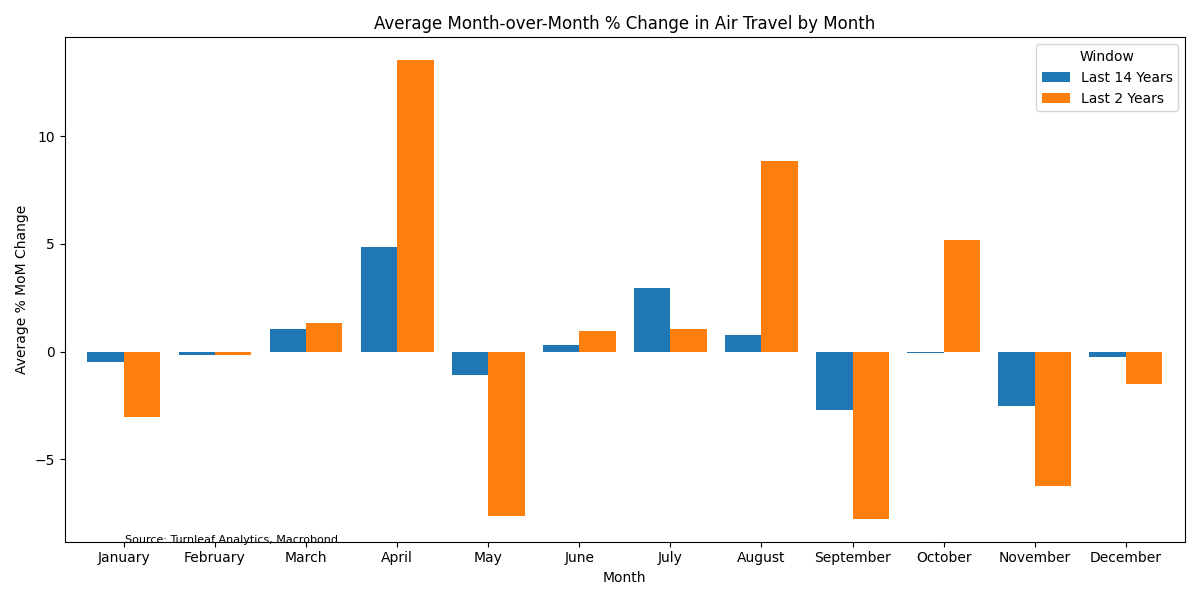

On August 3, 2025, Ben Gurion Airport will resume over 120 international flights for the month, though this remains insufficient to fully meet demand. Israeli travel companies have cited 10 to 15% higher ticket prices to destinations like New York City, due to reduced foreign carrier competition and reliance on Israeli airlines. Monthly changes in air travel costs have increased significantly over the past two years compared to the 14-year average, with August standing out in particular (Figure 1).

Figure 1

Changes in the methodology for calculating average airfare prices, introduced in September 2023, have pushed the air travel subcomponent above seasonal expectations in recent years. Prices are now calculated based on advertised fares for flights booked 1, 4, and 7 months in advance, reflecting how consumers actually purchase tickets. The mid-June conflict with Iran led many foreign airlines to cancel flights to and from Israel. However, with hundreds of new international flights set for August 2025, we expect prices to surge further beyond seasonal expectations as consumers rush to book in a market with constrained competition and insufficient capacity.

