In our April 2025 inflation preview, we project headline CPI will undershoot consensus, underpinned by subdued Brent‐crude volatility, cheaper USD imports due to dollar weakness, and softer inflation expectations. However, April’s seasonal dynamics—especially firmer flight prices amid elevated travel demand—pose an upside risk to our baseline.

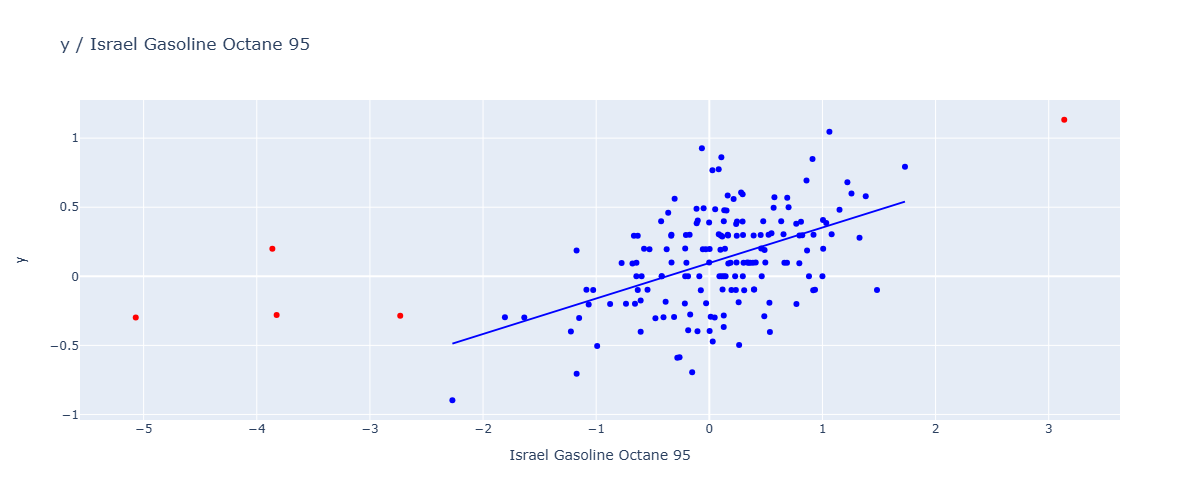

Our models show a strong positive correlation (0.45) between Israeli inflation and retail gasoline prices (Octane 95), which have continued to climb (Figure 1) in April 2025. In Israel, pump tariffs are regulated by the government based on regional benchmarks and the USD/ILS exchange rate. Recently, while Brent crude fell to about $67 / barrel, Israel’s primary import grade—Azeri Light—remains near $75 / barrel (as of April 28, 2025). From April 2025, authorities chose to raise regulated pump prices rather than pass through global declines. In May 2025, regulators are set to lower pump prices due to continued appreciation providing a disinflationary force to our inflation outlook for Israel.

Figure 1

Meanwhile, lower Brent prices have supported the shekel’s appreciation against the dollar in April 2025. Though our model does not flag USDILS in our model, foreign currency reserves have been indicated as having a disinflationary impact on prices. This is consistent with the Bank of Israel’s $30 billion shekel–support facility which has further stabilized the currency since October 2023. By injecting dollars at key moments to defend the shekel, the Central Bank has introduced reserve swings that amplify the pass-through effects captured in our model.

