Just as Turnleaf has been applying alternative data to forecast inflation amid trade policy uncertainty, understanding Argentine inflation requires moving beyond conventional structural models. Inflation dynamics in Argentina are shaped less by traditional monetary tools like interest rates and more by how well policies can anchor expectations in a highly reactive economy.

In this environment, we track real-time policy shifts, trade flows, currency dynamics, and tax receipts to capture inflation signals that conventional data would miss. Central to this is monitoring how the Milei administration’s market-liberalizing agenda—particularly in FX and trade deregulation—translates into price behavior.

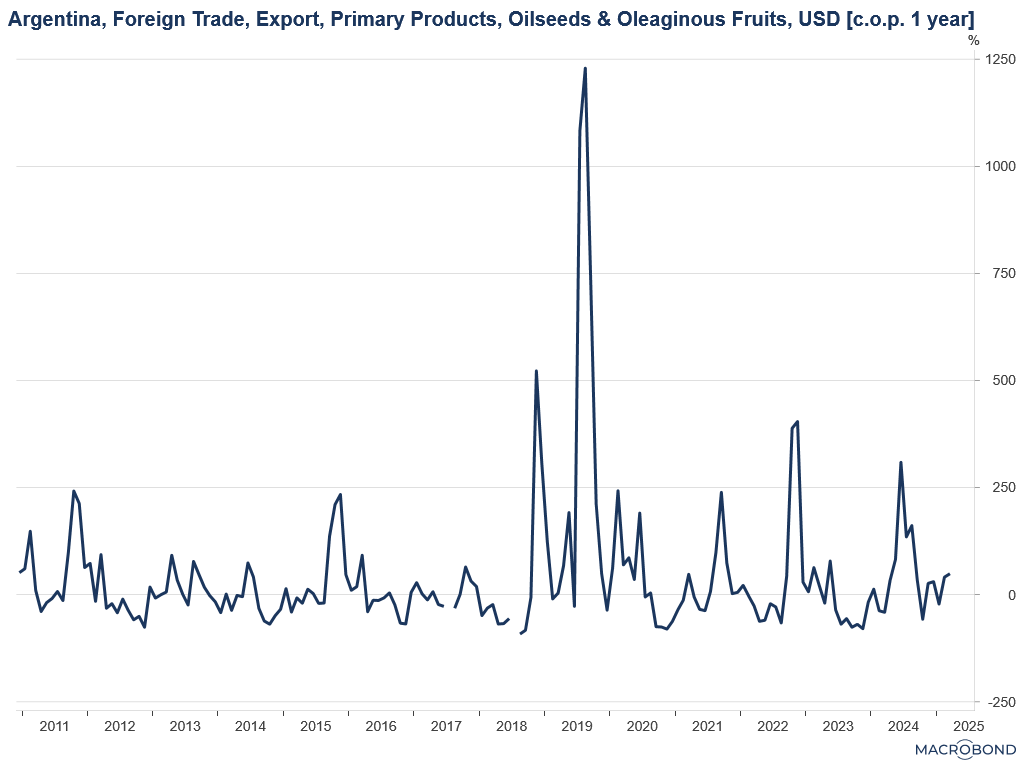

- Soy Exports and FX Pressure

Recent YoY increases in soy-related exports from February 2025 have helped steer FX pressure, as Argentina relies heavily on agricultural exports for dollars (Figure 1) and farmers rush to sell soybeans, soybean products, sunflower and peanuts before the export tax cut ends in the end of June 2025. Despite the peso’s slide to roughly ARS 1,200/USD, the temporary duty reduction incentivizes immediate dollar conversion—shoring up Central Bank reserves and dampening farmer hoarding. Nevertheless, ongoing peso depreciation raises peso-equivalent costs of oilseeds, agricultural inputs and imports, passing through into higher food prices and overall CPI inflation in H2 2025.

