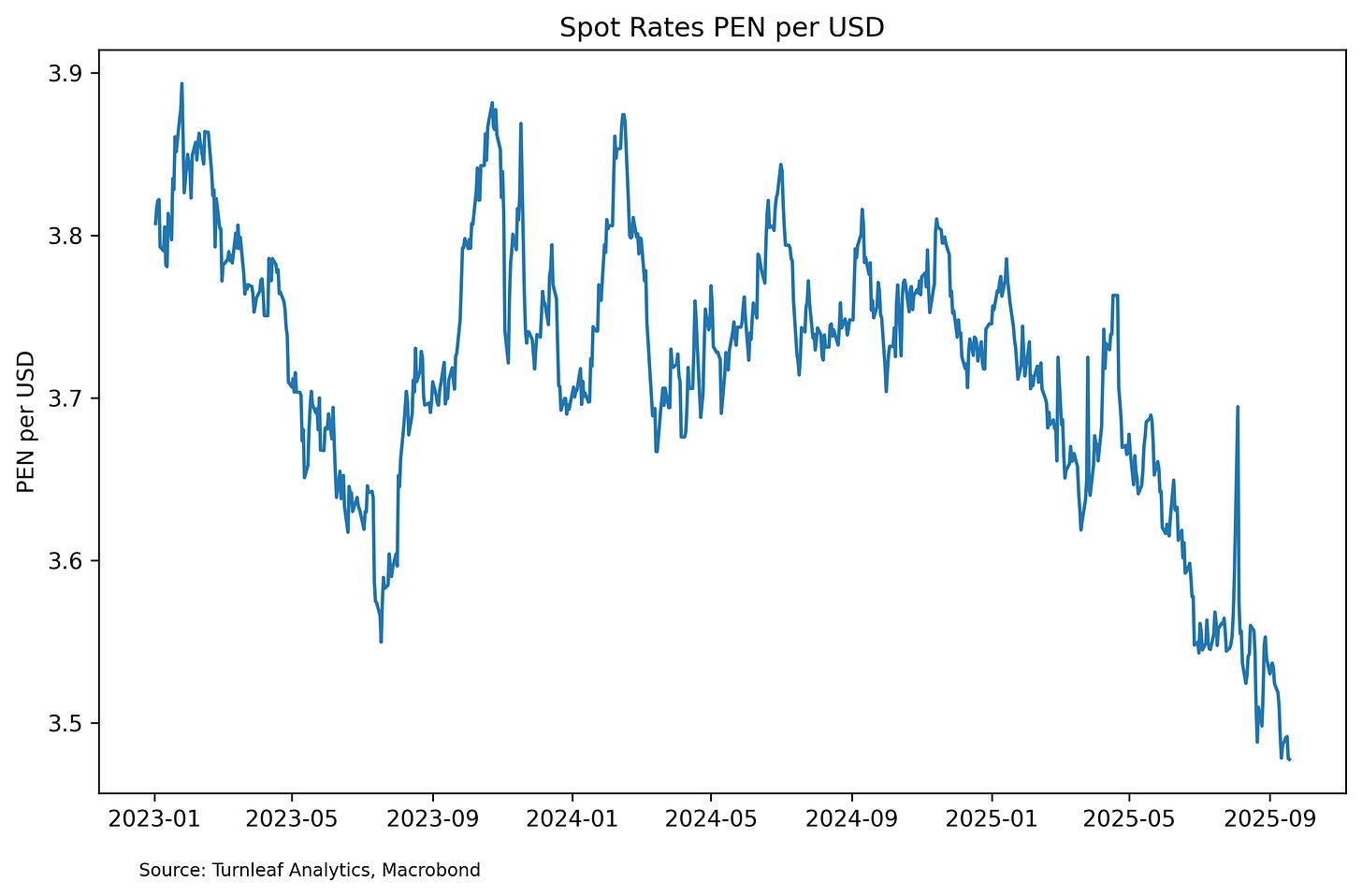

Since May 2025, Peru’s inflation has been consistently undershooting the forecasts of the central bank and economists. Figure 1 shows successive BCRP forecast vintages for 2025–2027. Each vintage slopes up over the horizon, but the whole curve has shifted lower with each update, reflecting downside surprises from a stronger sol (Figure 2) and atypical food and fuel seasonality. The August 2025 release highlighted this shift, with short term consensus at 1.57% YoY versus 1.11% realized. Year-end projections still remain close to 2% (BBVA 2.2% YoY as of 09-01-2025; BCRP 2.15% YoY as of 09-02-2025), but recent outcomes make clear that currency appreciation and unusual seasonal dynamics are overriding standard pass-through and seasonality models for central bankers and professional forecasters alike.