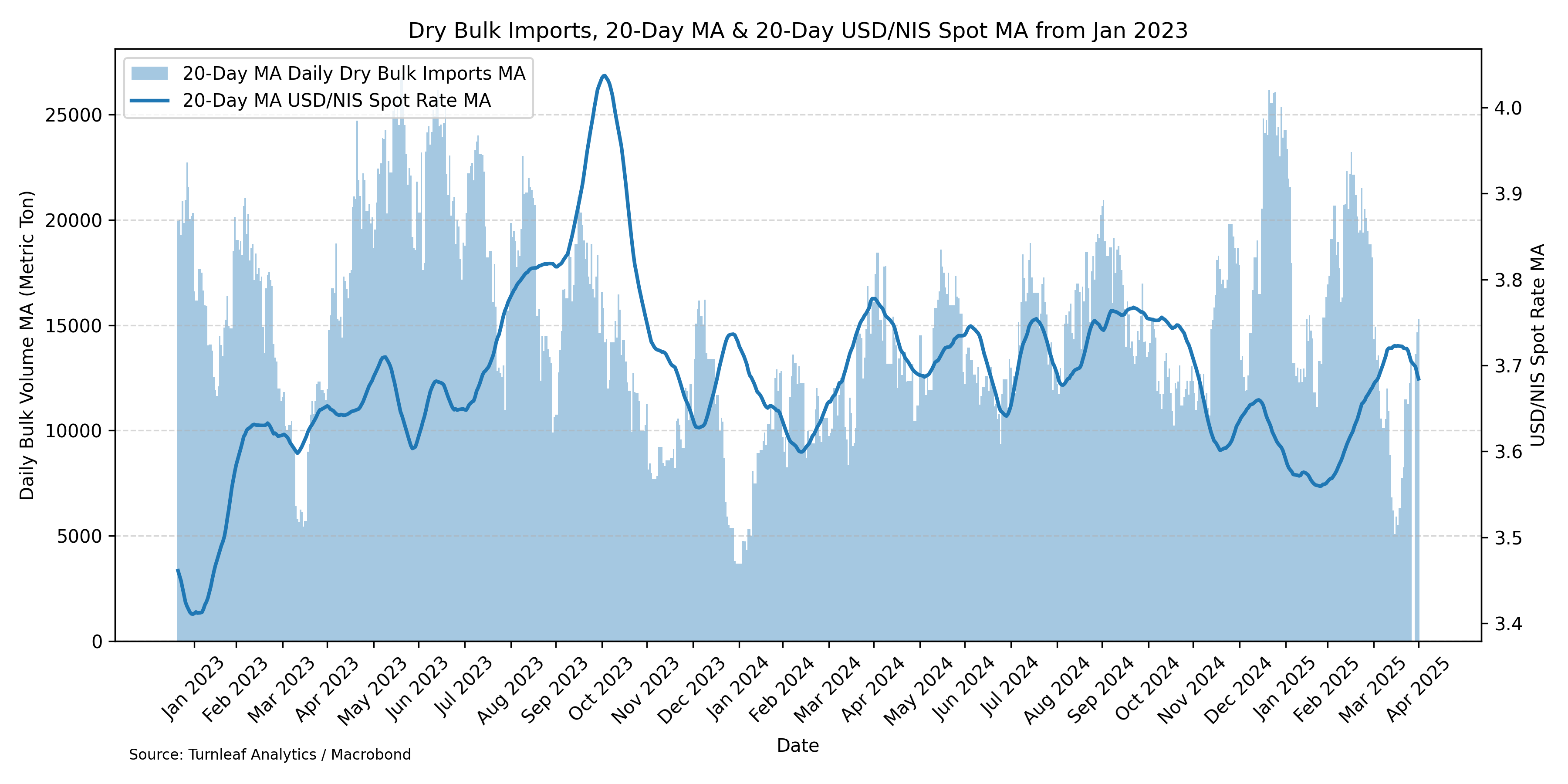

The appreciation of the shekel against the dollar has supported disinflation by reducing the local currency cost of dollar-priced imports, such as raw materials. For example, examining the 20-day moving average of daily dry bulk import volumes (e.g., grains, iron ore that are universally priced in dollars) from late 2024—when trade conditions began normalizing—we observe a delayed increase in import volumes following shekel appreciation. By April 2025, the rising import volumes contributed further to disinflationary pressures, as increased supply put downward pressure on prices (Figure 2).

