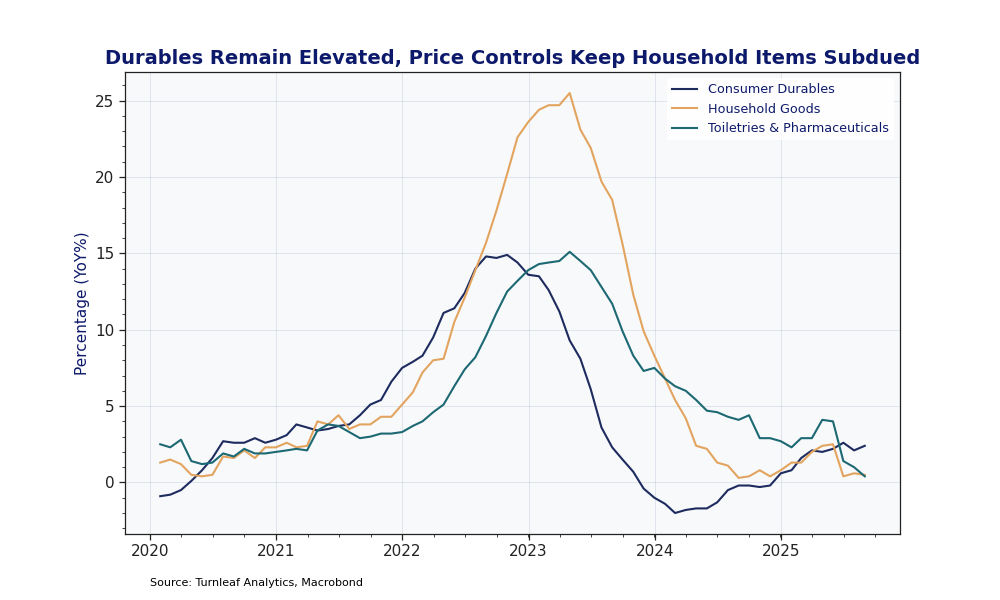

Turnleaf’s September 2025 headline inflation forecast for Hungary over the next 12 months points to an uptick toward 5% YoY by October 2025, followed by a steady decline into early 2026, with the trend reverting toward 4% YoY over the rest of 2026. With the Orban administration’s campaign against unfair retail pricing still in force for another two months and global energy prices subdued, we attribute this profile primarily to underlying pressures in core subcomponents and base effects.