Figure 1

Figure 2

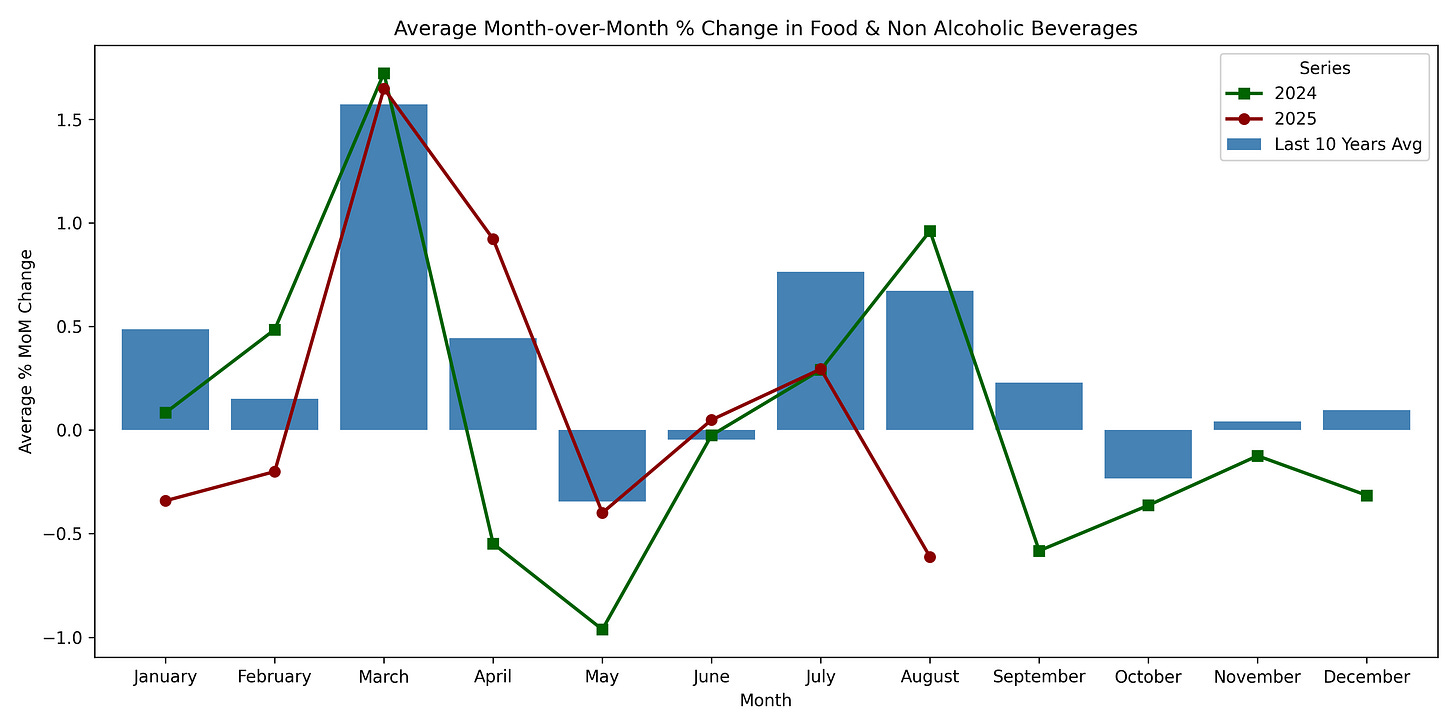

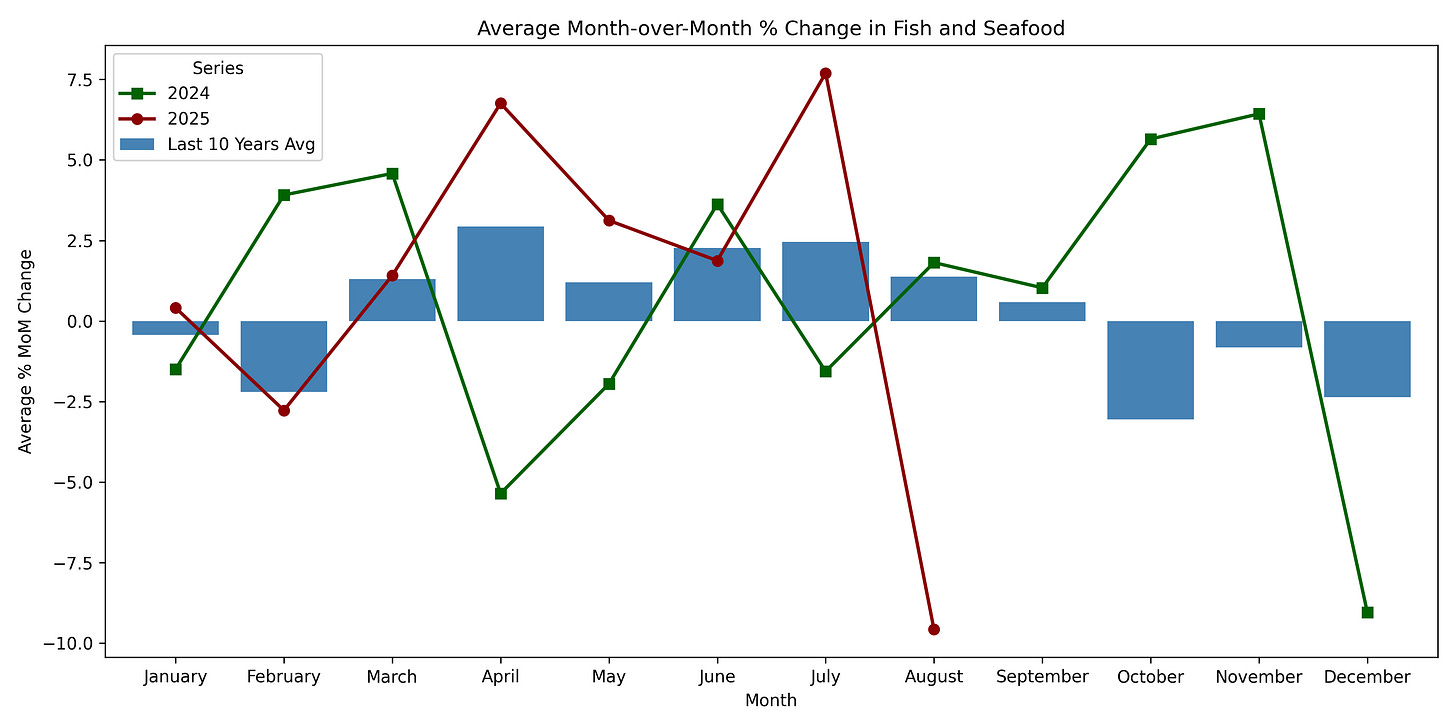

Food prices, which make up 24.4% of the CPI basket, were the main culprit in the most recent downside surprise. BBVA had expected Q3 inflation to average 1.5–2.0%, broadly in line with Turnleaf’s view at the time, but food’s outsized correction drove actual outcomes lower. After rising 1.68% YoY in July, food dropped sharply to –0.32% YoY in August, far below seasonal norms (Figure 3). In its latest policy briefing, the BCPR’s pointed to a faster-than-expected correction linked to improvements in fishing cycles that had previously disrupted supply (Figure 4).

Figure 3

Figure 4

To read more, please visit Turnleaf’s Substack page.