Figure 2

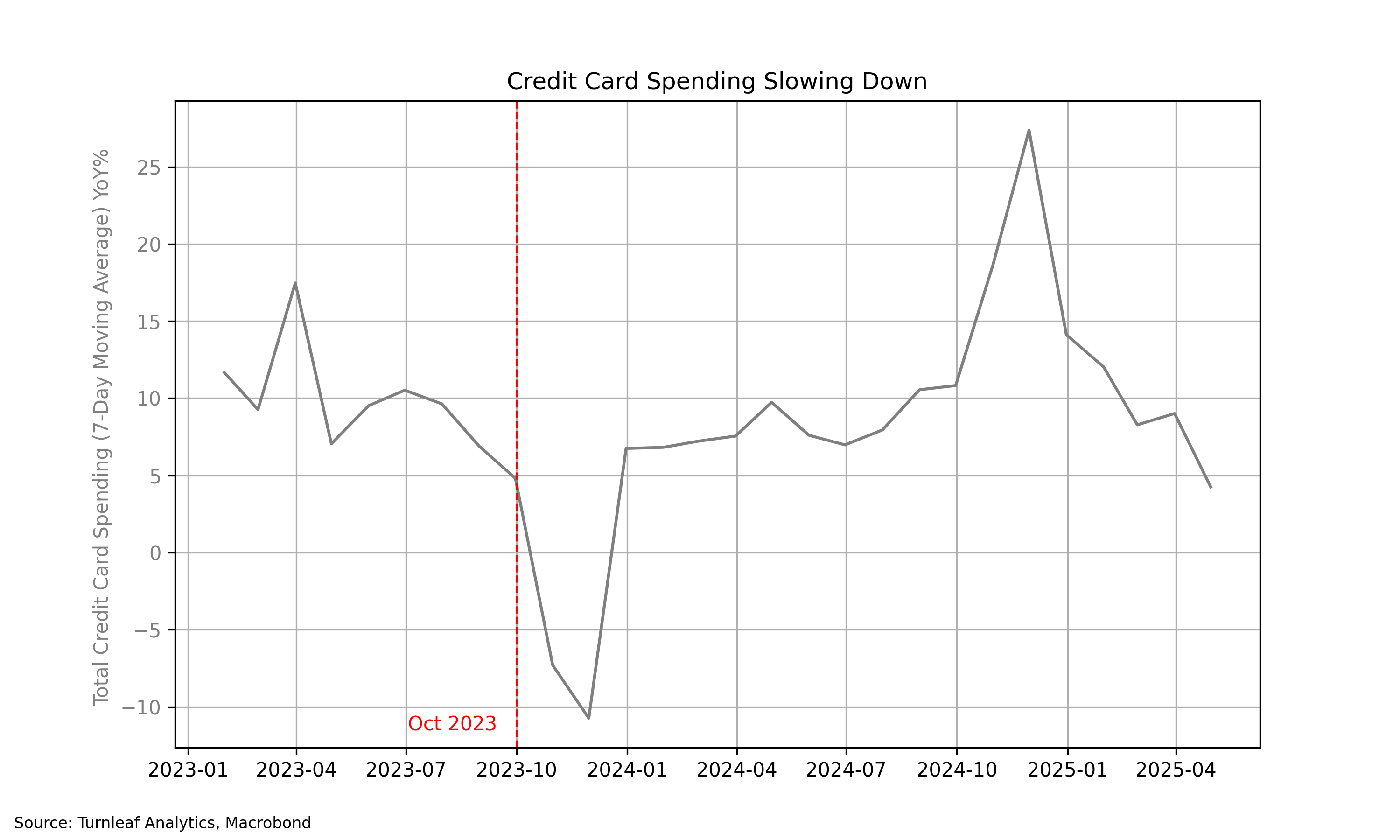

This backdrop of softer price growth in USD denominated commodities is mirrored in sentiment and credit card expenditure: Turnleaf’s inflation‐tone and media‐volume metrics indicate a cooling in prices, and seasonally adjusted credit-card spending has decelerated more than usual for this season (9% in March YoY vs 4.25% in April 2025) —pointing to softer demand and faster import price pass-through dampening costs (Figure 3).

