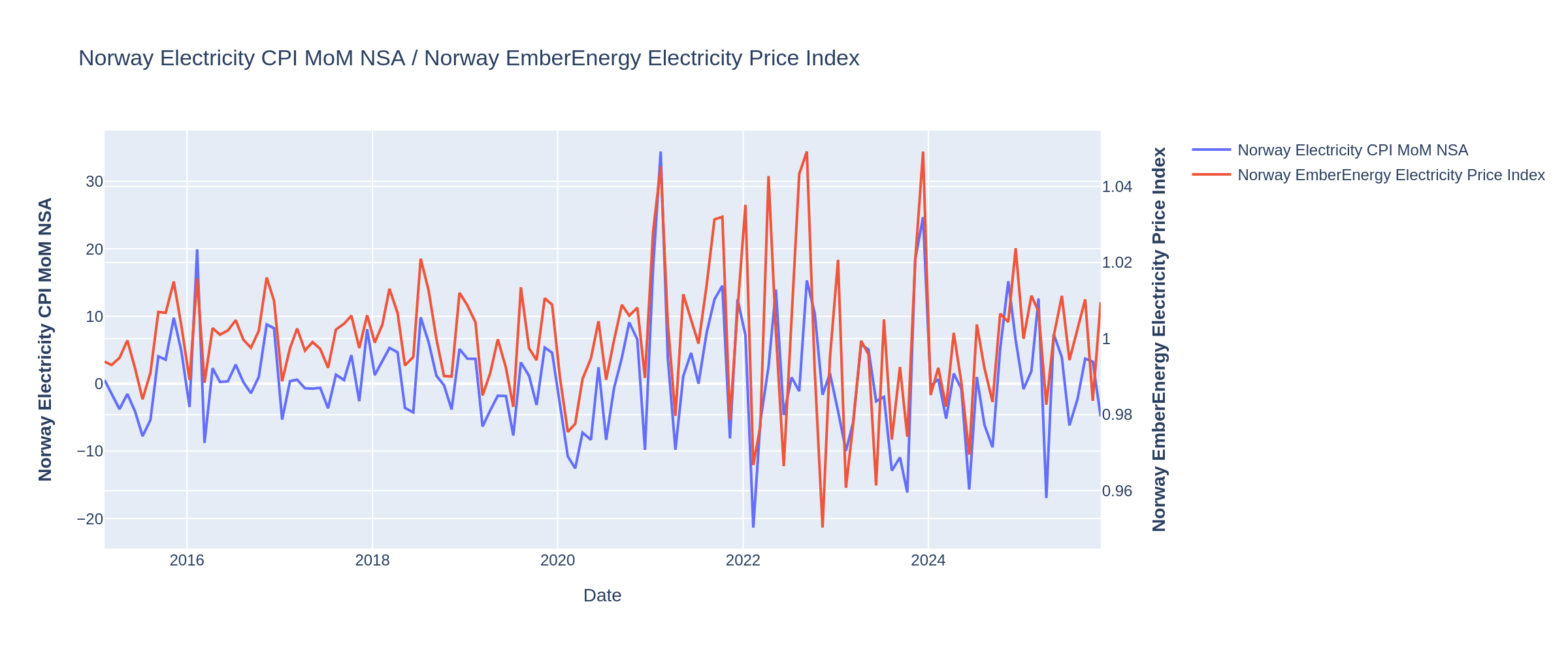

The Norway Statistical Institute recently revised the latest CPI print from 3.3% to 3.1%, correcting an error in electricity-price calculations that overstated inflation. Despite this adjustment, the institute maintained that the broader inflation picture, including core CPI, remained unchanged. For the October 2025 print, Turnleaf projected CPI to fall toward 3% YoY, accurately anticipating the effect of falling electricity prices by incorporating Turnleaf’s proprietary Electricity Price Index into its nowcasting framework (Figure 1).

Figure 1

At the time of the nowcast, Turnleaf’s Electricity Index signaled a decline in Norwegian electricity prices, reinforcing the estimated impact of Norgespris, the newly introduced voluntary fixed-price scheme intended to reduce household electricity bills beginning in October 2025. The index’s broad coverage of power-price inputs ensured a representative series and allowed the model to capture the policy’s effect with greater precision.

At the time of the nowcast, Turnleaf’s Electricity Index signaled a decline in Norwegian electricity prices, reinforcing the estimated impact of Norgespris, the newly introduced voluntary fixed-price scheme intended to reduce household electricity bills beginning in October 2025. The index’s broad coverage of power-price inputs ensured a representative series and allowed the model to capture the policy’s effect with greater precision.