Figure 1

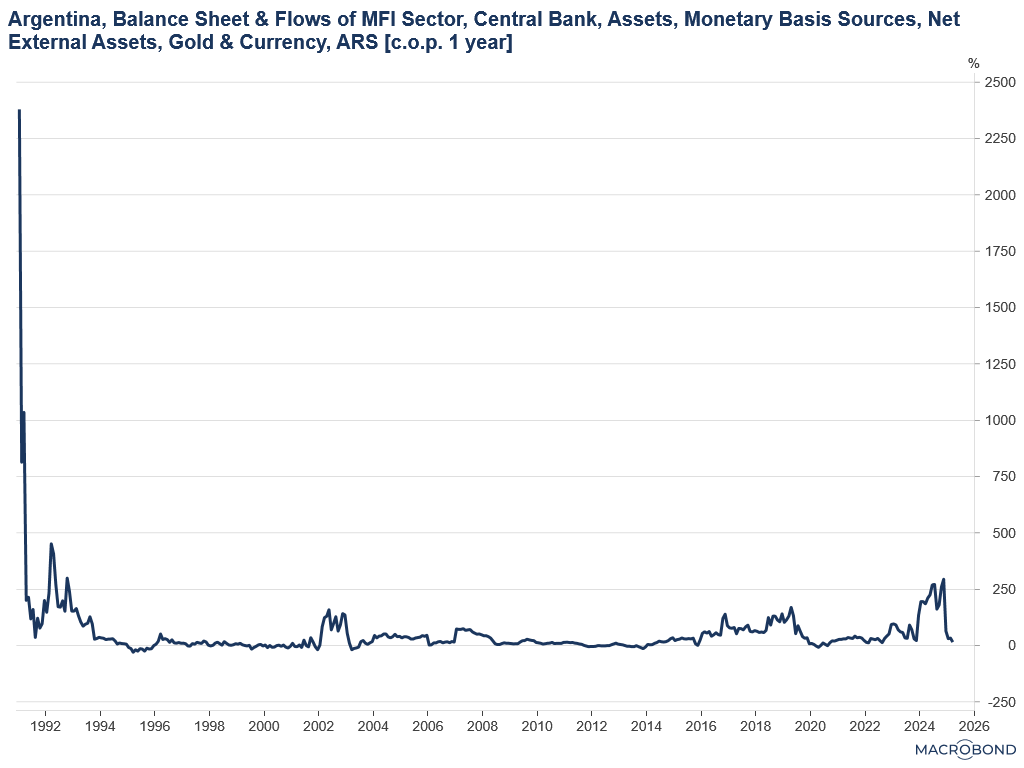

- End of Crawling Peg and Depleting Reserves: Disinflation with a Twist

Argentina’s crawling peg (1–2% monthly devaluation) has helped manage short-term expectations, but at the cost of reserve depletion. As the peso devalues more slowly than inflation, it appreciates in real terms, temporarily improving import affordability and aiding disinflation.

The recent $20 billion IMF bailout agreement—backed by an immediate $12 billion disbursement—offers FX support to continue this strategy. The updated framework includes a widening FX band (+1% monthly) and capital control adjustments. However, if the peso continues to weaken and FX reserves are drawn down further, import prices will rise again, placing upward pressure on CPI.

We monitor this risk by tracking gold and FX assets on the Central Bank’s balance sheet as leading indicators of devaluation capacity (Figure 2), and by evaluating sentiment survey data to assess whether inflation expectations are anchored. Short-term inflation is expected to tick up due to currency pass-through, but longer-term risks hinge on the credibility of normalization.