Figure 3

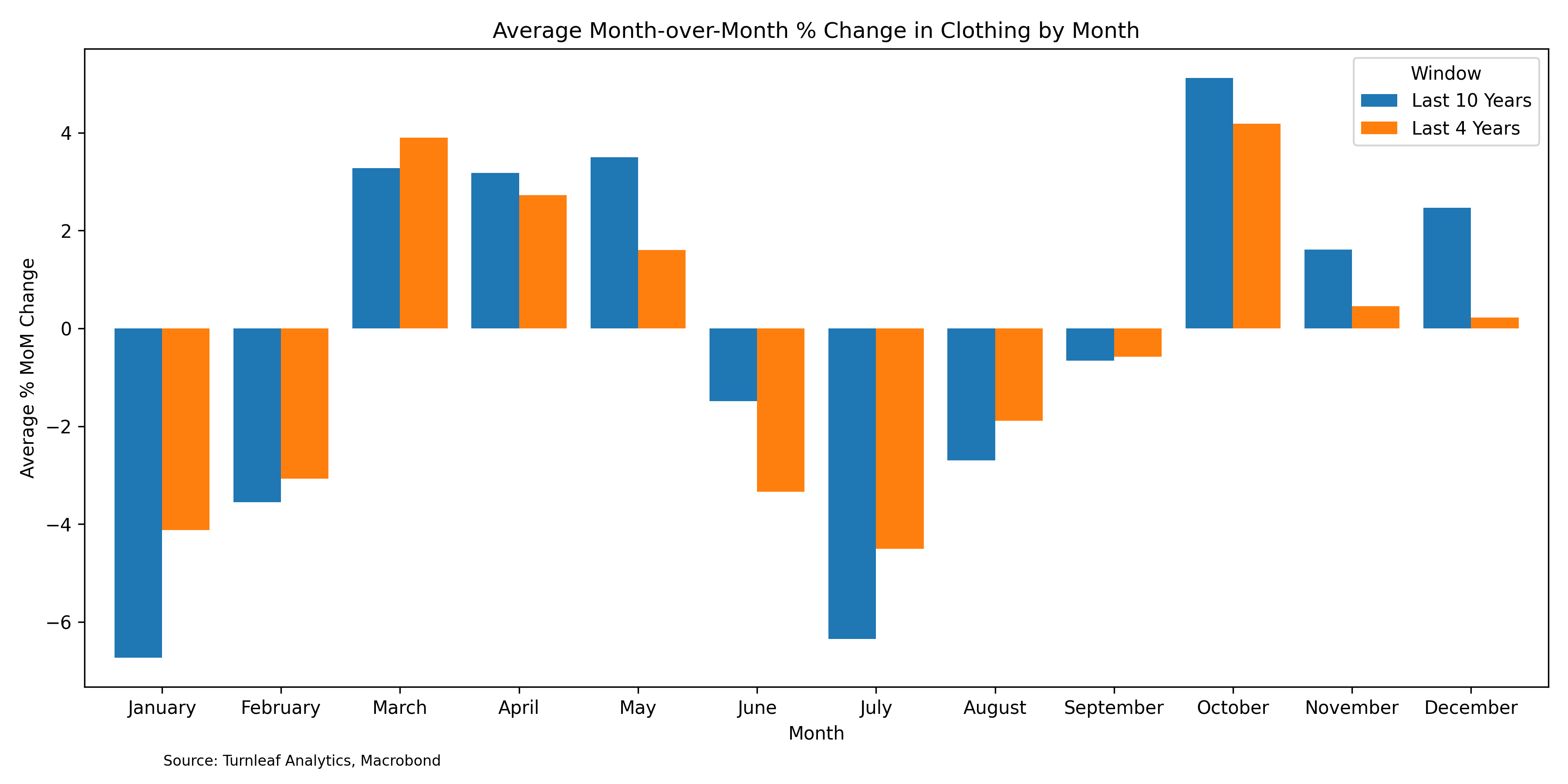

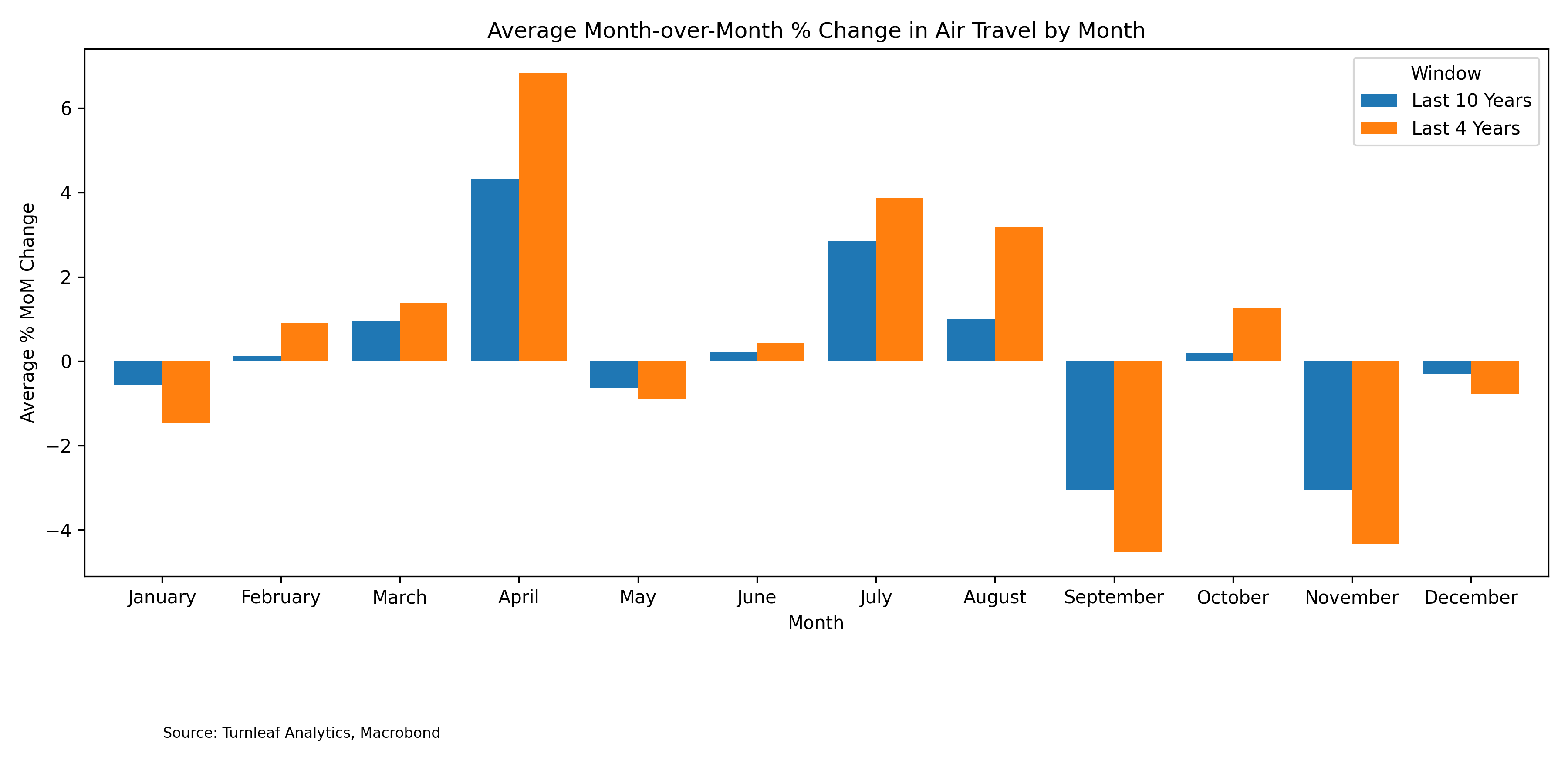

We also note the importance of Passover celebrated in the month of April and its relevance to clothing and flight prices. If we look at the average seasonal effect observed in April for the last four years, we notice that those associated with clothing have diminished (Figure 4a), while those associated with flights have increased sharply compared to the last 10 years (Figure 4b).