Turnleaf’s October 2025 estimate also incorporated a dedicated policy-impact analysis quantifying the combined influence of the Norgespris scheme and the reduced electricity tax. Looking ahead, Turnleaf anticipates some upward price adjustments in the coming months as suppliers partially counter the recent sharp declines, moderating the pace of the downturn in electricity prices.

Looking ahead to 2026, Turnleaf will incorporate additional budget-linked policy changes expected to influence inflation dynamics. These include (1) a lower EV VAT-exemption threshold, which is likely to exert upward pressure on prices given that EVs account for roughly 80% of Norway’s vehicle market, and (2) the unified electricity excise tax—roughly 12% of a household electricity bill—which is expected to push prices downward.

Changes in Seasonal Dynamics: Holiday Discounts

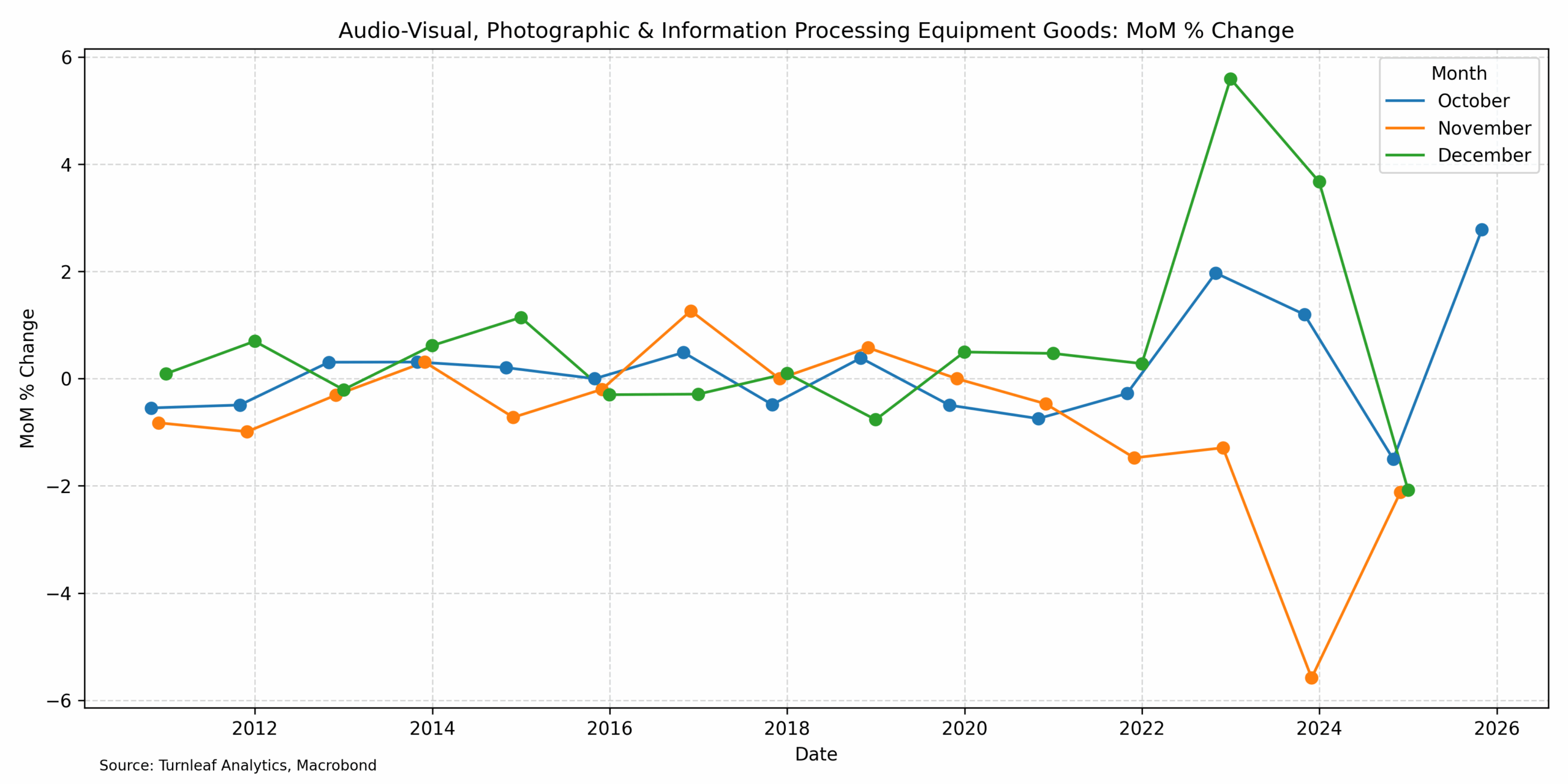