Figure 2

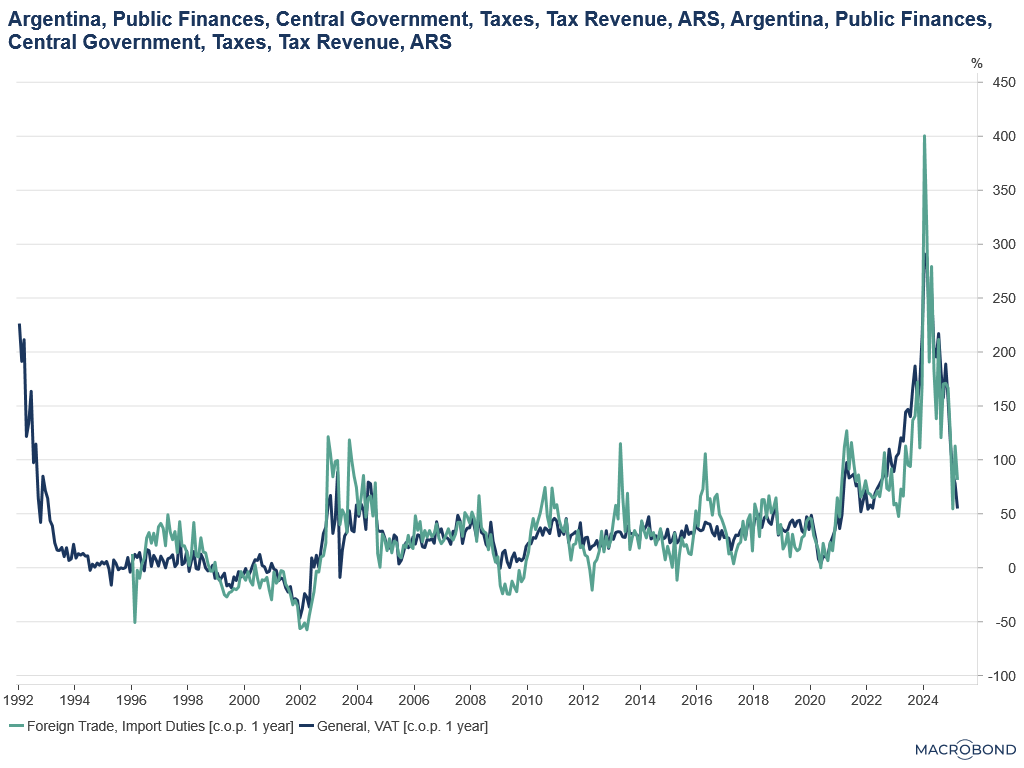

- Import Deregulation: Disinflation from Trade Liberalization

March CPI surprised to the upside (e.g., clothing +4.6% MoM vs. -0.7% in Feb), driven partly by seasonal factors. Still, the government has responded preemptively by cutting import duties on textiles, apparel, and footwear from 26–35% to 12–20%.

Such targeted deregulation is hard to quantify in real time, but we track its effects through monthly fiscal indicators like VAT and import duty revenues (Figure 3). Persistent declines in these revenues point to tangible disinflationary pressures from cheaper imports—particularly in consumer goods.

Figure 3

Inflation in Argentina is fundamentally a policy and expectations game, not just a monetary one. Traditional models underperform in this regime. Instead, we rely on alternative data: FX reserves, trade dynamics, tax receipts, and real-time policy tracking—to build a forward-looking view. With Milei’s reform agenda unfolding, the key question is whether inflation expectations can be credibly anchored, even as short-term price pressures remain elevated. We anticipate the long end of the curve will swing as investors probe supply and demand in a newly floating peso, injecting added volatility into long-term inflation expectations.

Inflation in Argentina is fundamentally a policy and expectations game, not just a monetary one. Traditional models underperform in this regime. Instead, we rely on alternative data: FX reserves, trade dynamics, tax receipts, and real-time policy tracking—to build a forward-looking view. With Milei’s reform agenda unfolding, the key question is whether inflation expectations can be credibly anchored, even as short-term price pressures remain elevated. We anticipate the long end of the curve will swing as investors probe supply and demand in a newly floating peso, injecting added volatility into long-term inflation expectations.