Figure 4a

Figure 4b

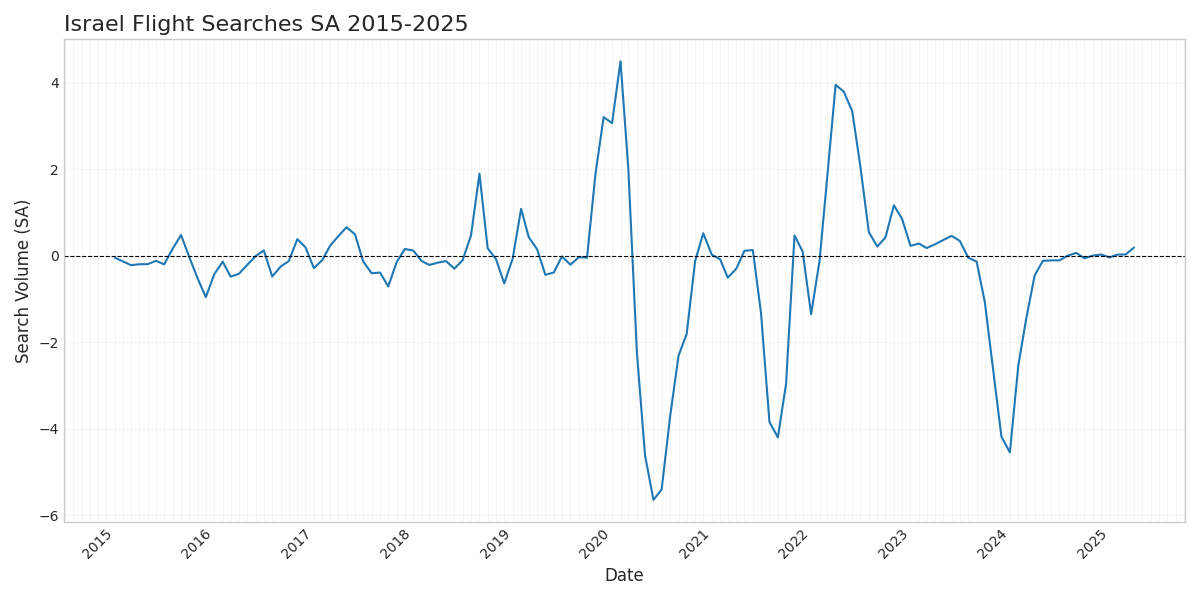

This is likely attributed to a combination of post-pandemic increase in demand and the ongoing war in Gaza. We also note for flights in particular, changes in methodology of measuring flight prices in September 2023 have distorted price expectations. While we can’t predict April 2025’s airfare levels with certainty, using seasonally-adjusted, normalized flight‐search data as a proxy for demand suggests only moderate upward pressure on inflation (Figure 5).

Figure 5

It will be crucial to closely track the Bank of Israel’s ongoing foreign currency operations, particularly as dollar swings introduce volatility into global prices and policy actions continue to distort market signals. Equally important is distinguishing whether the recent pullback in consumer spending reflects lower import costs or signs of weakening fundamentals such as rising unemployment. We will also continue to watch flight price trends in Israel as its CPI weight have changed considerably between 2024 (3.49%) and 2025 (4.55%) and hold a greater share in the basket than clothing. In the near term, Turnleaf expects disinflationary forces to persist, driven by subdued global demand and renewed dollar devaluations.