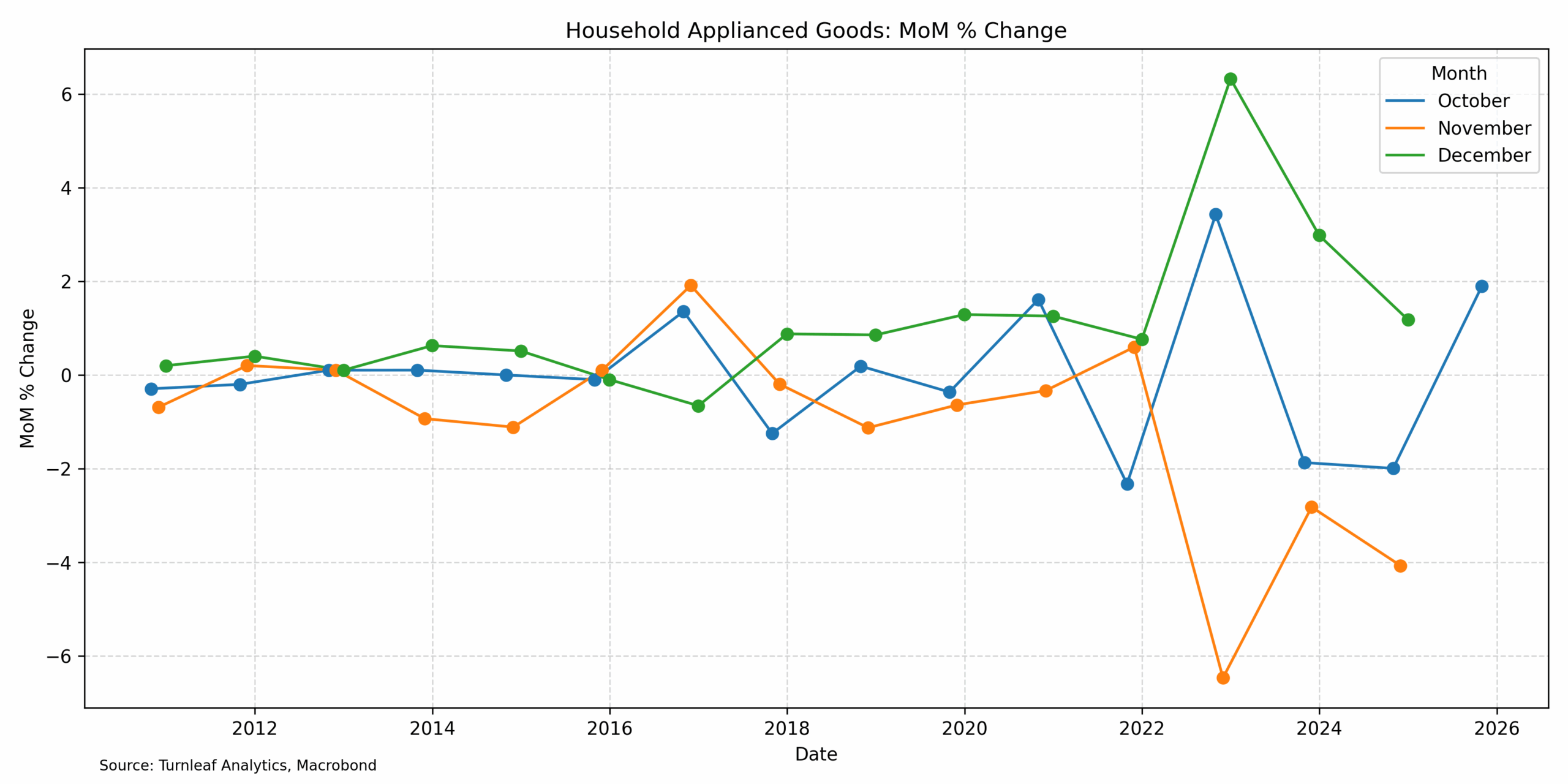

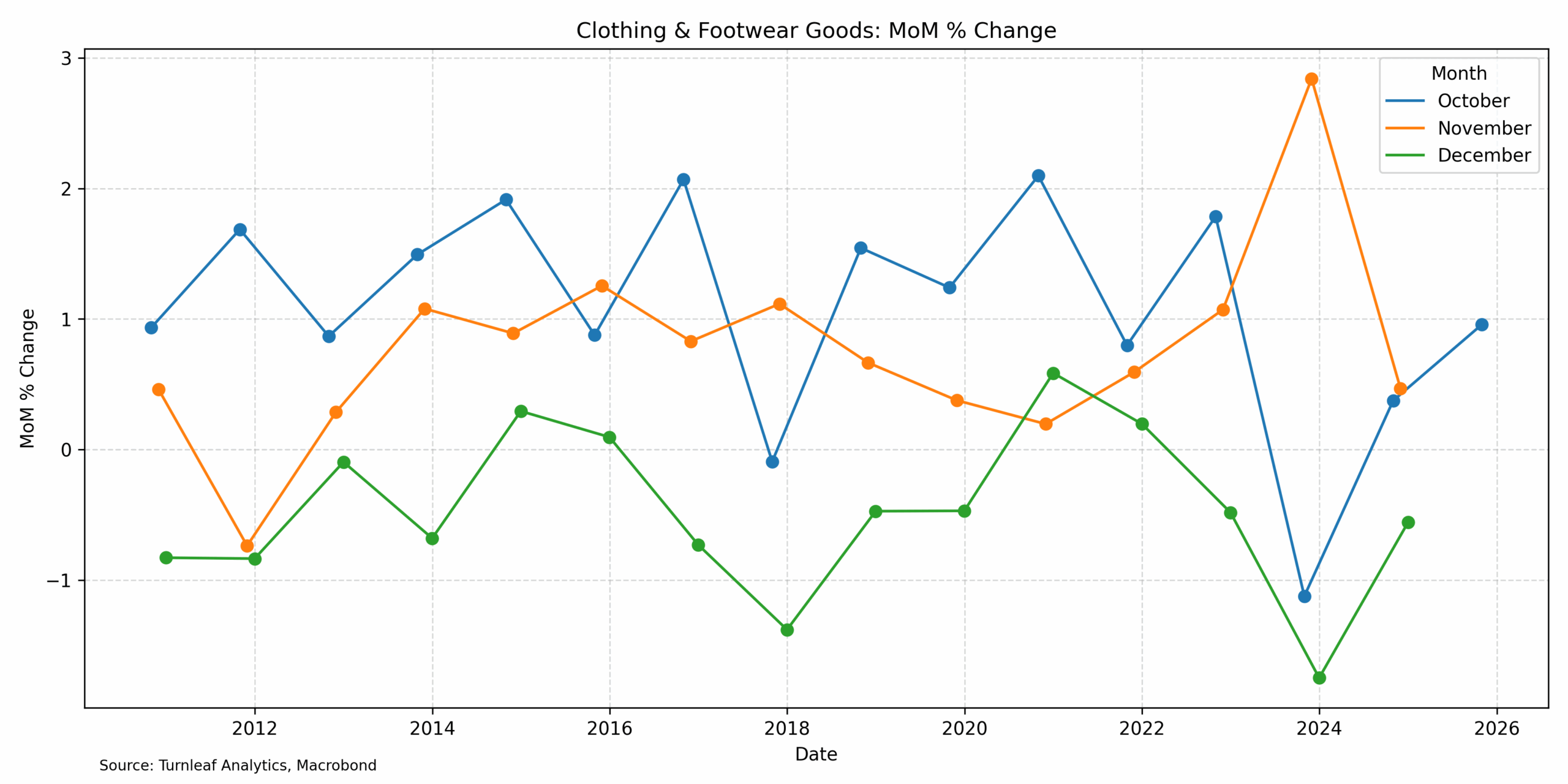

Local sources report that November’s Black Friday discounts are often preceded by pre-emptive price hikes in October, followed by price stability in December. A review of ten years of MoM data confirms stable seasonal patterns overall, with distortions emerging primarily in 2022 due to post-pandemic-related disruptions.

We do not expect these irregularities to materially alter the seasonal profile, but targeted monitoring is warranted for categories prone to opportunistic pricing, especially electronics such as mobile phones (Figure 2A) and household appliances (Figure 2B). Conversely, clothing and footwear (Figure 2C) continue to show muted seasonal effects and even recorded a YoY decline of –1.5% in October 2025, an improvement from –2.1% in September 2025.

Figure 2A

Figure 2B

Figure 2C

Turnleaf’s Outlook

Turnleaf’s ability to ingest and structure alternative, high-frequency data, notably granular electricity-price series and policy-linked inputs, provides a material forecasting edge in Norway’s CPI. Turnleaf expects Norway inflation to fluctuate between 2-3%YoY over the next 12 months with a possibility for a slight downward bias given the official correction of the latest CPI print downwards. Our Core CPI forecasts will remain unaffected by the revision and we continue to predict inflation hovering closer to 3%YoY.

By directly accounting for shifts in regulatory schemes, market pricing, and seasonal distortions via high-frequency data and features derived by our LLM models, Turnleaf is positioned to anticipate inflation inflection points well before official releases – even when official sources make a mistake. We will incorporate the revision soon, and republish our most recent forecast for Norway.