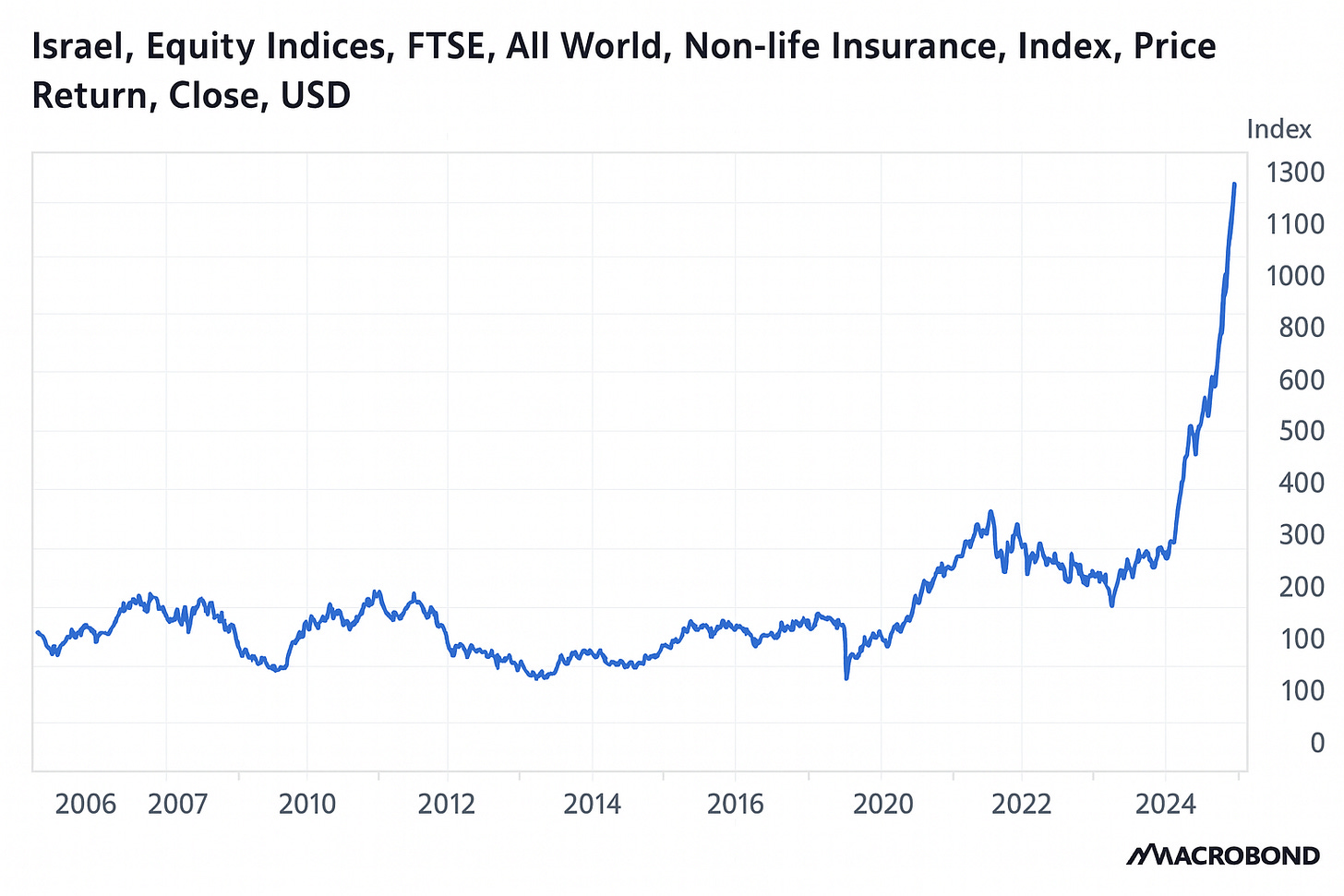

At the same time, the Israeli government intervened with $8 billion in war-risk insurance coverage for both Israeli and foreign airlines to prevent disruption, after global underwriters raised premiums on Middle East air routes.

Non-life insurance premiums have risen sharply through the war in Gaza and the recent conflict with Iran, with sector equity indices reflecting increased profitability and risk hedging demand (Figure 2). However, the approval of government-backed coverage has reinforced the sector’s resilience by limiting insurers’ exposure to catastrophic claims. This measure helps stabilize premium costs for airlines and is intended to support the availability of flights despite surging demand.

Figure 2

Turnleaf expects air travel to be an important driver of Israel CPI in the next August 2025 print, with growing relevance for core CPI as service-sector inflation increasingly reflects the structural costs of ongoing conflict.