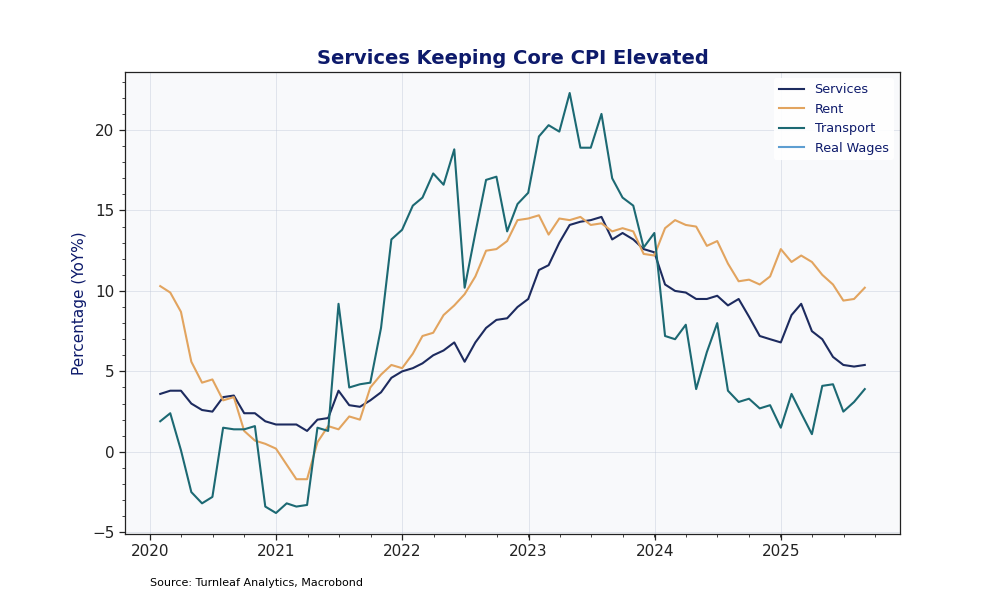

Inflation expectations remain high even with price controls. We see that our CPI Basket Media Volume Aggregate, which measures the total media volume reported relating to words associated with CPI Basket components, and the Inflation Media Volume, which measures the volume of media relating to the word ‘inflation’, is increasing in recent months for Hungary (Figure 1). This suggests that inflation concerns are reemerging as consumers begin to understand that price controls are temporary and that they should be expecting higher prices soon.

Figure 1

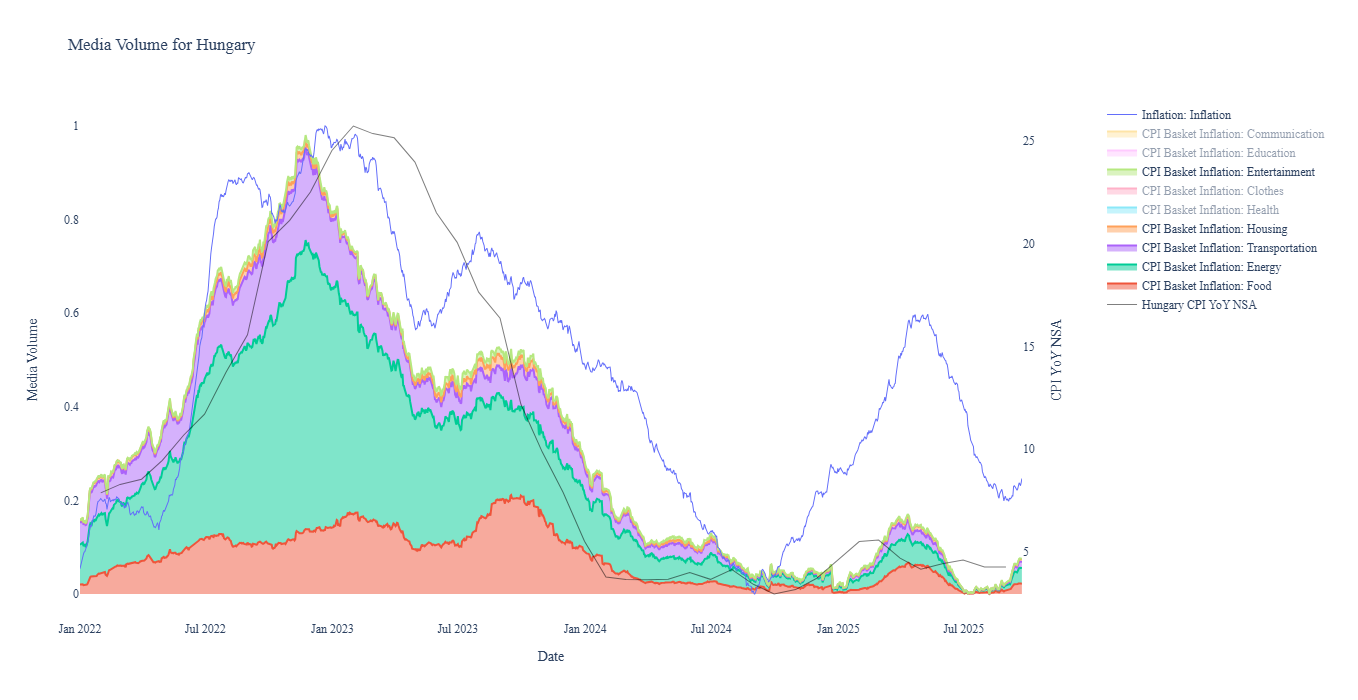

This may explain why, even after the recent forint appreciation, consumer durable goods remain elevated, relative to other categories that are covered by the price controls like household goods and toiletries and pharmaceuticals (Figure 2). We expect this to provide upwards pressure until base effects come into force at the end of the year.

Figure 2

Figure 3